2024 Burial Insurance For Dialysis Patients

First-day coverage burial insurance for dialysis patients is available, depending on the state you live in and any other health complications.

There are also insurance policies for burial that don’t ask any health questions so that they won’t cause an automatic decline for insurance benefits approval.

FOR EASIER NAVIGATION:

- What Is Dialysis?

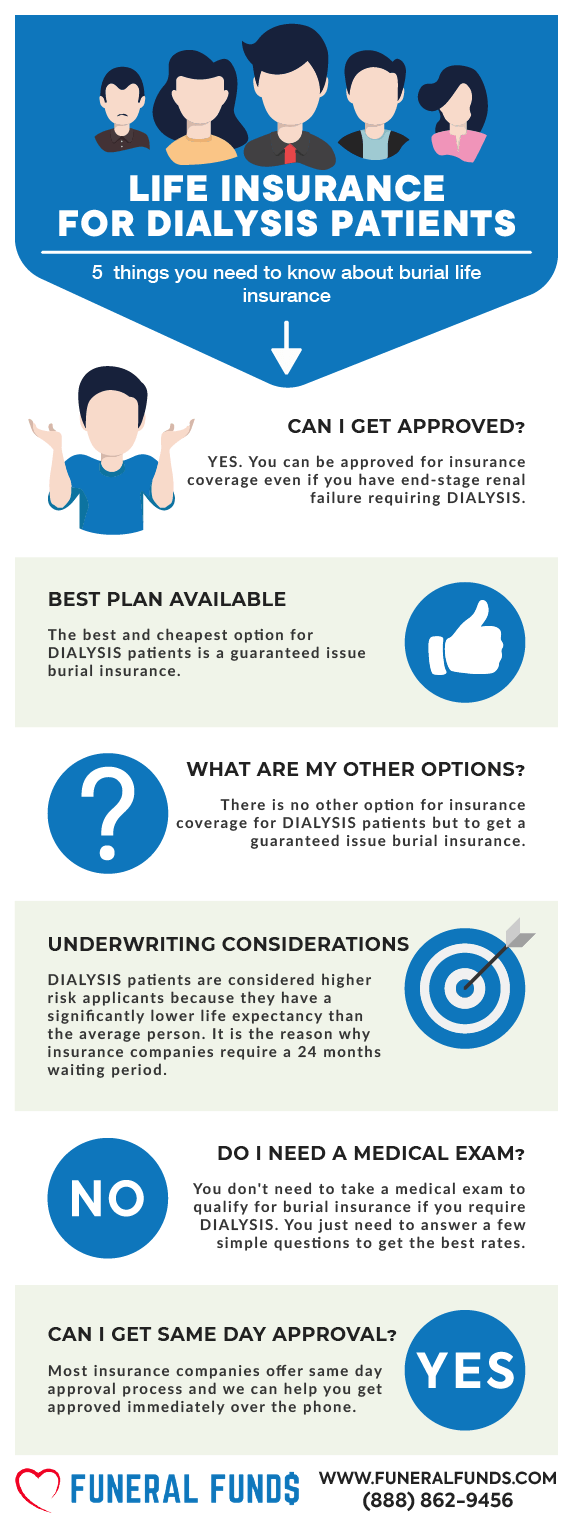

- Can I Get Burial Insurance If I’m On Dialysis?

- What Is My Best Insurance Option If I’m On Dialysis?

- What Are The Types Of Burial Insurance Available For Dialysis Patients?

- Do I Need A Medical Exam To Qualify For Burial Insurance?

- What If My Application Was Rejected Because of Kidney Dialysis?

- How Can Kidney Dialysis Affect My Insurance Rates?

- How Much Does Burial Insurance Cost For Dialysis Patients?

- Burial Insurance Underwriting For Kidney Dialysis

- How To Find The Best Burial Insurance For Dialysis Patients?

- How Can Funeral Funds Help Me?

- Frequently Asked Questions

What Is Dialysis?

Dialysis is a medical procedure that helps people with failing kidneys. Kidneys are vital organs that filter waste products and excess fluid from the blood. When kidneys fail, these harmful substances can build up in the body and cause serious health problems.

Dialysis acts as an artificial kidney, removing waste products and extra fluid from the blood. There are two main types of dialysis:

- Hemodialysis: In this procedure, blood is removed from the body and passed through a machine with a special filter (dialyzer) that removes waste and excess fluid. The cleaned blood is then returned to the body. Hemodialysis is usually done in a hospital or dialysis center several times a week for a few hours each time.

- Peritoneal dialysis: This type of dialysis uses the lining of the abdomen (peritoneum) as a natural filter. A sterile fluid is inserted into the abdominal cavity through a catheter. The fluid absorbs waste products and excess fluid from the blood, and then it’s drained out. Peritoneal dialysis can be done at home, which allows for more flexibility.

Dialysis is a life-saving treatment for people with kidney failure, but it’s not a cure. It needs to be done regularly to maintain health. If you have any questions about dialysis, it’s important to talk to your doctor.

Dialysis can make insurance applications challenging because it’s a pre-existing condition that increases the risk for insurance, it doesn’t necessarily mean you can’t get coverage.

If you’re considering life insurance with dialysis, speaking with a life insurance agent specializing in high-risk conditions can be helpful. They can advise you on the options and find the best rates for your situation.

Can I Get Burial Insurance If I’m On Dialysis?

Yes, you can get burial insurance if you have kidney disease and are undergoing dialysis treatments, depending on the state you live in and if your life insurance agent is licensed and contracted with the right companies.

What Is My Best Insurance Option If I’m On Dialysis?

If you have kidney failure or end-stage kidney disease and receive dialysis, you can often still get first-day coverage insurance if you are following a prescribed treatment plan from your doctor.

If your doctor prescribes dialysis treatment, and you refuse, your only option would be a guaranteed acceptance life insurance with a two-year waiting period.

What Are The Types Of Burial Insurance Available For Dialysis Patients?

First-Day Coverage – This type of policy does not require a medical exam. You only need to answer a few health questions, and you’ll qualify for immediate coverage with no waiting period.

Guaranteed Issue – This insurance has no medical exam and no health questions. Guaranteed issue whole life insurance policies are designed for people who may not qualify for traditional term or whole life insurance due to significant health issues.

The downside of guaranteed issue life insurance policies is the two-year waiting period before the full death benefit is payable. If you were to pass away during this waiting period, the policy would only pay out the premiums you have paid plus 7-10% interest (depending on the company).

Do I Need A Medical Exam To Qualify For Burial Insurance?

No, you don’t need to take a medical exam to qualify for burial insurance with kidney dialysis.

You only have to answer basic questions about your health. The application process is simple, and you don’t need to provide medical records or blood and urine samples. You’ll often get official approval from the insurance company within minutes!

What If My Application Was Rejected Because of Kidney Dialysis?

If your insurance application was rejected in the past because of kidney dialysis, you (or your agent) submitted your application to the wrong company. We will then shop your case to many life insurance companies that accept applicants with kidney dialysis.

Kidney dialysis patients who received transplants may also get guaranteed issue policies with no medical exam or health questions so that they can be approved regardless of their health.

How Can Kidney Dialysis Affect My Insurance Rates?

Kidney dialysis may impact the type of life insurance policy you qualify for and the cost of burial insurance.

For example, if you currently need a kidney transplant, you can only qualify for guaranteed issue life insurance, which is more expensive than first-day life insurance coverage, and it comes with a 2-year waiting period.

How Much Does Burial Insurance Cost For Dialysis Patients?

The cost of burial insurance, if you are a kidney dialysis patient, will depend on your:

- Age

- Gender

- State of residence

- Smoking status

- Type of policy

- Coverage amount

Burial Insurance Underwriting For Kidney Dialysis

You will often see kidney dialysis questions asked this way:

- During the past 24 months, have you been recommended by a medical professional for kidney dialysis?

- Have you ever had, or been diagnosed with, or received or been advised to receive dialysis for kidney disease?

- Within the past 12 months, have you been advised to have kidney dialysis?

Health question for kidney transplant:

- Within the last 5 years have you been advised to by a member of the medical professional to have an organ transplant?

- You must honestly answer “yes” to the health question if you are undergoing kidney dialysis or recommended to have an organ transplant.

How To Find The Best Burial Insurance For Dialysis Patients?

The best way to find the best burial insurance for dialysis patients is to work with an independent life insurance agent who knows the best insurance companies that offer first-day coverage life insurance policies for people with kidney disease and undergoing dialysis.

How Can Funeral Funds Help Me?

You don’t have to waste time searching with multiple insurance companies because we can do this work for you. We work with many A+ rated insurance carriers specializing in covering high-risk clients.

Our licensed insurance experts will search for all the best companies to get you the best life insurance rates, and we promise to make the process quick and easy.

Fill out our quote form on this page or call us at (888) 862-9456, and we can give you an accurate quote.

Frequently Asked Questions

Is there any insurance for dialysis patients?

Yes, there are a few insurance companies that offer first-day coverage to dialysis patients.

Which insurance is best for dialysis?

A first-day coverage plan with health questions is best for people on dialysis.

Can you be denied life insurance for kidney dialysis?

Yes, you can be denied a first-day coverage plan if you are recommended for dialysis and refuse to take the treatment.

Can I qualify for final expense insurance if I’m on dialysis?

Yes, you can get coverage for final expense insurance if you are on dialysis.

Do you have to be on dialysis to get life insurance?

No, it’s better to get life insurance before you are put on dialysis. However, insurance companies that accept end-stage renal failure patients require you to be on dialysis to offer you coverage;

Is there a limit to how much life insurance you can get if you are on dialysis?

Yes, you can often get from $2,000 to $20,000 in coverage if you are on dialysis (depending on the insurance company).

RELATED POSTS:

16 Comments

Mike

I have been on dialysis for 8 months now and have regular check-ups with my nephrologist. Will I qualify for a life insurance? If so, what’s the best and most affordable life insurance policy for me? I would appreciate a feedback. Thank you.

Funeral Funds

Mike,

We wish you the best in your medical recovery! A Gauranteed Issue policy would be your best bet with your medical diagnosis. An accidental policy would be something to consider in addition to a guaranteed issue policy. Accidents are the #1 cause of fatality in most age groups…even if you are currently on dialysis.

Funeral Funds

Michelle

With a guaranteed acceptance life insurance, how much premium are we talking about and what’s the most coverage to get?

Funeral Funds

Michelle,

We can help you get some pricing. We’ll have an agent get in touch with you right away to see if this makes sense for you and your budget.

Funeral Funds

Ellen

I am interested in the burial insurance for my mom.

I would like to know details like monthly premiums, coverage, etc. Can you connect with me through email? Thanks.

Funeral Funds

Ellen,

We will have an agent get in touch with you this week.

Funeral Funds

Jane

My parents are both on dialysis and both have been declined life insurance previously. Is there any chance for an approval for them at all in a different company? If there’s no chance can I apply for some kind of plan applicable to my parent’s situation instead?

Funeral Funds

Jane,

We can help your parents out with a guaranteed issue policy up to $25,000. We will send you an email shortly to help you out with this.

Funeral Funds

Vance

I’m thinking of getting an insurance now but I’m about to undergo a kidney transplant in 2 months. Can I get cover after my transplant?

Funeral Funds

Vance,

With a kidney transplant in 2 months, we won’t be able to get you immediate coverage. We can, however, get you a guaranteed issue policy with a waiting period.

Without knowing how your health will fair in the coming years after your kidney transplant, now would be the best time to get your waiting period out of the way.

Funeral Funds

Crystal

My husband is 38 and does not qualify for the guaranteed life according to what you're saying. Are there any policies or options for us now at his age with being on dialysis?

Funeral Funds

Crystal – We have a new company we are working with that will accept down to age 40 for most people.

Racquel Flowers

Interested in getting insurance for my Husband on dialysis

Funeral Funds

Racquel – You can get a free quote by visiting this page – https://funeralfunds.com/free-quote/

Irma Echevarria

Do I qualify for life insuranse if I'm on dialysis and waiting for a kidney transplant?

Funeral Funds

Irma – You would qualify for insurance, it would just have a mandatory 2-year waiting period for any death that was health or medical-related. We don't offer any of these plans, but we would be happy to refer you to the best company that offers those plans. Just call our toll-free number if you want that information.