2024 Burial Insurance with Insulin Shock

Affordable burial insurance is available for people who have had insulin shock in the past, depending on your current health and what companies are available in your state.

This article will help you explore your options and find the best rates.

FOR EASIER NAVIGATION:

- Can I Get Burial Insurance If I Had Insulin Shock?

- What Is My Best Insurance Option If I Had Insulin Shock?

- Do I Need to Take a Medical Exam to Qualify For Burial Insurance?

- Burial Insurance Underwriting For Insulin Shock

- Information We Need If You Had Insulin Shock

- What If I’m Decline Coverage Due To Insulin Shock?

- How To Get The Best Rates If You Had Insulin Shock

- How Can Funeral Funds Help Me?

- Frequently Asked Questions

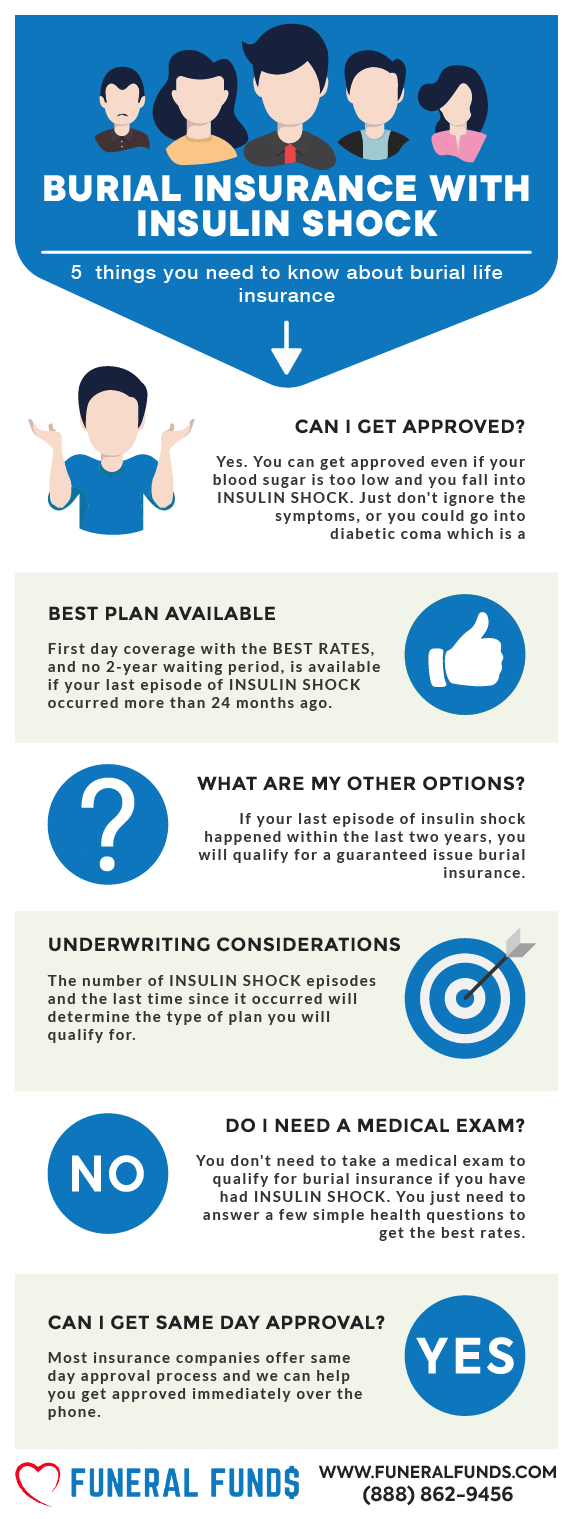

Can I Get Burial Insurance If I Had Insulin Shock?

YES: If you have a history of insulin shock and your health issues are now resolved, you may qualify for first-day coverage depending on the plans available in your state.

NO: No insurance company will offer coverage if you or someone you love is currently in insulin shock. You would need to be recovered and out of the hospital and not need help with Activities of Daily Living (ADLs) to qualify for better burial insurance programs.

What Is My Best Insurance Option If I Had Insulin Shock?

A first-day coverage burial insurance is the best option for diabetics who have had insulin shock at some point in their lives. However, your other health issues will also be considered before an insurance company issues you a first-day coverage plan.

We always recommend you avoid two-year waiting period plans.

Do I Need to Take a Medical Exam to Qualify For Burial Insurance?

No, When you apply for burial insurance for diabetics, you only have to answer some basic questions about your health; no medical exam is needed!

You’ll often get the official approval from the insurance company within minutes!

Burial Insurance Underwriting For Insulin Shock

Here’s how some burial companies ask about insulin shock on the insurance application:

- Have you ever been treated for or diagnosed as having insulin shock, diabetic coma, amputation caused by disease, or taken insulin shots before age 50?

- Have you been diagnosed with diabetes before age 30, or have you ever been treated for insulin shock, diabetic coma, or diabetic neuropathy?

- Within the past 2 years, have you had, or been diagnosed with, received, or been advised to receive treatment or medication for complications of diabetes such as insulin shock, diabetic coma, retinopathy, or neuropathy?

Insurance companies will also review your prescription history as part of their underwriting procedure and risk analysis.

Information We Need If You Had Insulin Shock

Here are some questions we may ask you:

- Do you have eye issues resulting from diabetes?

- Do you have kidney issues because of diabetes?

- Do you have a nerve or circulatory issue due to diabetes?

- Have you ever had an amputation resulting from your diabetes

- Have you experienced a diabetic coma?

- Were you diagnosed with what type of diabetes? (Type 1 or Type 2)

- Were you diagnosed with diabetes before age 50?

- What medications do you currently take?

- When did you last experience an insulin shock?

We will need to know your medical condition to be able to provide you with the best recommendation.

What If I’m Decline Coverage Due To Insulin Shock?

If you’ve been declined, we can often help you get approved with another insurance company that does not ask about insulin shock.

A 2-year waiting period policy should be your last resort, as a GI policy is the most expensive form of life insurance, and it has a two-year waiting period.

How To Get The Best Rates If You Had Insulin Shock

To get affordable rates for burial insurance, you should work with an independent agency like Funeral Funds, where we help people with insulin shock get the best plan with the best pricing.

How Can Funeral Funds Help Me?

Here at Funeral Funds, we specialize in getting life insurance coverage for applicants with insulin shock.

We work with many A+ rated insurance carriers that specialize in high-risk clients. We will search for those companies to find the best life insurance rates. We’ll match you up with your best life insurance option.

We will assist you in securing the coverage you need at a rate you can afford. So, if you want affordable life insurance with insulin shock, we can help. Fill out our quote form on this page or call us at (888) 862-9456 for accurate burial insurance rates.

Frequently Asked Questions

Can you get life insurance with insulin shock?

Yes, you may qualify for first-day coverage insurance depending on the plans available in your state.

Can insulin-dependent diabetics get life insurance?

Yes, many life insurance companies offer coverage for people who use insulin.

What is the best option if you have a history of insulin shock?

It depends on the time that has passed since your insulin shock occurred. Getting a first-day coverage insurance plan is your best option. Getting a 2-year waiting period plan is your worst option.

Can you get final expense insurance with insulin shock?

Yes, people with insulin shock may even qualify for a first-day burial insurance plan, depending on the plans available in their state.

How does insulin shock affect life insurance?

Some burial insurance companies may decline your application for first-day coverage if your insulin shock is very recent.

Do I need to tell insurance about insulin shock?

Yes, final expense insurance companies want to know about your medical conditions before applying for insurance coverage.