Burial Insurance with Lupus

Trying to qualify for burial insurance with Lupus can be stressful, and stress is the last thing you need when you have Lupus!

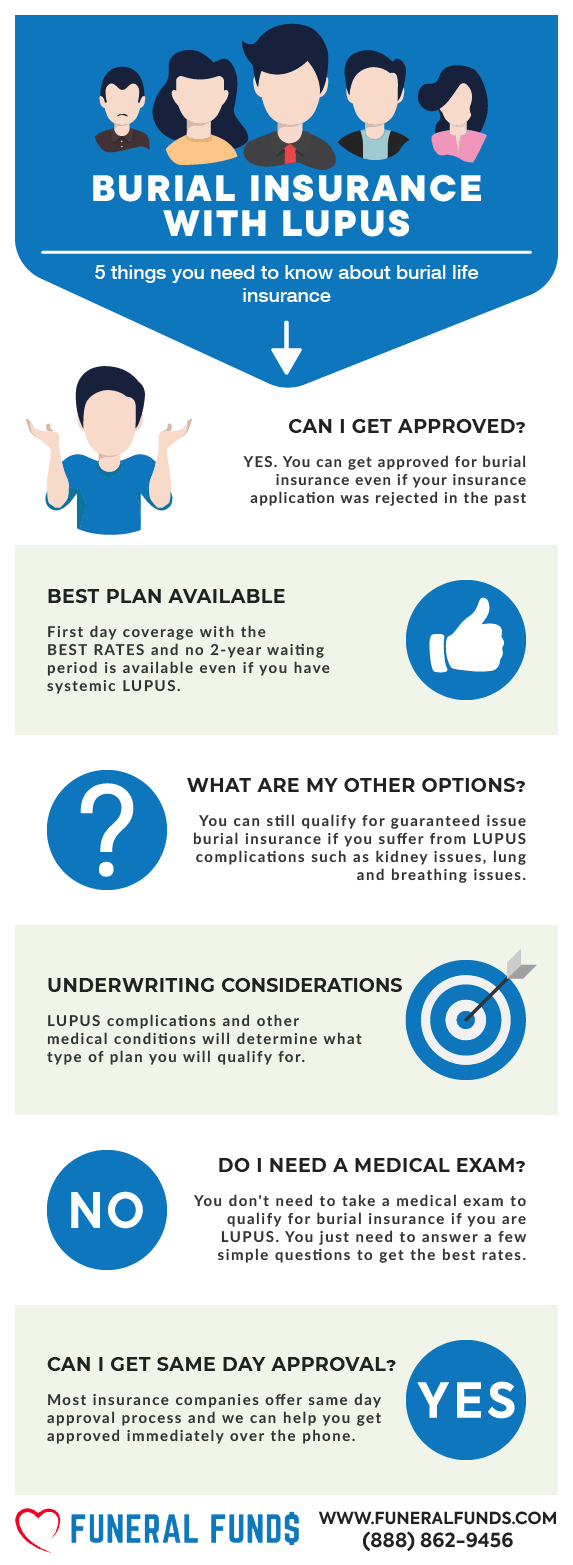

However, having a history of Lupus will not prevent you from being approved for coverage at an affordable rate.

If you have Lupus and you are considering applying for a burial insurance policy, keep reading and we will give you an overview of Lupus burial insurance underwriting and how to get the best rate possible.

| TABLE OF CONTENTS | |

|---|---|

What Is My Best Insurance Option If I Have A History Of Lupus?

IF YOUR DIAGNOSIS AND TREATMENT IS LONGER THAN 2 YEARS

If your lupus diagnosis and treatment is longer than two years ago, you may qualify for level death benefit with first-day coverage and no waiting period with a few burial insurance companies. You will also pay the lowest rate.

Your death benefit payout is fixed; it will not decrease and will remain the same throughout the duration of your policy. Your beneficiary will receive the full payout when you pass away.

Best Option: Level death benefit plan with first-day coverage

IF YOUR DIAGNOSIS AND TREATMENT IS WITHIN 2 YEARS

If your lupus diagnosis is recent or within two years, you will still qualify for burial insurance. Your best option is a first-day benefit plan.

Best Option: First-day benefits

With a first-day benefit plan, you are covered from the first day, and your death benefit will be phased in over time.

What Types Of Burial Insurance Should I Avoid?

| PLANS TO AVOID | WHY? |

|---|---|

| Term life | Premiums increase after 5 years. Coverage ends after 80. |

| Pre-paid funeral plans | Expensive |

| Universal life | Tied with stocks |

| No health questions policies | With 2-year waiting period |

| Plans offering "teaser rates" | $9.95 per unit plans or $1 buys $100,000 coverage |

| Over priced plans | Insurance from TV and junk mail |

| Plans that accept mail-in payments | Risky |

| Plans that accept Direct Express | High lapse rate |

| Plans that accept Credit Cards | High lapse rate |

What Type Of Burial Insurance Is Best?

| FUNERAL FUNDS PLAN BENEFITS | INCLUDED |

|---|---|

| 1st Day Coverage | YES |

| Rates NEVER Increase | YES |

| Coverage NEVER Decreases | YES |

| Easy to get approved | YES |

| No Medical Exam | YES |

| Same Day Approval | YES |

| Death Claims Pay Fast | YES |

| Builds cash value | YES |

| Coverage Up To Age 121 | YES |

Do I Need A Medical Exam To Qualify For Burial Insurance?

You are NOT required to take a medical exam to qualify for burial insurance with lupus.

When you apply for burial insurance, you only have to answer some basic questions about your health. The application process is simple, and you don’t need to provide medical records or blood and urine samples.

You’ll get the official approval from the insurance company often within minutes!

Burial Insurance Underwriting If You Have Lupus

Burial insurance companies have two ways of underwriting.

FIRST – They ask you a series of health questions. Your answers to their questions will determine your eligibility.

SECOND – They will electronically review your prescription history. Your Lupus medications will give them a clear picture of your current and past medical treatments.

HEALTH QUESTIONS:

Insurance companies would like to know if you have any of these types of lupus:

- Systemic Lupus

- Cutaneous Lupus

- Drug-Induced Lupus

- Neonatal Lupus

Here are some examples of how burial companies ask about Lupus in their health questions:

- During the past 24 months, have you been diagnosed or been treated for systemic lupus?

- Within the past 24 months,, have you been medically diagnosed, treated, or taken medication for systemic lupus (SLE)?

- Have you ever had, or been diagnosed with, received, or been advised to receive treatment or medication for Systemic Lupus (SLE)?

PRESCRIPTION HISTORY CHECK

The insurance companies will also review your prescription history as part of their underwriting procedure and risk analysis. Different medications are used to treat Lupus, and the carriers flagged them. Here are the most common prescription medications they are on the lookout for.

If they see you using these prescriptions, you will be viewed as a lupus patient, and they will underwrite your burial policy accordingly.

- Azasan

- Azathioprine

- Benlysta

- Chloroquine

- Cytoxan

- Hydrocortisone

- Hydroxychloroquine

- Imuran

- Methylprednisolone

- Plaquenil

- Prednisone

- Rheumatrex

Other drugs are often needed to treat the symptoms that develop as a result of Lupus. These can include the use of diuretics, anticonvulsants (for seizure disorders), antibiotics, antihypertensive drugs, and bone-strengthening drugs for osteoporosis.

However, if you apply for a burial insurance company that is lenient with lupus patients, they will not care about these medications, and you may qualify for a level death benefit plan.

How Much Insurance Do I Need?

The amount of burial insurance you should buy varies depending on your personal and financial circumstances. However, burial insurance should cover the cost of your funeral, burial, and final expenses.

The first step to figuring out how much burial insurance you need is to know your end-of-life expenses. Your funeral cost is often the biggest single expense you need to pay. Other end-of-life expenses to consider are your outstanding medical bills, living expenses, credit card bills, and other debts.

Here’s an example of a funeral cost breakdown from the National Funeral Directors Association.

| AVERAGE FUNERAL COST WITH VIEWING AND BURIAL | |

|---|---|

| Non-declinable basic services | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Hearse | $325 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Metal casket | $2,500 |

| Vault | $1,572 |

| Median Cost of a Funeral With Viewing and Burial | $9,420 |

| AVERAGE FUNERAL COST WITH VIEWING AND CREMATION | |

|---|---|

| Non-declinable basic services fee | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Cremation fee (if firm uses a third-party crematory) | $368 |

| Cremation Casket | $1,310 |

| Urn | $295 |

| Median Cost of a Funeral with Viewing and Cremation | $6,970 |

| Rental Casket | $995 |

| Alternate Cremation Container | $150 |

How Should I Pay My Premiums?

The best way to pay your premium is through a savings or checking account. We recommend you set a bank draft from your savings or checking account. That way, the bank will automatically pay your premium each month, and you don’t need to worry about your policy lapsing due to non-payment.

Lupus And Burial Insurance Riders

Insurance policy riders add benefits to your policy. Adding insurance riders will enhance your policy to fit your needs. Some riders are built into your policy, while other riders can be added at an additional cost. Most riders are affordable, and it involves little to no underwriting.

Here’s a list of common burial insurance riders:

| FUNERAL FUNDS ADD-ONS | AVAILABILITY |

|---|---|

| Terminal Illness Add-On Benefit | Included with most plans |

| Nursing Home Care Add-On Benefit | Included with most plans |

Information We Need If You Have Lupus

When applying for final expense insurance with lupus, it is important to provide us much information as possible.

We will ask you a series of health questions to better understand your condition. These questions include:

- When were you diagnosed with Lupus?

- What form of lupus do you have?

- Name the parts of your body affected by your lupus?

- Have you ever been hospitalized or had any complications due to lupus?

- What symptoms do you encounter?

- How often do your symptoms flare up?

- Are you currently receiving lupus treatment? What is your treatment plan?

- What prescription medications are you taking to treat your condition?

We need to know your medical condition to be able to provide you with the best recommendation. The more information we get, the better your chances of finding affordable insurance coverage.

How To Get The Best Burial Insurance Rates

You need to find companies that don’t ask about lupus or other autoimmune diseases like arthritis or multiple sclerosis. Those companies will provide you with the best burial insurance rates.

To find the best burial insurance rates for lupus, you need the help of an independent agency like Funeral Funds, that have access to lots of different insurance companies.

We will do two main things for you: First, we have the experience and familiarity with the underwriting of different burial insurance companies; this will get you the best rates and coverage. Second, we will compare quotes from burial insurance carriers that accept systemic lupus.

We will shop around and find you the most affordable plan which is suited for your needs and budget.

Benefits Of Burial & Funeral Insurance

Here are some of the benefits of purchasing a burial or funeral policy:

- No medical exam or doctor’s visit required – easy to get approved.

- Ease of issue – easy to qualify and get insurance coverage.

- No Money Down to get approved – have your policy start whenever you want.

- Level premium – your premium will never increase.

- Fixed death benefit – your death benefit will never decrease for any reason.

- Permanent protection – your policy can not be canceled by the life insurance company as long as you continue to pay your premiums.

- Tax-free – the death benefit is directly paid to your beneficiary tax-free upon your death

- Cash value builds up – burial insurance is a whole life policy that builds cash value over time

Other Common Uses For Final Expense Life Insurance With Lupus

All of these examples are appropriate uses for Final Expense Life Insurance:

- Burial insurance plan with lupus

- Cremation insurance plan with lupus

- Funeral home insurance plan with lupus

- Final Expense insurance plan with lupus

- Prepaid funeral plan insurance with lupus

- Mortgage payment protection plan with lupus

- Mortgage payoff life insurance plan with lupus

- Deceased spouse’s income replacement plan with lupus

- Legacy insurance gift plan to family or loved ones with lupus

- Medical or doctor bill life insurance plan with lupus

We can help you with any of the plans above. Your pricing will depend on your age, health, and coverage amount for each program option.

How Can Funeral Funds Help Me?

Finding a policy if you have systemic lupus can be frustrating, but working with an independent agency like Funeral Funds will make the process easier and quicker.

If you have lupus, let us help you; we will work with you side by side to find a plan that fits your needs.

You don’t need to waste your precious time searching for different insurance companies; we will do the work for you. We can shop your case to different companies to get your application approved.

Here at Funeral Funds, we specialize in obtaining the best life insurance coverage for people with a history of systemic lupus and other autoimmune diseases.

We will assist you in securing the coverage you need at a rate you can afford. So, if you are looking for burial insurance with systemic lupus, we can help.

Fill out our quote form on this page or call us at (888)862-9456, and we can give you an accurate quote.

Frequently Asked Questions

Can you get life insurance if you have lupus?

Yes, you can get life insurance if you have lupus. You may even qualify for a first-day coverage plan if your lupus diagnosis and treatment has been two years or longer.

Is lupus considered a pre existing condition?

Yes, lupus is considered a pre-existing condition. Any medical condition you have before life insurance application is considered a pre-existing condition.

Can you get burial insurance with lupus?

Yes, you can get burial insurance with lupus. You may even qualify for a first-day coverage plan if your lupus diagnosis and treatment have been two years or longer.

What is the life expectancy for lupus?

The life expectancy for someone with lupus can vary depending on the individual and how well they are managing the condition. With good treatment and management, many people live relatively normal lives. However, there is no definitive answer to this question.

Is lupus a disability?

Lupus is not currently a recognized disability by the Social Security Administration. However, this could change in the future as more is learned about the disease.

Is lupus considered fatal in life insurance?

Lupus can be fatal, but this is relatively rare. With good treatment and management, many people living with lupus are able to live relatively normal lives.

Can lupus patients get final expense life insurance?

Yes, lupus patients can get final expense life insurance. You may even qualify for a first-day coverage plan if your lupus diagnosis and treatment have been two years or longer.

What are the best life insurance companies for lupus?

Different life insurance companies have different underwriting processes. However, some of the best life insurance companies for people with lupus include Family Benefit Life, Trinity Life, and Guarantee Trust Life.

What is the average cost of life insurance for someone with lupus?

The average cost of life insurance for someone with lupus can vary depending on a number of factors, including the insurance company, your gender, your age, your location, policy amount, and your general health.

Is there a waiting period for life insurance with lupus?

There is no waiting period for life insurance with lupus. You may even qualify for a first-day coverage plan if your lupus diagnosis and treatment have been two years or longer.

What are some tips for getting life insurance with lupus?

Some tips for getting life insurance with lupus include:

- Shop around and compare different life insurance policies to find the best fit for you.

- Be honest and upfront about your lupus diagnosis when applying for life insurance.

Can you get funeral insurance if you have lupus?

Yes, you can get funeral insurance if you have lupus. You may even qualify for a first-day coverage plan if your lupus diagnosis and treatment have been two years or longer.

What are some things to consider when choosing a burial policy with lupus?

Some things to consider when choosing a burial policy with lupus include:

- How much coverage do you need?

- What type of funeral arrangements do you want?

- Are there any specific riders or add-ons that you would like?

Can you get cremation insurance with an autoimmune disease like Lupus?

Yes, you can get cremation insurance with lupus. You may even qualify for a first-day coverage plan if your lupus diagnosis and treatment have been two years or longer.

Can Lupus affect life insurance?

Lupus diagnosis and treatment can affect the type of policy you can qualify for. If you are recently diagnosed with lupus, you will only qualify for a first-day benefit plan.

Is Lupus considered a critical illness in life insurance?

No, lupus is not considered a critical illness in life insurance. However, lupus can be a factor in your overall health and life insurance rates.

Can you be rejected for life insurance because of Lupus?

No, you cannot be rejected for life insurance because of lupus. However, lupus can affect the type of plan you will qualify for.

Can you get cremation insurance if you have lupus?

Yes, you can get cremation insurance if you have lupus. You may even qualify for a first-day coverage plan if your lupus diagnosis and treatment have been two years or longer.

Can Lupus affect your life insurance rates?

Yes, lupus can affect your life insurance rates. The severity of your disease and the medications you are taking may affect the rates you are offered.

How can you get the best life insurance rates with Lupus?

The best way to get the best life insurance rates with lupus is to work with an independent life insurance agent who can shop around and compare different policies. Be honest and upfront about your diagnosis when applying for coverage.

Is there an age limit for burial insurance with Lupus?

You need to be at least 50 to 85 years old to qualify for burial insurance with lupus.

Can you get first-day coverage insurance if you have lupus?

Yes, you can get first-day coverage insurance if you have lupus. You may even qualify for a first-day coverage plan if your lupus diagnosis and treatment have been two years or longer.

What are some things to keep in mind when getting life insurance with Lupus?

Some things to keep in mind when getting life insurance with lupus include:

- Be honest about your Lupus diagnosis.

- Work with an independent agent who can compare different policies.

- Choose the coverage amount that is right for you.

Can lupus treatment medication affect my premium?

Yes, lupus treatment medication can affect your premium. The severity of your disease and the medications you are taking will be factors in the rates you are offered.

Can I qualify for life insurance with a history of lupus?

Yes, you can qualify for life insurance with a history of lupus. However, you may only qualify for a first-day benefit plan if you have a current diagnosis or treatment.