2024 Burial Insurance with Diabetic Amputation

Amputations caused by diabetes are a serious health emergency that most insurance companies will want more information about before approving you for a burial insurance policy. Depending on your current health, you may qualify for first-day coverage insurance if you apply for coverage with the right company.

Not all plans and benefits are available in all states.

This article will give you the information to find the right burial insurance with the best pricing.

FOR EASIER NAVIGATION:

- What Is Diabetic Amputation?

- Can You Get Burial Insurance With Diabetic Amputation?

- What Is My Best Insurance Option If I Have Had Diabetic Amputation?

- Do I Need A Medical Exam to Qualify for Burial Insurance?

- How Much Does Burial Insurance Cost If I Had Diabetic Amputation?

- Burial Insurance Underwriting If You’ve Had A Diabetic Amputation

- Questions We May Ask About Your Diabetic Amputation

- What If I’m Declined For Coverage?

- Getting First-Day Coverage Insurance With A Diabetic Amputation History

- How Can Funeral Funds Help Me?

- Frequently Asked Questions

What Is Diabetic Amputation?

Diabetic amputation is a surgical procedure to remove part of a limb, most commonly the foot or lower leg, in someone with diabetes. It is a last resort to treat complications arising from diabetes, typically diabetic foot ulcers that don’t heal and become infected.

There are two main reasons why diabetes can lead to amputation:

- Peripheral artery disease (PAD): This condition narrows the arteries that supply blood to the legs and feet. Reduced blood flow can slow healing and increase the risk of infection.

- Diabetic neuropathy: This is nerve damage caused by high blood sugar levels. It can cause numbness in the feet, which can make it difficult to feel pain or injuries. As a result, a person with neuropathy may not notice a sore or ulcer on their foot until it becomes infected.

If left untreated, an infected ulcer can spread to the bone and cause gangrene (tissue death). Amputation is then necessary to prevent the infection from spreading to other parts of the body.

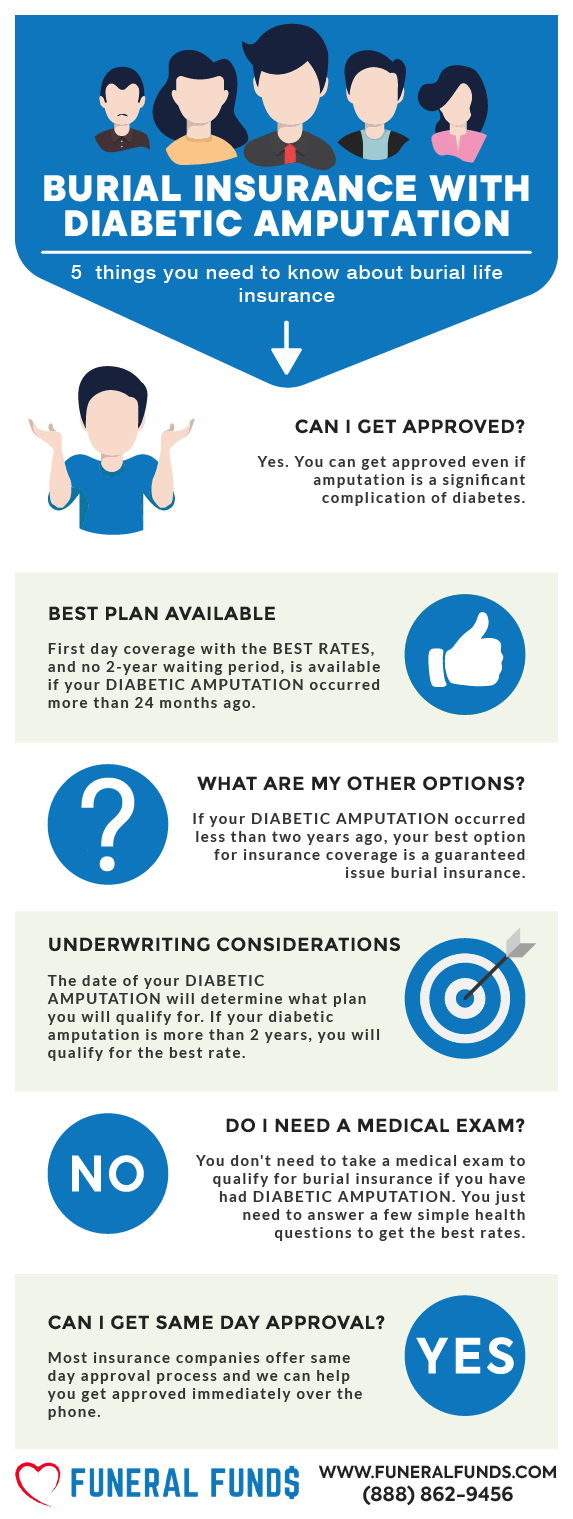

Can You Get Burial Insurance With Diabetic Amputation?

YES: You may qualify for first-day coverage insurance if you had a diabetic amputation in the past and you can still perform Activities of Daily Living (ADLs)* independently.

NO: No insurance company will offer coverage to someone in the hospital undergoing a diabetic-related amputation. You would need to be out of the hospital and not need help with Activities of Daily Living* to qualify for better burial insurance programs.

*ACTIVITIES OF DAILY LIVING include the ability to eat, bathe, and dress on your own, use the toilet, transfer from bed to chair, and go to the bathroom independently.

What Is My Best Insurance Option If I Have Had Diabetic Amputation?

If you have had a diabetic amputation, you may qualify for a first-day coverage burial insurance, depending on the insurance companies available in your state.

If you can perform these activities on your own, some insurance companies offer first-day coverage and burial insurance. I these companies are not available in your state, your best option is guaranteed acceptance life insurance.

If you use a wheelchair and need help with ADLs, or are currently hospitalized, your only option is to purchase guaranteed issue life insurance.

Do I Need A Medical Exam to Qualify for Burial Insurance?

No, When you apply for burial insurance with a diabetic amputation history, the best 1st-day coverage plans will ask you some basic health questions. The application process is simple, and you don’t need to provide blood and urine samples.

You’ll often get official approval from the insurance company within minutes!

If you don’t want to answer any health questions, a 2-year waiting period plan is your only option.

How Much Does Burial Insurance Cost If I Had Diabetic Amputation?

The burial insurance rates will depend on your:

- Age

- Coverage amount

- Gender

- State of residence

- Smoking status

- Type of policy

Burial Insurance Underwriting If You’ve Had A Diabetic Amputation

Here’s how some insurance companies ask about diabetic amputation on the insurance application:

- Have you been treated for or diagnosed as having diabetic coma, amputation caused by disease, or taken insulin shots prior to age 50?

- Have you ever received, or been advised to receive, amputation due to complications of diabetes?

- Within the past 24 months, have you been diagnosed or treated for an amputation caused by any disease?

In addition to the health questionnaire, the insurance company will also perform a prescription history check to verify your other health conditions.

Questions We May Ask About Your Diabetic Amputation

Here are some questions we may ask you to help get the best plan and pricing:

- At what age were you diagnosed with diabetes?

- Are you able to perform activities of daily living on your own?

- Are you being treated for kidney disease?

- Are you confined to a wheelchair?

- Did you have an insulin shock?

- Do you have neuropathy, retinopathy, or glaucoma?

- Do you use insulin?

- Do you use medication like Metformin, Actos, Glyburide, Januvia, or Glipizide to treat your diabetes?

- Have you been in a diabetic coma?

- What type of diabetes do you have?

What If I’m Declined For Coverage?

If you’ve been declined in the past, it is best to work with an independent insurance agency like Funeral Funds. We know the underwriting guidelines of multiple companies, and we can get you a better plan with the lowest rates.

We have access to more than 20 insurance companies and can help you qualify with a diabetic-friendly life insurance company. It will save you time and frustration during the life insurance application process.

Getting First-Day Coverage Insurance With A Diabetic Amputation History

The best way to get a first-day coverage burial insurance plan if you have had a diabetic amputation is to work with an independent agency like Funeral Funds. Our independent life insurance agents can compare companies offering first-day coverage insurance and recommend the best plan with the best pricing.

How Can Funeral Funds Help Me?

Here at Funeral Funds, we specialize in getting life insurance coverage for applicants with diabetic amputation.

We work with many A+ rated insurance carriers that specialize in high-risk clients. We will search for those companies to find the best life insurance rates. We’ll match you up with your best life insurance option.

We will assist you in securing the coverage you need at a rate you can afford. So, if you want to get affordable life insurance with diabetic coma, we can help. Fill out our quote form on this page or call (888) 862-9456 for an accurate burial insurance quote.

Frequently Asked Questions

Can I get insurance if I have diabetes or a diabetic amputation?

Yes, you can get burial, funeral, cremation, and final expense insurance if you have any type of diabetes or amputation due to diabetes.

Can an amputee get life insurance?

Yes, amputees who have lost a limb because of an accident or trauma can get life insurance coverage, but they must be able to perform all ADLs.

Is Type 1 diabetes or type 2 diabetes with an amputation considered a pre-existing condition?

Yes, any currently diagnosed medical condition is a pre-existing condition that the life insurance companies will want to know about.

Can you be denied life insurance for diabetes with an amputation?

Yes, some insurance companies will not accept you for first-day coverage life insurance if you have diabetic complications and cannot perform activities of daily living (ADLs).

Do I need to tell insurance about my diabetic amputation?

Yes, you should disclose all pre-existing conditions to your insurance company.

Do all carriers cover diabetes with complications?

No. Some companies will exclude people with diabetic complications, and others will approve diabetic health issues. That’s why you should seek a competent life insurance agent when there are significant pre-existing health conditions.