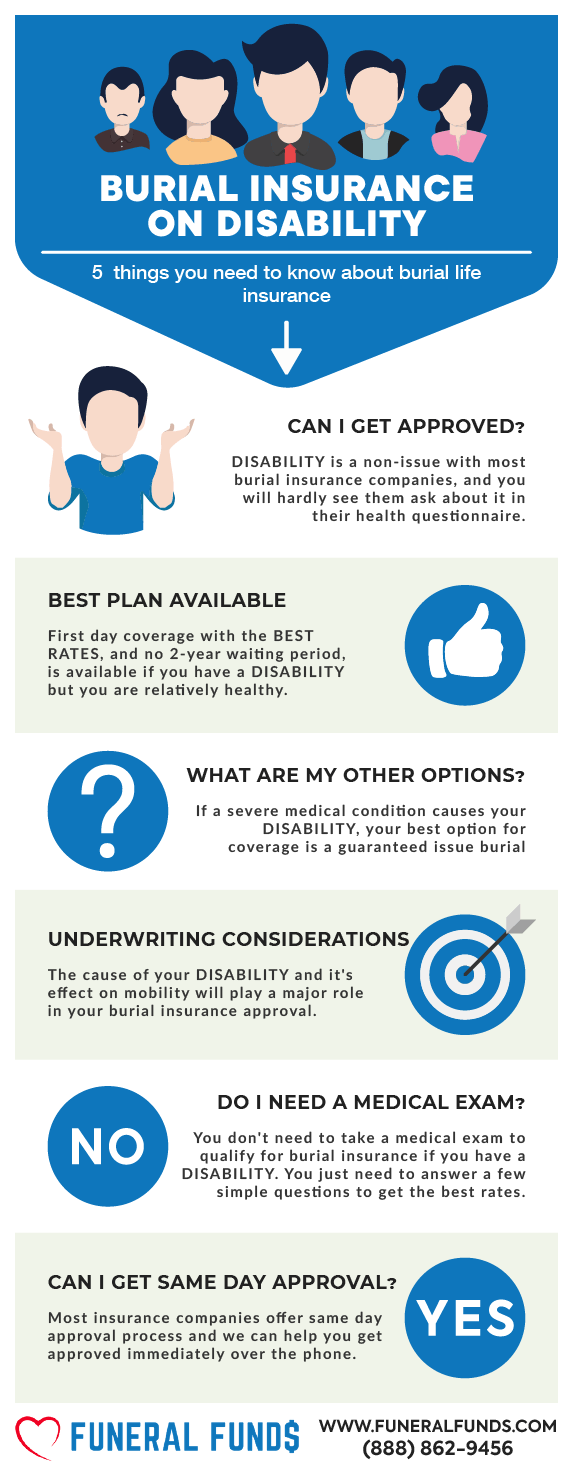

2024 Affordable Burial Insurance With Disability

Purchasing burial insurance with a disability is not out of reach. In fact, the American Disabilities Act prevents anyone from denying coverage to anyone because of their disability.

Most insurance companies handle disability applications on a case-to-case basis. Even if your application was denied in the past, there are still some options open for you to get life insurance coverage.

Keep reading to learn more about what options are open for you if you have a disability and how to get the best plan at the lowest price.

FOR EASIER NAVIGATION:

- What Is My Best Insurance Option If I Have a Disability?

- What Types of Burial Insurance Should I Avoid?

- What Type of Burial Insurance Is Best?

- If I Have a Disability, Do I Need a Medical Exam to Qualify for Burial Insurance?

- Burial Insurance Underwriting If You Have a Disability

- How Much Insurance Do I Need If I Have a Disability?

- How Should I Pay My Premiums?

- Disability and Burial Insurance Riders

- Information We Need if You Have a Disability

- How to Get the Best Burial Insurance Rates for People with Disabilities

- Benefits of Burial & Funeral Insurance

- Other Common Uses for Final Expense Life Insurance with Disability

- How Can Funeral Funds Help Me?

- Additional Questions & Answers On Burial Insurance With Disability

What Is My Best Insurance Option If I Have A Disability?

The cause of your disability will play a major role in your life insurance eligibility.

Here are the most common causes of disability:

CHRONIC PAIN

Chronic pain such as the knee, back or arthritis can cause disability.

If this is your case, you can qualify for the level death benefit. However, insurance carriers will look into the types of medications you use to treat your pain which may have a significant effect on your life insurance eligibility.

If you are taking a prescription medication like Tramadol, Vicodin, Percocet or Hydrocodone, some insurance companies may charge a higher premium because these drugs have the potential for abuse.

If you are taking narcotic drugs, the insurance companies will want to confirm that you have no history of substance abuse. Anti-inflammatory and non-narcotic over-the-counter pain medications have less severe side effects which will make it easier to qualify for a level death benefit.

You will be fully covered immediately and your beneficiary will receive 100% of the death benefit when you pass away for any reason.

Best Option: Level death benefit with first-day coverage

ACTIVITIES OF DAILY LIVING

Chronic pain is absolutely a non-issue with every burial insurance company. It will only pose a problem if your chronic pain caused you to need home health care or if you need help with activities of daily living. If this is your case, your best insurance option is a guaranteed issue burial insurance

You will qualify for this plan regardless of your disability. You don’t need to answer any health questions or take a medical exam to qualify for coverage. A guaranteed issue policy does even ask how mild or severe your disability is because you will be covered with no health questions.

If you die from illness as a result of your other medical condition, the insurance company will pay your beneficiary all premiums you paid plus 10% interest.

After the two-year waiting period, your policy will pay 100% of the death benefit if you die for any reason.

Best Option: Guaranteed issue burial insurance

HEART DISEASE

Heart disease includes many different heart conditions such as heart attack, atrial fibrillation, arrhythmias even hypertension.

Some heart disease like congestive heart failure may make applying for life insurance a challenge, but we know some life insurance carriers that will accept this condition.

The majority of heart diseases are a non-issue with most burial insurance companies. If you have heart disease, we can get you an affordable burial insurance plan. If your heart disease has been treated for more than two years. You will still qualify for a level death benefit plan.

Best Option: Level death benefit with first-day coverage

MENTAL HEALTH CONDITIONS

Many people with a disability may suffer from different mental health conditions such as anxiety, depression, schizophrenia, bipolar disorder, or post-traumatic stress disorder.

If you have mental health issues coupled with disability many burial life insurance companies will accept your application for a first-day coverage plan.

Best Option: Level death benefit with first-day coverage

CANCER 2+ YEARS AGO

Cancer can cause a disability. Whatever type of cancer you have, and when you had it, you still qualify for a burial life insurance plan.

Most cancers that occurred longer than 2 years are a non-issue with most insurance companies. You will qualify for a level death benefit plan with first-day coverage.

Best Option: Level death benefit with first-day coverage

CANCER LESS THAN 2 YEARS AGO

If your cancer occurred within the last 2 years, you will only pay a little more for your policy and have a short waiting period.

Best Option: Guaranteed issue burial insurance

DIABETES

Diabetes can cause disability, but most burial insurance companies will readily accept you with diabetes.

Even if you have diabetic complications like nephropathy, neuropathy, or retinopathy, it will may not even affect your application. You may still be able to get a level death benefit and immediate coverage with your diabetes.

Best Option: Level death benefit with first-day coverage

HOW DO PEOPLE WITH SOCIAL SECURITY DISABILITY INSURANCE (SSDI) GET BURIAL INSURANCE?

Most traditional life insurance carriers will flat out decline any applicant for coverage if they are currently receiving disability benefits.

Burial insurance is different than traditional life insurance. We work with companies that will approve people with a disability if the cause of the disability is not life-threatening and you have no other urgent medical issues.

Best Option: Level death benefit with first-day coverage

VA DISABILITY AND BURIAL INSURANCE

If you’re a disabled veteran that doesn’t collect SSDI, the approval process is often easier for burial insurance. Many veterans that collect VA disability benefits still work or own a business. Most of the time they would pay the same premium as people who are not on disability.

Best Option: Level death benefit with first-day coverage

None of the burial insurance companies care if you are receiving SSDI or veteran benefits. Only a few companies will ask if you are working, retired or disabled. Being on disability is a non-issue to most life insurance companies.

What Types Of Burial Insurance Should I Avoid?

| PLANS TO AVOID | WHY? |

|---|---|

| Term life | Premiums increase after 5 years. Coverage ends after 80. |

| Pre-paid funeral plans | Expensive |

| Universal life | Tied with stocks |

| No health questions policies | With 2-year waiting period |

| Plans offering "teaser rates" | $9.95 per unit plans or $1 buys $100,000 coverage |

| Over priced plans | Insurance from TV and junk mail |

| Plans that accept mail-in payments | Risky |

| Plans that accept Direct Express | High lapse rate |

| Plans that accept Credit Cards | High lapse rate |

What Type Of Burial Insurance Is Best?

| FUNERAL FUNDS PLAN BENEFITS | INCLUDED |

|---|---|

| 1st Day Coverage | YES |

| Rates NEVER Increase | YES |

| Coverage NEVER Decreases | YES |

| Easy to get approved | YES |

| No Medical Exam | YES |

| Same Day Approval | YES |

| Death Claims Pay Fast | YES |

| Builds cash value | YES |

| Coverage Up To Age 121 | YES |

If I Have A Disability, Do I Need A Medical Exam To Qualify For Burial Insurance?

You are NOT required to take a medical exam to qualify for burial insurance with a disability.

When you apply for burial insurance, you only have to answer some basic questions about your health. The application process is simple, and you don’t need to provide medical records or blood and urine samples.

You’ll get the official approval from the insurance company often within minutes!

Burial Insurance Underwriting If You Have A Disability

Burial insurance companies have two ways of underwriting:

FIRST – They may ask you a series of health questions. Your answers to their questions will determine your eligibility.

SECOND – They will electronically review your prescription history to verify your health.

To get the lowest rates and level death benefit that protects you immediately from day one, you need to apply for burial insurance that has underwriting (asks a few health questions).

How Much Insurance Do I Need If I Have A Disability?

The amount of burial insurance you should buy varies depending on your personal and financial circumstances. However, burial insurance should cover the cost of your funeral, burial, and final expenses.

The first step to figuring out how much burial insurance you need is to know your end-of-life expenses. Your funeral cost is often the biggest single expense you need to pay. Other end-of-life expenses to consider are your outstanding medical bills, living expenses, credit card bills, and other debts.

Here’s an example of a funeral cost breakdown from the National Funeral Directors Association.

| AVERAGE FUNERAL COST WITH VIEWING AND BURIAL | |

|---|---|

| Non-declinable basic services | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Hearse | $325 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Metal casket | $2,500 |

| Vault | $1,572 |

| Median Cost of a Funeral With Viewing and Burial | $9,420 |

| AVERAGE FUNERAL COST WITH VIEWING AND CREMATION | |

|---|---|

| Non-declinable basic services fee | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Cremation fee (if firm uses a third-party crematory) | $368 |

| Cremation Casket | $1,310 |

| Urn | $295 |

| Median Cost of a Funeral with Viewing and Cremation | $6,970 |

| Rental Casket | $995 |

| Alternate Cremation Container | $150 |

How Should I Pay My Premiums?

The best way to pay your premium is through a savings or checking account. We recommend you set a bank draft from your savings or checking account. That way, the bank will automatically pay your premium each month and you don’t need to worry about your policy lapsing due to non-payment.

Disability And Burial Insurance Riders

Insurance policy riders add benefits to your policy. Adding insurance riders will enhance your policy to fit your needs. Some riders are built into your policy, while other riders can be added at an additional cost. Most riders are affordable, and it involves little to no underwriting.

Here’s a list of common burial insurance riders:

| FUNERAL FUNDS ADD-ONS | AVAILABILITY |

|---|---|

| Terminal Illness Add-On Benefit | Included with most plans |

| Nursing Home Care Add-On Benefit | Included with most plans |

Information We Need If You Have A Disability

When applying for final expense insurance with a disability, it is important to provide us much information as possible.

It’s important, to be honest when answering all questions on your request for coverage. The more information you provide to us about your health and disability, the better we will be able to match you with a disability-friendly company.

- How long have you been disabled?

- What is the reason you qualify for disability benefits?

- Do you have other health issues?

- Do you have any form of paralysis?

- Are you currently confined to a wheelchair?

- Do you have amputations?

- Do you need help in performing activities of daily living such as eating, bathing, transferring, and continence?

We will use the information you provide to determine which company will be the best fit for you. Our knowledge of the underwriting guidelines of each carrier enables us to find the best burial insurance plan for your needs.

How To Get The Best Burial Insurance Rates For People With Disabilities?

To get affordable rates for burial insurance with a disability, you should use an independent agency like Funeral Funds. We are highly experienced in helping people with disabilities and we are uniquely equipped to shop the market for you to get you the best deal.

Our years of experience allow us to understand how each carrier works and which company would be the best for you. We can compare prices from different companies to see which one will offer you the cheapest plan.

Benefits Of Burial & Funeral Insurance

Here are some of the benefits of purchasing a burial or funeral policy:

- No medical exam or doctor’s visit required – easy to get approved.

- Ease of issue – easy to qualify and get insurance coverage.

- No Money Down to get approved – have your policy start whenever you want.

- Level premium – your premium will never increase.

- Fixed death benefit – your death benefit will never decrease for any reason.

- Permanent protection – your policy can not be canceled by the life insurance company as long as you continue to pay your premiums.

- Tax-free – the death benefit is directly paid to your beneficiary tax-free upon your death

- Cash value builds up – burial insurance is a whole life policy that builds cash value over time.

Other Common Uses For Final Expense Life Insurance With Disability

All of these examples are appropriate uses for Final Expense Life Insurance:

- Burial insurance plan with a disability

- Cremation insurance plan with a disability

- Funeral home insurance plan with a disability

- Final Expense insurance plan with a disability

- Prepaid funeral plan insurance with a disability

- Mortgage payment protection plan with a disability

- Mortgage payoff life insurance plan with a disability

- Deceased spouse’s income replacement plan with a disability

- Legacy insurance gift plan to family or loved ones with a disability

- Medical or doctor bill life insurance plan with a disability

We can help you with any of the plans above. Your pricing will depend on your age, health, and coverage amount for each program option.

How Can Funeral Funds Help Me?

Trying to find a policy with a disability needn’t be a frustrating process; working with an independent agency like Funeral Funds will make the process easier and quicker.

If you have a health history of disability, let us help you; we will work with you side by side to find a plan that fits your needs.

We will work with you every step of the way to find the plan that fits your financial requirements and budget. You don’t have to waste your precious time anymore searching for multiple insurance companies because we will do the dirty work for you.

We will shop your case to different insurance carriers and get you the best price.

We work with many A+ rated insurance carriers that specialized in covering high-risk clients like you. We will search all those companies to get the best rate. We will match you up with the best burial insurance company that gives the best rate.

We will help you obtain the policy you need at a rate you can afford. So, if you are looking for disability funeral insurance, or disability burial insurance, or disability life insurance, we can help.

Fill out our quote form on this page or call us at (888) 862-9456 and we can give you an accurate quote.

Additional Questions & Answers On Burial Insurance With Disability

Can I get life insurance if I am disabled?

Yes, you can get life insurance if you are disabled. In fact, there are also burial insurance policies available for those who are disabled. These policies typically do not have a waiting period and do not require a medical exam. They are also typically much less expensive than life insurance policies.

Can you get life insurance while on disability?

Yes, you can get life insurance while on disability. You can still qualify for coverage because most companies are happy to work with their customers who are disabled.

What is the best burial insurance for someone with a disability?

The best burial insurance for someone with a disability is typically a policy that does not have a waiting period and does not require a medical exam. These policies are typically much less expensive than life insurance policies that never ask health questions.

What is the difference between burial insurance and life insurance?

The main difference between burial insurance and life insurance is that burial insurance policies typically have small death benefit options than traditional life insurance policies.

What is the cost of burial insurance for someone with a disability?

The cost of burial insurance for someone with a disability is typically the same for people who have some health impairments.

What happens to life insurance when you go on disability?

When you go on disability, your life insurance policy will typically continue to be in effect.

Is there a waiting period for burial insurance if you are disabled?

There is no waiting period for burial insurance if you are disabled. First-day coverage is available for people with disability.

What is life insurance disability?

Life insurance disability is a policy that provides coverage in the event that you become disabled. This policy can provide you with a monthly income stream so that you can continue to live comfortably.

Are there any life insurance options for people who are permanently disabled?

Yes, there are many life insurance options for people who are permanently disabled. In fact, many companies offer policies that do not require a medical exam and ask no health questions. Guaranteed issue policies accept applicants regardless of their medical conditions.

Is there a difference between permanent disability and total disability?

Yes, there is a difference between permanent disability and total disability. Permanent disability means that you are unable to work ever again, while total disability means that you are unable to work at your current job.

What is the difference between life insurance and disability insurance?

The main difference between life insurance and disability insurance is that life insurance provides a benefit in the event of death, while disability insurance provides a benefit in the event of disability. Disability insurance typically has a monthly income stream, while life insurance pays out a lump sum of money.

Can I get disability insurance if I have an existing life insurance policy?

Yes, you can get disability insurance if you have an existing life insurance policy. Many companies offer policies that are specifically designed for those who already have life insurance. This coverage can help you maintain your standard of living in the event that you become disabled.

Can I get life insurance if I am receiving disability benefits?

Yes, you can get life insurance if you are receiving disability benefits. Most companies are happy to work with their customers who are on disability. In fact, many policies do not require a medical exam.

What is the difference between long-term disability and short-term disability?

The main difference between long-term disability and short-term disability is that long-term disability policies provide benefits for a longer period of time than short-term policies. Long-term policies typically last until you reach retirement age, while short-term policies typically last for one to two years.

What happens when a person on disability dies?

If a person on disability dies, their policy will typically pay out a death benefit to their beneficiaries. This money can be used to help cover funeral costs or other final expenses.

Why life and disability insurance is needed?

Life and disability insurance is needed because it can provide you with a financial safety net in the event of an unexpected tragedy. These policies can help you pay for medical expenses, funeral costs, and other expenses that may arise as a result of an illness or disability.

When should I get life or disability insurance?

The best time to get life or disability insurance is when you are healthy and have no pre-existing conditions. This will ensure that you are eligible for the best rates and coverage. If you already have an illness or disability, it is still possible to get life or disability insurance, but you may not be eligible for the best rates.

What kind of insurance do you get with disability?

There are many different types of insurance that you can get with a disability. Some of the most common types include life insurance, health insurance, and long-term care insurance.

Is it hard to get life insurance if you are on disability?

It is not hard to get life insurance if you are on disability. Most companies are happy to work with their customers who are on disability.

Is disability insurance a good idea?

Disability insurance is a good idea for anyone who wants to protect their finances in the event of an unexpected illness or disability. These policies can help you pay for medical expenses, funeral costs, and other expenses that may arise as a result of an illness or disability.

Are life insurance and disability insurance the same?

No, life insurance and disability insurance are not the same. Life insurance provides a benefit in the event of death, while disability insurance provides a benefit in the event of disability. Disability insurance typically has a monthly income stream, while life insurance pays out a lump sum of money.

What conditions qualify for disability?

There are many different conditions that can qualify for disability. Some of the most common conditions include cancer, heart disease, and stroke.

Can I get disability insurance if I have an existing life insurance policy?

Yes, you can get disability insurance if you have an existing life insurance policy. Many companies offer policies that are specifically designed for those who are already enrolled in a life insurance policy.

What conditions automatically qualify you for disability?

There are no conditions that automatically qualify you for disability. In order to be eligible for disability benefits, you must meet the eligibility requirements of your policy.

Can I get life insurance if I am receiving social security?

Yes, you can get life insurance if you are receiving social security.

What is disability income rider?

A disability income rider is an optional endorsement that can be added to a life insurance policy. This endorsement provides a benefit in the event that the policyholder becomes disabled.

What is a waiting period for disability insurance?

A waiting period is the amount of time that must pass before you become eligible for benefits under your disability policy. Most policies have a waiting period of 90 days or one year.

Is disability insurance a waste of money?

No, disability insurance is not a waste of money. These policies provide a valuable benefit in the event of an unexpected illness or disability.

What is the most approved disability?

The most approved disability is cancer. Cancer is one of the most common conditions that qualify for disability benefits.

What is the number one disability in the world?

The number one disability in the world is stroke. Stroke is responsible for more disabilities than any other condition.

Does burial insurance affect SSI benefits?

No, burial insurance does not affect SSI benefits.

Can I get life insurance if I am on SSI?

Yes, you can get life insurance if you are on SSI.

Can I get disability insurance if I am on SSI?

Yes, you can get disability insurance if you are on SSI.

What happens to life insurance when you go on disability?

Some life insurance policies have a rider that provides a benefit in the event that the policyholder becomes disabled. This rider provides a monthly income stream, which can help the policyholder pay for medical expenses and other expenses that may arise as a result of an illness or disability. If you are on disability, you should contact your life insurance company to find out if you are eligible for this rider.

Does life insurance affect Social Security disability benefits?

No, life insurance does not affect Social Security disability benefits.

Why life and disability insurance is needed?

Life and disability insurance are important because they provide a financial safety net in the event of an unexpected illness or disability. These policies can help you pay for medical expenses, lost income, and other costs that may arise as a result of an illness or disability.

Is it hard to get approved for life insurance if you have a pre-existing condition?

Getting approved for life insurance with a pre-existing condition can be easy because there are many companies that offer policies that are specifically designed for those who have pre-existing conditions.

What happens when a person on disability dies?

If a person on disability dies, their policy may provide a death benefit that can help their beneficiaries pay for funeral expenses and other costs.

RELATED POSTS:

2 Comments

Mike Paulson

I'm looking to get burial insurance for my disabled brother. I know I can't afford a funeral at this time and want to get a head start on my options. I'll be paying the monthly premiums for a policy. he's in a care facility and has cebral palsy. I want to know what it takes to get a policy for him. thank you. My cell phone number is 626-375-XXXX. if I don't answer because I'm at work just leave a message and I will return the call ASAP. thank you….

Funeral Funds

Visit this page for quotes – https://funeralfunds.com/free-quote/