2024 Affordable Burial Insurance with Autism

Buying burial insurance with autism is possible. However, the type of insurance policy you will qualify for will depend on the severity of your symptoms and any medical conditions you may have.

IMPORTANT: If you have severe autism, or no mental or cognitive ability to make legal decisions YOU WILL NOT qualify for burial insurance.

This article is going to discuss how burial insurance companies respond to applicants with autism, what options are open for you, and how to find the most affordable plan.

FOR EASIER NAVIGATION:

- What Is My Best Insurance Option If I Have a History of Autism?

- What Types of Burial Insurance Should I Avoid?

- What Type of Burial Insurance Is Best?

- If I Have Autism, Do I Need a Medical Exam to Qualify for Burial Insurance?

- Burial Insurance Underwriting If You Have Autism

- How Much Insurance Do I Need If I Have Autism?

- How Should I Pay My Premiums?

- Autism and Burial Insurance Riders

- Information We Need if You Have Autism

- Life Insurance for Family Members

- Benefits of Burial & Funeral Insurance

- Other Common Uses for Final Expense Life Insurance with Autism

- How Can Funeral Funds Help Me?

- Additional Questions & Answers Burial Insurance With Autism

What Is My Best Insurance Option If I Have A History Of Autism?

The severity of autism has an impact on eligibility for burial insurance coverage.

Insurance companies will consider if you only have autism or if you have other more serious issues like physical and mental impairments. Beyond these factors, they will also review your overall health to make a decision.

THERE ARE THREE LEVELS OF AUTISM SEVERITY:

MILD AUTISM

Higher functioning autism or mild autism has some communication skills and socialization issues. They often maintain a high quality of life with only little support and can complete daily living activities independently.

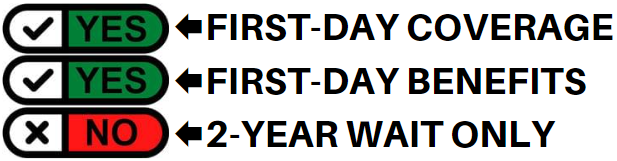

If you have mild autism, but you can function in high capacity, you are self-sufficient and no other behavioral problems, mental disorders, or epilepsy. You can qualify for level death benefit with first-day coverage.

This plan has immediate coverage effective on the first day, no waiting period, and your beneficiary will receive 100% of your death benefit when you pass away. It is the best life insurance policy you can qualify for if you have autism.

Best Option: Level death benefit plan with first-day coverage

Taking guaranteed burial insurance is your only option if you have mild autism but a mental and behavioral disorder or epilepsy.

The more severe your health condition is, the more likely it is that you have to consider a no medical exam, no-questions policy. Your approval is guaranteed with this plan, no matter how severe your condition is.

Guaranteed issue burial insurance is whole life insurance that lasts a lifetime. It has a graded death benefit during the first two years of the policy. If you are a U.S. citizen and live in the state where it is available, and you fall within the required age of 50 to 85, you should be able to qualify for this plan.

Best Option: Guaranteed issue burial insurance

MODERATE AUTISM

People with moderate autism require substantial support.

Symptoms include a more severe lack of verbal and nonverbal communication skills. Performing activities of daily living are difficult and generally needs more support than those with mild autism.

Moderate autism with behavioral problems, mental disorders, or epilepsy only qualifies for guaranteed issue life insurance policies for special needs.

Best Option: Guaranteed issue burial insurance

SEVERE AUTISM

People with severe autism require very substantial support.

They have a more severe lack of communication skills and display repetitive or restrictive behaviors.

Someone with severe autism may also need a caregiver to help them learn basic skills and help them in performing activities of daily living. People under this category may not qualify for burial insurance if they have no mental capacity to make legal decisions.

Best Option: Will not be approved for coverage

OTHER FACTORS THAT MAY AFFECT ELIGIBILITY

AUTISM WITH EPILEPSY & EPILEPTIC SEIZURES

It is estimated that 30% of people with autism spectrum disorder experience epilepsy or epileptic seizures. Prolonged, uncontrolled seizures may lead to permanent brain damage in people with autism.

Life insurance applications for people with epilepsy are handled differently from healthy individuals.

Insurance providers consider people with epilepsy or epileptic seizures high risk because studies have shown that their life expectancy can be reduced from two to ten years.

If you have autism with epilepsy and epileptic seizures, your best insurance option is a first-day benefit plan.

You will be covered from the first day, and your death benefit will be phased in over time.

Best Option: First-day benefit plan

AUTISM, DEPRESSION, AND ANXIETY

Studies show that at least 33% of people with autism suffer from anxiety like social phobias, obsessive worrying, and separation anxiety when they are separated from a loved one.

Anxiety can be mild to severe, and at times difficult to control.

Most adult autism patients also suffer from depression. Some people may take more than one medication and receive treatment from a psychiatrist. Depression in older adults with autism can co-occur with other severe medical conditions, such as heart disease, diabetes, and high blood pressure.

A person with depression can experience temporary hospitalization.

If you have been hospitalized due to major depression, it may affect your burial insurance eligibility. In the case of severe or clinical depression with a disability, you are looking at guaranteed issue burial insurance.

Best Option: Guaranteed issue burial insurance

AUTISM AND ATTENTION DEFICIT DISORDER (ADD) OR ATTENTION DEFICIT HYPERACTIVITY DISORDER (ADHD)

Hyperactivity and attention deficit disorder affect the ability of people with autism to focus and learn.

Most hyperactivity disorders do not affect your ability to qualify for life insurance. However, some medications used to treat hyperactivity disorders are red-flagged in life insurance companies and may impact the amount you pay and if you will have a waiting period on your policy.

Best Option: Guaranteed issue burial insurance

AUTISM AND PHYSICAL IMPAIRMENTS

In some circumstances, people with Autism may experience physical impairments like gait issues, paralysis, and limited mobility that may affect how they perform everyday activities.

Physical impairments may affect your ability to qualify for life insurance. The fewer physical impairments you have, the better your chances of qualifying for affordable burial insurance.

If you have physical impairments, the insurance company will want more details on how it affects your ability to do the activities of daily living.

ACTIVITIES OF DAILY LIVING

Almost all burial insurance companies will ask about the activities of daily living in their life insurance application.

There are six ADLs used by life insurance companies to determine if you will qualify for coverage:

- Eating

- Bathing

- Dressing

- Toileting

- Transferring

- Continence

If you have autism, you should be able to do these ADLs on your own to be eligible for life insurance. Most final insurance companies will flat out decline anyone who needs help with their daily activities.

If your autism is moderate to severe and you need help in doing the ADLs, your life insurance option is a guaranteed issue burial insurance.

Best Option: Guaranteed issue burial insurance

AUTISM AND MEDICATION

The medication you use to treat your autism spectrum disorder, like your other medical condition, will directly impact your insurability level.

Medication used to treat autism can also be used to treat other medical conditions such as anxiety, depression, and bipolar disorder.

The insurance company will want to know:

- What medications are you taking for autism

- The amount of dosage

- How long have you been taking the medication

Additionally, inform them if you are taking medications to treat other health issues unrelated to Autism or mental health issues. These medications will also be considered during the underwriting process.

What Types Of Burial Insurance Should I Avoid?

| PLANS TO AVOID | WHY? |

|---|---|

| Term life | Premiums increase after 5 years. Coverage ends after 80. |

| Pre-paid funeral plans | Expensive |

| Universal life | Tied with stocks |

| No health questions policies | With 2-year waiting period |

| Plans offering "teaser rates" | $9.95 per unit plans or $1 buys $100,000 coverage |

| Over priced plans | Insurance from TV and junk mail |

| Plans that accept mail-in payments | Risky |

| Plans that accept Direct Express | High lapse rate |

| Plans that accept Credit Cards | High lapse rate |

What Type Of Burial Insurance Is Best?

| FUNERAL FUNDS PLAN BENEFITS | INCLUDED |

|---|---|

| 1st Day Coverage | YES |

| Rates NEVER Increase | YES |

| Coverage NEVER Decreases | YES |

| Easy to get approved | YES |

| No Medical Exam | YES |

| Same Day Approval | YES |

| Death Claims Pay Fast | YES |

| Builds cash value | YES |

| Coverage Up To Age 121 | YES |

If I Have Autism, Do I Need A Medical Exam To Qualify For Burial Insurance?

You are NOT required to take a medical exam to qualify for burial insurance for autism.

When you apply for burial insurance, you only have to answer some basic questions about your health. The application process is simple; you don’t need to provide medical records or blood and urine samples.

You’ll get the official approval from the insurance company often within minutes!

Burial Insurance Underwriting If You Have Autism

You will have to go through underwriting when applying for final expense insurance with an autism spectrum disorder.

Burial insurance companies have two ways of underwriting:

FIRST – They may ask you a series of health questions. Your answers to their questions will determine your eligibility.

SECOND – They will electronically review your prescription history to verify your health.

HEALTH QUESTIONS:

You will only have to answer a few health questions as a part of the application process.

Some of the common questions you will be asked include:

- Have you ever been diagnosed or treated for autism spectrum disorder?

- Do you have any history of seizures or epilepsy?

- Do you need help performing daily living activities such as eating, bathing, dressing, transferring, and continence?

Depending on the life insurance company you are applying to, there may be many more questions on the application, but those are the more common questions asked of people who are applying for burial insurance with autism.

Insurance companies may ask many questions about your condition because they need loads of information to decide. Be sure to provide all this information to avoid getting denied.

PRESCRIPTION HISTORY CHECK

While there are no specific medications that apply directly to Autism, you could be taking medicines for other mental conditions like anxiety medications, antidepressants, and antipsychotic drugs, including:

- Aripiprazole (Abilify)

- Fluoxetine (Prozac)

- Naltrexone (Vivitrol)

- Quetiapine fumarate (Seroquel)

- Risperidone (Risperdal)

- Sertraline (Zoloft)

If you are taking any of these drugs, don’t worry. These medications could be insurable, depending on the severity of your condition.

WHY DO INSURANCE COMPANIES CARE IF YOU HAVE AUTISM?

Life insurance companies know autism or autism spectrum disorder is a neurodevelopment disorder. Autism is not a life-threatening condition, but autism affects behavioral and bodily functions. Most people with autism suffer from various health issues, such as epilepsy, seizure, and anxiety. This condition can last through adulthood since autism has no cure.

Life insurance companies care about autism because studies showed that those with autism without learning disabilities had an average life expectancy of 58 years. Their leading cause of death is heart disease, epilepsy, and suicide.

Having underlying health issues makes getting coverage for someone on the spectrum challenging because it can cause premature death.

How Much Insurance Do I Need If I Have Autism?

The amount of burial insurance you should buy varies depending on your personal and financial circumstances. However, burial insurance should cover the cost of your funeral, burial, and final expenses.

The first step to figuring out how much burial insurance you need is to know your end-of-life expenses. Your funeral cost is often the biggest single expense you need to pay. Other end-of-life expenses to consider are your outstanding medical bills, living expenses, credit card bills, and other debts.

Here’s an example of a funeral cost breakdown from the National Funeral Directors Association.

| AVERAGE FUNERAL COST WITH VIEWING AND BURIAL | |

|---|---|

| Non-declinable basic services | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Hearse | $325 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Metal casket | $2,500 |

| Vault | $1,572 |

| Median Cost of a Funeral With Viewing and Burial | $9,420 |

| AVERAGE FUNERAL COST WITH VIEWING AND CREMATION | |

|---|---|

| Non-declinable basic services fee | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Cremation fee (if firm uses a third-party crematory) | $368 |

| Cremation Casket | $1,310 |

| Urn | $295 |

| Median Cost of a Funeral with Viewing and Cremation | $6,970 |

| Rental Casket | $995 |

| Alternate Cremation Container | $150 |

How Should I Pay My Premiums?

The best way to pay your premium is through a savings or checking account. We recommend you set a bank draft from your savings or checking account. That way, the bank will automatically pay your premium each month, and you don’t need to worry about your policy lapsing due to non-payment.

Autism And Burial Insurance Riders

Insurance policy riders add benefits to your policy. Adding insurance riders will enhance your policy to fit your needs. Some riders are built into your policy, while others can be added at an additional cost. Most riders are affordable, and it involves little to no underwriting.

Here’s a list of common burial insurance riders:

| FUNERAL FUNDS ADD-ONS | AVAILABILITY |

|---|---|

| Terminal Illness Add-On Benefit | Included with most plans |

| Nursing Home Care Add-On Benefit | Included with most plans |

Information We Need If You Have Autism

We will need more information if you have autism spectrum disorder regarding your diagnosis and any other medical conditions you may have.

This information will help us to understand your current health condition better and enable us to provide you with an accurate quote.

Here are some of the questions we will ask to determine the best plan for you:

- When were you diagnosed with autism spectrum disorder?

- Do you have any intellectual or mental disabilities?

- What medications are you currently taking?

- Do you have physical impairments like cerebral palsy?

- Do you have a history of seizures or epilepsy?

- Do you suffer from any mental health disorders such as bipolar disorder, depression, or schizophrenia?

- Do you need help with activities of daily living such as eating, bathing, dressing, transferring, and continence?

- Do you have any other medical conditions?

Try to give an honest response to the questions. We will review your information to determine what insurance company is your best fit.

Life Insurance For Family Members

In most cases, it is often the family members of those with Autism spectrum disorder who are looking to get a life insurance policy for their loved one.

Most of the time, the family members are just looking for a policy to cover final expenses.

Guaranteed issue burial insurance with autism can be taken out by the family for their loved ones so that when they pass away, there will be some financial assistance in place.

REQUIREMENTS TO GET BURIAL INSURANCE FOR A FAMILY MEMBER WITH AUTISM

INSURABLE INTEREST

You need to prove an insurable interest between your family members who need insurance coverage. Your relationship with the proposed insured is critical in showing that you have an insurable interest. A blood relationship may provide the basis for insurable interest. Insurable interest exists if you will experience financial loss when they die.

You have an insurable interest if you would suffer a financial loss or certain other kinds of loss if your loved one dies. In most cases, you can get life insurance coverage for your loved ones to cover that loss.

CONSENT

Consent is the second requirement for getting life insurance for your family member with autism spectrum disorder. Life insurance companies do not allow family members to get life insurance on one another without their permission.

You can’t secretly apply for final expense insurance on your loved ones without them knowing about it, or without them having the cognitive ability to make their own legal decisions. They must be aware of the policy because they must sign the application.

If you have a family member with this condition, call us so we can help you understand your options.

BENEFITS OF BURIAL & FUNERAL INSURANCE

- Easy to qualify – You skip the medical exam. You only have to answer a few questions about your health.

- Level premium – Your monthly premium is fixed as long as you continue to pay your premium on time. It is guaranteed to never increase due to advancing age or worsening health conditions.

- Level death benefit – Your beneficiaries will receive the amount on your policy when you pass away.

- Tax-free – Your death benefit will be paid to your beneficiaries free of tax. They will generally not owe any income tax on the death benefit.

- Not cancellable – Your policy can never be canceled by the life insurance company as long as premium payments are made on time.

- Cash value builds up – Guaranteed issue life insurance builds cash value that you can borrow against for whatever purpose you deem necessary.

Other Common Uses For Final Expense Life Insurance With Autism

All of these examples are appropriate uses for Final Expense Life Insurance:

- Burial insurance plan with autism

- Cremation insurance plan with autism

- Funeral home insurance plan with autism

- Final Expense insurance plan with autism

- Prepaid funeral plan insurance with autism

- Mortgage payment protection plan with autism

- Mortgage payoff life insurance plan with autism

- Deceased spouse’s income replacement plan with autism

- Legacy insurance gift plan to family or loved ones with autism

- Medical or doctor bill life insurance plan with autism

We can help you with any of the plans above. Your pricing will depend on your age, health, and coverage amount for each program option.

How Can Funeral Funds Help Me?

Finding a policy with autism needn’t be frustrating; working with an independent agency like Funeral Funds will make the process easier and quicker.

We will work with you every step to find the plan that fits your financial requirements and budget. You don’t have to waste your precious time searching for multiple insurance companies because we will do the dirty work for you.

We work with many A+ rated insurance carriers that specialize in covering high-risk clients like you. We will search for all those companies and match you up with the best burial insurance company that gives the best rate.

We will assist you in securing the coverage you need at a rate you can afford. So, if you are looking for autism funeral insurance, or autism burial insurance, or autism life insurance, we can help.

Fill out our quote form on this page or call us at (888) 862-9456, and we can give you an accurate quote.

Additional Questions & Answers On Burial Insurance With Autism

Can I get life insurance if you have autism?

Yes, you can get life insurance if you have autism. There are a few things to keep in mind, though. Your insurance eligibility will depend on the severity of your condition and your mental and cognitive ability.

Is autism considered a pre existing condition?

Yes, autism is considered a pre-existing condition by most insurance companies. You may be subject to higher premiums or be denied coverage altogether.

Do I need to tell insurance about autism?

Yes, you will need to disclose your autism diagnosis to your insurance company. Failure to do so could result in your policy being void or your claims being denied.

What are the chances of getting insurance with autism?

The chances of getting insurance with autism will depend on the severity of your condition and your mental and cognitive ability. If you have a mild form of autism, you may be able to get coverage through a regular life insurance policy. However, if you have a more moderate form of autism, you may qualify for a guaranteed issue life insurance.

Can an autistic person be insured?

Yes, an autistic person can be insured. Your insurance eligibility will depend on the severity of your condition and your mental and cognitive ability.

Can a person with autism get burial insurance?

Yes, a person with autism can sometimes get burial insurance. There are a few things to keep in mind, though. Your insurance eligibility will depend on the severity of your condition and your mental and cognitive ability. You may also be subject to higher premiums or be denied coverage altogether.

Do I need to take a medical exam if I have autism?

No, you do not need to take a medical exam if you have autism.

Is there an age limit for burial insurance with autism?

The typical age limit for burial insurance with autism is 85 years old.

What are the benefits of having burial insurance with autism?

Burial insurance with autism can provide financial security for your loved ones in the event of your death. It can also help to cover the costs of your funeral and other final expenses.

Can autism be considered a critical illness in life insurance?

Yes, autism can be considered a critical illness in life insurance.

Is autism considered a terminal illness?

No, autism is not considered a terminal illness.

Can you get first-day coverage insurance if you have autism?

Yes, you can sometimes get first-day coverage insurance if you have a mild form of autism.

Is autism classed as a long-term health condition?

Yes, autism is classed as a long-term health condition.

What are the odds of getting life insurance with autism?

The odds of getting life insurance with autism will depend on the severity of your condition and your mental and cognitive ability.

What are the things that may affect my eligibility if I have autism?

A few things may affect your insurance eligibility if you have autism. These include the severity of your condition, your mental and cognitive ability, and your ability to make legal decisions.

What is the life expectancy autistics?

There is no definitive answer to this question as everyone with autism experiences the condition differently. However, the average life expectancy for people with autism is around 54 years old.

What are some of the challenges people with autism face when trying to get life insurance?

Some of the challenges people with autism face when trying to get life insurance include higher premiums, being denied coverage, and taking a medical exam.

Is autism classed as a disability?

Yes, autism is classed as a disability.

What disability category is autism?

Autism is classified as an intellectual disability.

Can I qualify for life insurance if I am currently receiving SSA Disability Benefits?

There is a possibility you could qualify for life insurance if you are currently receiving SSA Disability Benefits. Your eligibility will depend on the severity of your condition and your mental and cognitive ability.

If I have autism, can my family members get life insurance on me?

Yes, your family members can get life insurance on you if you have autism and you give consent.

What happens to life insurance when you go on disability?

When you go on disability, your life insurance policy will usually remain in effect.

Does life insurance proceeds affect disability benefits?

No, life insurance proceeds do not affect disability benefits.

Can I qualify for cremation insurance with a history of autism?

Yes, you can qualify for cremation insurance with a history of autism.

How do you get life insurance after an autism diagnosis?

You can often get life insurance after an autism diagnosis by working with a qualified insurance agent who will do the shopping around and finding a company that is willing to insure you.

What is my best insurance option if I have autism?

There is no one-size-fits-all answer to this question as it will depend on your individual needs.

Is autism fatal in life insurance?

No, autism is not considered a fatal condition in life insurance.

What are the most important things to know about burial insurance with autism?

Some of the most important things to know about burial insurance with autism are that your eligibility will depend on the severity of your condition.

What are some of the challenges people with autism face when trying to get burial insurance?

Some of the challenges people with autism face when trying to get burial insurance is being denied coverage because of the inability to perform activities of daily living.

Can you be denied insurance for autism?

You can be denied insurance for autism if the insurance company deems you to be a high risk if you have mobility impairments and can’t do daily activities on your own.

Is there a waiting period for life insurance with autism?

There is no waiting period for life insurance with autism except when you have mobility impairments, and you can’t do activities of daily living on your own then, you will only qualify for a guaranteed issue life insurance with a two-year waiting period.

Does autism affect life insurance rates?

Yes, autism can affect life insurance rates.

How does autism affect life insurance premiums?

Autism affects life insurance premiums because people with autism have a higher risk of dying prematurely.

What are some things to consider when buying life insurance with autism?

When buying life insurance with autism, some things to consider are the severity of your condition and your mental and cognitive ability.

Can autism medication affect my premium?

Yes, autism medication may affect your premium.

Can I take 2 life insurance policies if I have autism?

Yes, you can take 2 or more life insurance policies if you have autism as long as you can pay the premiums.

What are the premiums for burial insurance with autism?

The premiums for burial insurance with autism will depend on your age, gender, location, coverage amount, and health.

What is the average cost of life insurance for someone with autism?

The average cost of life insurance for someone depends on your coverage amount and the insurance company you choose.

Can autism patients get final expense insurance?

Yes, people with autism can get final expense insurance.

What is the best life insurance for people with autism?

The best life insurance for people with autism is a tailored policy to fit your individual needs.

What are some things to look for in life insurance for people with autism?

Some things to look for in life insurance for people with autism are no waiting period, no medical exam, and coverage for funeral and burial expenses.

Is autism covered by a critical illness rider?

No, autism is not covered by a critical illness rider.

What are some benefits of having life insurance with autism?

Some benefits of having life insurance with autism are peace of mind, financial security for your family, and coverage for funeral and burial expenses.

Can autism affect life insurance?

Yes, autism can affect life insurance. The severity of your condition will dictate what insurance policy you will qualify for.

Can special needs people get life insurance?

Yes, people with special needs can get life insurance.

Can you be rejected for life insurance because of autism?

Yes, you can be rejected for life insurance because of autism.

How can you get the best life insurance rates with autism?

The best way to get the best life insurance rates with autism is to work with an independent life insurance agent who can shop around for the best policy.

What are the best life insurance companies for autism?

The best life insurance companies for autism will depend on your individual needs.

What are some tips for getting life insurance with autism?

Some tips for getting life insurance with autism are: work with an independent life insurance agent, get a policy that is tailored to your individual needs.