2024 Burial Insurance with Paralysis

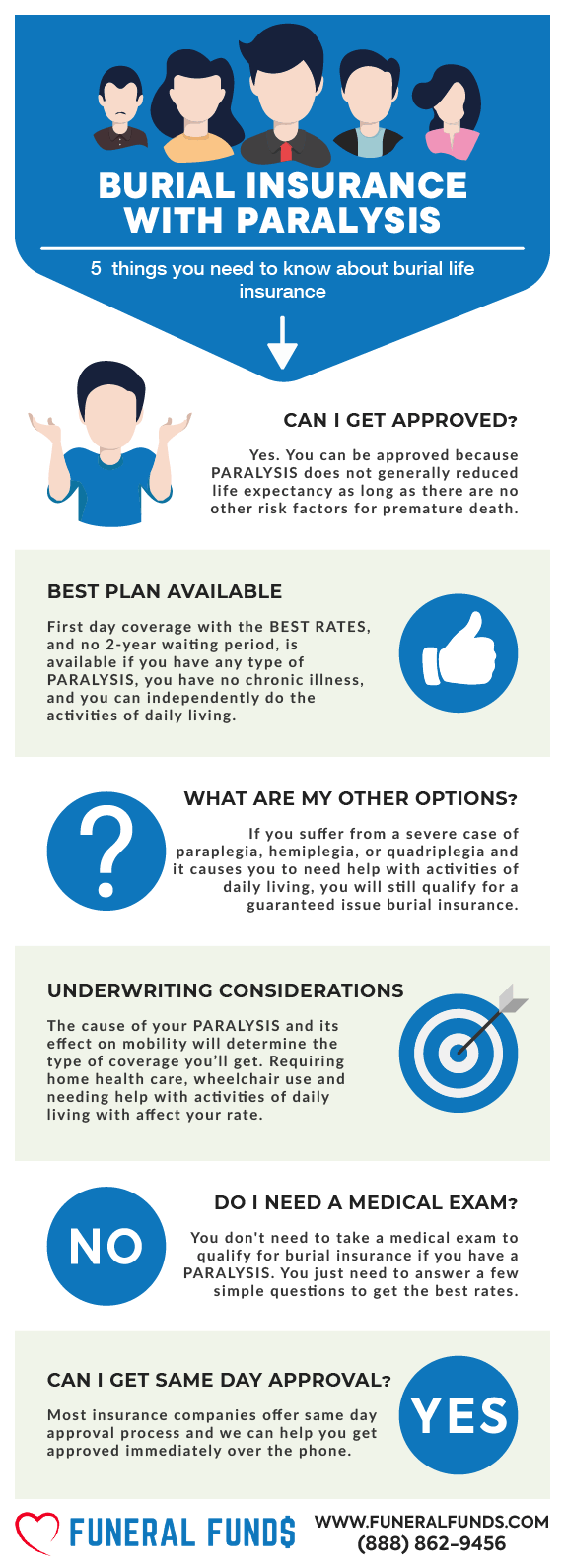

Affordable burial insurance is available to people with paralysis.

People who are paralyzed can even qualify for a first-day coverage plan depending on the severity of their paralysis, how many hospitalizations they have had in the last two years and their residence state.

If you or someone you love has paralysis, we can help you with the application process to find the best-priced burial insurance policy.

FOR EASIER NAVIGATION:

- What Is Paralysis?

- Can I Get Burial Insurance With Paralysis?

- What Are The Types Of Burial Insurance For People With Paralysis?

- Factors That Affect Life Insurance Eligibility If You Had Paralysis

- What Is My Best Insurance Option If I Have Paralysis?

- Do I Need A Medical Exam To Qualify For Burial Insurance?

- What Is The Cost Of Burial Insurance?

- Burial Insurance Underwriting For Paralysis?

- Information We Need if You Have Paralysis

- What To Do If Your Application Was Rejected Because Of Paralysis

- How To Apply For Burial Insurance With Paralysis

- How Can Funeral Funds Help Me?

- Frequently Asked Questions

What Is Paralysis?

Paralysis is a loss of voluntary muscle movement in all or part of the body. It can be caused by damage to the brain, spinal cord, or nerves. Paralysis can be temporary or permanent, and it can affect all or part of the body.

There are many different types of paralysis, and they can be classified in a number of ways. One way to classify paralysis is by the extent of the paralysis. Complete paralysis means that a person cannot move or feel anything in the affected area. Incomplete paralysis, also called paresis, means that a person has some weakness or loss of movement in the affected area.

Paralysis can also be classified by the location of the paralysis. Localized paralysis affects only a small area of the body, such as the face, arm, or leg. Generalized paralysis affects a larger area of the body.

Some of the common causes of paralysis include:

- Stroke

- Spinal cord injury

- Multiple sclerosis

- Bell’s palsy

- Guillain-Barré syndrome

- Brain tumor

- Cerebral palsy

The treatment for paralysis depends on the underlying cause. In some cases, paralysis can be improved with surgery, physical therapy, or medication. In other cases, paralysis is permanent.

Since paralysis statistically increases the risk of certain health complications, life insurance companies might view applicants with paralysis as higher risk.

- The extent of paralysis and the cause (e.g., spinal cord injury vs. Bell’s palsy) will play a role. Complete paralysis with a high risk of complications will likely have a bigger impact than a temporary paralysis.

- Your overall health: Other health conditions you have can be considered alongside the paralysis. A young applicant with paralysis but otherwise good health might get better rates than someone with paralysis and additional health concerns.

Can I Get Burial Insurance With Paralysis?

Yes, people with paralysis may qualify for first-day coverage insurance with no waiting period if there are no problems performing daily living activities like eating, bathing, dressing, toileting, continence, etc.

What Are The Types Of Burial Insurance For People With Paralysis?

First-Day Coverage – This is a no-medical exam policy; you only need to answer a few health questions. First-day coverage insurance has immediate coverage and no waiting period.

Guaranteed Issue – This is a no medical exam and no health questions policy. Guaranteed issue life insurance or guaranteed acceptance life insurance is designed for people with significant health issues who may not qualify for traditional term life insurance or whole life insurance.

Guaranteed issue whole life insurance policies come with a mandatory two-year waiting period because they accept all health issues. If you were to pass away during the waiting period, you would not get the full death benefit. The policy would only pay out the life insurance premiums you have paid plus 7-10% interest (depending on the company).

Factors That Affect Life Insurance Eligibility If You Had Paralysis

Questions that will help determine your eligibility for first-day coverage insurance:

- Are you able to perform activities of daily living?

- Do you use a wheelchair and cannot do daily living activities on your own?

- Are you confined to a home health care, nursing facility, or assisted living facility?

- Have you been hospitalized two or more times in the last two years?

If you answer yes to any of the four questions, your best option may be guaranteed issue permanent life insurance.

What Is My Best Insurance Option If I Have Paralysis?

Life insurance companies use six Activities of Daily Living (ADL) daily living activities to determine if you will qualify for a first-day coverage plan. You must be able to perform these activities independently to be eligible for first-day coverage and the lowest rate.

- EATING – the act of putting food into your body using a cup, plate, intravenously, or feeding tube.

- BATHING – washing your entire body in a shower or bathtub, also with your ability to get in and out of the bath or shower on your own.

- DRESSING – taking off and putting items of clothing on your body. The dressing also includes taking off and putting on braces, fasteners, and artificial limbs.

- TOILETING – doing necessary personal hygiene and getting on and off the toilet.

- TRANFERING – moving in or out of a chair, bed, or wheelchair.

- CONTINENCE – controlling the bladder and bowel functions. It also includes performing related personal hygiene tasks like caring for a colostomy or catheter bag.

The most severe cases of paraplegia, hemiplegia, and quadriplegia that need assistance in performing activities of daily living will only qualify for a guaranteed issue burial insurance.

TEMPORARY WHEELCHAIR USE – If you temporarily use a wheelchair but can still perform the activities of daily living on your own, you may qualify for first-day coverage insurance with specific companies offering policies in specific states.

WHEELCHAIR USE BUT NEEDS HELP WITH ADLS – If you are a wheelchair user because of an accident and you don’t have a chronic disease but need help with ADLs, your best option is to get a guaranteed issue burial insurance.

HOME HEALTH CARE – It’s common for paralyzed patients to need home health care temporarily or permanently. If you are currently receiving home health care because of paralysis, most carriers will offer you a guaranteed issue life insurance plan.

NURSING HOME OR ASSISTED LIVING FACILITY – If you are confined to a nursing home or assisted living facility, your only option for insurance coverage is to get a guaranteed issue life insurance.

Do I Need A Medical Exam To Qualify For Burial Insurance?

No, You won’t need to take a medical exam to qualify for burial insurance with paralysis.

When you apply for burial insurance with paralysis, you only have to answer some basic questions about your health.

You’ll often get the official approval from the insurance company within minutes!

What Is The Cost Of Burial Insurance?

The cost of burial insurance will depend on your:

- Age

- Coverage Amount

- Gender

- General Health

- State of Residence

- Smoking Status

- Type of Policy

Burial Insurance Underwriting For Paralysis?

Burial insurance companies with first-day coverage have two ways of underwriting:

FIRST – You will be asked a series of health questions.

SECOND – They will electronically review your prescription history to verify your health.

COMMON HEALTH QUESTIONS:

- Do you have paralysis of two or more extremities?

- Do you require a wheelchair due to a chronic illness or disease, or do you require assistance from anyone with activities of daily living such as eating, bathing, dressing, toileting, and transferring?

- Do you have any impairment, whether physical or mental, for which you need to receive assistance or supervision in performing normal activities of daily living such as eating, dressing, bathing, incontinence, toileting, or moving without any type of physical assistance?

- In the past 10 years, have you opted not to seek treatment, have not taken medication, and have not followed the prescribed treatment plan following a medical diagnosis of paralysis?

Only a handful of insurance companies will specifically ask about paralysis. Almost all insurance companies will ask if you can do Activities of Daily Living on your own. They will also ask about home health care and wheelchair use.

Information We Need if You Have Paralysis

Here are some questions that we will ask to help you qualify for this insurance:

- How long have you been paralyzed?

- What was the cause of your paralysis?

- Where is the location of your paralysis?

- What medicines do you take?

- Do you have other medical conditions in addition to paralysis?

You must be honest when answering these questions so we can determine what final expense insurance company will be the best fit for you.

What To Do If Your Application Was Rejected Because Of Paralysis

If your life insurance application were rejected in the past because of paralysis, we would do our best to get you approved for first-day coverage life insurance by shopping multiple life insurance companies that accept applicants with a paralysis history.

How To Apply For Burial Insurance With Paralysis

- Work with an Independent Insurance Agent – Ask for assistance from independent insurance agents specializing in underwriting for paralysis. An independent insurance agent from Funeral Funds can help you understand your options, compare quotes, and choose the most suitable burial insurance plan.

- Complete the Application Honestly – When filling out the life insurance health questionnaire, be truthful about your paralysis and other health issues. You need to provide accurate details about your health, treatments, and any lifestyle changes you’ve made.

- Review and Confirm Policy Details – Carefully review the policy terms before confirming your acceptance. Make sure the insurance coverage meets your needs and your budget.

How Can Funeral Funds Help Me?

Here at Funeral Funds, we specialize in getting life insurance coverage for people who have suffered paralysis.

We work with many A-rated insurance companies that specialize in high-risk clients. We will search those companies to give you the best rate. We’ll match you up with your best life insurance option.

We will assist you in securing the coverage you need at a rate you can afford. So, if you’re looking for burial insurance for stroke, we can help. Fill out our quote form on this page or call us at (888)862-9456 to get accurate quote burial insurance quotes.

Frequently Asked Questions

Is there an age limit for burial insurance with paralysis?

You can apply for burial insurance up to 85 years old.

Is paralysis a pre-existing condition for life insurance?

Yes, any health issues you have when you apply for life insurance are considered a pre-existing condition.

Do I need to tell the insurance agent about my paralysis?

Yes, you must tell the insurance company’s agent about paralysis if they ask for it in the health questionnaire.

Can I get life insurance after paralysis?

Yes, however, the policy you will qualify for will depend on the severity of your paralysis and your ability to perform daily activities independently.

Can you get first-day coverage insurance if you have paralysis?

Yes, if it does not affect your ability to perform daily living activities. This will depend on what policies are available in your state.

Which insurance is best for patients with paralysis?

First-day coverage insurance is the best option to qualify for if the insured has paralysis.

Can I qualify for cremation insurance with a history of paralysis?

Yes, depending on the severity of your paralysis and how it affects your ability to perform activities of daily living.

Can you be denied insurance for paralysis?

Yes, if you can’t perform daily living activities on your own or have been hospitalized twice or more in the last two years (depending on the company you apply for coverage with).

Can I get insurance if I am paralyzed?

Yes, however, the policy you will qualify for will depend on the severity of your paralysis and your ability to perform daily activities independently.

Can paralysis affect your life insurance rates?

Yes, the severity of your paralysis and how it affects your ability to perform daily activities will be considered when the insurance company calculates your rates.

Can paralysis medication affect my premium?

Yes, any medications you are taking for your paralysis will be considered when the insurance company is calculating your rates.

What is the maximum coverage I can get with burial insurance if I am paralyzed?

You can get up to $20,000 to $50,000 coverage with most companies if you qualify.

What is the average cost of life insurance for someone with paralysis?

The average cost of life insurance for someone with paralysis depends on their age, gender, location, coverage amount, and general health.

How can you get the best life insurance rates with paralysis?

The best way to get the best life insurance rates with paralysis is to work with an independent life insurance agent like Funeral Funds, who can shop around for the best policy that fits your needs.

RELATED POSTS:

2 Comments

Antonio C Cosby

Am a Quadriplegic

Funeral Funds

Antonio – If you need any help with ADLs (Activities of Daily Living), the only plan you would qualify for is one with a 2-year waiting period. If you get in touch with us, we can point you to the best company for your situation.