Burial Insurance After A Stroke (2024 Update)

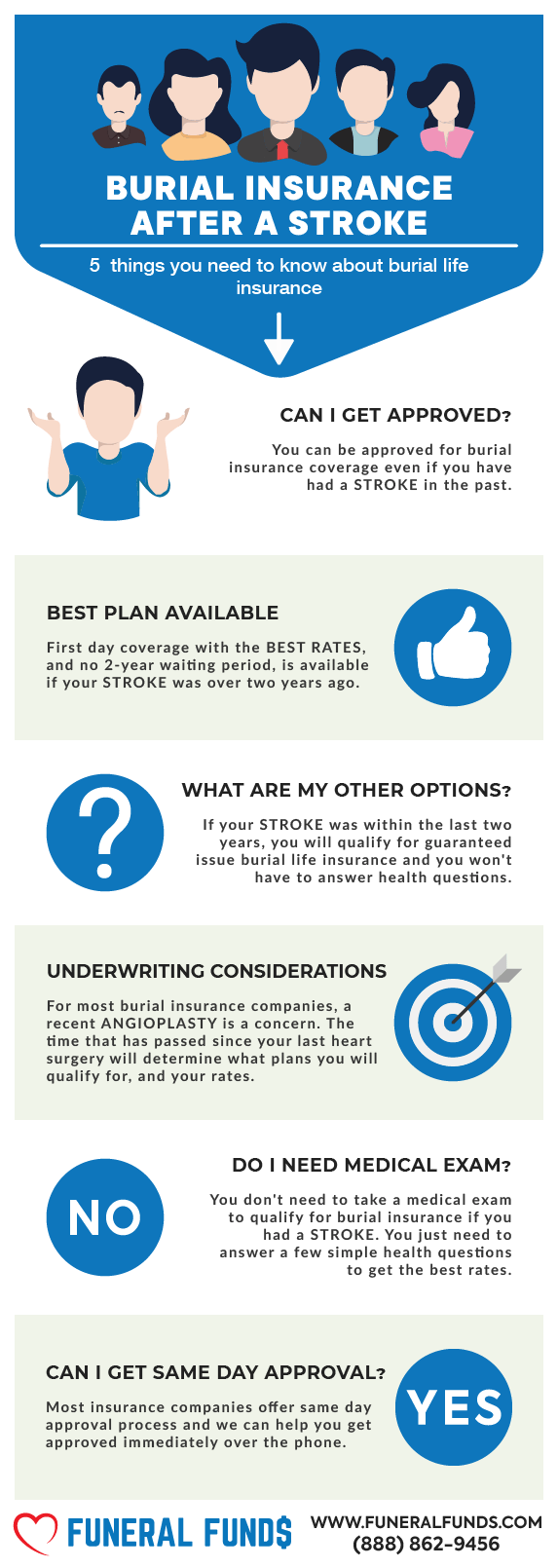

If you had a stroke there are affordable burial insurance options available for you! Most folks can snag first-day coverage once we get the scoop on their health and where they’re living.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with stroke, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is Stroke?

A stroke is a medical emergency when your brain’s blood supply gets cut off. Without that precious blood, your brain cells start gasping for air and nutrients, and they begin to bite the dust. The longer you let it slide, the more brain cells you lose.

There are two main types of strokes:

- Ischemic stroke: This is the most common culprit, making up about 87% of strokes. It’s what happens when a blood clot decides to crash the party and block blood flow to your brain.

- Hemorrhagic stroke: This one’s when a blood vessel in your brain decides to burst and bleed everywhere. The mess puts pressure on your brain cells, and they don’t take too kindly to that.

Strokes are serious business – leading the pack in death and disability stats. According to the CDC, they’re the fifth leading cause of death in the US. Every year, around 795,000 people have a stroke, and about 130,000 of those are fatal.

When insurance companies size up someone who’s had a stroke, here’s what they’re checking out:

- Severity of the Stroke: A little bump in the road with a full recovery is usually easier to handle than a major hit with lasting issues.

- Time Since Stroke: The longer it’s been with no hiccups and you’re in good shape, the better your chances.

- Current Health Status: They’ll look at whether you’re still dealing with any leftover effects or need ongoing treatment.

Can I Get Burial Insurance After A Stroke?

Absolutely! You might even snag first-day coverage with no waiting period if you’re still rocking those daily activities like eating, bathing, dressing, and all that jazz.

What Are The Types Of Burial Insurance For People Who Had A Stroke?

First-Day Coverage – This is your VIP pass to burial insurance. No medical exam needed – just a few health questions, and boom, you’re covered immediately with no waiting period.

Guaranteed Issue – This one’s for those who can’t get traditional insurance due to serious health issues. No medical exam or health questions here, but it comes with a two-year waiting period. If you kick the bucket during this time, the payout is just your premiums plus 7-10% interest (depending on the company). Oh, and the premiums are pricier than first-day coverage.

Alright, here’s the scoop: guaranteed issue whole life insurance comes with a two-year waiting period, and the premiums are steeper than first-day coverage. If you shuffle off this mortal coil during that waiting time, you won’t get the full death benefit. Instead, you’ll just get your premiums back plus 7-10% interest (depends on the company).

What Factors Affect Insurance Eligibility If You Had A Stroke?

Here are four juicy questions to see if you’re in for first-day coverage:

- Are you able to perform activities of daily living?

- Are you confined to a nursing facility or home healthcare

- Do you have any physical and mental impairments due to stroke

- Has there been two or more hospitalizations in the last two years

What Is My Best Insurance Option After A Stroke?

YOU HAD A STROKE BUT CAN DO ACTIVITIES OF DAILY LIVING – If you’ve had a stroke but are still managing to eat, bathe, and dress yourself like a champ, you’re in luck! First-day coverage is on the table for you, provided you’re on treatment and keeping up with your meds.

YOU NEED HELP IN ACTIVITIES OF DAILY LIVING (ADLs) – If you’re in need of a hand with eating, bathing, or any of those other daily tasks, your insurance options are a bit limited. You’ll have to go with guaranteed issue whole life insurance, which doesn’t ask you to juggle any health questions.

YOU ARE IN A NURSING HOME – If your stroke landed you in a nursing home, well, insurance companies have some concerns. They’ll likely steer you toward a guaranteed issue life insurance policy with no health questions.

YOU REQUIRE HOME HEALTH CARE – Similar to the nursing home situation, home healthcare can raise eyebrows with insurance companies. Again, guaranteed issue whole life might be your only option.

YOU HAVE PHYSICAL IMPAIRMENTS FROM STROKE – Strokes can leave you with some lingering battle wounds (weakness, balance issues). While temporary impairments shouldn’t be a total dealbreaker, they might exclude you from first-day coverage. Back to guaranteed issue whole life it is!

YOU HAVE BEEN HOSPITALIZED 2 OR MORE TIMES IN THE LAST TWO YEARS –

If you’ve had a few hospital stays recently, it’s time to go with guaranteed issue whole life insurance. It’s like the VIP pass for those with a rocky medical history!

Remember, this is a simplified overview. Talking to a licensed insurance agent is always a wise move. They can help you navigate the options and hopefully find a policy that fits your situation.

Do I Need A Medical Exam To Qualify For Burial Insurance?

No. Burial insurance is all about skipping the hassle. You won’t need a doctor’s note or a blood sample to qualify. Just answer some basic health questions, and you’re good to go.

Plus, with first-day coverage, you might be approved faster than you can say ‘six feet under.’

What Is The Cost Of Burial Insurance If I Had A Stroke?

The cost of burial insurance after a stroke will depend on your:

- Age

- Coverage amount

- Gender

- General health

- State of residence

- Smoking status

- Type of policy

Here’s a pricing example for a persistent 60-year-old female who have had a stroke:

| FEMALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Here’s a pricing example for a tenacious 60-year-old male who have had a stroke:

| MALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Burial Insurance Underwriting for Stroke

Here’s how these companies decide if you’re insurable:

FIRST – They may ask you a bunch of health questions. Your answers to these questions will determine your eligibility.

SECOND – They’ll take a peek at your prescription history, basically playing detective in your medicine cabinet.

HEALTH QUESTIONS EXAMPLES – You will often find stroke history questions asked in the application form this way:

- During the past 24 months, have you been diagnosed by a physician as having a stroke or other circulatory issues?

- Within the past 2 years, have you had or been diagnosed with stroke or Transient Ischemic Attack (mini-stroke)?

- Within the past 24 months, have you been diagnosed or treated by a member of the medical profession for stroke or transient ischemic attack?

Here are the most common medications for stroke:

- Activase

- Aggrenox

- Clopidogrel

- Coumadin

- Heparin

- Jantoven

- Nimodipine

- Nimotop

- Plavix

- Ticlid

- Warfarin

Information We Need If You Had A Stroke

Here’s what we gotta know to match you up with the best plan and price:

- When did you have a stroke?

- What was your age when you had your stroke?

- What kind of stroke did you have?

- What medications are you taking?

- Do you have any physical impairments resulting from your stroke?

- Can you perform daily living activities on your own?

- Do you require home health care, nursing, or rehabilitation?

Once we know your medical history, we can provide you with the best recommendation.

How To Apply For Burial Insurance After A Stroke

- Work with an Independent Insurance Agent – Skip the big insurance companies and find yourself an independent agent from Funeral Funds. We’ll explain your options like you haven’t taken a medical terminology course.

- Complete the Application Honestly – Be truthful about your stroke and any other health issues. No point fibbing – they’ll find out eventually, and your policy might get revoked.

- Review and Confirm Policy Details – Read the policy details carefully before saying “I do.” Make sure the coverage is what you need and fits your budget.

How Can Funeral Funds Help Me?

Funeral Funds isn’t here to pressure you into buying a plot just yet. We specialize in helping folks like you find the best burial insurance, even if you’ve had a brush with a stroke.

Think of us as the Cupid of life insurance. We work with a bunch of A+ rated companies that understand your situation. We’ll search high and low to find the perfect match, so you can rest easy knowing your loved ones won’t be stuck with a car wash fundraiser.

So, if you’re looking for some peace-of-mind insurance after a stroke, we can definitely help. Fill out the form or give us a call at (888)862-9456.

Frequently Asked Questions

Can I get life insurance if I’ve had a stroke?

Sure, you might even qualify for “first-day coverage” life insurance, which sounds amazing.

Is a stroke a critical illness?

Absolutely. Think of it as a party crasher in your brain – not cool. It can be serious, but the good news is some insurance companies understand that and still offer coverage.

Which insurance is best for patients with stroke?

A first-day coverage final expense insurance is a great option. It’s like a superhero for your loved ones’ wallets, swooping in to cover the costs when you’re no longer around to, you know, pay bills.

Is stroke considered a pre-existing condition in insurance?

Yep, any health thingy you have before applying counts as pre-existing.

Can you be denied life insurance for stroke?

It depends. Recent strokes or needing help with daily activities might make first-day coverage a no-go. But there are other options!

What is my best insurance option if I have a stroke and use a wheelchair?

Guaranteed-issue life insurance is your friend here. No medical exam needed, coverage for everyone – even those who roll in style.

What are the things that may affect my life insurance eligibility if I have a stroke?

The severity of the stroke, home health care, nursing homes, wheelchairs, and your daily living skills all play a role.

Can I get cremation insurance after a stroke?

Absolutely! With the right company, you might even snag first-day coverage.

Is it harder to get life insurance after a stroke?

Maybe. But working with an independent life insurance agent from Funeral

Funds can make it easier. They’re like ninjas, shopping around for the best deal for you.

What is the best age to get life insurance if you’ve had a stroke?

Younger and healthier is always better – keeps those premiums low. But hey, better late than never, right?

What is the average cost of life insurance after a stroke?

Depends on the stroke’s severity, your age, coverage amount, and policy type. It’s like a choose-your-own-adventure for pricing.

Can stroke affect life insurance?

Yes, your premiums might cost more if you have lasting effects. But hey, at least you’re covered!

Can you be rejected for life insurance because of a stroke?

Yes, if you can’t do daily activities on your own, are hospitalized, or live in a nursing home, first-day coverage might be a no. But there are other options!

Is there an age limit for burial insurance with stroke?

Just gotta be between 18 and 89 – that’s the magic zone for burial insurance.

How can you get the best life insurance rates with stroke?

Work with an independent life insurance agent from Funeral Funds – we’ll shop around for you, kind of like a discount coupon clipper for life insurance.

Do you have to tell insurance about TIA or mini-stroke?

Only if they ask about it on the application. But honesty is always the best policy (plus, lying might get you denied coverage).