2024 Burial Insurance for Disabled Persons

Being a disabled person is not a factor with most burial life insurance companies, and final expense life insurance companies don’t even ask about this on their health questionnaires unless you have problems with Activities of Daily Living (ADL).

This article will examine the different insurance options for disabled persons and how to get the best insurance policy at the lowest life insurance rates.

FOR EASIER NAVIGATION:

- Key Learning Points

- Best Insurance Options If You Are Disabled

- How Do People With Social Security Disability Insurance (SSDI) Get Burial Insurance?

- VA Disability And Burial Insurance

- What Types of Burial Insurance Should I Avoid?

- What Type of Burial Insurance Is Best For People with Disabilities?

- Do I Need a Medical Exam to Qualify for Burial Insurance?

- Burial Insurance Underwriting for Disabled Adults

- How Much Insurance Do I Need?

- Information We Need if You’re a Disabled Person

- How Can Funeral Funds Help Me Find the Best Life Insurance?

- Frequently Asked Questions

Key Learning Points

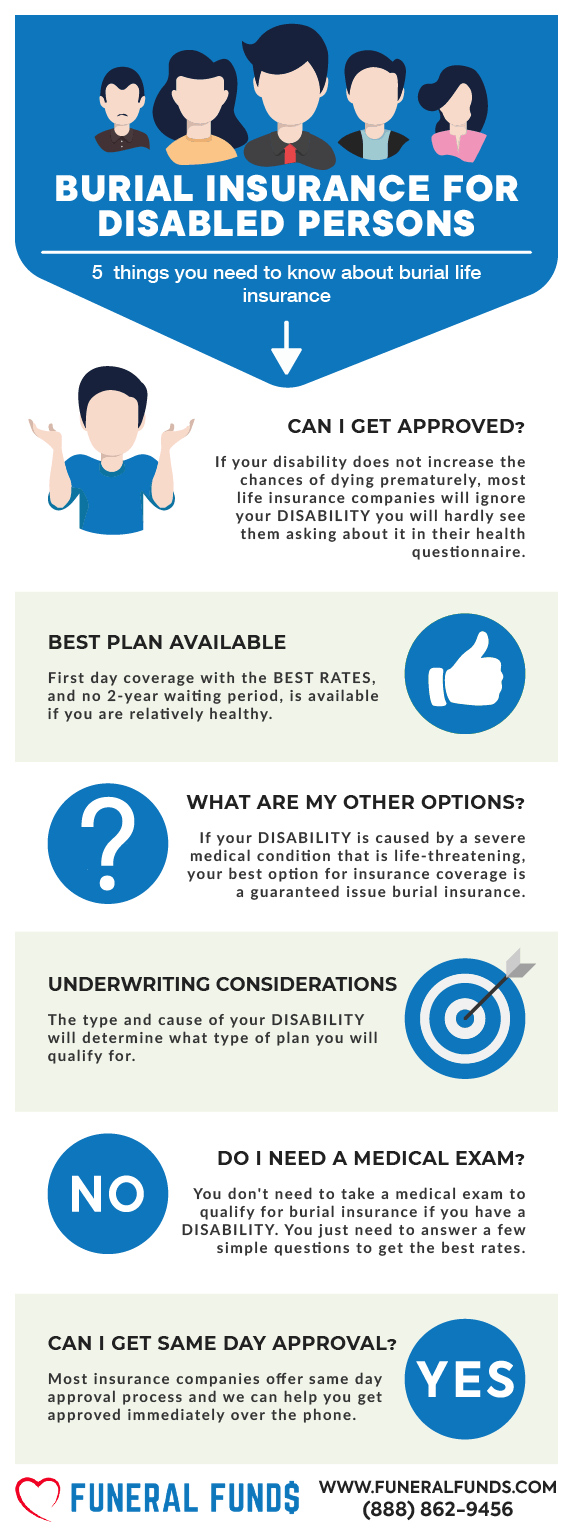

- Burial insurance is available for disabled individuals.

- The waiting period for burial insurance only applies if the disabled person cannot perform activities of daily living on their own.

- Burial insurance and disability insurance provide peace of mind that funeral costs will be covered.

- Burial insurance options are available for specific disabilities, such as wheelchair users and individuals with PTSD.

- The best rates for people with disabilities can be found at Funeral Funds of America.

Best Insurance Options If You Are Disabled

Most insurance companies handle disability applications on a case-to-case basis. Even if your application was denied, there are often options for you to buy life insurance.

Here’s a list of common disabilities that factor into the life insurance application and approval process (in alphabetical order):

ACTIVITIES OF DAILY LIVING

The only time a disability may be an issue to an insurance company is if it causes you to need help with activities of daily living such as eating, bathing, dressing, toileting, transferring, or continence. Your best option for insurance, if you are disabled with ADL issues, is guaranteed issue burial insurance.

You will qualify for this plan regardless of your disability. You don’t need to answer health questions or take a medical exam to qualify for coverage.

Guaranteed issue burial insurance has a graded period for the first two years of the policy for any natural causes of death. The policy will only pay the full death benefit if you die from an accident during the two-year waiting period.

If you die from illness due to your other medical condition, the insurance company will pay your beneficiary all premiums you paid plus 10% interest (with most companies).

After the two-year waiting period, your policy will pay 100% of the death benefit if you die for any reason.

Best Option: Guaranteed Issue Life Insurance through Funeral Funds of America

ARTHRITIS AND OTHER MUSCULOSKELETAL PROBLEMS

According to the CDC, arthritis and other musculoskeletal problems are common causes of long-term disability and account for one-third of all disability cases. This is because muscle and joint problems limit the ability to perform one’s job and daily functions.

Arthritis is a non-issue with most burial insurance companies. You will easily qualify for a level-death benefit plan.

The best feature of a level death benefit is 100% coverage from day one. You will be instantly covered, and your beneficiary will receive a full death benefit when you pass away for any reason.

Best Option: Level death benefit with first-day coverage through Funeral Funds of America

CANCER (MORE THAN 2 YEARS AGO)

Cancer can cause a disability. The type of cancer you have, and when you had it, you still qualify for a burial life insurance plan.

If you’ve been cancer-free for 2 years or longer, it’s a non-issue with most insurance companies. You will qualify for a level death benefit plan with first-day coverage.

Best Option: Level death benefit with first-day coverage through Funeral Funds of America

CANCER (WITHIN LAST 2 YEARS)

If your cancer occurred within the last 2 years, you will only pay a little more for your policy and have a waiting period to deal with.

Best Option: Guaranteed Issue Life Insurance through Funeral Funds of America

CHRONIC PAIN

Chronic pain, such as the knee, back, or arthritis, can cause disability.

You can qualify for the level death benefit if this is your case. However, insurance carriers will look into the types of medications you use to treat your pain, which may significantly affect your life insurance eligibility.

If you are taking narcotic drugs like Tramadol, Vicodin, Percocet, or Hydrocodone, insurance companies will want to confirm that you have no history of substance abuse that would possibly lead to a higher life insurance premium because of the potential for drug abuse.

Anti-inflammatory and non-narcotic over-the-counter pain medications have less severe side effects, making qualifying for a level death benefit easier. You will be fully covered immediately and your beneficiary will receive 100% of the death benefit when you pass away for any reason.

Best Option: Level death benefit with first-day coverage through Funeral Funds of America

DIABETES

Diabetes can cause disability, but most burial insurance companies readily accept diabetics for coverage.

Even if you have diabetic complications like nephropathy, neuropathy, or retinopathy, you may still get a level death benefit and immediate coverage with select companies.

Best Option: Level death benefit with first-day coverage through Funeral Funds of America

HEART DISEASE

Heart disease includes many heart conditions, such as heart attack, atrial fibrillation, arrhythmias, and hypertension.

Some heart diseases, like congestive heart failure, are challenging to get approved for life insurance policies, but some carriers accept these health issues.

The majority of heart diseases are non-issues with most burial insurance companies. We can get you an affordable burial insurance plan if you have heart disease. If your heart disease has been treated for more than two years. You will still qualify for a level-death benefit plan.

Best Option: Level death benefit with first-day coverage through Funeral Funds of America

INJURIES CAUSED BY ACCIDENTS

Injury can occur anytime due to an accident at home, work, or while driving. Accidents account for 10% of all disabilities.

Injuries are not an issue with most burial insurance companies and you will likely still qualify for a level death benefit plan.

Best Option: Level death benefit with first-day coverage through Funeral Funds of America

It will only be an issue if your injury causes mobility problems or your ability to perform activities of daily living.

Best Option (with ADL issues): Guaranteed Issue Life Insurance through Funeral Funds of America

MENTAL HEALTH CONDITIONS

Mental health conditions, such as depression, anxiety, bipolar disorder, schizophrenia, or post-traumatic stress disorder (PTSD), can cause disability.

Many life insurance companies will still accept your application if you have a mental health condition that caused you to have a disability.

Best Option: Level death benefit with first-day coverage through Funeral Funds of America

NERVOUS SYSTEM DISORDERS

Multiple sclerosis, Parkinson’s, ALS, Alzheimer’s, epilepsy, and other conditions that affect the nerves and brain are leading causes of disability in adults. Nervous system disorders affect people for the rest of their lives.

You can still qualify for life insurance coverage if you have any of these conditions. However, in severe cases that may cause the patient to require home health care or help with activities of daily living, they will need to apply for guaranteed issue burial insurance to obtain insurance coverage.

Best Option: Guaranteed Issue Life Insurance through Funeral Funds of America

STROKE

Stroke is a common cause of disability. Almost 75% of stroke survivors were significantly affected by their stroke. Stroke can cause temporary or permanent brain damage and affect mental, physical, and emotional functioning.

People with a stroke often have limited functional mobility in one-half of their body. Depending on the severity, the survivor may need home health care because they need assistance performing daily activities. If this is your case, you will only qualify for guaranteed issue burial insurance for coverage.

Best Option (if more than 2 years ago): Level death benefit with first-day coverage through Funeral Funds of America

Best Option (with ADL issues): Guaranteed Issue Life Insurance through Funeral Funds of America

How Do People With Social Security Disability Insurance (SSDI) Get Burial Insurance?

Traditional life insurance and disability insurance carriers often decline any applicant for coverage if they receive Social Security Disability Income and disability benefits.

Burial insurance is different than traditional life insurance options. We work with companies that will approve people with a disability if the cause of the disability is not life-threatening and they have no other urgent medical issues.

Best Option: Level death benefit with first-day coverage through Funeral Funds of America

VA Disability And Burial Insurance

No quality insurance companies ask if you receive SSDI or veteran benefits. Only a few less desirable companies will ask if you are working, retired, or disabled. Being on disability is a non-issue to different types of life insurance companies that we properly research for our clients.

Best Option: Level death benefit with first-day coverage through Funeral Funds of America

What Types Of Burial Insurance Should I Avoid?

Avoid term life insurance as a type of burial insurance because the premiums often increase after 5 years, and the coverage ends after 80.

As a disabled person, choosing the right type of burial insurance that provides the coverage you need without any limitations or unexpected costs is important. Term life insurance may initially seem affordable, but it isn’t suitable for your long-term life insurance needs.

With term life insurance, you’ll have to pay increasing premiums every five years, which can become a financial burden. Additionally, the coverage ends when you reach the age of 80, leaving your loved ones without any financial protection for funeral expenses. This will cause unnecessary stress and financial strain during an already difficult time.

To ensure that your insurance meets your needs as a disabled person, it’s recommended to explore other options, such as burial insurance, as it provides lifelong coverage and doesn’t have age restrictions or increasing premiums.

What Type of Burial Insurance Is Best For People with Disabilities?

To ensure the best type of burial insurance, exploring different life insurance for disabled people and finding a policy that meets your specific needs and budget is important.

Here are four factors to consider when choosing the best permanent life insurance for disabled adults:

- Coverage: Look for a burial insurance policy that provides sufficient coverage to cover the cost of your funeral, burial, and final expenses. Consider factors such as funeral costs, medical bills, living expenses, credit card bills, and other debts that must be covered.

- Eligibility: Some burial insurance policies have specific eligibility requirements for disabled individuals. Find a policy that doesn’t require extensive underwriting or medical exams, as this can make the application process much easier and quicker.

- Riders: Consider burial insurance policies that allow riders to enhance their coverage. Riders can customize the policy to meet your specific needs. Look for common burial insurance riders such as the Terminal Illness Add-On Benefit and Nursing Home Care Add-On Benefit.

- Cost: Compare the cost of different burial insurance policies to find one that fits within your budget. Remember that the cost may vary based on age, health condition, and coverage amount.

Do I Need A Medical Exam To Qualify For Burial Insurance?

You are NOT required to take a medical exam to qualify for burial insurance for disabled persons.

When you apply for burial insurance, you only have to answer some basic questions about your health. The application process is simple, and you don’t need to provide medical records or blood and urine samples.

You’ll get the official approval from the insurance company often within minutes!

Working with an insurance agent specializing in serving disabled individuals can greatly assist you in finding the best rate on whole life insurance. They have the knowledge and experience to guide you through the application process and help you find a policy that meets your needs.

Burial Insurance Underwriting for Disabled Adults

Burial insurance companies have two ways of underwriting:

FIRST – They may ask you a series of health questions. Your answers to their questions will determine your eligibility.

SECOND – They will electronically review your prescription history to verify your health.

To get the lowest rates and level death benefit that protects you immediately from day one, you need to apply for burial insurance that has underwriting (asks a few health questions).

The insurance companies will assess each applicant individually. If you have a minor form of disability but are generally healthy, you may qualify for level death benefit with immediate coverage. How the life insurance companies will look at your disability will all come down to your overall health.

For example, you lost a limb, but you have been fitted with a prosthetic leg and are now fully functional and able to walk. The insurance company will often approve your application regardless of your amputation. On the other hand, if you lose a leg due to diabetic amputation, you may find applying for life insurance a little difficult to get first-day coverage, and you will have a waiting period.

Every life insurance provider has its unique underwriting guidelines. They differ and may accept or decline applicants based on various health conditions and lifestyles.

How Much Insurance Do I Need?

Typically, you will want to assess how much insurance you need if you have a disability. It’s important to consider your specific expenses, such as funeral, medical, living, credit card, and other debts.

To help you determine the appropriate amount of insurance, here is a breakdown of end-of-life expenses from the National Funeral Directors Association:

| Expense | Average Cost |

|---|---|

| Funeral | $7,640 |

| Cemetery Plot | $1,000 |

| Headstone | $1,500 |

| Funeral Home Services | $3,000 |

| Miscellaneous Expenses | $2,000 |

The first step to figuring out how much burial insurance you need is to know your end-of-life expenses. Your funeral cost is often the biggest single expense you need to pay. Other end-of-life expenses are your outstanding medical bills, living expenses, credit card bills, and other debts.

Information We Need if You’re a Disabled Person

When applying for burial insurance as a disabled person, it’s important to provide information about your disability.

Here are two key pieces of information that insurance companies may need from you:

- Medical History: Be prepared to provide details about your medical condition, including the diagnosis, treatment, and any medications or therapies you’re currently receiving. This information will help the insurance company assess the risk of insuring you.

- Activities of Daily Living: Insurance companies may inquire about your ability to perform activities of daily living, such as bathing, dressing, eating, and mobility. This helps them determine the severity of your disability and how it may impact your ability to qualify for traditional life insurance coverage.

We will use your information to determine which company will best fit you. Our knowledge of the underwriting guidelines of each carrier enables us to find the best burial insurance plan for your needs.

How Can Funeral Funds Help Me Find the Best Life Insurance?

Funeral Funds can assist you in getting burial insurance tailored to your specific needs as a disabled person. We understand that navigating the insurance market can be overwhelming, especially when you have unique circumstances. That’s why we’re here to help.

Here’s how Funeral Funds can assist you:

- Personalized Guidance: Our experienced team will work closely with you to understand your disability and the coverage you require. We’ll guide you through the life insurance application process, ensuring you provide all the necessary information to secure the right burial insurance.

- Specialized Options: We offer life insurance options for people with disabilities, such as wheelchair users, blind, paralyzed, and those with PTSD. These options provide coverage tailored to your unique situation, offering peace of mind that funeral costs will be covered.

- Competitive Rates: Funeral Funds is a licensed and nationally recognized expert in life insurance for people with disabilities. You can stop searching for multiple insurance companies because we’ve established relationships with multiple insurance companies, allowing us to find the lowest-priced burial insurance coverage that meets your needs and budget.

- 1st-Day Coverage: We understand the importance of immediate coverage. That’s why we offer burial insurance options with 1st-day coverage, ensuring that your loved ones will have financial assistance for funeral expenses as soon as the policy is in effect.

At Funeral Funds, we’re committed to serving disabled individuals and their families. Let’s assist you in securing the burial insurance you deserve.

Frequently Asked Questions

Can I Get Burial Insurance if I Have a Disability?

Yes, you can get life insurance coverage if you have a disability. Many insurance companies offer burial insurance for disabled individuals. You will need to provide information about your disability during the application process.

What Factors Should I Consider When Choosing Burial Insurance as a Disabled Person?

When choosing burial insurance for a disabled person, consider your needs, health, and budget. Evaluate the cost and coverage options available and determine what suits your circumstances best.

Do I Need to Undergo a Medical Exam to Qualify for Burial Insurance if I’m Disabled?

You don’t need a medical exam to get life insurance if you’re disabled. The application process is simple and only requires basic health questions. The insurance company provides quick approval.

Are There Any Burial Insurance Options to Avoid for Disabled Individuals?

Yes, there are burial insurance options to avoid for disabled individuals. Term life insurance policy is one to watch out for because premiums increase and coverage ends after a certain age.

How Can Burial Insurance Riders Benefit Disabled Persons?

Burial insurance riders can benefit disabled individuals by enhancing their existing life insurance policy. These life insurance riders, such as the Terminal Illness Add-On Benefit and Nursing Home Care Add-On Benefit, can be added to meet specific needs without extensive underwriting.

2 Comments

Padma Karra

My 25 yr old son who is currently in a group home in NJ is on SSDI & Medicaid. We came to know about "burial insurance"

Funeral Funds

Padma – Your son would not make this insurance a great alternative given his needs in the group home.