2024 Burial Insurance with High Cholesterol

All the insurance companies we work with accept high cholesterol as a pre-existing health condition, and we have no problem getting people qualified for first-day coverage burial insurance.

Additional underwriting will be required to assess your eligibility if you have other health conditions besides high cholesterol.

This article will tell you how to qualify for burial insurance with high cholesterol and how to get affordable coverage.

FOR EASIER NAVIGATION:

- Can I Get Burial Insurance With High Cholesterol?

- What Is My Best Insurance Option If I Have High Cholesterol?

- Do I Need A Medical Exam To Qualify For Burial Insurance?

- How Much Does Burial Insurance Cost If I Have High Cholesterol?

- Burial Insurance Underwriting If You Have High Cholesterol

- How to Get the Best Burial Insurance Rates

- How To Apply For Burial Insurance With High Cholesterol

- How Can Funeral Funds Help Me?

- Frequently Asked Questions

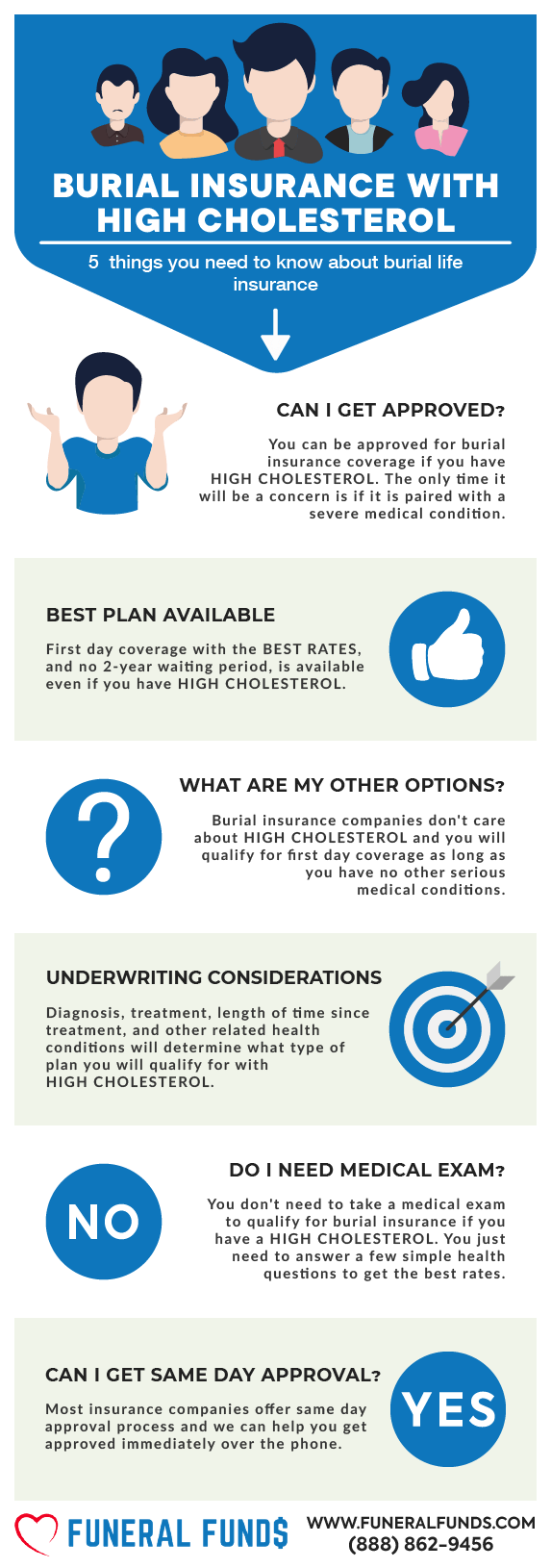

Can I Get Burial Insurance With High Cholesterol?

YES: Most insurance companies don’t ask about high cholesterol or cholesterol medications.

NO: If you had a recent stroke because of high cholesterol, most companies will not approve you for first-day coverage until two years have passed from the day of your stroke.

What Is My Best Insurance Option If I Have High Cholesterol?

Your best insurance option is a first-day coverage plan. This insurance has no waiting period. You will also pay the lowest rate with this plan.

Do I Need A Medical Exam To Qualify For Burial Insurance?

Medical exams, blood tests, and urine samples are not required to get approved if you have high cholesterol.

How Much Does Burial Insurance Cost If I Have High Cholesterol?

The cost of burial insurance will depend on your:

- Age

- Coverage amount

- Gender

- General health

- State of residence

- Smoking status

- Type of policy

Burial Insurance Underwriting If You Have High Cholesterol

The insurance company will check your prescription history to verify your health and any history of high cholesterol levels.

Some common medications prescribed for cholesterol control are:

- Atorvastatin (Lipitor)

- Fluvastatin (Lescol)

- Pitavastatin (Livalo)

- Pravastatin (Pravachol)

- Rosuvastatin calcium (Crestor)

- Simvastatin (Zocor)

Taking any of these medications will not affect your burial insurance eligibility with most life insurance companies. If you are taking other prescription medications, additional underwriting will be necessary to qualify for 1st-day coverage.

How to Get the Best Burial Insurance Rates

The best way to get the best rates on burial insurance if you have high cholesterol is to work with an independent agency like Funeral Funds. Our independent life insurance agents will compare companies offering first-day coverage insurance and recommend the best life insurance companies with the best pricing.

How To Apply For Burial Insurance With High Cholesterol

- Consult with an Independent Insurance Agent – Ask for assistance from independent insurance agents specializing in underwriting for people who have high cholesterol. They can help you understand your options, compare quotes, and choose the most suitable burial insurance plan.

- Complete the Application Honestly – When filling out the life insurance application with your agent, be truthful about your high cholesterol level and provide accurate details about your health, treatments, and any lifestyle changes you’ve made.

- Review and Confirm Policy Details – Carefully review the life insurance policy terms before confirming your acceptance. Make sure the insurance coverage meets your needs and your budget.

How Can Funeral Funds Help Me?

Here at Funeral Funds, we specialize in getting life insurance coverage for people who have high cholesterol.

We work with many A+ rated insurance companies that specialize in high-risk clients. Our licensed insurance agents will search those companies to give you the best rate. We’ll match you up with your best life insurance option.

We will assist you in securing the coverage you need at a rate you can afford. So, if you’re looking for burial insurance with high cholesterol, we can help. Fill out our quote form on this page or call us at (888)862-9456 to get accurate burial insurance quotes.

Frequently Asked Questions

Is high cholesterol a big deal in life insurance?

Most life insurance companies don’t ask about high cholesterol on their health questionnaire.

Can you get life insurance with high triglycerides?

Yes, you can qualify for first-day coverage insurance if you have high triglycerides.

Can I be denied life insurance for high cholesterol?

Getting denied is not an issue unless you have significant cardiovascular issues.

What is my best insurance option if I have high cholesterol?

Your best insurance option is a first-day coverage plan with no waiting period. Never buy a 2-year waiting period plan if your only health issue is high cholesterol.

Is high cholesterol a pre-existing condition for life insurance?

Yes, but they approve of this pre-existing condition for 1st-day coverage.

Can high cholesterol affect your life insurance rates?

No, high cholesterol will not affect your life insurance rates.

Is there an age limit for burial insurance with high cholesterol?

You can qualify for a first-day coverage plan if you are 18-89.