2024 Burial Insurance for Marijuana and Illegal Drug Users

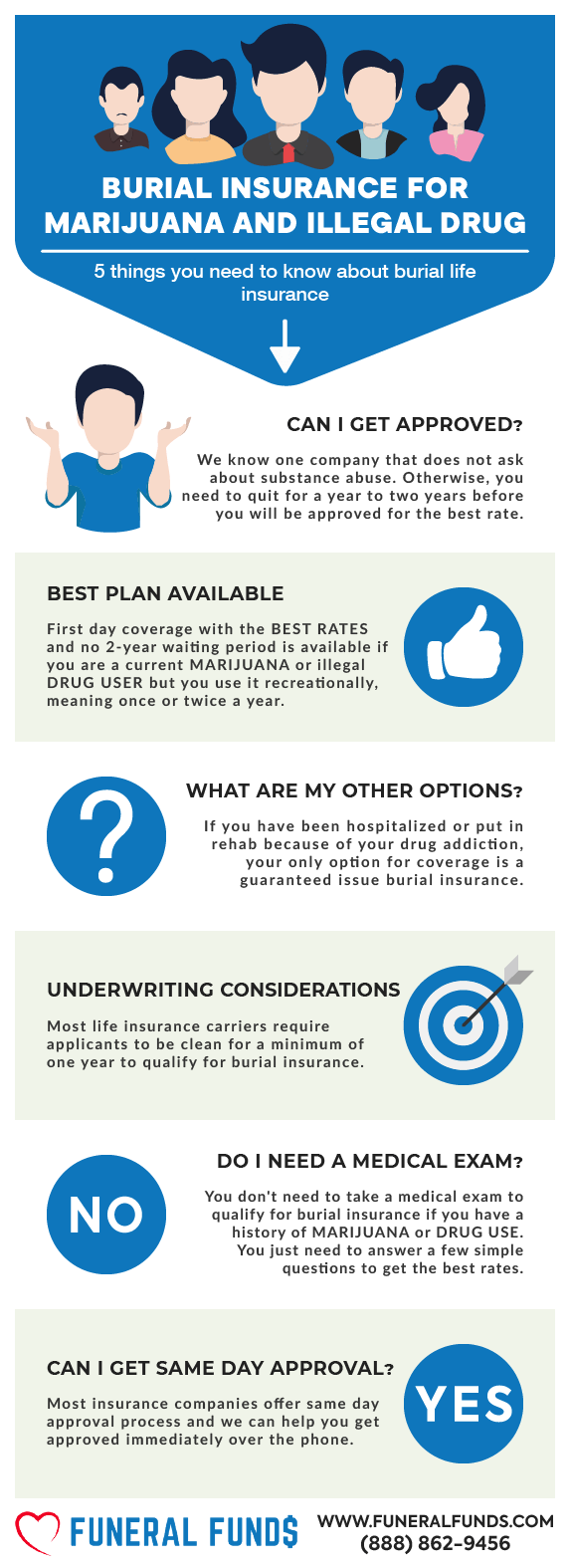

In the past, most life insurance companies often denied burial insurance for marijuana and illegal drug users. With an increasing number of states in the U.S. legalizing marijuana or cannabis for medical use, the insurance industry has been lenient on marijuana and CBD oil use over the past decade.

Life insurance is available for marijuana users with or without a prescription. If you’re a recreational marijuana user, there are plans available where you don’t have to disclose your usage. Policies are now available even if you live in a state that has yet to legalize marijuana for medicinal or recreational use.

If you’re a recovering addict, qualifying for final expense insurance depends on a few factors. Read on to learn how to purchase burial insurance for marijuana and illegal drug users.

FOR EASIER NAVIGATION:

- What Is My Best Insurance Option If I Have a History of Marijuana and Illegal Drug Use?

- What Types of Burial Insurance Should I Avoid?

- What Type of Burial Insurance Is Best?

- If I Have a Marijuana and Illegal Drug Use History, Do I Need a Medical Exam to Qualify for Burial Insurance?

- Burial Insurance Underwriting If You Have a Marijuana and Illegal Drug Use History

- How Much Insurance Do I Need If I Have a Marijuana and Illegal Drug Use History?

- How Should I Pay My Premiums?

- Marijuana and Illegal Drug Use and Burial Insurance Riders

- Information We Need if You’re a Marijuana and Illegal Drug User

- Benefits of Burial & Funeral Insurance

- Other Common Uses for Final Expense Life Insurance for Marijuana and Illegal Drug Users

- How Can Funeral Funds Help Me?

- Additional Questions & Answers On Burial Insurance For Marijuana And Illegal Drug Users

What Is My Best Insurance Option If I Have A History Of Marijuana And Illegal Drug Use?

RECREATIONAL MARIJUANA USE

If you are a current marijuana user using it recreationally, meaning once or twice a year, you may qualify for level death benefit at a non-tobacco rate. You will be covered from the first day, and your beneficiary will receive 100% of your death benefit when you pass away.

Ironically, you will be charged tobacco rates if you’re using marijuana with a prescription to treat a medical condition such as chronic pain and various other diseases.

Best Option: Level death benefit plan with first-day coverage

MEDICAL MARIJUANA USE

Your burial insurance eligibility if you use medical marijuana will depend on the medical condition treated with marijuana.

Medical marijuana may be used for common illnesses like high blood pressure, high cholesterol, or obesity

Best Option: Level death benefit plan with first-day coverage

Medical marijuana use for chronic and terminal illness

If you are using medical marijuana to treat chronic and terminal illnesses, your best insurance option is guaranteed issue burial insurance.

This plan is a little bit more expensive than the level death benefit, it has a maximum of $25,000 death benefit and a two-year waiting period.

The plan does not go into effect immediately like a level death benefit. You must live for two years before your beneficiary will receive your full death benefit if you pass away from a natural cause.

If you die during the two-year waiting period, your beneficiary will only receive the full refund of all the premiums you paid plus interest which is usually 10%.

Best Option: Guaranteed issue burial insurance

ILLEGAL DRUG USE

Substance abuse can cause premature death or increased mortality risk. This is why insurance carriers require applicants to be clean for a minimum of two years to qualify for burial life insurance with the first-day coverage.

Illegal drugs that carry the highest risk of addiction:

- Marijuana

- Ecstasy

- Benzodiazepines

- Methadone

- Amphetamines

- Cocaine

- Bath salts

- Methamphetamine

- Heroin

- Crack cocaine

SOBRIETY FOR 2 YEARS AND LONGER

Most life insurance companies strictly insure people with a history of drug abuse unless they have remained clean and sober for a minimum of two years.

If you’ve been clear for 2 years or longer, you will qualify for the best plan with the lowest rate.

It is important to remember that whether or not you may qualify for a level death benefit is completely up to the individual company. Every life insurance carrier has a different requirement than others. It is best to seek professional advice from an independent life insurance agency like Funeral Funds about your specific case.

Best Option: Level death benefit plan with first-day coverage

ILLEGAL DRUG ABUSE OR TREATMENT WITHIN THE LAST 2 YEARS

If you’ve been diagnosed, received treatment, hospitalized, or recommended for counseling or treatment within the last two years, you will qualify for a first-day benefit plan.

You will be covered for the first day, and your death benefit will be phased in over time.

Best Option: First-day benefit plan

What Types Of Burial Insurance Should I Avoid?

| PLANS TO AVOID | WHY? |

|---|---|

| Term life | Premiums increase after 5 years. Coverage ends after 80. |

| Pre-paid funeral plans | Expensive |

| Universal life | Tied with stocks |

| No health questions policies | With 2-year waiting period |

| Plans offering "teaser rates" | $9.95 per unit plans or $1 buys $100,000 coverage |

| Over priced plans | Insurance from TV and junk mail |

| Plans that accept mail-in payments | Risky |

| Plans that accept Direct Express | High lapse rate |

| Plans that accept Credit Cards | High lapse rate |

What Type Of Burial Insurance Is Best?

| FUNERAL FUNDS PLAN BENEFITS | INCLUDED |

|---|---|

| 1st Day Coverage | YES |

| Rates NEVER Increase | YES |

| Coverage NEVER Decreases | YES |

| Easy to get approved | YES |

| No Medical Exam | YES |

| Same Day Approval | YES |

| Death Claims Pay Fast | YES |

| Builds cash value | YES |

| Coverage Up To Age 121 | YES |

If I Have A Marijuana And Illegal Drug Use History, Do I Need A Medical Exam To Qualify For Burial Insurance?

You are NOT required to take a medical exam to qualify for burial insurance for marijuana and illegal drug users.

When you apply for burial insurance, you only have to answer some basic questions about your health. The application process is simple, and you don’t need to provide medical records or blood and urine samples.

You’ll get the official approval from the insurance company often within minutes!

Burial Insurance Underwriting If You Have A Marijuana And Illegal Drug Use History

Almost all life insurance companies with underwriting ask about marijuana and illegal drug use in their health questionnaire.

They are going to ask you about what kind of medications you are presently taking and order a prescription database check.

They do this to learn more about what drugs you are taking to see if they can identify any red flags that may indicate whether or not you are abusing your medications.

For example, some insurance companies may ask about drug use this way:

- Within the last two years, have you been treated for, been advised by a medical professional to have treatment for, or excessively used, alcohol or any drugs of abuse?

- During the past 24 months, have you been advised to have treatment or counseling for alcohol or drug abuse?

- Within the past 2 years, have you had, or been diagnosed with, or received or been advised to receive treatment for medication for alcohol or drug abuse, or have used illegal drugs?

When we ask about marijuana use, do not lie. Be honest with your agent about your past or current drug use, including the frequency and the amount you take.

Lying on an insurance application is a fraud, and you risk losing your benefits; just tell the truth on your application.

When you apply for a life insurance policy, don’t worry about your marijuana usage being used against you by law enforcement agents because your rights are protected under HIPPA laws (Health Insurance Portability and Accountability Act 1996).

HIPPA guarantees the “privacy of individually identifiable health information.” All the information you disclose on your life insurance application is strictly private and confidential.

We need to know as much information about your drug use so we can place you with the right insurance carrier that will look at your case favorably and offer you the best-priced policy.

There are three common methods burial insurance companies use to learn about your potential illegal drug use in their underwriting process:

- Insurance application – Every burial insurance company with underwriting (health questions) will ask about illegal drugs or if you have a history of alcohol or drug abuse.

- Prescription Database Check – Insurance carriers will automatically order a prescription database check which will provide information about any prescription medications you are taking and how many times those drugs have been filled over the years.

- Medical Information Bureau (MIB) Reports – MIB is shared among insurance companies that provide previous life insurance application results to other insurance carriers to review. If you applied for a life insurance policy in the last 6 months and were denied due to illegal drug use, this information will be available to any company should you decide to apply.

How Much Insurance Do I Need If Have A Marijuana And Illegal Drug Use History?

The amount of burial insurance you should buy varies depending on your personal and financial circumstances. However, burial insurance should cover the cost of your funeral, burial, and final expenses.

The first step to figuring out how much burial insurance you need is to know your end-of-life expenses. Your funeral cost is often the biggest single expense you need to pay. Other end-of-life expenses to consider are your outstanding medical bills, living expenses, credit card bills, and other debts.

Here’s an example of a funeral cost breakdown from the National Funeral Directors Association.

| AVERAGE FUNERAL COST WITH VIEWING AND BURIAL | |

|---|---|

| Non-declinable basic services | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Hearse | $325 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Metal casket | $2,500 |

| Vault | $1,572 |

| Median Cost of a Funeral With Viewing and Burial | $9,420 |

| AVERAGE FUNERAL COST WITH VIEWING AND CREMATION | |

|---|---|

| Non-declinable basic services fee | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Cremation fee (if firm uses a third-party crematory) | $368 |

| Cremation Casket | $1,310 |

| Urn | $295 |

| Median Cost of a Funeral with Viewing and Cremation | $6,970 |

| Rental Casket | $995 |

| Alternate Cremation Container | $150 |

How Should I Pay My Premiums?

The best way to pay your premium is through a savings or checking account. We recommend you set a bank draft from your savings or checking account. That way, the bank will automatically pay your premium each month, and you don’t need to worry about your policy lapsing due to non-payment.

Marijuana And Illegal Drug Use And Burial Insurance Riders

Insurance policy riders add benefits to your policy. Adding insurance riders will enhance your policy to fit your needs. Some riders are built into your policy, while other riders can be added at an additional cost. Most riders are affordable, and it involves little to no underwriting.

Here’s a list of common burial insurance riders:

| FUNERAL FUNDS ADD-ONS | AVAILABILITY |

|---|---|

| Terminal Illness Add-On Benefit | Included with most plans |

| Nursing Home Care Add-On Benefit | Included with most plans |

Information We Need If You’re A Marijuana And Illegal Drug User

When applying for final expense insurance for marijuana and illegal drug users, it is important to provide us much information as possible.

We will ask you a series of health questions to better understand your condition. These questions include:

- When did you start using marijuana or illegal drugs?

- How long have you been using marijuana or illegal drugs?

- What type of drugs have you used?

- Have you ever been hospitalized due to marijuana or illegal drugs?

- How long have you been living a drug-free life?

- Have you sought treatment or professional help to ensure sobriety?

- Have you gone to rehab? How long have you been there?

- Did you have a relapse? If so, how many times?

- Do you have any medical issues caused by marijuana or illegal drug use (heart disease, stroke or HIV)?

We need to know your medical condition to provide you with the best recommendation. The more information we get, the better our chances of finding affordable insurance coverage.

Benefits Of Burial & Funeral Insurance

Here are some of the benefits of purchasing a burial or funeral policy:

- No medical exam or doctor’s visit is required – easy to get approved.

- Ease of issue – easy to qualify and get insurance coverage.

- No Money Down to get approved – have your policy start whenever you want.

- Level premium – your premium will never increase.

- Fixed death benefit – your death benefit will never decrease for any reason.

- Permanent protection – your policy can not be canceled by the life insurance company as long as you continue to pay your premiums.

- Tax-free – the death benefit is directly paid to your beneficiary tax-free upon your death

- Cash value builds up – burial insurance is a whole life policy that builds cash value over time.

Other Common Uses For Final Expense Life Insurance For Marijuana And Illegal Drug Users

All of these examples are appropriate uses for Final Expense Life Insurance:

- Burial insurance plan for marijuana and illegal drug users

- Cremation insurance plan with marijuana and illegal drug users

- Funeral home insurance plan with marijuana and illegal drug users

- Final Expense insurance plan with marijuana and illegal drug users

- Prepaid funeral plan insurance with marijuana and illegal drug users

- Mortgage payment protection plan marijuana and illegal drug users

- Mortgage payoff life insurance plan marijuana and illegal drug users

- Deceased spouse’s income replacement plan marijuana and illegal drug users

- Legacy insurance gift plan to family or loved one’s marijuana and illegal drug users

- Medical or doctor bill life insurance plan marijuana and illegal drug users

We can help you with any of the plans above. Your pricing will depend on your age, health, and coverage amount for each program option.

How Can Funeral Funds Help Me?

Finding a policy for marijuana and illegal drug users needn’t be frustrating; working with an independent agency like Funeral Funds will make the process easier and quicker.

We will work with you every step in finding the plan that fits your financial requirements and budget. You don’t have to waste your precious time searching for multiple insurance companies because we will do the dirty work for you.

We work with many A+ rated insurance carriers that specialize in covering high-risk clients like you. We will search all those companies to get the best rate. We will match you up with the best burial insurance company that gives the best rate.

We will assist you in securing the coverage you need at a rate you can afford. So, if you are looking for marijuana or illegal drug use funeral insurance, marijuana or illegal drug use burial insurance, or marijuana or illegal drug use life insurance, we can help.

Fill out our quote form or call us at (888) 862-9456, and we can give you accurate life insurance quotes.

Additional Questions & Answers On Burial Insurance For Marijuana And Illegal Drug Users

What is considered illegal drugs in life insurance?

The term “illegal drugs” can refer to a wide range of substances, including controlled substances like heroin and cocaine and recreational drugs like marijuana or LSD. Because these substances are often associated with increased risk factors for health complications and other negative behaviors, most life insurance companies will consider applicants who use illegal drugs to be high-risk candidates.

Do I qualify for life insurance if I have a history of marijuana use?

Yes, in some cases, you may be able to qualify for life insurance even if you have a history of marijuana use. However, the coverage you’ll obtain will likely be limited, and you may have to pay higher premiums than someone with no history of drug use.

Do I qualify for life insurance if I have a history of illegal drug use?

Yes, in some cases, you may be able to qualify for a traditional life insurance policy even if you have a history of illegal drug use.

Do I need to take a medical exam if use illegal drugs?

No, you don’t need to take a medical exam if you use illegal drugs. However, the insurance company will likely require you to answer questions on the application about your drug use.

Do I qualify for life insurance if I’m undergoing drug abuse treatment?

If you’re currently undergoing drug abuse treatment, you may still be able to qualify for life insurance. However, you may qualify for first-day benefits or a guaranteed issue life insurance.

Do I need to tell insurance about my illegal drug use?

Yes, you must disclose your history of illegal drug use to any life insurance company you’re applying for coverage with. If you fail to disclose this information, your insurance policy may be null and void.

Do I need to take a medical exam if I have a history of marijuana use?

No, you don’t need to take a medical exam if you have a history of marijuana use. However, the insurance company will likely answer some questions on your request for coverage about your drug use history.

Is it possible to get life insurance if I have a history of marijuana use?

Yes, in some cases, you may be able to qualify for life insurance even if you have a history of marijuana use.

Can I get burial insurance if use illegal drugs?

Yes, you may still be able to qualify for burial insurance even if you use illegal drugs. However, your eligibility will depend on several factors, including age and health.

Can you get first-day coverage insurance if you use marijuana or illegal drugs?

Yes, you get first-day coverage insurance if you’ve been sober for two years or longer.

Can you get first-day coverage insurance if I’m undergoing illegal drug treatment?

Unfortunately, you can’t get first-day coverage insurance if you’re currently undergoing treatment for illegal drug use.

What are the consequences of not telling my insurance company about my illegal drug use?

If you fail to disclose your history of illegal drug use to your life insurance company, your policy may be null and void. This means that the life insurance company would not have to pay out a death benefit to your beneficiaries in the event of your death.

What are the benefits of burial insurance if use illegal drugs?

One of the main benefits of burial insurance is that it can help provide financial support and security to your loved ones in the event of your death. This type of insurance can also help to cover the costs of your funeral and other final expenses.

Does current illegal drug use affect life insurance eligibility?

In general, current illegal drug use can affect your eligibility for life insurance. However, the specific requirements will depend on various factors, such as the type of policy you’re applying for and the insurance company you’re applying with.

Do I need a marijuana card to apply for insurance?

No, you don’t need a marijuana card to apply for life insurance. However, you will likely be required to complete a questionnaire about your history of marijuana use.

Does current illegal drug treatment affect life insurance?

In general, current illegal drug treatment can affect your eligibility for life insurance. Any current treatment may qualify you for first-day benefits or guaranteed issue life insurance.

Can I qualify for funeral insurance if I use illegal drugs?

It depends on several factors, including your age and health status. However, in some cases, you may be able to qualify for funeral insurance.

How long do I need to be sober to qualify for a first-day coverage plan?

You will need to be sober for at least two years to qualify for a first-day coverage plan. This period may differ depending on the insurance company you’re applying with.

What is the maximum age to apply for life insurance if I use marijuana?

The maximum age to apply for life insurance is typically 85 years old, and your policy would last until age 121 years old if approved.

Do I need to tell the insurance company about my illegal drug use treatment?

Yes, if you’re asked about your drug use history, you must be honest and upfront about your use.

Can I get burial insurance if I’m in recovery from drug addiction?

Yes, you may be able to qualify for burial insurance even if you’re in recovery from drug addiction. However, this will depend on your age and health status.

What are the consequences of lying about my illegal drug use on a life insurance application?

Your policy may be null and void if you lie about your illegal drug use on a life insurance application. This means that the life insurance company would not have to pay out a death benefit to your beneficiaries in the event of your death.

How does my current illegal drug use affect life insurance?

Your current illegal drug use will likely affect your eligibility for life insurance. However, the specific requirements will depend on various factors, such as the type of policy you’re applying for and the insurance company you’re applying with.

What happens if I don’t disclose my marijuana or illegal drug use?

If you fail to disclose your marijuana or illegal drug use, your life insurance policy may be null and void. This means that the life insurance company would not have to pay out a death benefit to your beneficiaries in the event of your death.

How long do I need to be sober to qualify for a first-day coverage plan?

You will need to be sober for at least two years to qualify for a first-day coverage plan.

What is the waiting period for life insurance if I’m currently using illegal drugs?

The waiting period for life insurance if you’re currently using illegal drugs is typically two years to qualify for a first-day coverage plan.

Do I qualify for cremation insurance if I use illegal drugs?

Yes, you may be able to qualify for cremation insurance even if you use illegal drugs. However, this will depend on your age and health status.

What are the things that may affect the insurance eligibility if I use illegal drugs?

Some things that may affect your eligibility for life insurance if you use illegal drugs include your age, health status, and the type of policy you’re applying for.

Can I get life insurance coverage if I’m in recovery from drug addiction?

Yes, you may be able to qualify for life insurance coverage even if you’re in recovery from drug addiction. However, this will depend on your age and health status.

Can you be denied insurance if you’re abusing illegal drugs?

Yes, you may be denied insurance if you’re abusing illegal drugs. Some life insurance companies will deny your application if you are currently in a rehabilitation facility.

Can illegal drug use affect my life insurance rates?

Yes, illegal drug use can affect your life insurance rates, which may indicate an increased mortality risk. Factors that will affect your rates include your treatment and how long you have been sober.

Will the life insurance company tell my employer I use marijuana or illegal drugs?

No, the life insurance company will not tell your employer that you use marijuana or illegal drugs. However, you may be required to disclose this information on your life insurance application.

Can I qualify for funeral insurance if I use medical marijuana?

Yes, you may be able to qualify for funeral insurance even if you use medical marijuana. However, this will depend on your age and health status, as well as the specific requirements of your insurance provider.

What is the average cost of life insurance for marijuana users?

The average cost of life insurance for marijuana users will vary depending on several factors, including your age, health status, and the type of policy you’re applying for. In general, marijuana users will pay higher premiums than non-users.

Can you be denied insurance if you use illegal drugs?

Yes, you may be denied insurance if you use illegal drugs. Some life insurance companies will not issue policies to applicants recently in a drug or alcohol rehabilitation facility. However, many providers will offer coverage to applicants with past drug abuse issues.

What are the tips for getting life insurance for illegal drug users?

Some tips for getting life insurance for illegal drug users include:

- Quitting drugs and alcohol for at least two years before applying for coverage.

- Applying for a policy that does not require a medical exam.

- Choosing a life insurance company specializing in high-risk applicants, such as those with a history of substance abuse.

- Seeking the advice of a qualified insurance agent who can help you find a policy with the best rates.

RELATED POSTS:

2 Comments

Linda Howell

I'm looking for quotes for burial coverage for my husband. he is a recovering addict.

Funeral Funds

It depends on if your husband is still using, and how long it's been since he last used. We have some options, so go to this page for more information – https://funeralfunds.com/free-quote/