Burial Insurance Over 70 – 2024 Update

Not to be unkind, but at 70, you’re not a spring chicken anymore. Statistically speaking, at 70 years of age, you don’t have many years left. We hope you live a long time, but the statistics are not on your side. Does life insurance make sense after 60? You should be looking for burial insurance over 70 sooner rather than later!

Can you get life insurance after age 70? If you are looking for life insurance for seniors over 70, you are the perfect candidate for a burial policy. Think about it…you know you’re going to die…why not take care of your burial needs now, so others don’t have to take care of what you should have taken care of while you are alive.

At age 70, you undoubtedly understand every minute and every day is a precious gift. With that in mind, we give you all the details you need to know, so you can make the most informed decision possible and get the lowest final expense coverage premiums.

Burial policies are ideal for folks who don’t want to burden their loved ones with the cost of their funeral and final expenses. These life insurance plans for 70 and over are intended to pay for your funeral cost, cremation cost, and other end-of-life expenses.

They can also be used to pay off any outstanding debts, leave money behind for loved ones, or make mortgage payments until your loved ones can sell it, so the bank doesn’t get the equity in your home.

This is important …time is not on your side.

If you are over age 70, you’ve likely seen many friends and family members pass away. You understand life is a gift, and you have to roll with the punches that life delivers you. Your guess is as good as mine as to when you will die. But it’s always good to be prepared.

Life insurance for over 70-year-old males and life insurance over 70-year-old females is available and affordable for most folks. So, if you’re in that 70 to 79-year age range, now is the best time to purchase a policy if you haven’t done so already.

FOR EASIER NAVIGATION

- Funeral policy over 70

- Life insurance for my elderly parents

- What is the average cost of burial insurance?

- What is the best life insurance option for 70 and older?

- What’s the best thing about burial insurance for over 70 policy?

- What kind of burial policies should I avoid?

- Why choose Funeral Funds for my burial policy?

- How can Funeral Funds help me?

- Additional Questions & Answers On Burial Insurance Over 70

Funeral Policy Over 70

You have to apply for burial insurance for a company to accept you for burial insurance, cremation insurance, or final expense insurance coverage. Just because you are over 70 doesn’t mean you cannot purchase low-cost burial insurance.

Here’s the lowdown on burial insurance for 70-year-olds:

- We are experts at helping folks in their 70s get approved for burial insurance policies.

- Even with health problems, you can get approved for this coverage.

- Once approved, your policy will not expire as long as you keep making the premium payments.

- Once approved, your monthly premium will never increase as you age.

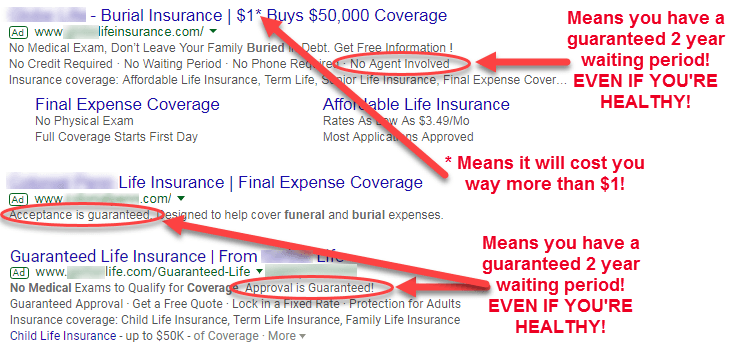

- You can get approved for a policy with no waiting period (never purchase a policy from the television advertisement, magazine advertisement, or letter that shows up in your mailbox).

Here is some info for the older guys!

If you are a male looking for life insurance over 70, you have final expense needs that are approaching quickly; we can help you find the following:

- Funeral insurance for a 70-year-old male or burial insurance for a 70-year-old male

- Funeral insurance for a 71-year-old male or burial insurance for a 71-year-old male

- Funeral insurance for a 72-year-old male or burial insurance for a 72-year-old male

- Funeral insurance for a 73-year-old male or burial insurance for a 73-year-old male

- Funeral insurance for a 74-year-old male or burial insurance for a 74-year-old male

- Funeral insurance for a 75-year-old male or burial insurance for a 75-year-old male

- Funeral insurance for a 76-year-old male or burial insurance for a 76-year-old male

- Funeral insurance for a 77-year-old male or burial insurance for a 77-year-old male

- Funeral insurance for a 78-year-old male or burial insurance for a 78-year-old male

- Funeral insurance for a 79-year-old male or burial insurance for a 79-year-old male

Are you get getting the idea that if you are a male over 70, we can help you? You’re a winner!

But what about the ladies?

If you are a female looking for life insurance over 70, you have final expense needs that are approaching quickly; we can help you find the following:

- Funeral insurance for a 70-year-old female or burial insurance for a 70-year-old female

- Funeral insurance for a 71-year-old female or burial insurance for a 71-year-old female

- Funeral insurance for a 72-year-old female or burial insurance for a 72-year-old female

- Funeral insurance for a 73-year-old female or burial insurance for a 73-year-old female

- Funeral insurance for a 74-year-old female or burial insurance for a 74-year-old female

- Funeral insurance for a 75-year-old female or burial insurance for a 75-year-old female

- Funeral insurance for a 76-year-old female or burial insurance for a 76-year-old female

- Funeral insurance for a 77-year-old female or burial insurance for a 77-year-old female

- Funeral insurance for a 78-year-old female or burial insurance for a 78-year-old female

- Funeral insurance for a 79-year-old female or burial insurance for a 79-year-old female

Are you get getting the idea that if you are a female over 70, we can help you? You’re a winner!

Life Insurance For My Elderly Parents

If you’re looking for life insurance for elderly parents over 70 years old, we can also help you. Many adult children shop for funeral policies for parents or loved ones. A large part of what we do at Funeral Funds is to help adult children find burial policies for senior parents.

We understand shopping around for final expenses life insurance no exams is probably not your tea. We are happy to provide funeral insurance quotes, so you can ensure your parents get the cheap burial insurance or cheap funeral insurance they require.

We understand our senior parents are often on a fixed income and need affordable burial insurance options and affordable funeral insurance availability.

So, the ball is in your court. Do you want to figure out all this insurance stuff on your own, or have a final expense insurance expert or burial policy expert like Funeral Funds do the shopping for you?

Shopping for burial insurance isn’t all it’s cracked up to be, so let us do the shopping for you.

What Is The Average Cost Of Burial Insurance?

You may ask, “how much is life insurance for 70? Your funeral insurance rates and burial insurance costs will depend on your age, height and weight, medical records, and prescription history. The best funeral and burial insurance policies require no waiting period for immediate burial insurance coverage.

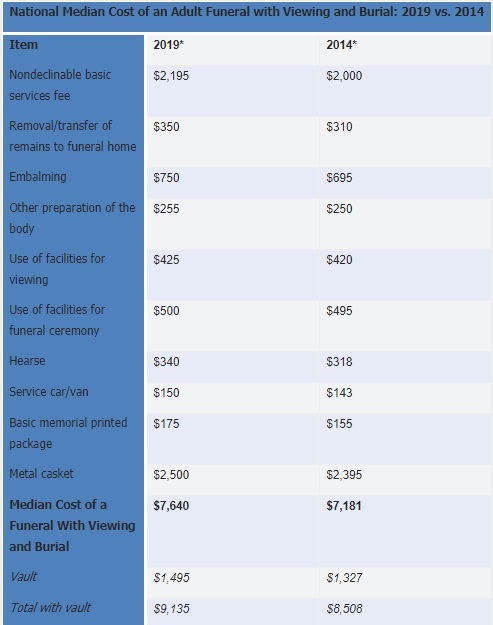

The cost of a burial is in the $8,000-$10,000 range and will go up yearly with inflation. Purchasing your policy now is your best bet to save loads of money in the future.

What Is The Best Life Insurance Option For 70 And Older?

If you’re a senior 70 and older, you probably have had life insurance coverage in the past. It may have been one of the following:

- An employer-provided life insurance policy (part of a group benefits plan)

- Term life insurance

- Universal life insurance

- Variable life insurance

- And many more

If you are over 70, most of your insurance options have expired or terminated. When shopping for burial insurance over 70, your best bet is a whole life insurance policy.

While some types of insurance policies, like indexed universal life, variable life insurance, and survivorship life insurance, are complicated, whole life policies are straightforward.

You die, and the insurance company pays.

Additionally, these policies are hands-down favorites for senior life insurance needs, as the underwriting is simple. The policies are simple and have no fine print to be nervous about! They also won’t expire as you get older.

Some advantages of whole life funeral policies and whole life final expense policies are:

- Easy underwriting eligibility

- No medical or doctor visits necessary to apply for coverage

- Monthly premiums that don’t increase as you age

- No maximum age of death or expiration date at any age

- Guaranteed benefit payment upon death that does not decrease as you age

These final expense policies make it easy for seniors to get the best rates and coverage they need at their current age and health.

What’s The Best Thing About Burial Insurance For Over 70 Policy?

Insurance companies are fully aware that, as we age, we develop health problems. The reality is you may not be fit as a fiddle. The insurance companies have designed these final expense policies for seniors with that in mind.

It can be hard to swallow for some if they have been denied life insurance. The flexible underwriting criteria of these policies mean you can have many health issues and still qualify for the best rates; these burial policies are not like any other life insurance you may have purchased in the past.

You can have serious medical problems and still get approved for the best no-waiting life insurance coverage. How do they do that? Insurance companies simply state that, after a certain amount of time, it’s as if you’re health problem never occurred (from an underwriting perspective). Even if you have a chronic illness, you will still qualify for no health questions guaranteed issue burial insurance.

If you have recovered from a heart attack and it’s been more than two years, you can qualify for the best burial policy rates!

Past medical problems? No Problem!

There are many other medical problems the insurance companies simply don’t care about if more than 12 to 36 months have passed.

We help people find affordable premiums daily, with full coverage and no waiting period, even if they have had health problems in the past. So, just because you’re over 70 years old doesn’t mean you can’t qualify for the best burial insurance for seniors over 70!

What Kind Of Burial Policies Should I Avoid?

TV AND MAGAZINE ADVERTISEMENTS – Most burial policies or final expense policies you see advertised on television or in magazines are sold as “the no-brainer way” to shop for this protection.

Just about everyone is eligible for immediate coverage and better pricing allowed by these heavily advertised policies that cost an arm and leg.

To make a long story short, it is better to shop with a specialist in burial insurance, like FuneralFunds.com, than to sign up with a company that spends ba-zillions of dollars each month advertising on television and in magazines.

INCREASING PRICE POLICIES – Those TV and magazine final expense policies may increase in price every five years or have a two-year waiting period before your benefits kick in!

These tricky television magazine ads will lure you in with an attractive rate, only to have the cost of your insurance increase every five years until you cannot afford the premiums, then you must cancel your policy.

What happens after you cancel the policy? You’ll die and have wasted all that money because you bought a policy that increases the price as you get older.

Avoid policies that increase in price every year or end at a certain age. You don’t want your family to get hung out to dry when they need this coverage the most.

Seen any misleading internet advertisements?

Yeah, the old “bait and switch” is still alive and well in America….buyer beware!

Why Choose Funeral Funds For My Burial Policy?

Most life insurance agents are fine, respectable people. However, some life insurance agents will sell you the easiest and most expensive policy possible. The guaranteed issue folks claim you don’t even need to talk to an agent (but you will need to wait two years for your coverage to begin…even if you’re healthy).

Answering a few health questions will often get you immediate coverage and MUCH better rates.

Avoid these people at all costs!

The rest of the life insurance agents, who are fine respectable people, are most often generalists. They deal with all kinds of life insurance policies. They are nice people but are not the logical choice if you want the best pricing and policy.

We work with 20+ final expense companies to get you qualified for the best price plan to get folks like you immediate coverage when possible.

All the companies and options will often confuse you more than the average burial insurance final expense insurance shopper.

How Can Funeral Funds Help Me?

Affordable burial insurance over 70 doesn’t have to cost an arm and a leg.

Our job at Funeral Funds is to be the most knowledgeable burial insurance expert available. We can help you get the most accurate quote and affordable rates by doing so.

Once we know more about your age and health history, we can accurately give you burial insurance quotes from the final expense companies that best fit you.

The reality is that most inexperienced and less knowledgeable insurance agents will cost you loads of money by selling you more expensive policies.

Working with an independent brokerage like Funeral Funds is always in your best interest. With access to all the best final expense insurance companies, we will help you understand your best options, given your current age, health, and financial situation.

Additional Questions & Answers On Burial Insurance Over 70

What is the best burial insurance for seniors?

The best burial insurance policy varies from one senior to another. Some factors that you will want to consider when shopping for burial insurance include the cost of the policy, first-day coverage, the benefits that are offered, and the age at which you will be able to receive benefits.

Is there an age limit for burial insurance plans?

Most life insurance companies accept applicants who are 85 years old and younger (but once accepted your plan will last until age 121).

What is the difference between funeral insurance and burial insurance?

Funeral insurance, burial insurance, cremation insurance, and final expense insurance refer to whole life insurance that pays a sum of money to cover the costs of funeral and burial expenses.

Is final expense insurance a good deal?

Final expense insurance is a good deal for those seeking coverage in case of death. The premiums are typically low, and the policy offers a benefit amount that can cover funeral and burial costs.

Can I buy life insurance at 70?

Yes, you can buy life insurance at 70. Most life insurance companies will accept applicants who are 85 years old or younger. Some companies go up to age 89. Once approved, all plans will last until age 121 years old.

What is the best time to buy burial insurance?

The best time to buy burial insurance is NOW when you are healthy and have no pre-existing medical conditions. This will ensure that you qualify for a policy and receive the best rates.

When should I buy burial insurance?

You should buy burial insurance when you are healthy and have no pre-existing medical conditions. This will ensure that you qualify for a policy and receive the best rates.

What happens to life insurance when you turn 70?

With whole life insurance, it will last until age 121 years old as long as you make your premium payments.

What is the best type of burial insurance for someone over 70?

The best type of burial insurance for someone over 70 is a first-day coverage plan that lasts until age 121.

Is funeral insurance for seniors right for me?

It depends on your needs and budget. Funeral insurance for seniors typically offers a low premium and a high benefit amount. This makes it a good deal for those seeking coverage in case of death.

Can a 72 year old get life insurance?

Yes, a 72-year-old can get life insurance where the price and coverage will never change, and it will last until age 121.

Can you get life insurance at age 75?

Yes, you can get whole life insurance at age 75.

Is it worth having life insurance after 70?

Yes, life insurance is worth having after 70. This is a terrific way to protect your loved ones if you die financially.

Can a 74 year old man get life insurance?

Yes, a 74-year-old man can get life insurance.

What’s the average cost of final expense insurance?

The average cost of final expense insurance depends on the purchased policy, age, gender, and location. Some policies have a lower premium, while others offer higher benefits.

How much does final expense insurance cost?

Final expense insurance typically costs between $30 and $100 per month, depending on the policy.

Is there an age limit for final expense insurance?

Most life insurance companies accept applicants who are 85 years old and younger (and once accepted, whole life insurance lasts until age 121.

What are the benefits of burial insurance?

Burial insurance policies typically offer a benefit amount that can be used to cover funeral and burial costs.

What should I look for in a burial insurance policy?

When shopping for a burial insurance policy, you will want to consider the cost of the policy, the first-day coverage, and the benefits offered. You will also want to ensure that the policy is age-appropriate, so you can receive benefits when needed.

Can I get life insurance on my 70 year old father?

Yes, you can get life insurance on your 70-year-old father if he provides his consent to do so.

What is the average cost of funeral and burial expenses?

The average cost of funeral and burial expenses varies depending on the location and the services provided. However, some estimates cost around $7,000 to $10,000.

What are some of the benefits offered by burial insurance policies?

Some benefits often offered by burial insurance policies include coverage for funeral and burial expenses, a death benefit that can be used to cover final expenses, and a waiver of premium so that premiums will not have to be paid after the policyholder dies.

Is there a waiting period before I can receive benefits from my burial insurance policy?

Most burial insurance policies do not have a waiting period before benefits can be paid. However, you will want to confirm this if you bought your policy from anyone other than Funeral Funds.

Can I purchase burial insurance for my parents?

You can purchase burial insurance for your parents.

What happens if you don’t have burial insurance?

If you don’t have burial insurance, the funeral and burial expenses will likely have to be paid out-of-pocket. This can be a costly burden for those grieving the loss of a loved one.

Is it too late to purchase burial insurance if I am 70 years old?

No, it is not too late to purchase burial insurance if you are 70. You can apply for a policy with most life insurance companies that will last up to 121 years old.

What does a burial policy cover?

Burial insurance policies typically cover the costs of funeral and burial expenses. This can include the cost of the funeral service, the casket, the cemetery plot, and other associated costs.

What do I need to know about burial insurance?

When shopping for burial insurance, you will want to consider the cost of the policy, the first-day coverage, and the benefits offered. You will also want to ensure that the policy is age-appropriate, so you can receive benefits when needed.

How much would it cost for life insurance for a 70 year old man?

The cost of life insurance for a 70-year-old man will vary depending on the age and health of the applicant. However, premiums typically start at around $40 to $50 per month.

Can you get life insurance on a grandparent?

Yes, you can get life insurance on a grandparent that will last up until they are 121 years old.

How much does life insurance for a 70 year old cost?

The cost for life insurance for a 70-year-old typically starts at around $40 to $50 per month. However, the cost will vary depending on the age and health of the applicant.

Is it too late to purchase life insurance if I am 70 years old?

No, it is not too late to purchase life insurance if you are 70. You can apply for a policy with most life insurance companies up to 85.

What are the benefits of life insurance for a 70 year old?

Life insurance benefits for a 70-year-old can include coverage for final expenses, a death benefit, and a waiver of premiums. These benefits can help those grieving the loss of a loved one to cover the costs associated with their death.

Which life insurance is best for seniors whole or term?

Whole life insurance is best for those who are looking for lifelong coverage.

What happens to life insurance after age 85?

After age 85, you can no longer apply for life insurance. However, if you are already a policyholder, most life insurance companies will allow you to continue coverage.

RELATED POSTS:

4 Comments

jung chun

want to quote only birthdate 04 02 1942 woman. nosmoking no drinking .

Funeral Funds

Jung – With only the information you have provided, we would only be guessing at an accurate rate for you. We recommend you start here to get accurate pricing – https://funeralfunds.com/free-quote/

Denice Shoemake

I am inquiring on behalf of my mother who currently resides in Texas while I reside in Guam. Please be so kind as to email me the information due to the time difference. I would like to be able to speak with my mother about this. Thank You. Kindest regards, Denice Shoemake.

Funeral Funds

Denice – You haven't told us what information you would want to be emailed to you. Our website is comprehensive and should answer your basic questions. For pricing, a short phone call is how we do it to make sure we get you with the best insurance company with the lowest rates. You can call us directly at (888) 862-9456.