2024 Burial Insurance with Diabetic Coma

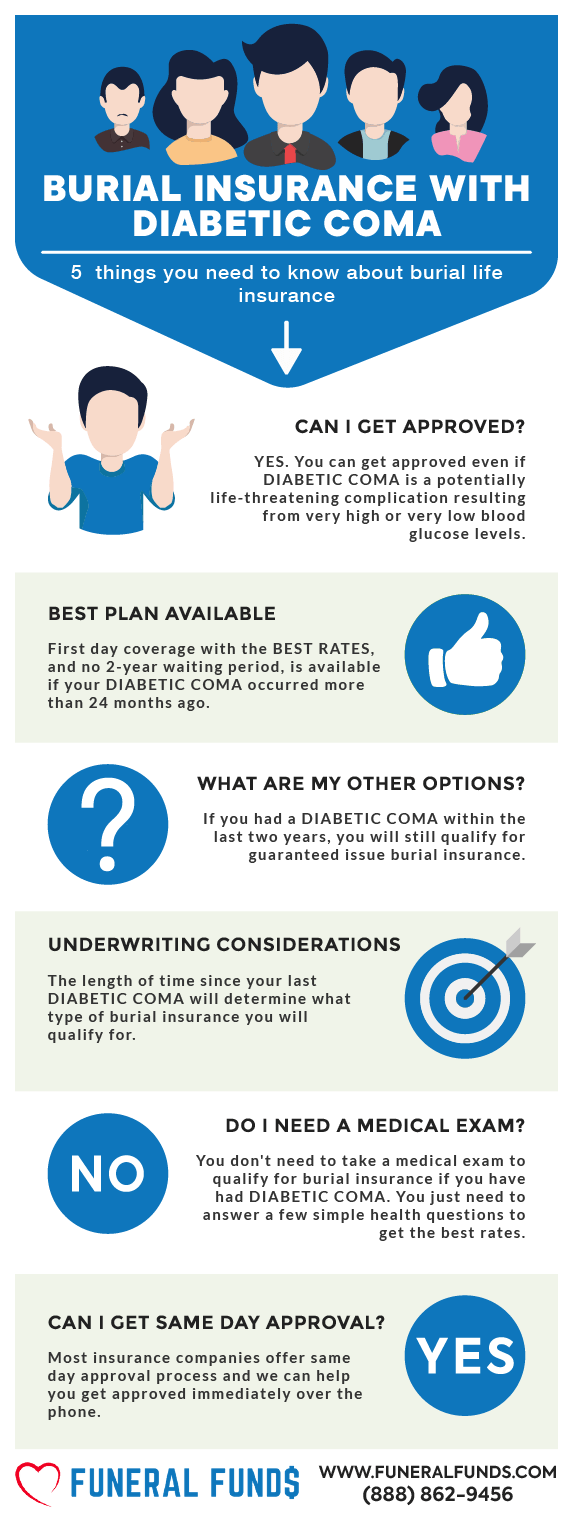

If you have a health history that includes diabetic coma, you can still often qualify for affordable burial insurance with first-day coverage.

You may also qualify for cremation, funeral, whole life, or final expense insurance with many of our life insurance companies.

This article will give you the information you need to find the right insurance policy based on your needs and budget.

FOR EASIER NAVIGATION:

- What Is Diabetic Coma?

- Can You Get Burial Insurance With Diabetic Coma?

- What Is My Best Insurance Option If I Have Had Diabetic Coma?

- Do I Need A Medical Exam to Qualify for Burial Insurance?

- How Much Does Burial Insurance Cost If I Had Diabetic Coma?

- Burial Insurance Underwriting If You’ve Had A Diabetic Coma

- Questions We May Ask About Your Diabetic Coma

- Getting First-Day Coverage Insurance With A Diabetic Coma History

- How Can Funeral Funds Help Me?

- Frequently Asked Questions

What Is Diabetic Coma?

A diabetic coma is a life-threatening complication of diabetes that occurs when blood sugar levels become dangerously high or low. It can be caused by either severe hypoglycemia (low blood sugar) or hyperglycemia (high blood sugar).

Early diagnosis and treatment are critical for preventing serious complications or death.

Here are the three main causes of diabetic coma:

- Diabetic ketoacidosis (DKA): This is a serious complication of type 1 diabetes, but it can also occur in people with type 2 diabetes. It is caused by a lack of insulin, which leads to the buildup of ketones in the bloodstream. Ketones are an acidic byproduct of fat metabolism that can cause the blood to become too acidic.

- Hyperglycemic hyperosmolar state (HHS): This is a condition that occurs when blood sugar levels are very high for an extended period of time. It is most common in people with type 2 diabetes. HHS can cause severe dehydration and electrolyte imbalances.

- Severe hypoglycemia: This is a condition that occurs when blood sugar levels fall too low. It can be caused by missing a meal, taking too much insulin, or exercising too much. Symptoms of severe hypoglycemia can include confusion, seizures, and coma.

Having a history of diabetic coma indicates a higher risk of future complications from diabetes. The longer it’s been since the coma and the better your diabetes has been managed since then, the less impact it will likely have.

Can You Get Burial Insurance With Diabetic Coma?

YES: If you have a history of diabetic coma and your health issues are now resolved, you may qualify for first-day coverage depending on the plans available in your state.

NO: If you or someone you love is currently in a diabetic coma, no insurance company will offer you coverage at this time. You would need to be recovered and out of the hospital and not need help with Activities of Daily Living (ADLs) to qualify for better burial insurance programs.

What Is My Best Insurance Option If I Have Had Diabetic Coma?

If you have had a diabetic coma at some point in your life, you may qualify for a first-day coverage burial insurance if this insurance plan is available in your state and your general health allows it.

First-day coverage insurance does not have a medical exam and no waiting period. First-day coverage also comes with the lowest rate possible.

Do I Need A Medical Exam to Qualify for Burial Insurance?

No. The life insurance application process is simple; you don’t need to provide medical records or blood and urine samples.

You’ll often get the official approval from the insurance company within minutes!

How Much Does Burial Insurance Cost If I Had Diabetic Coma?

The burial insurance rates will depend on your:

- Age

- Coverage amount

- Gender

- State of residence

- Smoking status

- Type of policy

Burial Insurance Underwriting If You’ve Had A Diabetic Coma

Burial insurance companies offering first-day coverage will ask health questions and check your prescription history to verify your health.

Examples of diabetic coma the insurance company will be concerned about:

- Hypoglycemia – Too much insulin or not enough food can cause a diabetic coma.

- Diabetic ketoacidosis (DKA) – Occurs in both forms of diabetes, but it is more common among people with type 1 diabetes.

- Hyperosmolar Syndrome – This syndrome only occurs in type 2 diabetes. It’s most common in older adults.

Here are some examples of how burial companies ask about diabetic coma in their health questionnaire:

- Have you been diagnosed as having diabetic coma, insulin shock, diabetic amputation, or taken insulin shots before age 50?

- Have you been diagnosed with diabetes before age 30, or have you ever been treated for a diabetic coma, insulin shock, or diabetic neuropathy?

- Within the past two years, have you had or received treatment for a diabetic coma, insulin shock, retinopathy, or nephropathy?

The final expense insurance companies will review your prescription history as part of their underwriting procedure and risk analysis.

Questions We May Ask About Your Diabetic Coma

Here are some common health questions we ask diabetics:

- Do you have eye issues (retinopathy) resulting from diabetes?

- Do you have kidney issues (nephropathy) due to diabetes?

- Do you have nerve or circulatory issues (neuropathy) due to diabetes?

- Have you ever been in a diabetic coma?

- Have you ever gone into insulin shock?

- Have you ever had to have an amputation resulting from your diabetes?

- How old were you when you were first diagnosed with diabetes?

- What medications do you currently take?

- What type of diabetes do you have (Type 1 or Type 2)

Getting First-Day Coverage Insurance With A Diabetic Coma History

The best way to get first-day coverage burial insurance if you have had a diabetic come is to work with an independent agency like Funeral Funds. Our independent agents can compare different life insurance companies that offer first-day coverage insurance and recommend the best plan with the best pricing.

How Can Funeral Funds Help Me?

Here at Funeral Funds, we specialize in getting life insurance coverage for applicants with diabetic coma.

We work with many A+ rated insurance carriers that specialize in high-risk clients. We will search for those companies to find the best life insurance rates. We’ll match you up with your best life insurance option.

We will assist you in securing the coverage you need at a rate you can afford. So, if you want to get affordable life insurance with diabetic coma, we can help. Fill out our quote form on this page or call (888) 862-9456 for an accurate burial insurance quote.

Frequently Asked Questions

Can diabetics with a history of diabetic coma buy cremation insurance?

Yes, depending on the plans available in your state, most diabetics can qualify for a first-day coverage plan.

Is it hard to get life insurance with any diabetic coma in the past?

It will be easier to get life insurance if you work with an independent life insurance agent.

Can you get life insurance for someone in a coma?

No, the applicant must be conscious to be able to give consent and sign the application.

Can you get funeral insurance for people who have had a diabetic coma?

Yes, however, you need to have insurable interest and consent depending on the plans available in your state.

Do I need to tell the insurance company about type 2 diabetes and diabetic coma?

Yes, if you want 1st-day coverage. Guaranteed issue life insurance (which we don’t recommend) asks no health questions.

Can you be denied life insurance with any diabetic coma?

Yes, some insurance companies offering first-day coverage plans may deny coverage if you have had a recent diabetic coma.

Does diabetic coma affect burial insurance?

Yes, some insurance companies will only accept a diabetic coma if it happened two years ago. Other companies may decline you or offer you a Graded or Guaranteed Issue 2-year wait plan.

Does a diabetic coma disqualify you from life insurance?

No, if enough time has passed and you apply to the ideal insuarnce company.

Yes, if you are currently in a coma, still in the hospital, or within 2 years of your diabetic coma (with some insurance companies)