2024 Burial Insurance and Build Chart

There are some things you need to know about burial insurance build charts when purchasing final expense insurance. Almost all life insurance companies have build charts or weight tables that determine the minimum and maximum height and weight limits.

Some insurance companies rely on a build chart to determine your risk class. They also use it to assess your mortality based on their underwriting experiences.

Your build is the relationship between height, weight, and weight distribution. When buying life insurance, your build may play a significant role in determining whether your application for life insurance will be approved.

If you are overweight or underweight, we have good news for you – Some burial insurance companies do not have a build chart.

In this article, we will discuss burial insurance and build charts to show you how you can find the most affordable final expense insurance if you’re overweight or underweight.

FOR EASIER NAVIGATION:

- What Is A Build Chart?

- Burial Insurance And Build Chart Underwriting

- Burial Insurance And Build Chart

- Burial Insurance For Overweight

- Policy Options If You Are Overweight Or Underweight

- Don’t Put Off Buying Burial Insurance Until You Reach Your Ideal Weight

- How Can Funeral Funds Help Me?

- Additional Questions & Answers On Burial Insurance And Build Chart

What Is A Build Chart?

A build chart is a table that serves as a guideline for the maximum and minimum weight per height that life insurance companies will accept. For example, if you’re only 5’4″, your weight limit will be lower than someone 5’9″.

Every life insurance company has its build chart, and some companies even have no build chart at all.

Build charts or height, and weight tables determine the applicants’ rating class when applying for a life insurance policy. Your build is a significant factor in determining your premium.

According to the company’s build chart, if you are in perfect health but weigh too much, you may end up paying a higher premium or being denied coverage.

Some life insurance companies have very lenient build charts. Being 20-50 pounds overweight doesn’t prevent you from qualifying for the company’s best rate class. Some even provide additional weight allowances for men and women applying after age 60. This is helpful if you are on the heavier side of the chart.

If your only issue is that you are overweight, you will still qualify for the best life insurance rates with some companies. Even if you have a high BMI and are generally obese, you can still get great-priced burial insurance as there are life insurance companies with no build chart.

It is usually mobility issues and weight-related complications such as diabetes or heart disease that may cause you to receive a poor rating or a higher premium. It is important to shop around with the help of an independent life insurance agency like Funeral Funds to see which company will offer you the lowest rate for your height and weight.

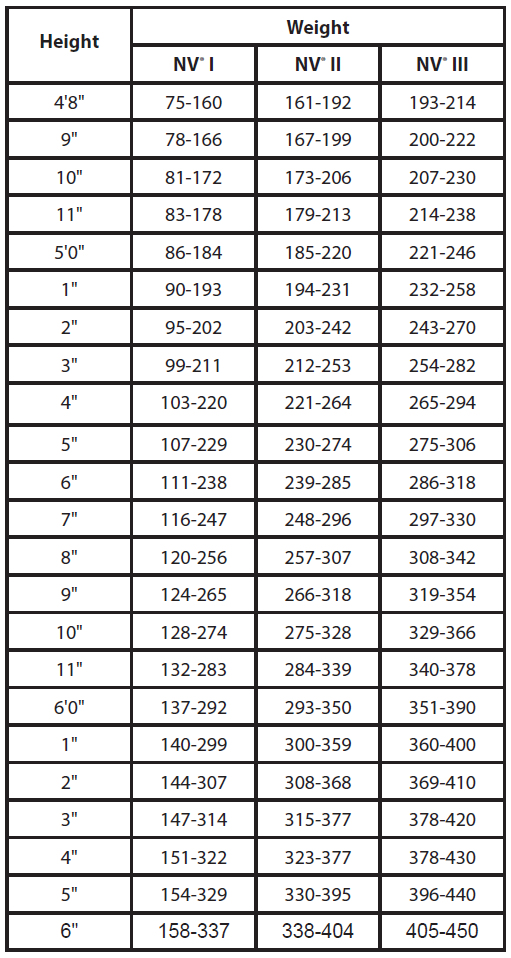

All companies have different build charts, and some don’t even have build charts. Here is an example of one company’s build chart:

Burial Insurance And Build Chart Underwriting

The purpose of insurance underwriting is to determine your medical level of risk. Being overweight increases your risk of many diseases, which increases the life companies’ insurance risk of prematurely paying out the death benefit.

Life insurance companies set rates depending on how risky they determine you are or how likely you are to pass away during the policy’s life.

The Center for Disease Control and Prevention reports that being overweight increases your mortality risk for:

- Stroke

- Heart disease

- Cancer

- Diabetes

- High cholesterol

- High blood pressure

- Liver disease

- Kidney disease

- Osteoarthritis

- Sleep apnea

Although you may not have developed any of these medical conditions, the insurance providers won’t offer you the best rate if you fall outside their recommended weight limits because being overweight can increase your chances of having medical problems later in life.

Burial Insurance And Build Chart

Most insurance companies have a build chart to determine the maximum weight for each rating category. Some companies use a unisex weight chart. This is more favorable to overweight women since men have a higher range of acceptable height-to-weight ratios.

Burial insurance companies that have built charts generally have lenient height and weight requirements as they are designed for more elderly individuals (and we tend to get heavier as we get older).

Some burial insurance or final expense insurance companies have no build chart at all. With these companies, you can be overweight, which does not matter. They won’t care whether you are overweight or underweight, which will not impact your rate.

Burial Insurance For Overweight

The only way being overweight could become an issue with most life insurance companies are if you have mobility issues. If you are too heavy that you need help in activities of daily living, your application for traditional life insurance will be declined, but you still have other options.

Life insurance or funeral insurance companies use six daily living activities to measure mobility and determine if you will be eligible for immediate coverage.

- Eating – the process of feeding yourself using a container like a cup, plate, utensils, feeding tube, or intravenously.

- Bathing – your ability to safely get in and out of the bathtub or shower. Washing your whole body in a basin, a shower, or tub.

- Dressing – taking off and putting on an item of clothing. Putting on and taking off fasteners, braces, and prostheses are also a part of getting dressed.

- Toileting – your ability to safely get on and off the toilet and perform the necessary personal hygiene tasks.

- Transferring – the act of moving in or out of bed, a chair, or a wheelchair. Includes getting in and out of vehicles.

- Continence – the ability to control your bladder and bowel functions. Continence also includes performing related personal hygiene tasks such as caring for a colostomy or catheter bag.

If you are morbidly obese and need help with these self-care activities, you will not qualify for level death benefit even with those companies that do not have a build chart. Your best life insurance option is to take a guaranteed issue life insurance. We can help you get a policy that is priced well.

Policy Options If You Are Overweight Or Underweight

LEVEL DEATH BENEFIT

If you’ve been denied life insurance coverage because of your weight, simplified issue life insurance without a medical exam may be your best option. This plan has less underwriting (health questions) than traditional life insurance, you skip the physical and weight measurement, and you will only need to answer a few health questions.

If you answer no to the “knockout” health questions on the application, most final expense insurance companies will approve your application for coverage even if you are overweight or underweight. Your height and weight proportion will not matter.

Burial insurance with no waiting period will have immediate coverage, and your life insurance payout will be the same throughout the policy’s life. Your premium will not increase for life. Your beneficiaries will receive 100% of your death benefit payout whenever you pass away.

We work with companies that do not have a build chart and are very lenient in underwriting. You can easily qualify for a level-death benefit plan if you are generally healthy and have no mobility issues or daily living activities. It has first-day coverage without a waiting period, and at the lowest rate, the company can offer.

GUARANTEED ISSUE BURIAL INSURANCE

Guaranteed issue life insurance policies are best for morbidly obese applicants with mobility problems. Those who need help with the activities of daily living such as eating, bathing, dressing, toileting, transferring, and continence. If you are obese or underweight with a severe medical condition, this is the only plan.

No exam final expense life insurance doesn’t ask about your height and weight or any health questions. As long as you are a U.S. citizen, you can sign your name on the application, your coverage will be approved, and you will be immediately covered for an accidental form of death.

Guaranteed acceptance whole life insurance has a two-year graded benefit clause for a natural cause of death. If you die within the two-year waiting period, your beneficiaries will receive your total premium paid plus 10% interest. After the waiting period, you will be covered for life.

Aside from being overweight or underweight, you may only qualify for guaranteed issue burial insurance if you have a serious medical issue. This plan is your best option if you cannot qualify for a level death benefit. Whatever happens, for as long as you pay your premiums on time, your beneficiaries will receive a cash payout when you pass away after the waiting period.

Many life insurance companies offer guaranteed issue whole life insurance for people with weight problems and those with severe medical conditions. The only difference is the amount of premium and the length of the waiting period.

Don’t Put Off Buying Burial Insurance Until You Reach Your Ideal Weight

Many people put off buying final expense insurance because they plan on losing weight. But, many weeks and months have passed, and they haven’t lost weight and are still uninsured.

One of the worst things you can do when applying for life insurance is waiting to lose weight to get a better rate. Waiting around to get better rates is not a wise decision. If you need life insurance, you should buy it now. When you reach your ideal weight in a year or so, you can reapply to qualify for cheaper premiums.

Don’t risk living without life insurance because we don’t know what will happen tomorrow. If you put off getting life insurance until you reach your ideal weight and something happens to you, your family would be left with nothing. Buy your policy now and protect your family.

How Can Funeral Funds Help Me?

Finding a policy with a problem with a build chart needn’t be frustrating; working with an independent agency like Funeral Funds will make the process easier and quicker.

If you have a problem with the build chart, let us help you; we will work with you side by side to find a plan that fits your needs.

We will work with you every step to find the plan that fits your financial requirements and budget. You don’t have to waste your precious time searching for multiple insurance companies because we will do the dirty work for you.

We will shop your case at different insurance carriers and get you the best price.

We work with many A+ rated insurance carriers specializing in covering high-risk clients like you. We will search for all those companies to get the best rate. We will match you up with the best final expense insurance companies with the best rate.

We will assist you in securing the coverage you need at a rate you can afford. So, if you are looking to build chart funeral insurance, or build chart burial insurance, or build chart life insurance, we can help. Fill out our quote form on this page or call us at (888) 862-9456, and we can give you accurate funeral insurance quotes.

Additional Questions & Answers On Burial Insurance And Build Chart

What is a build chart?

A build chart is an insurance underwriting tool that considers an applicant’s height and weight when determining insurability and premium rates.

Why is a build chart important?

This is important because it helps to determine an insurance company’s risk in insuring an individual. It also helps set premiums commensurate with the risk being assumed.

What factors are considered in a build chart?

There are some factors that are considered in a build chart. These include height, weight, age, gender, health history, and family health history.

What are the benefits of using a build chart for the insurance company?

There are a number of benefits to using a build chart. Perhaps the most important benefit is that it can help to keep premiums affordable for policyholders by accurately assessing risk. Additionally, building charts can help to streamline the underwriting process and make it more efficient.

What are the drawbacks of using a build chart?

There are a few potential drawbacks to using a build chart. One potential drawback is that it may not always be able to assess risk accurately, as many factors determine risk. Additionally, build charts may not always be updated with the most recent data, leading to inaccurate assessments.

What is the weight and height chart?

The weight and height chart is a tool used by insurance companies to help assess risk. The chart looks at an applicant’s height and weight to help determine the level of risk associated with insuring that individual and set appropriate premiums. Other factors that may be considered in the weight and height chart include age, gender, health history, and family health history.

How often is the weight and height chart updated?

There is no set answer to this question, as insurance companies update their charts at different intervals. However, it is generally recommended that the chart be updated at least every five years to ensure accuracy.

Does weight matter for life insurance?

Yes, weight does matter for some life insurance companies. Many insurance companies use a weight and height chart to assess risk, and this can affect the cost of life insurance premiums.

Does height matter in life insurance?

Yes, height can matter for some life insurance companies. Many insurance companies use a weight and height chart to assess risk, affecting the cost of life insurance premiums.

What is the weight according to age?

There is no one-size-fits-all answer to this question, as weight can vary depending on factors such as age, health, and lifestyle. However, the Centers for Disease Control and Prevention (CDC) provides general guidelines for healthy weight ranges according to age.

What does your height have to be for life insurance?

There is no one-size-fits-all answer to this question as height. However, many life insurance companies use a weight and height chart to help assess risk and set premiums.

Why do life insurance companies ask how tall you are?

Height is just one of the many factors that can affect an individual’s risk level and may be used by life insurance companies to help assess risk and set premiums.

Do insurance companies use BMI?

Final expense life insurance companies do not use BMI or body mass index to help assess risk and set premiums.

How important is BMI in determining life insurance rates?

BMI is just one of the many factors that can affect an individual’s risk level and may be used by life insurance companies to help assess risk and set premiums. Generally speaking, the higher an individual’s BMI, the more likely they have health conditions that could affect their risk level. As a result, BMI can be an important factor in determining life insurance rates with some companies.

Can I get life insurance with high BMI?

Yes, you can get life insurance with a high BMI. However, your BMI may affect your premiums and coverage options.

What is the maximum BMI for life insurance?

There is no one-size-fits-all answer to this question, as BMI can vary depending on several factors, including age, health, and lifestyle. However, many life insurance companies use a BMI of 30 or less to help assess risk and set premiums.

What weight should I be for life insurance?

There is no one-size-fits-all answer to this question, as weight can vary depending on several factors, including age, health, and lifestyle. However, many life insurance companies use a weight and height chart to help assess risk and set premiums. Generally, individuals with a healthy weight are likely to pay lower premiums than those overweight or obese.

RELATED POSTS: