2024 Burial Insurance after Angioplasty

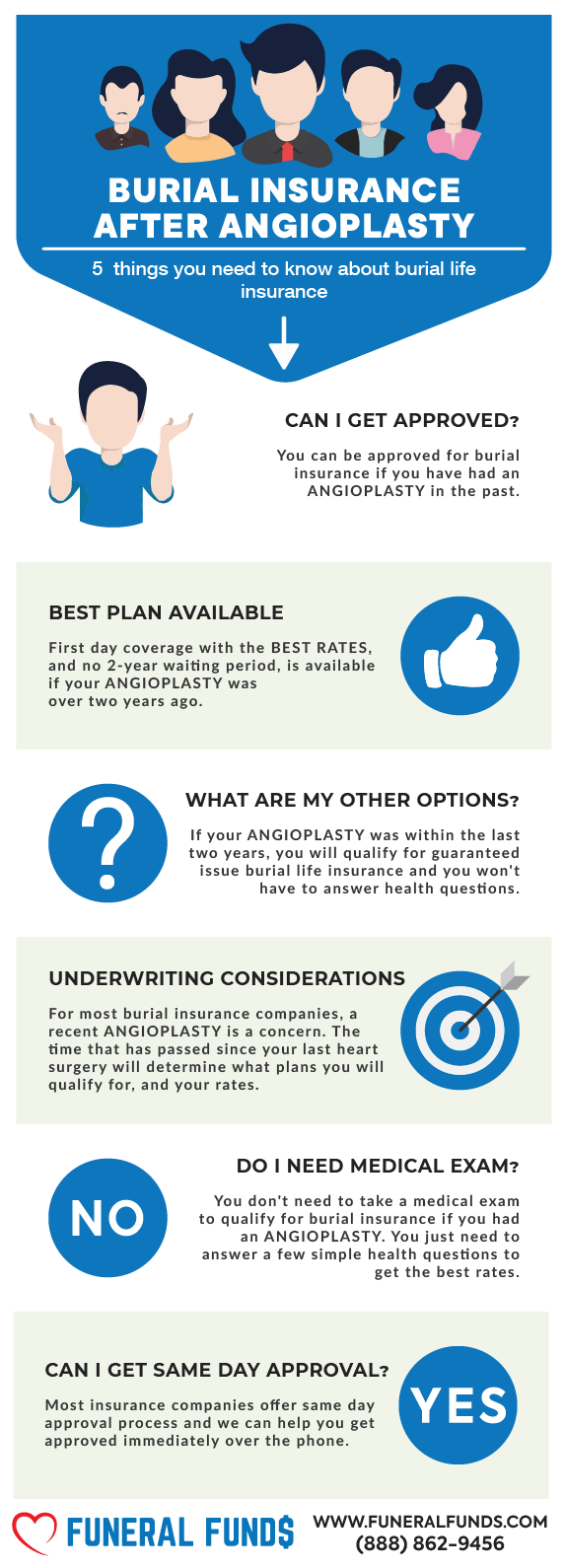

After an angioplasty, you can get affordable burial insurance. Depending on your current health, you may even qualify for first-day coverage insurance if you apply with the right company.

Not all plans and benefits are available in all states.

This article will give you the information to find the right burial insurance with the best pricing.

FOR EASIER NAVIGATION:

- What Is Angioplasty?

- Can I Get Burial Insurance After An Angioplasty?

- What Are The Types Of Burial Insurance Available To People With Angioplasty?

- What Is My Best Insurance Option After Angioplasty?

- Do I Need A Medical Exam To Qualify For Burial Insurance?

- What Is My Burial Insurance Rates After Angioplasty?

- Burial Insurance Underwriting After Angioplasty

- Information We Need if You Have Had Angioplasty

- What If My Application Was Rejected Because of Angioplasty?

- How to Get the Best Burial Insurance Rates With Angioplasty

- How Can Funeral Funds Help Me?

- Frequently Asked Questions

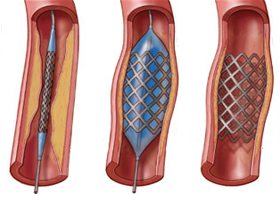

What Is Angioplasty?

Angioplasty is a minimally invasive procedure that widens narrowed coronary arteries, the vessels supplying blood to your heart. A thin tube with a balloon is inserted and inflated at the blockage, improving blood flow and reducing chest pain.

It’s a common treatment for coronary artery disease (CAD). CAD increases the risk of future heart attacks, strokes, and other cardiovascular complications.

Having undergone angioplasty suggests a higher likelihood of needing further treatment for CAD in the future. This could include medications, additional procedures, or even bypass surgery.

Life insurance companies assess risk, and a history of angioplasty indicates a potential for future heart problems and a higher risk for the insurance company having to pay out a claim.

Can I Get Burial Insurance After An Angioplasty?

YES: You even qualify for first-day burial insurance coverage with no waiting period, depending on your current health and what plans are available in your state,

NO: With our preferred company, you can’t qualify for a first-day coverage plan if you are currently hospitalized or have been hospitalized twice or more in the last two years. You can still qualify for guaranteed-issue burial insurance with a two-year waiting period if you don’t qualify for our best plan.

What Are The Types Of Burial Insurance Available To People With Angioplasty?

FIRST-DAY COVERAGE – This burial insurance provides insurance protection from the first day. Your beneficiaries will receive a 100% death benefit when you pass away. Burial insurance with no waiting period is always cheaper than guaranteed issue life insurance.

GUARANTEED ISSUE LIFE INSURANCE—This policy does not require a medical exam or health questions. You will be approved regardless of any health issues. This type of insurance is designed for people who will not qualify for traditional term life insurance or whole life insurance. The downside is the mandatory two-year waiting period.If you pass away during the 2-year waiting period, the insurance company will only pay out the premiums you have paid plus 7-10% interest (depending on the insurance carrier).

What Is My Best Insurance Option After Angioplasty?

If you’ve had an angioplasty procedure, your preferred option should always be a first-day coverage plan.

Our preferred company that offers this 1st-day coverage will ask if you’ve been hospitalized two times in the past two years. If not, you’ll qualify for 1st-day coverage if that plan is available in your state.

If you’re currently hospitalized or have been hospitalized two or more times, your next best insurance option is to get guaranteed issue whole life insurance with a two-year waiting period.

Do I Need A Medical Exam To Qualify For Burial Insurance?

Medical exams, blood tests, and urine samples are not required for burial insurance approval.

The best plans with first-day coverage ask some health questions, and you’ll often get official approval from the insurance company within minutes!

If you don’t want to answer any health questions, you can get guaranteed issue life insurance with a 2-year waiting period.

What Is My Burial Insurance Rates After Angioplasty?

The burial insurance rates will depend on your:

- Age

- Coverage amount

- Gender

- State of residence

- Smoking status

- Type of life insurance policy

Burial Insurance Underwriting After Angioplasty

Here are some examples of angioplasty questions you will see on the health questionnaire:

- During the past 36 months, have you been hospitalized for stroke, angina, heart attack, or heart or circulatory surgery, including angioplasty, pacemaker, stent, or any procedure to improve circulation to the heart or brain?

- Have you ever been advised by a doctor to seek coronary disease treatment?

- In the last two years, other than to prevent or lower risks, have you received treatment for heart or circulatory disorders?

- In the previous 12 months, have you been advised to have heart surgery for coronary disease?

- In the previous two years, did you have any surgery for circulation or blood clots in the heart or brain or been prescribed medication?

Common medications after angioplasty include:

- ACE inhibitors (Captopril, Enalapril, Lisinopril)

- Antiplatelet (Aspirin, Clopidogrel, Prasugrel, Ticagrelor)

- Beta-blockers (Atenolol, Metoprolol, Nadolol)

The presence of these drugs in your prescription history will indicate to the insurance company that you have a history of heart disease.

Information We Need if You Have Had Angioplasty

Here are some of the questions we may ask to get you the best plan and pricing:

- Have you been diagnosed with other health conditions?

- How many stents did you have?

- Was your angioplasty a result of a heart attack?

- What type of heart disease do you have?

- What medications are you currently taking?

- When was your first angioplasty?

- When did you have your last angioplasty?

What If My Application Was Rejected Because of Angioplasty?

If you’ve been declined in the past because of angioplasty, it is best to work with an independent insurance agency like Funeral Funds. We know the underwriting guidelines of multiple companies, and we can get you a better plan with the lowest rates.

We have access to more than 20 insurance companies and can help you qualify with a heart-friendly life insurance company.

How to Get the Best Burial Insurance Rates With Angioplasty

If you have had an angioplasty, the best way to get a first-day coverage burial insurance plan is to work with an independent agency like Funeral Funds. Our independent life insurance agents can compare companies offering first-day coverage insurance and recommend the best plan with the best pricing.

How Can Funeral Funds Help Me?

Here at Funeral Funds, we specialize in getting life insurance coverage for people with a history of angioplasty.

We work with many A+ rated insurance companies that specialize in high-risk clients. We will search those companies to give you the best rate. We’ll match you up with your best life insurance option.

We will assist you in securing the coverage you need at a rate you can afford. So, if you’re looking for burial insurance after angioplasty, we can help. Fill out our quote form on this page or call (888)862-9456 for accurate burial insurance quotes.

Frequently Asked Questions

Can angioplasty be considered a critical illness in life insurance?

No, angioplasty does not typically result in death.

Is angioplasty a major surgery in insurance?

No, angioplasty is considered a relatively minor surgery in insurance.

Can you get first-day coverage insurance if you have angioplasty?

Yes, some insurance companies will offer first-day coverage to people with an angioplasty history.

Do I need to tell insurance about angioplasty?

Yes, if they ask for angioplasty in the health questionnaire.

Can you be denied insurance for angioplasty?

Yes, if you are currently hospitalized, you may be declined for first-day coverage insurance.

Is there a waiting period for insurance after angioplasty?

No, if you qualify for first-day coverage insurance.

Is there an age limit for burial insurance with angioplasty?

You can apply for life insurance and burial insurance until 89 years old, and your plan would last until age 121.

RELATED POSTS: