2024 Burial Insurance with Nephropathy or Berger’s Disease

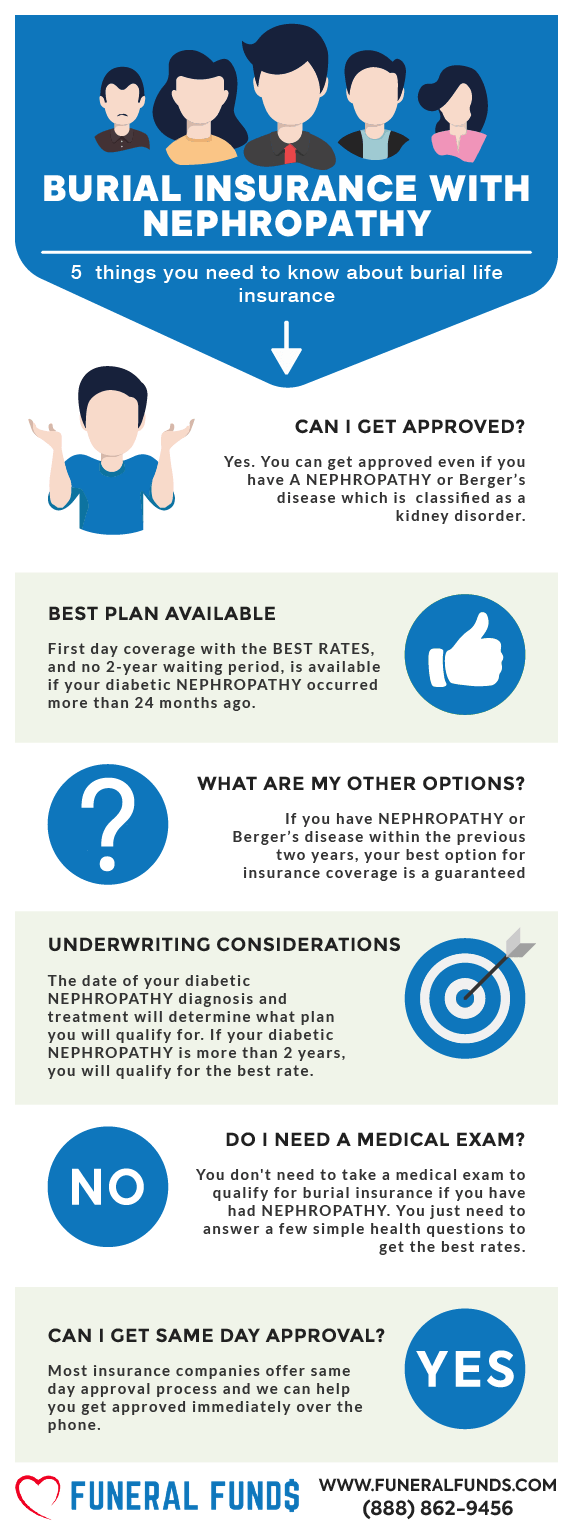

You can qualify for burial insurance if you have nephropathy or Berger’s disease, and you can often get first-day coverage depending on what company you go with.

Eligibility options vary by insurance, so read on for more plan and approval information.

FOR EASIER NAVIGATION:

- What Is Diabetic Nephropathy?

- Can I Get Burial Insurance If I Have Nephropathy?

- What Are The Types of Burial Insurance For People With Nephropathy?

- What Is My Best Insurance Option If I Have Nephropathy?

- Do I Need To Take A Medical Exam To Qualify For Burial Insurance?

- What Is The Cost Of Burial Insurance With Nephropathy Or Berger’s Disease?

- Burial Insurance Underwriting For Nephropathy Or Berger’s Disease

- Information We Need If You Have Nephropathy

- What If I’m Declined For Coverage Because Of Nephropathy?

- How To Get Affordable Burial Insurance

- How Can Funeral Funds Help Me?

- Frequently Asked Questions

What Is Diabetic Nephropathy?

Diabetic nephropathy, also sometimes called diabetic kidney disease, is a specific type of kidney disease that affects people with diabetes. It’s caused by high blood sugar levels damaging the filters in the kidneys over time.

- Cause: Chronically high blood sugar from diabetes

- Effect: Damages the tiny filters in the kidneys called glomeruli, which are responsible for filtering waste products from the blood.

- Progression: Gradual loss of kidney function, which can lead to kidney failure if left untreated.

Diabetic nephropathy is the leading cause of chronic kidney disease globally. It’s important to manage diabetes well to help prevent or slow the progression of this complication.

Diabetic nephropathy can shorten life expectancy, a major factor for life insurance companies when determining rates and eligibility. Kidney disease, particularly when it progresses to kidney failure and requires dialysis or transplant, can be very expensive to treat. Insurers want to mitigate the risk of incurring these costs.

Can I Get Burial Insurance If I Have Nephropathy?

YES: Some companies offer first-day coverage even if you are undergoing treatment. These plans are state-specific, and you must be under a doctor’s care and medical guidance to qualify.

NO: Not all companies offer 1st-day coverage in all states. We can help you understand your most viable options, but we would need more information.

What Are The Types of Burial Insurance For People With Nephropathy?

First-Day Coverage – This is a no-medical exam policy; you only need to answer a few health questions. First-day coverage insurance has immediate coverage and no waiting period.

Guaranteed Issue – This is a no medical exam and no health questions policy. Guaranteed issue life insurance or guaranteed acceptance life insurance is designed for people with significant health issues who may not qualify for traditional term life insurance or whole life insurance.

Guaranteed issue whole life insurance policies come with a mandatory two-year waiting period because they accept all health issues. If you were to pass away during the waiting period, you would not get the full death benefit. The life policy would only pay out the life insurance premiums you have paid plus 7-10% interest (depending on the company).

What Is My Best Insurance Option If I Have Nephropathy?

Nephropathy Without Dialysis – Some insurance companies offer first-day coverage insurance. However, the first-day coverage plan is not available in all states. Applicants with nephropathy must be compliant with their doctor’s treatment plans to qualify for a first-day coverage plan.

Nephropathy With Dialysis – First-day coverage insurance is available from some insurance companies if the applicant is on dialysis and following the prescribed treatment plan from their doctor.

Kidney Transplant – If your transplant was more than five years ago, some companies and plans offer 1st-day coverage. If your doctor recommends you for a transplant, or you’ve had a transplant in the last five years, your only option for coverage is to get a guaranteed issue whole life insurance.

Do I Need To Take A Medical Exam To Qualify For Burial Insurance?

No. When you apply for burial insurance, you only have to answer some basic questions about your health. The application process is simple, and you don’t need to provide medical records or blood and urine samples.

Approvals are often available within minutes!

What Is The Cost Of Burial Insurance With Nephropathy Or Berger’s Disease?

The burial insurance cost will depend on your:

- Age

- Coverage amount

- Gender

- State of residence

- Smoking status

- Type of policy

Burial Insurance Underwriting For Nephropathy Or Berger’s Disease

Here are some common ways nephropathy or kidney disease is asked about in the health questionnaire:

- Within the past 2 years, have you had, or been diagnosed with, or received or been advised to receive treatment for medication for complications of diabetes such as diabetic coma, nephropathy (kidney), insulin shock, retinopathy (eye), or neuropathy (nerve, circulatory)?

- During the past 24 months, have you been treated for kidney failure (including dialysis)?

- Have you had, or been advised, or have been diagnosed, treated (including dialysis), or taken medication for chronic kidney disease or kidney failure?

- In the past 10 years, have you opted to not seek treatment, have not taken medication, and or have not followed the prescribed treatment plan following a diagnosis of kidney disease, including dialysis?

Some of the prescription medications for nephropathy or Berger’s disease include:

- Benazepril (Lotensin)

- Enalapril (Vasotec)

- Lisinopril (Prinivil)

- Losartan (Cozaar)

- Moexipril (Univasc)

- Quinapril (Accupril)

- Ramipril (Altace)

- Valsartan (Diovan)

The presence of these medications in your prescription history may indicate to the insurance company that you have been diagnosed or treated for nephropathy in the past.

Information We Need If You Have Nephropathy

We may ask you some health questions to get you with the most appropriate company with the lowest rates.

Here are some example questions we may ask:

- Do you have any other diabetic complications?

- Have you ever been advised to have dialysis?

- Have you ever been hospitalized for any reason in the last 12 months?

- Have you experienced any symptoms of nephropathy within the past six months?

- What medications are you taking?

- When did you have diabetic nephropathy?

What If I’m Declined For Coverage Because Of Nephropathy?

If you’ve been declined, we can often help you get approved with another insurance company that won’t ask any health questions. Keep in mind that no-questions-asked insurance policies all have mandatory 2-year waiting periods for any health or medical-related death.

A 2-year waiting period policy should be your last resort, as a GI policy is the most expensive form of life insurance, and it has a two-year waiting period.

How To Get Affordable Burial Insurance

To get affordable rates for burial insurance, you should work with an independent agency like Funeral Funds of America. Our licensed life insurance agents can shop at different life insurance companies to get you the best pricing.

How Can Funeral Funds Help Me?

Here at Funeral Funds, we specialize in getting life insurance coverage for applicants with nephropathy.

We work with many A+ rated insurance carriers that specialize in high-risk clients. We will search for those companies to find the best life insurance rates. We’ll match you up with your best burial insurance option.

We will assist you in securing the coverage you need at a rate you can afford. So, if you want affordable insurance with diabetic nephropathy, we can help. Fill out our quote form on this page or call us at (888) 862-9456 for accurate burial insurance rates.

Frequently Asked Questions

Can you qualify for final expense insurance with nephropathy?

Yes, and you may even qualify for first-day final expense insurance if the plan is available in your state.

Can you get life insurance with Berger’s disease?

Yes, first-day coverage life insurance is available depending on what company you go with.

Is nephropathy the same as chronic kidney disease in life insurance?

Yes, most insurance companies consider diabetic nephropathy as a type of chronic kidney disease (CDK).

How much do you need to tell an agent about your diabetes and nephropathy?

You should inform your agent about all known health conditions, including any medications, if you want 1st-day coverage.

Can I get life insurance with nephropathy and dialysis?

Yes. You can even get 1st-day coverage if specific plans are available in your state.