Burial Insurance For Dialysis Patients

First-day coverage burial insurance for dialysis patients is available. Depends on where you live and how many other health issues you’re juggling.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with COPD, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is Dialysis?

Your kidneys are basically your body’s janitors, sweeping up all the nasty stuff. But when they decide to take a permanent vacation, dialysis comes in to save the day (or at least it buys you some time). It’s like calling in a hazmat team for your bloodstream.

When your kidneys aren’t working right, they can’t filter out the bad stuff in your blood. That’s where dialysis comes in! It’s like a super-powered filter that helps your body stay clean.

There are two main ways to do dialysis:

- Hemodialysis: Your blood takes a trip outside your body through a tube to a special machine. This machine filters out the waste and extra water, then sends the clean blood back to you.

- Peritoneal dialysis: This time, the cleaning happens inside your body. A special liquid is put into your belly through a tube. It soaks up the waste, and then it’s drained out.

Dialysis? More like a glorified Band-Aid for your busted kidneys. It’s not a magic cure, just a fancy way to keep you from turning into a toxic waste dump. You’ll need to hit up that dialysis machine regularly, like it’s your annoying but necessary gym buddy.

Dialysis is like a red flag for insurance companies. They see you and think “risk, risk, risk!” But don’t freak out, it’s not a total insurance death sentence. There’s still a chance to find coverage, but it might take a little extra effort.

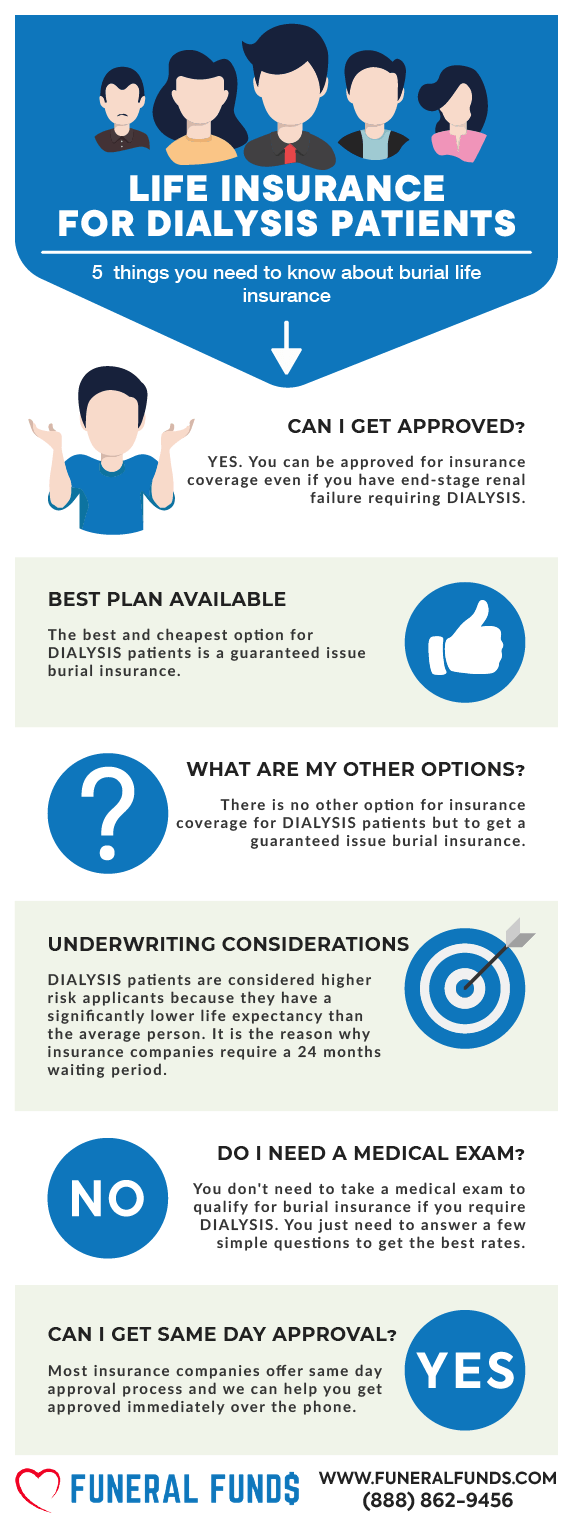

Can I Get Burial Insurance If I’m On Dialysis?

Short answer: Yes. It depends on where you live and if your insurance agent is playing with the right cards. Kidney disease and dialysis? That’s a tough hand to be dealt when it comes to insurance. But hey, there might be a 1st-day coverage silver lining if you find the right agent.

What Is My Best Insurance Option If I’m On Dialysis?

So, your kidneys are kaput and you’re hooked up to a dialysis machine? Well, good news (kinda): you might still snag that first-day coverage insurance if you’re playing by your doctor’s rules. Just make sure you’re following their orders like a good patient who wants to live a long time.

What Are The Types Of Burial Insurance Available For Dialysis Patients?

First-Day Coverage – It’s like the fast-pass to insurance. No medical drama, just a few questions and boom – you’re covered! It’s like insurance companies decided to be nice for once.

Modified Coverage – Think of this as the “patience is a virtue” option. You get some coverage right away, but don’t expect a big payday right off the bat. Your benefits are phased in over two years.

Guaranteed Issue – It’s like the insurance world’s last resort. No questions asked, you’re in! But, there’s a catch: if you bite the dust too soon, your family gets a tiny refund, not the big bucks. The policy would only pay out the premiums you have paid plus 7-10% interest (depending on the company).

Do I Need A Medical Exam To Qualify For Burial Insurance?

No, As long as you’re not allergic to answering simple questions, you’re good to go. No blood tests, no pee cups, and no white coats. It’s like the insurance world’s version of a walk in the park. Plus, you’ll know if you’re covered faster than you can say “final expenses.”

What If My Application Was Rejected Because of Kidney Dialysis?

Rejected for burial insurance because you need dialysis? Don’t worry! It just means you picked the wrong insurance company or agent. Some companies are picky, like kids who only want to play with certain toys. But we’ll find a company that’s cool with your dialysis and get you covered.

If you have a brand new kidney transplant and are feeling good (like you have a brand new superpower!), guaranteed insurance with no questions asked may be your best bet for the time being.

How Can Kidney Dialysis Affect My Insurance Rates?

Dialysis might make it harder to snag that fancy “regular” life insurance, like trying to get into an exclusive club with a secret handshake. Even if you find a plan that lets you in, it might cost more than your favorite candy store (and trust me, that’s saying something!). Plus, there might be a waiting period before the insurance actually kicks in.

But hey, don’t despair! There are still ways to get covered. We just gotta find an insurance company that’s a little more chill and a plan that fits your situation.

How Much Does Burial Insurance Cost For Dialysis Patients?

Here’s the lowdown on how much burial insurance might cost you if you’re rocking that dialysis machine:

- Age

- Gender

- State of residence

- Smoking status

- Type of policy

- Coverage amount

1st-day coverage plans always start from your first payment date. Guaranteed Issue (GI) and Modified plans always have 2-3 year waiting periods.

Here’s a pricing example for a tenacious 60-year-old female on dialysis.

| FEMALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Here’s a pricing example for a determined 60-year-old male on dialysis.

| MALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Burial Insurance Underwriting For Kidney Dialysis

You will often see kidney dialysis questions asked this way:

- During the past 24 months, have you been recommended by a medical professional for kidney dialysis?

- Have you ever had, or been diagnosed with, or received or been advised to receive dialysis for kidney disease?

- Within the past 12 months, have you been advised to have kidney dialysis?

Health question for kidney transplant:

- Within the last 5 years have you been advised to by a member of the medical professional to have an organ transplant?

- You must honestly answer “yes” to the health question if you are undergoing kidney dialysis or recommended to have an organ transplant.

How To Find The Best Burial Insurance For Dialysis Patients?

Don’t sweat it! Finding the right plan is like finding the best video game – there are tons out there, but only one is perfect for you.

An independent life insurance agent from Funeral Funds is like your own personal insurance superhero. They know all the cool insurance companies that offer “first-day coverage” for people with kidney stuff and dialysis. They’ll help you find the perfect plan, so you can relax and focus on feeling better.

How Can Funeral Funds Help Me?

Stop wasting time playing phone tag with a million insurance companies! We’re like the ultimate search engine for burial insurance – we do all the hard work for you.

Think of us as your insurance matchmaker. We work with the coolest companies, the ones with top marks (like A+), who specialize in helping people who might need a little extra TLC (like you with your dialysis machine).

Our awesome experts will sniff out the best deals from all the best companies, so you get the sweetest rates possible. Plus, we promise this whole process will be faster and easier than tying your gym shoes the first time (you know, before you figured it out).

Ready to ditch the stress and find the perfect plan? Fill out the form on this page, or call us at (888) 862-9456. We’ll get you a quote faster than you can say “peace of mind!”

Frequently Asked Questions

Is there any insurance for dialysis patients?

Yes, There are actually some cool insurance companies out there who don’t make you wait forever to get covered. It’s like first-day coverage – bam, you’re in!

Which insurance is best for dialysis?

Answer a few quick health questions and boom! You’re covered faster than a greased-up waterslide.

Can you be denied life insurance for kidney dialysis?

Yes. Here’s the deal: if the doctor says “dialysis time!” and you throw a tantrum like a toddler refusing broccoli, then yeah, your insurance application might get the boot with some companies.

Can I qualify for final expense insurance if I’m on dialysis?

Absolutely! Even if you’re rocking the dialysis machine, you can still get coverage with the right insurance companies.

Do you have to be on dialysis to get life insurance?

No, life insurance is your BFF before the dialysis machine shows up. But hey, if you’re already on it, don’t worry! Some amazing companies specialize in covering folks with end-stage renal failure, as long as you’re undergoing dialysis.

Is there a limit to how much life insurance you can get if you are on dialysis?

The amount of coverage you can get on dialysis varies depending on the insurance company, kind of like video game levels. It can range from a sweet $2,000 to a whopping $20,000! We’ll find the perfect plan that fits your needs and keeps your wallet happy.

16 Comments

Mike

I have been on dialysis for 8 months now and have regular check-ups with my nephrologist. Will I qualify for a life insurance? If so, what’s the best and most affordable life insurance policy for me? I would appreciate a feedback. Thank you.

Funeral Funds

Mike,

We wish you the best in your medical recovery! A Gauranteed Issue policy would be your best bet with your medical diagnosis. An accidental policy would be something to consider in addition to a guaranteed issue policy. Accidents are the #1 cause of fatality in most age groups…even if you are currently on dialysis.

Funeral Funds

Michelle

With a guaranteed acceptance life insurance, how much premium are we talking about and what’s the most coverage to get?

Funeral Funds

Michelle,

We can help you get some pricing. We’ll have an agent get in touch with you right away to see if this makes sense for you and your budget.

Funeral Funds

Ellen

I am interested in the burial insurance for my mom.

I would like to know details like monthly premiums, coverage, etc. Can you connect with me through email? Thanks.

Funeral Funds

Ellen,

We will have an agent get in touch with you this week.

Funeral Funds

Jane

My parents are both on dialysis and both have been declined life insurance previously. Is there any chance for an approval for them at all in a different company? If there’s no chance can I apply for some kind of plan applicable to my parent’s situation instead?

Funeral Funds

Jane,

We can help your parents out with a guaranteed issue policy up to $25,000. We will send you an email shortly to help you out with this.

Funeral Funds

Vance

I’m thinking of getting an insurance now but I’m about to undergo a kidney transplant in 2 months. Can I get cover after my transplant?

Funeral Funds

Vance,

With a kidney transplant in 2 months, we won’t be able to get you immediate coverage. We can, however, get you a guaranteed issue policy with a waiting period.

Without knowing how your health will fair in the coming years after your kidney transplant, now would be the best time to get your waiting period out of the way.

Funeral Funds

Crystal

My husband is 38 and does not qualify for the guaranteed life according to what you're saying. Are there any policies or options for us now at his age with being on dialysis?

Funeral Funds

Crystal – We have a new company we are working with that will accept down to age 40 for most people.

Racquel Flowers

Interested in getting insurance for my Husband on dialysis

Funeral Funds

Racquel – You can get a free quote by visiting this page – https://funeralfunds.com/free-quote/

Irma Echevarria

Do I qualify for life insuranse if I'm on dialysis and waiting for a kidney transplant?

Funeral Funds

Irma – You would qualify for insurance, it would just have a mandatory 2-year waiting period for any death that was health or medical-related. We don't offer any of these plans, but we would be happy to refer you to the best company that offers those plans. Just call our toll-free number if you want that information.