Burial Insurance with Paralysis

Paralysis won’t stop you from qualifying for an affordable burial insurance! Even if you’re paralyzed, you might just qualify for a first-day coverage plan. It all hinges on how severe your paralysis is, how many hospital trips you’ve had in the last couple of years, and your zip code.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with paralysis, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is Paralysis?

Paralysis is when you lose control over your muscles in part or all of your body. This can happen due to damage to the brain, spinal cord, or nerves, and it can be a temporary hiccup or a permanent situation.

Paralysis comes in all shapes and sizes. It can be complete – where you can’t move or feel anything in the affected area – or incomplete, also known as paresis, where you’ve got some weakness or movement loss.

You’ve also got localized paralysis, which is like a targeted attack on a specific area (think just your face, arm, or leg), and generalized paralysis, which takes a broader swipe at your body.

Some common troublemakers behind paralysis include:

- Stroke

- Spinal cord injury

- Multiple sclerosis

- Bell’s palsy

- Guillain-Barré syndrome

- Brain tumor

- Cerebral palsy

Treatments vary based on the root cause. Surgery, physical therapy, or medication might work in some cases, while in others, paralysis might stick around for good.

Paralysis can make you seem like a higher risk to insurance companies, especially if it’s severe or linked to complications. If you’ve got other health issues on top of your paralysis, they’ll be factored in too. But, if you’re a young and otherwise healthy person with paralysis, you might score better rates than someone with additional health concerns.

- The extent of paralysis and the cause: (example:, spinal cord injury vs. Bell’s palsy) will play a role. Complete paralysis with a high risk of complications will likely have a bigger impact than temporary paralysis.

- Your overall health: Other health conditions you have can be considered alongside the paralysis. A young applicant with paralysis but otherwise good health might get better rates than someone with paralysis and additional health concerns.

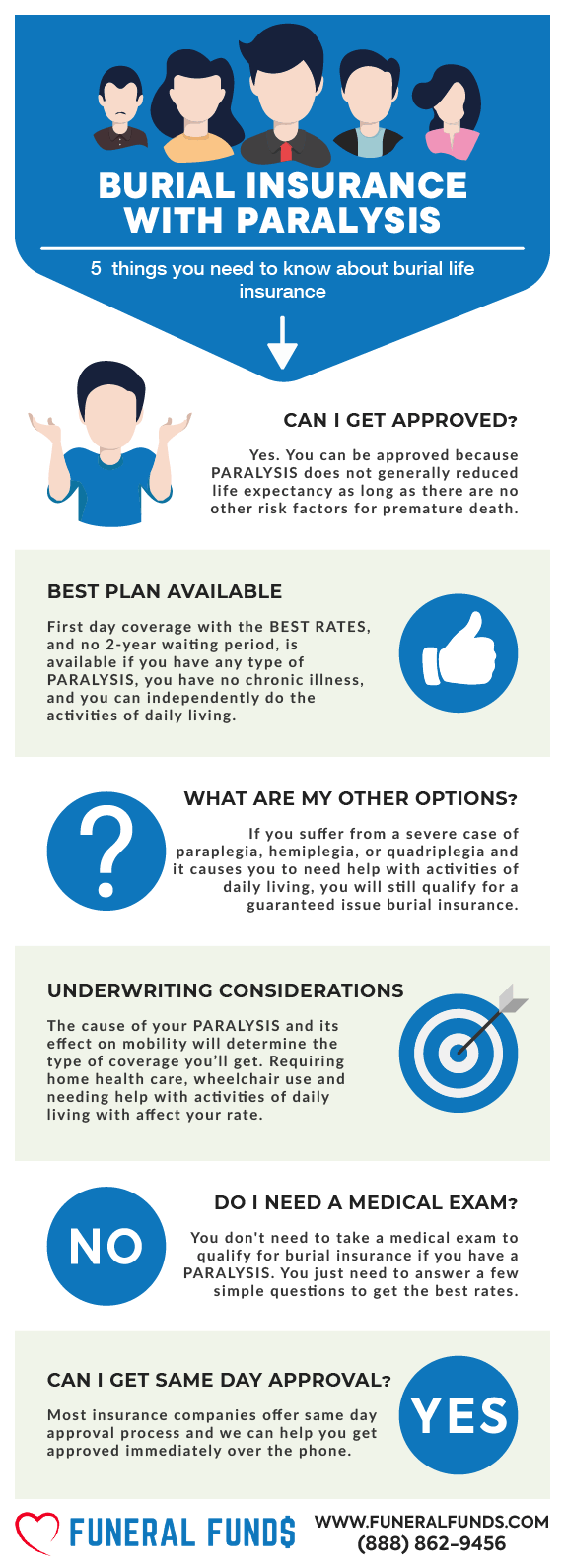

Can I Get Burial Insurance With Paralysis?

Absolutely! If you’ve got paralysis but can still handle your daily activities like eating, bathing, dressing, and the usual, you might just get a first-day coverage plan where no waiting period is required!

What Are The Types Of Burial Insurance For People With Paralysis?

First-Day Coverage – This one’s a breeze. No medical exam is needed – just a few health questions. With first-day coverage, you’re in the game right away with no waiting period to worry about.

No medical exam, no health questions—This is your go-to if you have serious health issues that might keep you from qualifying for traditional life insurance. Guaranteed issue life insurance is here to cover you, no matter what.

Just a heads-up: Guaranteed issue whole life policies do come with a mandatory two-year waiting period. If you pass away during that time, the policy won’t pay out the full death benefit. Instead, it’ll cover what you’ve paid in premiums plus a little interest (7-10%, depending on the company).

Factors That Affect Life Insurance Eligibility If You Had Paralysis

Here’s what we’ll check to see if you’re a good fit for first-day coverage:

- Are you able to perform activities of daily living?

- Do you use a wheelchair and cannot do daily living activities on your own?

- Are you confined to a home health care, nursing facility, or assisted living facility?

- Have you been hospitalized two or more times in the last two years?

If you’re answering “yes” to any of these, your best bet might be a guaranteed issue permanent life insurance policy.

What Is My Best Insurance Option If I Have Paralysis?

Life insurance companies are all about those six Activities of Daily Living (ADL) to figure out if you’re a prime candidate for first-day coverage and the best rates.

To qualify for that sweet spot, you’ve gotta handle these tasks all on your own:

- EATING – Whether you’re using a cup, plate, or feeding tube, you’ve gotta manage your chow time.

- BATHING – Yep, this means washing yourself and getting in and out of the bath or shower without a hitch.

- DRESSING – Getting dressed, undressed, and dealing with any braces, fasteners, or artificial limbs.

- TOILETING – Handling personal hygiene and navigating the toilet.

- TRANFERING – Moving in and out of chairs, beds, or wheelchairs like a pro.

- CONTINENCE – Controlling your bladder and bowels, plus managing any colostomy or catheter bag.

If you’re dealing with severe paraplegia, hemiplegia, or quadriplegia and need help with these daily activities, your best bet is a guaranteed issue burial insurance.

TEMPORARY WHEELCHAIR USE – If you’re temporarily in a wheelchair but still manage your ADLs on your own, you might qualify for first-day coverage with some insurers in specific states.

WHEELCHAIR USE BUT NEEDS HELP WITH ADLS – If you’re using a wheelchair due to an accident and need help with ADLs but don’t have a chronic disease, go for guaranteed issue burial insurance.

HOME HEALTH CARE – If you need home health care due to paralysis, most carriers offer guaranteed-issue life insurance.

NURSING HOME OR ASSISTED LIVING FACILITY – Confined to a nursing home or assisted living? Guaranteed issue life insurance is likely your best policy.

Do I Need A Medical Exam To Qualify For Burial Insurance?

Nope, no medical exam is needed if you’ve got paralysis! When you apply for burial insurance, you’ll just answer a few basic health questions.

And the best part? You might get your official approval within minutes!

What Is The Cost Of Burial Insurance?

The cost of your burial insurance will be influenced by your:

- Age

- Coverage Amount

- Gender

- General Health

- State of Residence

- Smoking Status

- Type of Policy

Check out these sample rates for a compassionate 60-year-old female with paralysis.

| FEMALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Check out these sample rates for a mature 60-year-old male with paralysis.

| MALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Burial Insurance Underwriting For Paralysis?

Burial insurance companies with first-day coverage have two ways of getting the scoop on you:

FIRST – They’ll hit you up with a series of health questions.

SECOND – They’ll do a quick digital dive into your prescription history to check out your health.

COMMON HEALTH QUESTIONS:

- Do you have paralysis of two or more extremities?

- Do you require a wheelchair due to a chronic illness or disease, or do you require assistance from anyone with activities of daily living such as eating, bathing, dressing, toileting, and transferring?

- Do you have any impairment, whether physical or mental, for which you need to receive assistance or supervision in performing normal activities of daily living such as eating, dressing, bathing, incontinence, toileting, or moving without any type of physical assistance?

- In the past 10 years, have you opted not to seek treatment, have not taken medication, and have not followed the prescribed treatment plan following a medical diagnosis of paralysis?

Not every insurance company will ask about paralysis specifically, but they’ll definitely want to know if you can handle those daily activities on your own. Plus, expect questions about home health care and wheelchair use.

Information We Need if You Have Paralysis

To help you score that insurance, we’ll need answers to these:

- How long have you been paralyzed?

- What was the cause of your paralysis?

- Where is the location of your paralysis?

- What medicines do you take?

- Do you have other medical conditions in addition to paralysis?

Be straight-up with your answers so we can match you with the best final expense insurance company.

What To Do If Your Application Was Rejected Because Of Paralysis

If your life insurance application got the boot in the past because of paralysis, don’t sweat it. We’re here to pull some strings and get you approved for first-day coverage by hunting down insurers who welcome applicants with a history of paralysis.

How To Apply For Burial Insurance With Paralysis

- Work with an Independent Insurance Agent – Get some backup from independent insurance agents from Funeral Funds who know their way around paralysis underwriting. An agent from Funeral Funds can help you navigate your options, compare quotes, and find the perfect burial insurance plan.

- Complete the Application Honestly – When you’re filling out that health questionnaire, spill the beans about your paralysis and any other health issues. Accurate details about your health, treatments, and lifestyle changes are key.

- Review and Confirm Policy Details – Take a good look at the policy terms before giving the thumbs up. Make sure the coverage fits your needs and your wallet.

How Can Funeral Funds Help Me?

At Funeral Funds, we’re pros at landing life insurance for folks who’ve dealt with paralysis.

We team up with top-rated insurance companies that handle high-risk clients like a boss. We’ll dig through those options to score you the best rate and match you with the ideal life insurance plan.

Need coverage that won’t break the bank? Whether you’re after burial insurance for stroke or anything else, we’ve got your back. Just fill out our quote form on this page or give us a ring at (888) 862-9456 for a spot-on quote.

Frequently Asked Questions

Is there an age limit for burial insurance with paralysis?

You can qualify for burial insurance up until you’re 85 years old, and your plan will last until age 121.

Is paralysis a pre-existing condition for life insurance?

Yep, any health issues you have when applying for life insurance are considered pre-existing conditions.

Do I need to tell the insurance agent about my paralysis?

Absolutely! If the agent asks about it in the health questionnaire, you better spill the beans.

Can you be denied insurance for paralysis?

For sure. If you can’t handle daily activities by yourself or have been hospitalized twice or more in the last two years, you might get the axe, depending on the company.

Can paralysis affect your life insurance rates?

Definitely. The severity of your paralysis and how it impacts your daily activities will be factored into your rates.

What is the average cost of life insurance for someone with paralysis?

The cost varies based on your age, gender, location, coverage amount, and overall health.

2 Comments

Antonio C Cosby

Am a Quadriplegic

Funeral Funds

Antonio – If you need any help with ADLs (Activities of Daily Living), the only plan you would qualify for is one with a 2-year waiting period. If you get in touch with us, we can point you to the best company for your situation.