2024 Affordable Burial Insurance with Arthritis

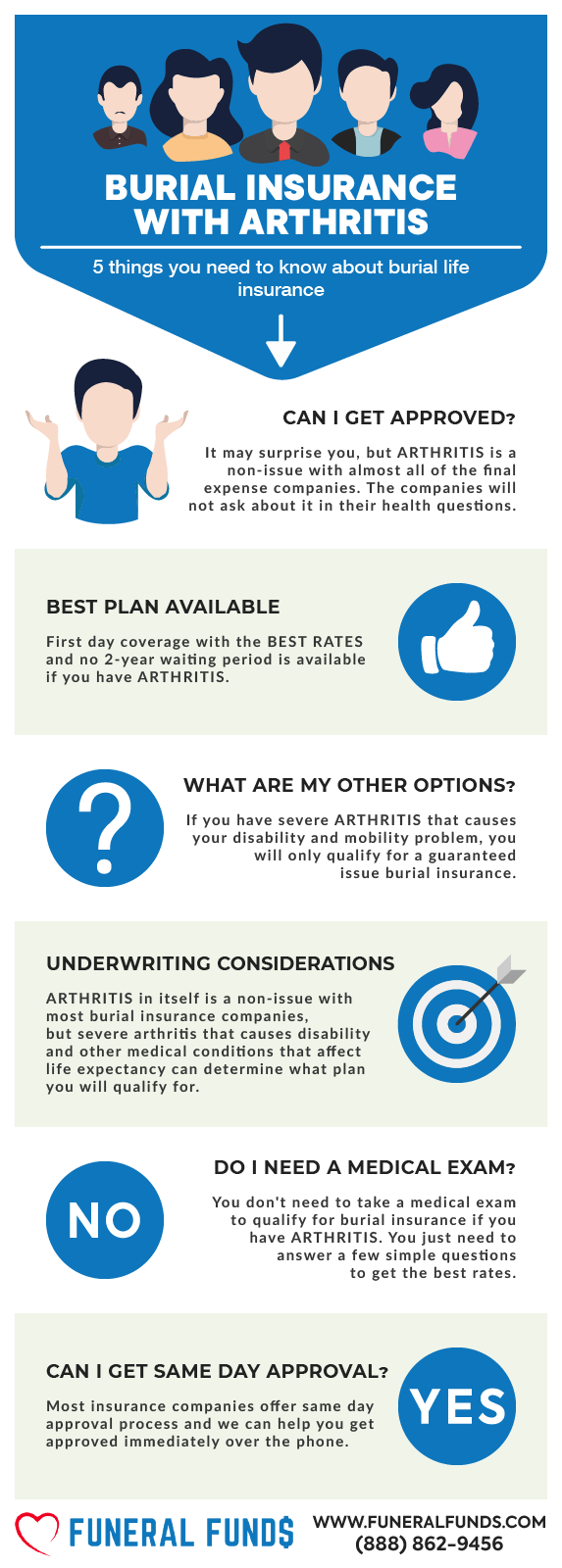

Living with arthritis can be difficult, but finding affordable burial insurance with arthritis shouldn’t be. Regardless of the severity of your arthritis, there is a life insurance policy available to you.

Most burial life insurance companies will arthritis patients (but some won’t accept certain medications). The good news is that arthritis is generally a non-issue with most insurance companies. They will not ask about it in their health questions on the application. And it is also okay if you take medications to manage your condition.

And, even if your arthritis condition deteriorates and you are concerned that you will not be eligible for life insurance, you can still qualify for life insurance. You will not have trouble getting burial insurance.

Most final expense insurance companies will issue you a plan with immediate coverage. There will be no waiting period, and you will be able to access the lowest rate.

This article will explore underwriting for final expense insurance with arthritis. Learn what insurance options you will have and how to find the most affordable burial insurance with arthritis. We will also help you get the most coverage for the least amount of money.

FOR EASIER NAVIGATION:

- Burial Insurance with Arthritis

- What Is My Best Insurance Option If I Have Arthritis?

- The Impact of Arthritis on Life Insurance Eligibility

- Factors That Can Affect Life Insurance Eligibility If You Have Arthritis

- What Types of Insurance Policies Should I Avoid?

- If I Have Arthritis, Do I Need to Take A Medical Exam to Qualify for Burial Insurance?

- Burial Insurance Underwriting If You Have Arthritis

- How Much Insurance Do I Need If I Have Arthritis?

- How Should I Pay My Insurance Premiums?

- Arthritis and Burial Insurance Riders

- How to Get the Best Insurance Rates for Arthritis

- Information We Need to Help You If You Have Arthritis

- How Can Funeral Funds Help Me?

- Additional Questions & Answers Burial Insurance With Arthritis

Burial Insurance With Arthritis

Arthritis is a common medical condition affecting 27 million Americans. This condition can cause pain, discomfort, and sometimes disability. Although this condition is not as serious as other medical conditions, it can still affect your life insurance rates.

Here are some common types of insurance that people often have questions about:

- Arthritis burial insurance

- Arthritis final expense insurance

- Arthritis life insurance

- Gout burial insurance

- Gout final expense insurance

- Gout life insurance

- Lupus burial insurance

- Lupus final expense insurance

- Lupus life insurance

- Osteoarthritis burial insurance

- Osteoarthritis final expense insurance

- Osteoarthritis life insurance

- Psoriatic arthritis burial insurance

- Psoriatic arthritis final expense insurance

- Psoriatic arthritis life insurance

- Rheumatoid arthritis burial insurance

- Rheumatoid arthritis final expense insurance

- Rheumatoid arthritis life insurance

Here are some common internet search terms for people with Arthritis searching for burial or final expense insurance:

- Burial insurance arthritis

- Burial insurance psoriatic arthritis

- Burial insurance underwriting arthritis

- Does burial insurance cover arthritis

- Does final expense cover arthritis

- Does life insurance cover arthritis

- Does rheumatoid arthritis affect burial insurance

- Does rheumatoid arthritis affect final expense insurance

- Does rheumatoid arthritis affect life insurance

- Final expense insurance arthritis

- Final expense psoriatic arthritis

- Final expense underwriting arthritis

- Life insurance arthritis

- Life insurance psoriatic arthritis

- Life insurance underwriting arthritis

- Rheumatoid arthritis life expectancy and life insurance

As you can see, people often have many questions about how arthritis affects their life insurance, burial insurance, and final expense insurance needs. They are also looking for a trusted insurance agent to get them the most coverage for the least amount of money.

The good news about buying burial insurance with arthritis is that you can qualify for funeral insurance plans. Even with this arthritis, life insurance can still be affordable.

It may surprise you, but arthritis is a non-issue with almost all of the final expense companies. The companies will not ask about it in their health questions. And it is also okay with them even if you are taking medications to manage your condition.

Furthermore, you will pay the same premium as a person in perfect health and have first-day coverage.

If you’re looking for life insurance and you’ve been diagnosed with arthritis, keep reading this detailed guide on how to get affordable burial insurance with arthritis.

What Is My Best Insurance Option If I Have Arthritis?

Several types of life insurance coverage options are available to you if you have arthritis and are looking for some kind of life insurance coverage.

LEVEL DEATH BENEFIT (First-day coverage)

A level benefit plan is the best insurance option for people with arthritis. Level benefit insurance plan comes with first-day coverage and no waiting period. You will also pay the lowest premium with this plan.

Several burial insurance carriers are not concerned with arthritis. They don’t even ask about arthritis!

A company with simplified underwriting is seldom concerned with your arthritis. Their no-exam policies are the best because you will be covered immediately. Level death benefit policies are straightforward and provide 100% death benefit from the first day of the policy.

If you have arthritis, we have companies that will accept you with a level death benefit. The life insurance payout will be the same throughout the whole life of the policy. Additionally, your premium will never increase.

Level death benefit works this way. Let’s say Bruce applies for $25,000 burial insurance. The insurance company approves his application with level death benefit coverage. Two days later, Bruce passed away due to an accident. Bruce’s beneficiary will receive the $25,000 death benefit tax-free to help pay for his funeral costs.

Arthritis as a standalone condition will not create an issue unless you have other health conditions that may prevent you from qualifying for first-day coverage.

Here are the benefits of first-day coverage life insurance:

| FUNERAL FUNDS PLAN BENEFITS | INCLUDED |

|---|---|

| 1st Day Coverage | YES |

| Rates NEVER Increase | YES |

| Coverage NEVER Decreases | YES |

| Easy to get approved | YES |

| No Medical Exam | YES |

| Same Day Approval | YES |

| Death Claims Pay Fast | YES |

| Builds cash value | YES |

| Coverage Up To Age 121 | YES |

GUARANTEED ISSUE WHOLE LIFE INSURANCE

We’re not saying that insurance companies will completely ignore arthritis. There are some cases when severe arthritis can cause disability and mobility issues. Sometimes arthritis can cause damage to some organs like the lungs or heart, which may affect your ability to breathe correctly and shorten your lifespan. In this case, you will be declined for a level death benefit plan, and your only option for coverage is guaranteed issue burial insurance.

Guaranteed-issue policies are the next best choice for anyone who will not get through traditional underwriting because of other medical conditions, wheelchair use, or needing help with activities of daily living.

Your approval is guaranteed regardless of your severe arthritis, disability, and mobility issues. Applying for guaranteed burial insurance is easier because it does not require a medical exam, and it has no health questions.

Remember that even if you have major health issues, you will not be denied coverage with a guaranteed issue life insurance without health questions. Applying for GI is easier because it does not require a medical exam, and it does not ask about your health. This means that even if you have a terminal illness like cancer, you can still be eligible for coverage.

Whatever happens, as long as you keep paying your premiums on time, your beneficiaries will surely receive your death benefit payout when you pass away after the waiting period. You will qualify for guaranteed issue burial insurance if you meet 50 to 85 years old.

Many life insurance companies offer guaranteed issue burial insurance for people with arthritis and those with severe medical conditions. The only difference between the companies is the amount of premium and the length of the waiting period.

Guaranteed issue life insurance has a graded period for a natural cause of death. You must live for two years before your policy will pay a 100% death benefit. After two years, you got 100% protection for life.

The Impact Of Arthritis On Life Insurance Eligibility

Life insurance companies will look at your arthritis as a part of your overall health to determine the type of plan you qualify for and the amount you will pay.

The good news about arthritis as a medical condition is that most sufferers in otherwise good health will be able to qualify for immediate coverage that has no waiting period. This is because arthritis does not pose an immediate threat to the individual’s life span, and no severe medical complications are associated with this condition.

We’re not saying that the insurance companies will completely ignore your condition. There are some cases when an applicant with severe arthritis with a disability can only qualify for guaranteed issue burial insurance, which means the premiums will be a bit more expensive than immediate coverage.

Due to the potential for disability and mobility issues, some moderate to severe forms of arthritis can cause damage to some organs like the lungs or heart, affecting the individual’s ability to breathe properly and may shorten the lifespan. In this case, you will be declined for traditional life insurance, and your only option for coverage is a guaranteed issue whole life insurance.

Factors That Can Affect Life Insurance Eligibility If You Have Arthritis

ACTIVITIES OF DAILY LIVING (ADL)

Life insurance companies use six activities of daily living to measure functionality and determine if you will be eligible for immediate coverage. You must be able to do these ADL on your own to prove that you can take care of yourself properly.

- Eating – the process of feeding yourself using a container like a cup, plate, utensils, feeding tube, or intravenously.

- Bathing – your ability to safely get in and out of the bathtub or shower. Washing your whole body in a basin, a shower, or a bathtub.

- Dressing – taking off and putting on an item of clothing. Putting on and taking off fasteners, braces, and prostheses are also a part of the dressing.

- Toileting – your ability to safely get on and off the toilet and perform necessary personal hygiene tasks.

- Transferring is moving in or out of bed, a chair, or a wheelchair. Includes getting in and out of vehicles.

- Continence – the ability to control your bladder and bowel functions. Continence also includes performing related personal hygiene tasks such as caring for a colostomy or catheter bag.

If you have a severe form of arthritis and it causes you to require help with any of the activities of daily living, it will be harder to find a company that will offer you immediate coverage at the lowest rate (although you will qualify for a guaranteed issue life insurance policy).

Every life insurance company asks about activities of daily living in their application. Needing help with ADL will significantly affect your life insurance eligibility.

Life insurance providers will react in one of two ways when they learn you need help with ADLs:

- They will automatically decline your application

- They will offer a guaranteed issue burial insurance with no medical exam and health questions.

Your best life insurance option if you need help with ADLs is to take a guaranteed issue life insurance. Most insurers have a GI policy that is priced well. It’s only about 15 to 30% more than a policy with immediate coverage. You will be approved if you are 50 to 85 years old and the plan is available in your state. Your inability to do the ADL will not matter with GI policy.

WHEELCHAIR USE BECAUSE OF ARTHRITIS

If you need a wheelchair for mobility, but you can still do the activities of daily living independently, burial insurance companies will not hold your wheelchair use against you. You can qualify for an immediate coverage plan and pay the same amount as a healthy applicant. There will be no waiting period on your plan.

If you’re confined in a wheelchair because your arthritis is severe, your life insurance options will be limited. If you cannot perform daily living activities and are in a wheelchair, you will need to pay a bit more and have a waiting period.

If you die during the two-year waiting period, the company will refund all your premiums plus 10% interest to your beneficiary. This plan will not lose any money because no savings account will ever earn you 10% interest.

What Types Of Insurance Policies Should I Avoid?

A level death benefit plan is the best burial insurance for arthritis. Here are the types of life insurance policies you should avoid:

| PLANS TO AVOID | WHY? |

|---|---|

| Term life | Premiums increase after 5 years. Coverage ends after 80. |

| Pre-paid funeral plans | Expensive |

| Universal life | Tied with stocks |

| No health questions policies | With 2-year waiting period |

| Plans offering "teaser rates" | $9.95 per unit plans or $1 buys $100,000 coverage |

| Over priced plans | Insurance from TV and junk mail |

| Plans that accept mail-in payments | Risky |

| Plans that accept Direct Express | High lapse rate |

| Plans that accept Credit Cards | High lapse rate |

If I Have Arthritis, Do I Need To Take A Medical Exam To Qualify For Burial Insurance?

No. You are not required to take a medical exam to qualify for burial insurance. You don’t need to submit blood and urine samples either.

If you’re afraid of needles or hate to be poked, burial insurance is best for you. You will only need to answer a few health questions. Companies that ask health questions offer first-day coverage.

You can even choose a no-health questions policy if you like. But, we advised against it because the no-health questions policy has a two-year waiting period.

Burial Insurance Underwriting If You Have Arthritis

Burial insurance policies contain knockout questions on the application. They will also conduct a prescription history check as a part of underwriting.

Don’t worry; burial insurance with arthritis has relaxed underwriting. Most burial insurance companies do not ask about arthritis in their health questionnaire.

Since the insurance company doesn’t ask about arthritis on the health question, the only way to have your application declined is if you answered yes to a different knockout question because of your other medical condition.

Most knockout questions revolved around heart attack, stroke, Alzheimer’s disease, activities of daily living, and some of the prescription medications these conditions treated. Because arthritis is not a knockout question, you can qualify for the best-priced policy.

It is important to understand that if a company does not ask about a particular health condition, they accept it. If you have no other health issues aside from arthritis, you will qualify for a first-day coverage plan without a waiting period.

Instead of a medical exam, the insurance company will check your

- Answer to health questions on the application

- Medical history through the Medical Information Bureau

- Medication history through Prescription database

- Driving record through the Department of Motor Vehicle

- Other companies may want to do a phone interview

PRESCRIPTION HISTORY CHECK

Burial insurance companies will see that you are on arthritis medication during the prescription history check, but most don’t even care even if you are taking any of these drugs to treat your condition:

- Leflunomide (Arava)

- Azathioprine (Imuran)

- Cyclosporine (Neoral )

- hydroxychloroquine (Plaquenil)

- Methotrexate (Trexall)

- Minocycline (Minocin)

- Rituximab (Rituxan)

- Tofacitinib (Xeljanz)

You can take any of these drugs, but it will not affect your life insurance eligibility. Taking medication for arthritis won’t keep you from securing the best policy.

If you have arthritis, when you apply for burial insurance and take any of these medications, the insurance company will see and understand that you are taking measures to control your condition. They will overlook arthritis prescriptions as long as the medication relieves your symptoms and improves your joint function.

How Much Insurance Do I Need If I Have Arthritis?

Now that you understand getting burial insurance with arthritis is easy, let’s determine how much insurance coverage you need.

Your insurance needs vary depending on your personal need and financial circumstances. The amount should be sufficient to cover your final expenses so your family won’t have to worry about it when you’re gone.

Here are the steps to calculate your burial insurance needs:

1. Write your final wishes to get a better idea of how much your burial or cremation will cost. Your funeral and burial costs are often the biggest final expense your family needs to pay. Here’s the average cost of funeral and burial expenses from the National Funeral Directors Association.

| AVERAGE FUNERAL COST WITH VIEWING AND BURIAL | |

|---|---|

| Non-declinable basic services | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Hearse | $325 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Metal casket | $2,500 |

| Vault | $1,572 |

| Median Cost of a Funeral With Viewing and Burial | $9,420 |

Using this table to estimate your burial cost if you choose to be buried when you pass away. If you opt for cremation, use the table below to compute your cremation costs.

| AVERAGE FUNERAL COST WITH VIEWING AND CREMATION | |

|---|---|

| Non-declinable basic services fee | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Cremation fee (if firm uses a third-party crematory) | $368 |

| Cremation Casket | $1,310 |

| Urn | $295 |

| Median Cost of a Funeral with Viewing and Cremation | $6,970 |

| Rental Casket | $995 |

| Alternate Cremation Container | $150 |

Do online research or request a general price list from your nearest funeral home to determine your area’s funeral, burial, or cremation cost. Compute your burial or cremation costs.

2. Compute your other final expenses. Include your outstanding debts, credit card debt, medical bills, living expenses, legal costs, and other past-due accounts on your computation.

3. Don’t forget to factor in the inflation in your computation. The average inflation rate is 2%, which means you lose 2% of your money’s worth due to inflation. If your burial insurance needs today cost $10,000, it’s wise to get at least $15,000 to cover inflation.

Do these three steps to determine how much coverage to buy.

How Should I Pay My Insurance Premiums?

Using savings or checking accounts is the best method. We recommend you set a bank draft from your savings or checking account. That way, the bank will automatically pay your premium monthly, and you will not worry about your insurance policy lapsing due to non-payment.

We recommend you pay your premium monthly because it’s easier on the budget. You can also schedule your payment when you receive your retirement allowance.

Arthritis And Burial Insurance Riders

Burial insurance policy riders add benefits to your plan. You can add policy riders to your plan to enhance coverage to fit your specific needs. Some riders are built into the policy, while others come with extra costs.

Here’s a list of common burial insurance riders:

| FUNERAL FUNDS ADD-ONS | AVAILABILITY |

|---|---|

| Terminal Illness Add-On Benefit | Included with most plans |

| Nursing Home Care Add-On Benefit | Included with most plans |

Terminal Illness Rider

The terminal illness rider allows you to access a part of your death benefit if you’re diagnosed with a terminal illness like cancer. A medical professional must certify that you have six months to one year to live to access this rider.

Nursing Home Rider

The nursing home rider lets you access a portion of your death benefit while you’re still alive to pay for nursing home expenses. To access this rider, you must reside in a nursing home and cannot perform at least two activities of daily living, such as eating, bathing, toileting, dressing, transferring, or continence.

Accidental Death Rider

An accidental death rider is generally included in all plans. This rider increases your death benefit payout if you die from an accident.

How To Get The Best Insurance Rates For Arthritis

Buying burial insurance today is the best way to get the best insurance rates. You will never be as young and healthier as you do today. Your premium will increase each year you postpone getting burial insurance. By buying burial insurance today, you will be able to lock in the price at your current age and pay the same rate throughout your life.

You don’t need to lose weight before getting burial insurance with arthritis. We can help you qualify for the best rate even if you’re overweight.

You don’t need to quit smoking before getting burial insurance. We work with some life insurance companies that offer the best rate for smokers.

| GETTING THE BEST RATE | |

|---|---|

| Younger | Less Expensive |

| Older | More Expensive |

| Healthier | Less Expensive |

| Television Ads | More Expensive |

| Junk Mail | More Expensive |

| No Health Questions | More Expensive |

| Funeral Funds | Less Expensive |

Today is the best time to get burial insurance with arthritis. Each year you procrastinate, you pay a higher premium.

And the best tip to get the best insurance rates is to work with an independent life insurance agency like Funeral Funds.

Information We Need To Help You If You Have Arthritis

When you reach out to us regarding buying final expense insurance with arthritis, we will ask you some health questions to better understand your current medical condition. These questions may include:

- When were you diagnosed with arthritis?

- What form of arthritis do you have?

- Name the parts of your body affected by your arthritis.

- How often do you experience flare-ups?

- Do you have deformity from your arthritis?

- Have you ever been hospitalized due to arthritis?

- What prescription medications are you taking to treat your arthritis?

- Do you live independently, or do you need help with activities of daily living?

- Do you have a disability that causes you to use a wheelchair?

- What other medical conditions do you have?

Your answers to these health questions will help us determine the type of life insurance plan you will qualify for and how much life insurance companies will charge you.

How Can Funeral Funds Help Me?

Finding a policy with arthritis needn’t be frustrating; working with an independent agency like Funeral Funds will make the process easier and quicker.

We will work with you every step to find the plan that fits your financial requirements and budget. You don’t have to waste your precious time searching for multiple insurance companies because we will do the dirty work for you.

We work with many A+ rated insurance carriers that specialize in covering high-risk clients like you. We will search for all those companies and match you up with the best burial insurance company that gives the best rate.

We will assist you in securing the coverage you need at a rate you can afford. So, if you are looking for arthritis funeral insurance, arthritis burial insurance, or arthritis life insurance, we can help.

Fill out our instant quote form or call us at (888) 862-9456, and we can give you accurate funeral insurance quotes.

Additional Questions & Answers On Burial Insurance With Arthritis

Can you get life insurance if you have arthritis?

Yes, you can get life insurance if you have arthritis. You will easily qualify for a first-day coverage plan if you have arthritis and you can do activities of daily living on your own.

Is arthritis considered a pre-existing condition?

Yes, arthritis is considered a pre-existing condition by insurance companies. If you have arthritis, you will likely have to pay higher premiums for your life insurance policy.

What are the best life insurance companies for people with arthritis?

The best life insurance companies for people with arthritis offers first-day coverage plans.

Do I need to tell insurance about arthritis?

Yes, you must tell your insurance company about your arthritis diagnosis when applying for life insurance. The insurance company will likely ask you about your arthritis symptoms and how the condition affects your daily life.

Can a person with arthritis get burial insurance?

Yes, a person with arthritis can get burial insurance. Burial insurance is a type of life insurance that does not require a medical exam.

Is arthritis classed as a medical condition?

Yes, arthritis is classed as a medical condition. Insurance companies will likely ask you about your arthritis symptoms and how the condition affects your daily life.

Do I need to take a medical exam if I have arthritis?

No, you do not need to take a medical exam if you have arthritis. Burial insurance is a type of life insurance that does not require a medical exam.

Is there an age limit for burial insurance with arthritis?

You can get burial insurance if you are 18-85 years old.

Can arthritis be considered a critical illness in life insurance?

No, arthritis cannot be considered a critical illness in life insurance. Critical illnesses are typically more severe conditions that can lead to death, such as cancer or heart disease.

Is arthritis considered a terminal illness?

No, arthritis is not considered a terminal illness. Terminal illnesses are typically more severe conditions that can lead to death, such as cancer or heart disease.

Can you get first-day coverage insurance if you have arthritis?

Yes, you can get first-day coverage insurance if you have arthritis. First-day coverage plans do not require a medical exam and they will cover you for your arthritis condition.

Is it hard to get life insurance with rheumatoid arthritis?

No, it is not hard to get life insurance with rheumatoid arthritis. Rheumatoid arthritis is a chronic condition that can lead to joint pain and stiffness, but it is not a critical or terminal illness.

What are the things that may affect my eligibility if I have arthritis?

Some of the things that may affect your eligibility for life insurance if you have arthritis include:

- The severity of your arthritis symptoms

- How your arthritis affects your daily life

- Your age

- Your overall health

What is the life expectancy after arthritis?

The life expectancy after arthritis is the same as the general population. Arthritis is a chronic condition that can lead to joint pain and stiffness, but it is not a critical or terminal illness.

Which insurance is best for patients with arthritis?

The best insurance for patients with arthritis is first-day coverage insurance. First-day coverage plans do not require a medical exam, and they will cover you immediately.

Is arthritis a disability?

Yes, arthritis can be a disability. If your arthritis symptoms are severe and they prevent you from working, you may be eligible for disability benefits.

What type of arthritis qualifies for disability?

There is no specific type of arthritis that qualifies for disability. If your arthritis symptoms are severe and they prevent you from working, you may be eligible for disability benefits.

What disability category is arthritis?

Arthritis is in the musculoskeletal category of disability. This category includes conditions affecting bones, joints, muscles, and tendons.

Can you get SS disability for arthritis?

Yes, you can get SS disability for arthritis. If your arthritis is severe and it prevents you from working, you may be eligible for SS disability benefits.

Can I qualify for cremation insurance with a history of arthritis?

Yes, you can qualify for cremation insurance with a history of arthritis. Cremation insurance is a type of life insurance that does not require a medical exam.

What is the best cremation insurance for someone with arthritis?

The best cremation insurance for someone with arthritis is first-day coverage insurance. First-day coverage plans do not require a medical exam, and they will cover you for your arthritis condition.

How do you get life insurance after an arthritis diagnosis?

You can get life insurance after an arthritis diagnosis by applying for a first-day coverage plan with a qualified insurance agent. First-day coverage plans do not require a medical exam, and they will cover you for your arthritis condition.

What is my best insurance option if I have arthritis?

The best insurance option for someone with arthritis is first-day coverage insurance. First-day coverage plans do not require a medical exam.

Is arthritis fatal in life insurance?

No, arthritis is not fatal in life insurance. Arthritis is a chronic condition that can lead to joint pain and stiffness, but it is not a critical or terminal illness.

Can you be denied insurance for arthritis?

Yes, you can be denied insurance for arthritis. If your arthritis is severe and it prevents you from performing activities of daily living, you may be denied life insurance.

Is there a waiting period for life insurance with arthritis?

No, there is no waiting period for life insurance with arthritis. You can get coverage immediately if you qualify for a first-day coverage insurance plan.

What is the cheapest life insurance for someone with arthritis?

The cheapest life insurance for someone with arthritis is a first-day coverage insurance plan. First-day coverage plans do not require a medical exam, and they will cover you for your arthritis condition.

Does psoriatic arthritis affect life insurance?

Yes, psoriatic arthritis can affect life insurance. If your psoriatic arthritis is severe and it prevents you from working due to ADLs, you may be denied life insurance.

Can arthritis medication affect my premium?

No, arthritis medication alone will not affect your premium. Arthritis medication is used to treat the symptoms of arthritis, and it will not impact your insurance rates.

What are the premiums for burial insurance with arthritis?

The premiums for burial insurance with arthritis will depend on your age, gender, health, and the coverage amount.

What is the average cost of life insurance for someone with arthritis?

The average cost of life insurance for someone with arthritis varies by age, gender, health, and coverage amount.

Can arthritis patients get final expense insurance?

Yes, arthritis patients can get final expense insurance. Final expense insurance is a type of life insurance that does not require a medical exam.

Is arthritis covered by a critical illness rider?

No, arthritis is not covered by a critical illness rider. A critical illness rider is an insurance policy that pays out a lump sum benefit if you are diagnosed with a critical illness.

Can arthritis affect life insurance?

Yes, arthritis can affect life insurance. If your arthritis is severe and prevents you from performing activities of daily living, you may be denied life insurance.

Can you be rejected for life insurance because of arthritis?

Yes, you can be rejected for life insurance because of arthritis. If your arthritis is severe and prevents you from performing activities of daily living, you may be denied life insurance.

How can you get the best life insurance rates with arthritis?

You can get the best life insurance rates with arthritis by applying for a first-day coverage insurance plan. First-day coverage plans do not require a medical exam.

What are the best life insurance companies for arthritis?

The best life insurance companies for arthritis are those that offer first-day coverage insurance plans. First-day coverage plans do not require a medical exam.

What are some tips for getting life insurance with arthritis?

Some tips for getting life insurance with arthritis include:

- Apply for a first-day coverage insurance plan. First-day coverage plans do not require a medical exam.

- Let our agents in Funeral Funds shop around and compare life insurance rates from different companies.

RELATED POSTS: