Burial Insurance with Liver Disease

Finding the most affordable 1st-day burial insurance with liver disease is possible. Spoiler alert: It all depends on your specific liver condition and medical history.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with liver disease, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is Liver Disease?

Liver disease is any condition that messes with your liver. There are a many of different types of liver problems, each with its own drama.

Here are some of the biggest culprits:

- Viruses such as hepatitis A, B, and C

- Excessive alcohol consumption

- Fatty liver disease

- Autoimmune hepatitis

- Inherited disorders, such as hemochromatosis and Wilson disease

The symptoms? They’re all over the place, depending on how bad things are. Catching it early and getting treated can stop your liver from throwing in the towel.

Now, here’s the scoop on life insurance. Companies love to play detective with your health. Liver disease might bump you into the high-risk club since it can cut your life short.

But, every insurance company has its own playbook. If one says “no thanks,” don’t throw in the towel. Hit us up at Funeral Funds to explore other options: there are always other fish in the sea!

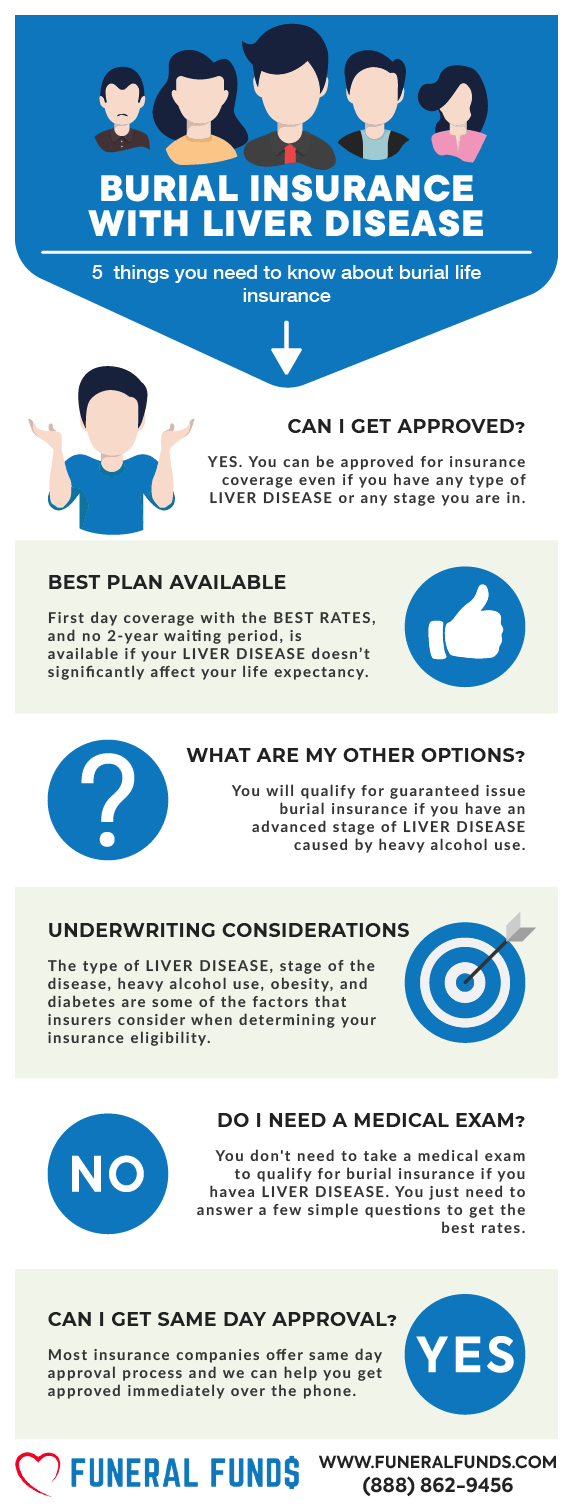

Can You Get Burial Insurance With Liver Disease?

Absolutely! Having liver disease doesn’t mean you’re out of the insurance game. Whether you’ve got fatty liver, cirrhosis, liver failure, or any other liver shenanigans, there are insurance options ready and waiting for you.

What Are The Types of Burial Insurance Available To People With Liver Disease?

First-Day Coverage – No medical exam? No problem! This policy just needs you to answer a few health questions, and boom – you’re covered immediately with no waiting period.

Guaranteed Issue Life Insurance – Forget the medical exams and health questions altogether! Guaranteed issue life insurance is your go-to if first-day coverage is playing hard to get due to serious health issues.

Now, here’s the catch – the guaranteed issue comes with a two-year waiting period before the full death benefit kicks in. If you happen to pass away during this time, they’ll just return the premiums you’ve paid plus a sweet 7-10% interest (depending on the company).

What Is My Best Insurance Option If I Have Liver Disease?

Liver disease is a catch-all term for any liver problems, from the mildly annoying to the downright scary. With over 100 different types, it’s no wonder liver disease can cause serious long-term health issues.

Let’s break down the most common liver diseases and the best policy options you’ll likely qualify for:

FATTY LIVER – Got some extra fat in your liver? Whether it’s from hitting the bottle too hard or other reasons, you can still get first-day coverage.

HEPATITIS A – This short-term infection doesn’t stick around long. If you’ve got Hep A, first-day coverage is on the table for you.

HEPATITIS B – Starting as an acute infection, Hep B can turn into a chronic issue. If you’re still battling the virus or getting treatment, some insurance companies will still hook you up with first-day coverage.

HEPATITIS C – Hep C can be a short-term visitor or an unwelcome long-term guest. If you’re in treatment or cured, you’re in luck – first-day coverage with no waiting period is within reach.

LIVER CIRRHOSIS – Cirrhosis is serious business, often caused by chronic alcoholism, hepatitis, cystic fibrosis, fat buildup, bile duct issues, or medications. Depending on your state, you might qualify for first-day coverage.

LIVER CANCER – If you’ve beaten liver cancer and are now cancer-free, some insurance companies will offer you first-day coverage.

LIVER TRANSPLANT – Had a liver transplant over five years ago? You could qualify for first-day coverage. If it’s been less than five years, look into guaranteed issue life insurance.

Do I Need A Medical Exam To Qualify For Burial Insurance?

Nope! No medical exams are needed to get burial insurance with liver disease.

When you apply, your agent will just ask you a few basic health questions. The application process is a breeze – no need to dig up medical records or deal with blood and urine samples. Most of the time, you’ll get the green light from the insurance company within minutes!

What Is The Impact Of Liver Disease On Insurance Eligibility?

The severity of your liver disease can shake up your life insurance options and the cost of burial insurance. For instance, if you’re in line for a liver transplant, you’ll only qualify for guaranteed issue life insurance.

While it guaranteed issue promises you coverage, it’s pricier than first-day coverage and comes with a two-year waiting period.

So, keep in mind – liver disease can affect your options, but there’s always a way to get covered!

Burial Insurance Underwriting For Liver Disease

Burial insurance companies will ask about liver disease history by asking if you have ever had liver disease at any point in your life or been treated for liver disease within a certain number of years.

Here are some examples of how burial insurance companies ask about liver disease in their health questions:

- Have you ever had or been treated for any liver disease?

- Have you ever had or been treated for liver disease within the last 24 months?

Some illnesses they associate with liver disease include:

- Alcohol-related liver disease

- Biliary atresia

- Benign liver tumors

- Cirrhosis

- Epstein Barr virus

- Hemochromatosis

- Hepatitis A, B, C

- Liver cancer

- Non-alcoholic fatty liver disease

Got any form of liver disease? You’ll have to check “yes” on those health questions.

What Is The Burial Insurance Pricing For Liver Disease?

Pricing can vary widely and depends on age, gender, where you live, the type of policy, coverage amount, your overall health, and the severity of your liver disease.

Here’s a pricing example for an accomplished 60-year-old female with liver disease:

| FEMALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Here’s a pricing example for an independent 60-year-old male with liver disease:

| MALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

How To Find Affordable Burial Insurance with Liver Disease

Want affordable burial insurance? Team up with an independent insurance agent at Funeral Funds who can get you quotes from multiple carriers.

We’ll steer you towards the best life insurance companies that offer first-day coverage approvals for liver disease. Let’s get you covered!

How To Apply For Life Insurance If You Have Liver Disease

- Consult with Independent Agents – Work with independent insurance agents from Funeral Funds who specialize in liver disease underwriting. We’ll break down your options, compare quotes, and help you pick the best policy for your situation.

- Complete the Application Honestly – When filling out your life insurance application, don’t hold back. Be upfront about your liver disease history, treatments, and any lifestyle changes. Honesty guarantees a fair assessment and the right coverage.

- Review and Confirm Policy Details – Give those finalized policy terms a thorough review before you say yes. Make sure the coverage fits your needs and your budget.

How Can Funeral Funds Help Me?

Skip the hassle of hunting through multiple insurance companies. We’ve got you covered. At Funeral Funds, we work with A+ rated carriers that specialize in high-risk clients.

Our licensed agents will search all the top companies to find you the best rates, making the process quick and easy.

Just fill out our quote form on this page or call us at (888) 862-9456 for an accurate quote. We’ll handle the rest!

Frequently Asked Questions

Is liver disease considered a pre-existing condition in insurance?

Absolutely! Liver disease is definitely considered a pre-existing condition in the insurance world.

Do I need to tell insurance companies about liver disease?

Yep, you sure do. Spill the beans about your liver disease if you want to qualify for insurance.

What are the things that may affect my eligibility if I have liver disease?

The severity of your liver disease and your treatment plan can make or break your insurance eligibility.

Can you be rejected or denied insurance for liver disease?

Yes, you can be shown the door. Some insurance companies just aren’t liver disease-friendly.

How long does it take to get life insurance with liver disease?

It’s quick! You can get approved for life insurance in just a few minutes over the phone.

Is there a difference in rates for men and women who have liver disease?

Yes, there’s a difference. Men usually get hit with higher rates compared to women.

1 Comment

Anthony Indelicato

Thank you!