Burial Insurance with a Heart Murmur

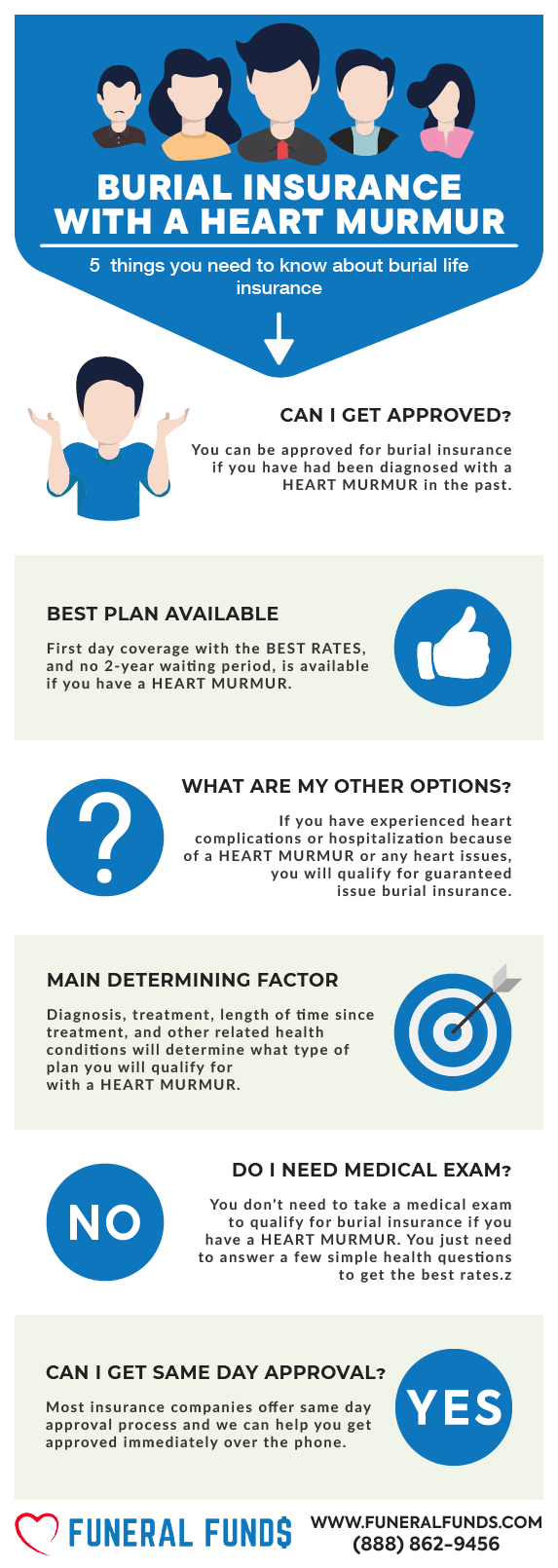

Finding affordable burial insurance with a heart murmur? That little murmur doesn’t make you a life insurance nightmare, so breathe easy. You might even score first-day coverage at rock-bottom rates if you’re not juggling other major health hiccups.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with a heart murmur, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is My Best Insurance Option If I Have A History Of Heart Murmur?

Some heart murmurs are as harmless as a kitten’s purr, but others can be a warning bell for something more serious.

Your approval and the type of policy you’ll qualify for all depends on:

- What type of heart murmur do you have (functional or organic)

- Your date of diagnosis

- What kind of treatment have you received

- Medications prescribed

FUNCTIONAL HEART MURMUR

Got a functional heart murmur? The insurance folks don’t bat an eye. It’s no big deal because it doesn’t mean there’s a problem with your ticker. No symptoms, no meds, no worries.

With a functional murmur that isn’t tied to other heart issues, you’re looking at a level death benefit plan with the lowest premiums.

Translation: You get first-day coverage, no waiting around, and your beneficiary gets 100% of your death benefit when you kick the bucket.

ORGANIC HEART MURMUR

Now, if you’ve got an organic heart murmur – thanks to heart disease or something you were born with – it’s a different story. This kind can come with some serious symptoms like a sketchy heart valve, chest pain, palpitations, or feeling like you just ran a marathon (without the fun).

The real issue for them is what’s causing the murmur, not the murmur itself.

If you had a murmur as a kid and it’s long gone, don’t stress. The insurance folks won’t hold that against you.

Our go-to company will just ask, “Been hospitalized twice in the last two years?” If you can answer “Nope,” you’re on the express lane to first-day coverage perks – assuming you’re in the right zip code, of course.

But if you’re still in the hospital or you’ve had two or more visits in the past couple of years, then it’s time to go for guaranteed-issue whole life insurance.

HEART MURMUR DIAGNOSIS AND TREATMENT (ANGIOPLASTY OR STENT IMPLANT)

Heart Murmur Diagnosis and Treatment Over Two Years Ago

If your heart murmur diagnosis and treatment happened over two years ago, you’re in luck! You’ve got the best and cheapest options waiting for you. Burial insurance companies will roll out the red carpet with a level death benefit plan that comes with first-day coverage at the lowest possible premium.

Heart Murmur Diagnosis and Treatment Within the Last 24 Months

For heart murmurs, our top pick – the one that’s chill with recent circulatory surgery (within 24 months) -might toss you this question: “Have you been hospitalized twice in the last two years?” If you can confidently say, “Nope,” then you’re cruising toward first-day coverage perks, as long as you live in the zip code where the right plans are available.

Now, if you’re still in the hospital or you’ve racked up two or more visits in the last couple of years, your best bet is to grab guaranteed-issue whole life insurance. Sure, there’s a two-year waiting period, but hey, it’s way better than kicking yourself later for not getting insured sooner.

Do I Need A Medical Exam To Qualify For Burial Insurance?

Nope, no medical exam required! To get burial insurance with a heart murmur, you just need to answer a few basic health questions. The application process is so simple, you won’t need to dig up your medical records or give blood and urine samples. And guess what? You’ll usually get approved in minutes!

What Is The Cost Of Burial Insurance?

The cost of burial insurance will depend on your:

- Age

- Coverage amount

- Gender

- General health

- State of residence

- Smoking status

- Type of policy

Pricing example for a graceful 60-year-old female with a heart murmur:

| FEMALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Pricing example for a witty 60-year-old male with a heart murmur:

| MALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Burial Insurance Underwriting If You Have A Heart Murmur

When you’re applying for insurance coverage, the company’s going to give your health the once-over to figure out how much they’re going to charge you.

Burial insurance companies have two tricks up their sleeves when it comes to underwriting:

FIRST – They’ll hit you with a bunch of health questions. Your answers will seal the deal on whether you’re in or out.

SECOND – They’ll do a little electronic snooping through your prescription history to see what meds you’re on and what they reveal about your health.

HEALTH QUESTIONS

Every burial insurance company has its own way of grilling you with health-related questions (except for guaranteed burial insurance, where they don’t ask a thing).

But let’s be real – it’s rare for an insurance carrier to get all up in your business about a heart murmur. Most of them couldn’t care less about the murmur itself – they’re more interested in any underlying health conditions and treatments connected to it.

If they do decide to ask, it’ll look something like this:

- In the last 24 months, have you been diagnosed or treated for a heart murmur?

- Within the past 2 years have you had or been diagnosed with angina (chest pain) heart attack or any type of heart or circulatory surgery?

- Have you been diagnosed with or has been hospitalized for angina, heart attack, heart or circulatory surgery, including pacemaker, heart valve replacement, angioplasty, stent implant, or any procedure to improve circulation to the heart?

PRESCRIPTION HISTORY CHECK

Next, they’re going to dig through your prescription history. They’re on the lookout for any meds you’re taking for a heart murmur or other health issues. They’ll use your meds to piece together the puzzle of your health and any heart murmur diagnosis.

Common medications for a heart murmur include:

- Aspirin

- Coumadin

- Clopidogrel (Plavix)

- Water pills (Diuretics)

- Angiotensin-converting enzyme (ACE) inhibitors (Lisinopril)

- Statins – Simvastatin (Zocor)

- Beta-Blockers – Metoprolol (Lopressor, Toprol-XL)

Now, if you’re popping any of the usual meds for a heart murmur, don’t freak out. Some burial insurance carriers might label you a “heart murmur patient,” but that doesn’t mean you’re uninsurable.

We know some burial insurance carriers that couldn’t care less if you’re on these meds. They’ll still issue a policy, no problem, no matter what’s going on with your heart.

How Much Insurance Do I Need If I Have A Heart Murmur?

How much burial insurance you need? Well, that depends on your personal and financial situation. But let’s get real – burial insurance is there to cover the cost of your funeral, burial, and final expenses.

Start by figuring out your end-of-life costs. Your funeral is usually the big-ticket item. Then, throw in those lingering medical bills, living expenses, credit card debt, and any other loose ends you want to tie up.

How Should I Pay My Premiums?

The easiest way to pay your premiums? Set it and forget it with a bank draft from your savings or checking account. That way, the bank handles it automatically every month, and you won’t have to stress about your policy lapsing because you forgot to make a payment.

Information We Need If You Have A Heart Murmur

When you’re applying for life insurance with a heart murmur, we’ll ask you a few questions about your health to make sure you’re paired up with the best company out there.

Be straight with us – honesty is key to nailing down the right policy for your medical condition. Every insurance company views heart murmurs differently, and picking the right one can save you a ton of time and money.

Here’s what we’ll need to know:

- When did you get your initial heart murmur diagnosis?

- How long have you been having heart murmur?

- Do you have any symptoms of heart disease?

- What caused your heart murmur?

- Did you have any heart surgeries within the last 24 months as heart murmur treatment?

- Have you ever experienced a heart attack, a stroke, or been diagnosed with diabetes?

- Do you suffer from heart failure or coronary artery disease?

- Are you taking prescription medications due to a heart murmur?

- Have you ever been hospitalized due to a heart murmur?

Tell us all about your heart condition. Once we’ve got the details, we’ll shop around with multiple insurance carriers to find the best deal for you.

How Can Final Expense Guy Help Me?

Finding a policy when you’ve got pre-existing heart conditions doesn’t have to be a headache. Working with an independent agency like Final Expense Guy makes it a whole lot easier and faster.

We’ll be with you every step of the way to find a plan that fits your wallet and your needs. No need to waste your time searching high and low for insurance companies – we’ll do the dirty work for you.

We partner with a bunch of A+ rated insurance carriers that specialize in covering high-risk clients like you. We’ll sift through all the options and match you with the best burial insurance company at the best rate.

Our mission? To get you the coverage you need at a price you can afford. So, whether you’re after heart murmur funeral insurance, burial insurance, or life insurance, we’ve got you covered. Fill out our quote form on this page or give us a call at (888) 862-9456, and we’ll hook you up with an accurate quote.

Frequently Asked Questions

Is a heart murmur a pre-existing medical condition?

Oh, absolutely. A heart murmur is definitely a pre-existing medical condition. This means your life insurance company is going to take it into account when deciding if they’ll issue you a policy or not.

Can I get burial insurance if I have a heart murmur?

You bet you can! Having a heart murmur doesn’t disqualify you from getting burial insurance. The type of plan you qualify for will depend on the specifics of your heart murmur, along with your diagnosis and treatment history.

Can you get first-day coverage insurance if you have a heart murmur?

Yes, indeed! You can still get first-day coverage insurance even if you have a heart murmur.

Do I need to tell insurance about heart murmur?

Yes, you do. You’ve got to let your life insurance company know about your heart murmur because it’s considered a pre-existing medical condition.

What is my best insurance option if I have a heart murmur?

It really depends on the specifics of your heart murmur and how it’s been diagnosed and treated. Some folks might qualify for first-day coverage insurance, while others might only be eligible for a guaranteed issue life insurance if their treatment was within the last year.

Can you be denied insurance for a heart murmur?

Unfortunately, yes. You can be denied insurance because of a heart murmur, especially if you’ve had a recent angioplasty or stent implant related to it.

How can you get the best life insurance rates with a heart murmur?

To get the best life insurance rates with a heart murmur, team up with an independent life insurance agent from Final Expense Guy who can do the legwork for you. They’ll shop around and find the best plan that fits your needs.