Buyers Guide

There is A LOT OF CONFUSION surrounding the plans and pricing for burial, cremation, funeral, final expense, and life insurance products.

To help you understand your best plan and pricing options, we put together this “No Stress” buyer’s guide to provide you with all the information you need to save money and purchase the best plan with the lowest pricing.

So invest TWO MINUTES to read this guide and you will be smarter than 99% of other final expense life insurance shoppers…and by doing so, we hope to save you money and earn your business!

WE DON’T SELL GARBAGE

When you die, your burial, cremation, final expense, or life insurance policy must work 100% of the time. We take this responsibility seriously. Because of that, we don’t sell expensive term life insurance or expensive 2-year waiting period policies.

Could we make more money by selling expensive policies that have high rates or that cancel before you die…heck yeah!

Would it be worth getting a call 5, 10, or 15 years in the future with bad news for the family of someone who just died with an expired policy or a policy that they had overpaid on for 5, 10, or 15 years? Heck no!

WHAT TO NEVER DO

We used to have a quoting tool on our website that showed rates based on age and gender alone. The problem was our website visitors did not know what plans they would or would not qualified for. As a result, the rates they thought they qualified for based on their age alone and were usually incorrect.

Your age is only one factor that determines your pricing on these programs.

Here is an example conversation we had recently with a final expense life insurance shopper:

- Adviser: Hello Mary, how can I help you with this insurance today?

- Mary: Yeah…I’m 67 years old, what’s my price!

- Advisor: Mary, I would need a little bit more information to get you accurate pricing.

- Mary: I’m 67 years old…just give me my price now!

You see, most people are just like Mary and have no idea that your pricing on this insurance is not based just on your age alone.

WHAT’S YOUR PRICING?

At Funeral Funds, we work with many other insurance companies and our Advisors can price check over 30 different companies to find you the lowest rate and 1st-day coverage.

We have a “NO STRESS” quoting process. Here are the three easy steps:

STEP 1: One of our Advisors will check your request for any errors.

STEP 2: We will shop for a “Best Case” price for the programs in your area.

STEP 3: We’ll provide you pricing, benefit, and coverage options by phone.

We will deliver your results within 24 hours, and no purchase is necessary.

To get first-day coverage, we will need to know your:

- Age

- Gender

- State you live in

- Tobacco use

- Height and weight (only with some companies)

- Overall health and doctor-prescribed medications

With the above information, we will be able to provide you rates for all the top insurance companies available to you. And don’t forget…NEVER settle for a 2-year waiting period policy when you qualify for first-day coverage!

WHAT SHOULD YOU AVOID?

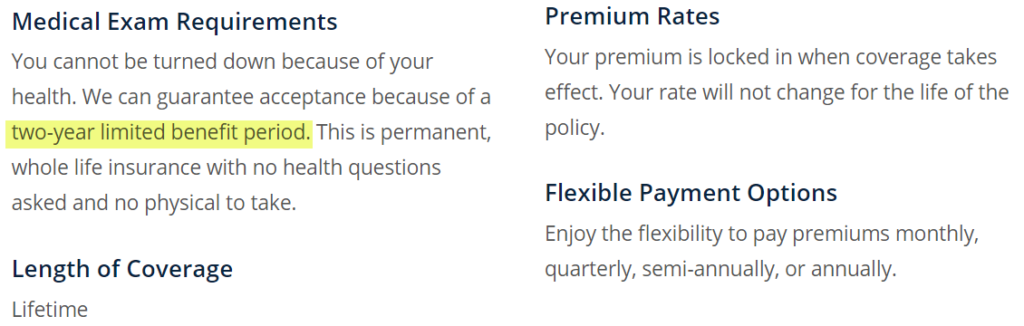

Avoid those expensive plans that advertise on the TV commercials and mailbox postcards when they are “limited benefit period” plans. Those “limited benefit period” plans won’t pay out any death benefit in the first two years of your policy.

You would NEVER buy a car if it had a “limited benefit period” where you couldn’t drive it for the first two years.

You would NEVER buy a house with a “limited benefit period” where you couldn’t live in it for the first two years.

You would NEVER buy groceries with a “limited benefit period” where you couldn’t eat your food for the first two years.

So why would you ever buy an expensive “limited benefit period” life insurance policy that WILL NOT pay out any money in the first two years when you qualify for 1st-day coverage?

PLANS & PRICING AVAILABILITY

There are three basic types of plans available:

- Level Coverage – Best pricing & 1st-day coverage (RECOMMENDED)

- Modified Coverage – Expensive pricing and coverage phased in over 1 to 3 years (NOT RECOMMENDED)

- Graded Coverage – Expensive pricing and mandatory 2-year waiting period (NOT RECOMMENDED)

BEST PRICING: Level Coverage is the FIRST-DAY COVERAGE we help people with at Funeral Funds. This coverage starts from the very first day and will pay out for any kind of death from the very first day. This is the best and lowest-priced insurance product you can purchase.

BAD PRICING: Modified Coverage – These plans are very expensive; even more expensive than graded (2-year wait) coverage plans in many cases. We don’t recommend these plans because some of them won’t get you full coverage for up to 3 years.

WORST PRICING: Graded Coverage – These expensive plans are also called “Guaranteed Issue Life Insurance” and are most often sold by television commercials (they call it “limited benefit period” life insurance) and through junk mail they send to your mailbox every week. These plans place your family and loved ones at great risk in the first two years when no death benefit will be paid.

INTERNET AND TV ADVERTISEMENTS?

If an offer sounds too good to be true…it probably is (and it’s probably expensive)!

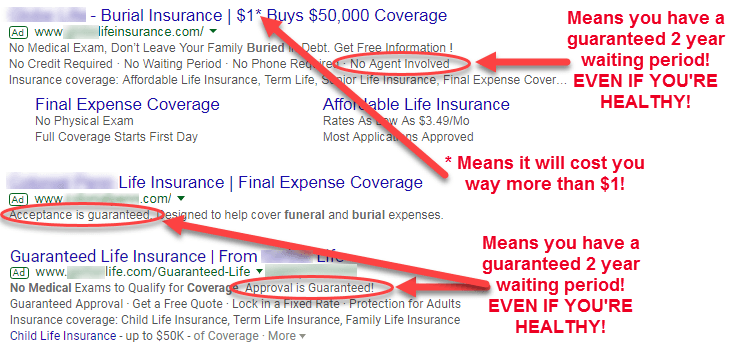

Don’t fall for plans that offer coverage advertised for $1 or $9.95 a month, “approval is guaranteed”, “guaranteed acceptance”, or “no agent involved”. These are big RED FLAGS that insurance buyers should be on the lookout for.

“Guaranteed Issue” 2-year waiting period plans only require your age, gender, and payment method to qualify. They don’t ask any health questions and they will charge you the highest rate possible even if you are perfectly healthy.

AVOIDING A 2-YEAR WAITING PERIOD

As you already know, at Funeral Funds we don’t sell 2-year waiting period plans…but that is not true of all companies.

If you buy from the wrong company, you will always be sold a 2-year waiting period plan (even if you qualify for first-day coverage).

Colonial Penn is a heavily advertised company that offers a $9.95 per month plan. The problem is that their $9.95 offer is PER UNIT (a unit of coverage may can potentially as low as $250). The other problem with Colonial Penn is that they have a MANDATORY 2-year waiting period (they call it a “limited benefit period”).

Additionally, Mutual of Omaha (United of Omaha), AIG, Gerber, and Lincoln Heritage ALL sell plans with 2-3 year waiting periods.

As long as you don’t have a terminal illness, AIDS/HIV, active cancer, congestive heart failure, chemotherapy, COPD with oxygen use, Dementia or Alzheimer’s Disease, dialysis, nursing home confinement, organ failure, or a terminal illness, then we should have no problem getting you approved for first-day coverage.

IS EVERYONE APPROVED?

Most people we help are approved for first-day coverage, but your specific and unique health needs will determine what pricing and plan you qualify for.

If you have a terminal illness with less than 2 years to live, you can get approved for Guaranteed Issue life insurance, but you will only qualify for a 2-year waiting period plan (which makes no sense at all to buy if you have less than two years to live).

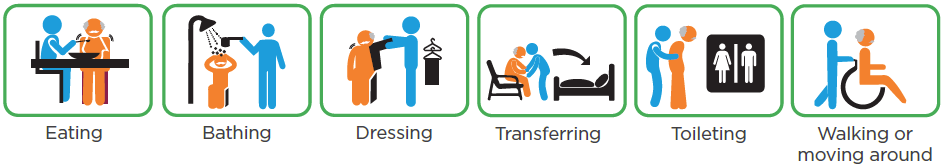

Here are some examples of ADL’s the insurance companies will consider:

If you need help with Activities of Daily Living (ADL’s), then your life insurance options will be limited to a 2-year waiting period plan.

CHOOSING A LIFE INSURANCE AGENT

At Funeral Funds, all of our agents are independent and can price shop about 30 different insurance companies for you so that you get approved for the lowest pricing. You will probably qualify for more than one program when working with an independent agent like the ones at Funeral Funds.

You should also do some research on the following:

- WEBSITE: Ask your agent for a business website. If they cannot provide one, don’t work with them.

- CAPTIVE vs. INDEPENDENT AGENT: Captive agents work for one company only and often only sell term life insurance or 2-year waiting period policies. Independent agents at Funeral Funds can price shop many different companies to get you the best pricing.

- LICENSES: Ask your agent to provide a valid state license number.

- PHONE NUMBER: Ask your agent for a phone number that you can call them back on and verify that the phone number is correct.

- EMAIL: Ask your agent for an email address. If they provide a Gmail, Yahoo, AOL, Verizon, or any other non-secure email, don’t do business with them.

- POLITENESS: If your agent is not polite, you shouldn’t work with them now or in the future.

WILL YOUR PRICING GO UP?

Not if you buy the right plan. Never buy an expensive term life insurance policy that increases in price over time if you want permanent lifetime coverage.

AARP, New York Life, Globe Life, and TruStage offer TERM life insurance that is lower priced at first, but then it will then go up in price every 5 years and cancel after you turn 80 years old (exactly when you need this coverage the most!). We don’t recommend these plans for final expense needs.

At Funeral Funds, our 1st-day coverage plans NEVER increase in price. Your prices are locked in at today’s low rates for the life of your policy.

WILL YOUR COVERAGE GO DOWN?

Your coverage will NEVER go down over time as long as you purchase whole life insurance from Funeral Funds.

With expensive term life, it’s a different story! Term life insurance will cancel when you need it the most (after age 80).

BUY THIS INSURANCE NOW?

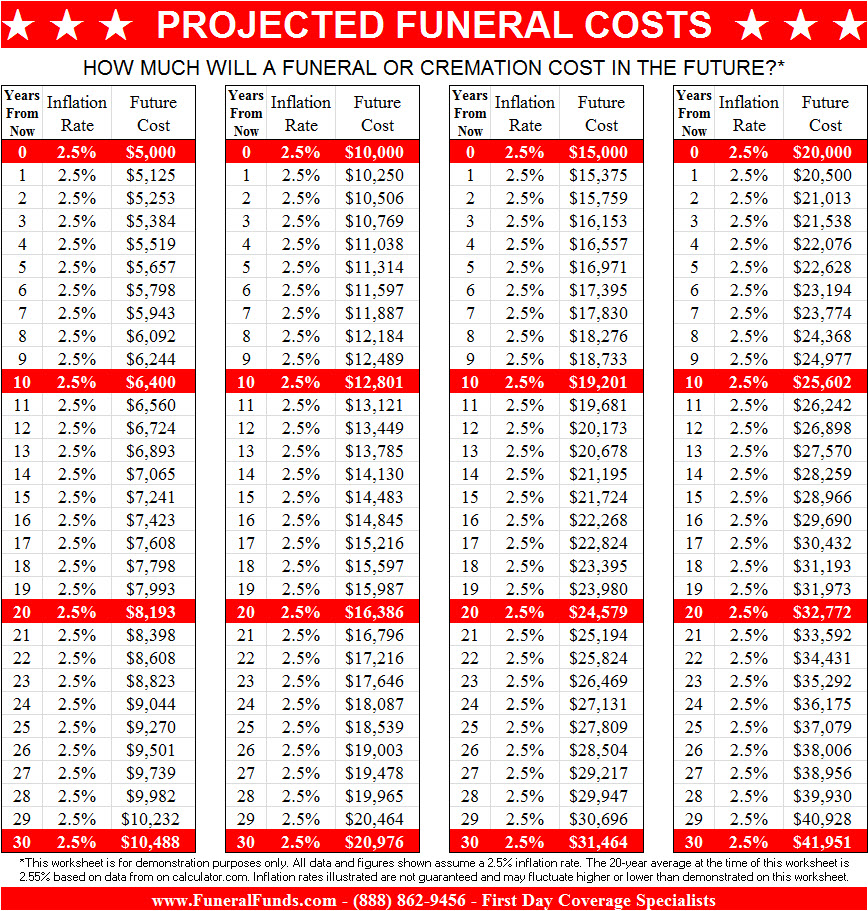

Inflation increases the cost of goods and services over time…including insurance prices! A $15,000 funeral today will cost over $31,000 in 30 years (with an 2.5% annual inflation rate).

Here is a guide we created that shows how much pricing will increase over time at the average annual inflation rate of 2.5%.

WHAT COMPANIES ARE BEST?

At Funeral Funds, we work with many companies, but our best companies offer 1st-day coverage or benefits. Below is a list of almost all the final expense life insurance companies. We have bolded the names of the companies that are most often the right choice for most people.

You can try to call them all yourself, or you can call us directly at (888) 862-9456 and we can price shop them all for you in just a few minutes.

Most common final expense companies (in alphabetical order):

- AAA Life Insurance: EXPENSIVE! No health questions, 2-year waiting period only

- AARP: Low Price BUT Term life, 5-year price increases, cancels after age 80

- AETNA (CVS Health): Low price. Good for overweight people & COPD

- Allstate: Expensive & strict underwriting

- Assurant/American Memorial

- Americo: Expensive & terrible smoker rate program

- American Amicable: Moderate rates, good smoker rates

- AIG/American General: EXPENSIVE! No health questions, 2-year waiting period only

- Christian Fidelity: In-person application only

- Family Benefit: Lowest price & easy underwriting, great for diabetics

- Farmers Insurance: Expensive & strict underwriting

- Foresters: Moderate rates about 8% more expensive

- Gerber: EXPENSIVE! No health questions, 2-year waiting period only

- Globe Life: Term life insurance, 5-year price increases, cancels after age 80

- Great Western: No health questions, 2-year waiting period only

- Grange Insurance

- Greek Catholic Union: Good pricing, limited state availability

- Guarantee Trust Life: GREAT for CHF, COPD, heart problems, serious health issue

- Liberty Bankers Life: Niche carrier for specific health problems

- Lifeshield Life Insurance Company

- Lincoln Heritage: EXPENSIVE! About 40% more expensive & up to 3-year wait plan

- Mutual Of Omaha: No same day approval, slow & difficult underwriting

- New York Life: Low Price BUT Term life, 5-year price increases, cancels after age 80

- Oxford Life: Good pricing, in-person application only

- Pioneer Insurance Company: More expensive

- Prosperity Life/SUSA: Niche carrier some health problems, good with seizures

- Royal Neighbors Of America: Low prices & great for overweight people & diabetics

- Security National Life

- Sentinel Security

- Standard Life And Casualty

- State Farm: Expensive & strict underwriting

- Transamerica: Slow & difficult underwriting

- Trinity Life: Lowest price & easy underwriting, great for diabetics

- TruStage: Low Price BUT Term life, 5-year price increases, cancels after age 80

- United Home Life: More expensive