Burial Insurance with Insulin Shock

Affordable burial insurance is available for people who have had insulin shock in the past, depending on your current health and which companies are available in your zip code, you might just score a first-day coverage plan.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those who have had insulin shock, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

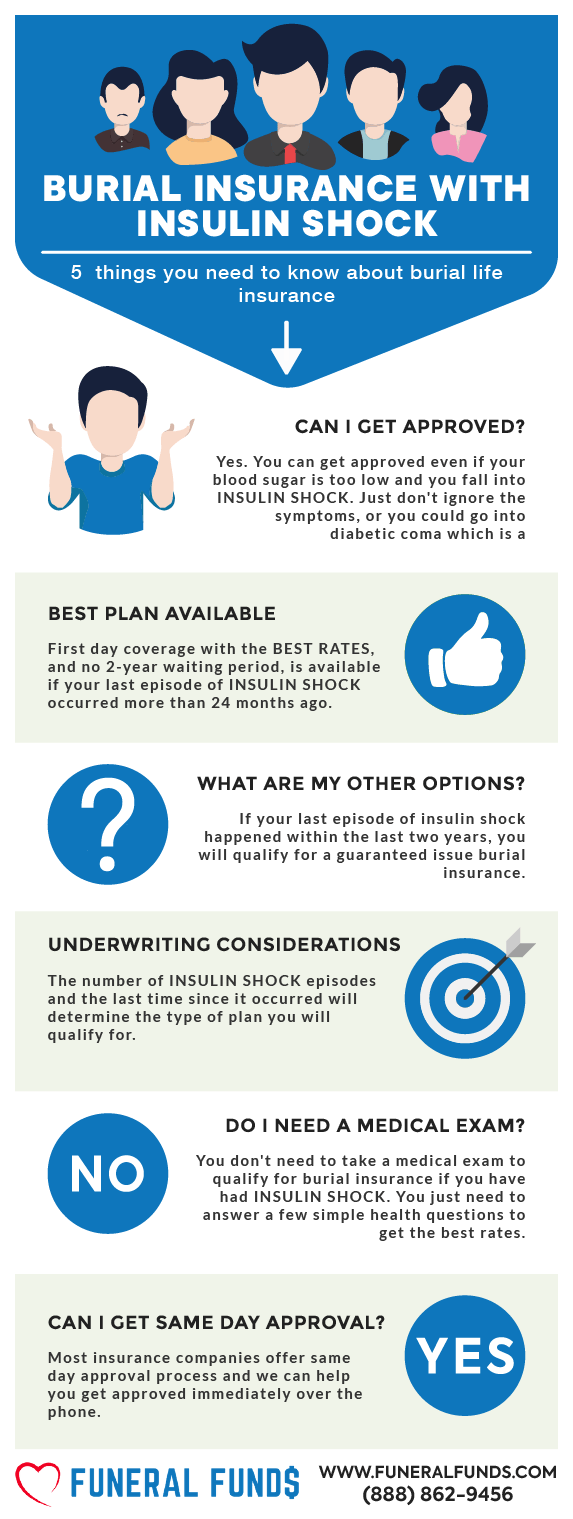

Can I Get Burial Insurance If I Had Insulin Shock?

YES: If you’ve had insulin shock but are back to living your best life, you might just qualify for first-day coverage, as long as this plan is available in your zip code.

NO: If you or your loved one is still riding the insulin shock rollercoaster, no insurer will touch that with a ten-foot pole. You’ll need to be fully recovered, out of the hospital, and back to handling your day-to-day living activities independently before they’ll even consider offering a first-day coverage plan.

What Is My Best Insurance Option If I Had Insulin Shock?

First-day coverage burial insurance is the golden ticket for diabetics who’ve had insulin shock. But remember, the insurance company will still give you the once-over on your other health issues before rolling out the red carpet with a plan.

And here’s a tip: steer clear of those two-year waiting period plans.

What Is The Cost Of Burial Insurance?

The cost of burial insurance will depend on your:

- Age

- Coverage amount

- Gender

- General health

- State of residence

- Smoking status

- Type of policy

Pricing example for an independent 60-year-old female who have had insulin shock:

| FEMALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Pricing example for a resourceful 60-year-old male who have had insulin shock:

| MALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Do I Need to Take a Medical Exam to Qualify For Burial Insurance?

Nope, no need to stress about needles or doctor visits. When you’re applying for burial insurance as a diabetic, all you have to do is answer a few basic health questions – no medical exam required!

And the best part? You can get approved within minutes. How’s that for quick and easy?

Burial Insurance Underwriting For Insulin Shock

Here’s how it goes down: Some burial insurance companies will ask about your insulin shock history on the application.

- Have you ever been treated for or diagnosed as having insulin shock, diabetic coma, amputation caused by disease, or taken insulin shots before age 50?

- Have you been diagnosed with diabetes before age 30, or have you ever been treated for insulin shock, diabetic coma, or diabetic neuropathy?

- Within the past 2 years, have you had, or been diagnosed with, received, or been advised to receive treatment or medication for complications of diabetes such as insulin shock, diabetic coma, retinopathy, or neuropathy?

They’ll also take a peek at your prescription history as part of their underwriting process. So, be ready for that!

Information We Need If You Had Insulin Shock

We’ll ask you a few questions about your medical condition to give you the best possible recommendation:

- Do you have eye issues resulting from diabetes?

- Do you have kidney issues because of diabetes?

- Do you have a nerve or circulatory issue due to diabetes?

- Have you ever had an amputation resulting from your diabetes

- Have you experienced a diabetic coma?

- Were you diagnosed with what type of diabetes? (Type 1 or Type 2)

- Were you diagnosed with diabetes before age 50?

- What medications do you currently take?

- When did you last experience an insulin shock?

The more we know about your health issue, the better we can match you with the right plan.

What If I’m Decline Coverage Due To Insulin Shock?

If one company shuts the door, don’t sweat it – we can usually find another insurer that doesn’t care about your insulin shock history. Seriously, we’ve got options!

But remember, a 2-year waiting period policy should be your absolute last resort. Guaranteed issue policies are the most expensive and come with that pesky 2-year wait.

How To Get The Best Rates If You Had Insulin Shock

Want the best rates? Work with an independent agency like Final Expense Guy. We specialize in helping people with insulin shock score the best plan at the best price. Let’s get you covered without breaking the bank!

How Can Final Expense Guy Help Me?

Here at Final Expense Guy, we’re like matchmakers – but for life insurance! We specialize in finding coverage for folks who’ve had insulin shock.

We’ve got you hookup with top-rated insurance carriers that don’t shy away from high-risk clients. Our mission? To hunt down the best rates out there and set you up with the perfect life insurance plan.

We’re all about getting you the coverage you need at a price that won’t make your wallet cry. So, if you’re looking for affordable life insurance despite your insulin shock history, we’re your go-to. Just fill out our quote form or give us a ring at (888) 862-9456 for the real deal on burial insurance rates.

Frequently Asked Questions

Can you get life insurance with insulin shock?

You bet! Depending on what’s available in your zip code, you might even score first-day coverage.

Can insulin-dependent diabetics get life insurance?

Absolutely! Plenty of insurance companies are ready to cover folks who rely on insulin.

What is the best option if you have a history of insulin shock?

Timing is everything. If it’s been a while since your insulin shock, aim for that first-day coverage plan. But avoid those 2-year waiting period plans like the plague – they’re the worst.

Can you get final expense insurance with insulin shock?

Yes, indeed! Depending on your zip code, you might even qualify for a first-day burial insurance plan.

How does insulin shock affect life insurance?

If your insulin shock happened recently, some companies might play hard to get and decline first-day coverage.

Do I need to tell insurance about insulin shock?

Yep, you’ve gotta spill the beans. Final expense insurance companies want the full scoop on your medical history before you apply.