2024 Burial Insurance With Uncontrolled High Blood Pressure

You can qualify for burial insurance if you have uncontrolled high blood pressure and you are taking medications as prescribed by your doctor.

For this article, we will treat uncontrolled high blood pressure and high blood pressure the same. Just be aware that fewer companies accept uncontrolled high blood pressure than controlled high blood pressure.

Keep reading for some excellent info to help you get an affordable burial insurance policy with many high blood pressure problems.

FOR EASIER NAVIGATION:

- What Is Uncontrolled High Blood Pressure?

- Can I get Burial Insurance If I Have Uncontrolled High Blood Pressure?

- Types of Burial Insurance For People With Uncontrolled High Blood Pressure?

- What Is My Best Insurance Option With Uncontrolled High Blood Pressure?

- Do I Need A Medical Exam?

- How Much Does Burial Insurance Cost If I Have Uncontrolled High Blood Pressure?

- Burial Insurance Underwriting For High Blood Pressure Patients

- How To Get The Best Rates For Burial Insurance

- How To Apply For Burial Insurance With High Blood Pressure

- How Can Funeral Funds Help Me?

- Frequently Asked Questions

What Is Uncontrolled High Blood Pressure?

Uncontrolled high blood pressure, also known as hypertension, is when blood pressure remains consistently elevated above the recommended levels. Normally, blood pressure readings are given in two numbers: systolic and diastolic.

- Systolic pressure is the top number and represents the pressure when your heart beats.

- Diastolic pressure is the bottom number and represents the pressure between beats.

A healthy blood pressure reading is generally considered to be less than 120/80 mmHg. High blood pressure is categorized as:

- Elevated: Systolic pressure of 120-129 and diastolic pressure less than 80 mmHg

- Stage 1 hypertension: Systolic pressure of 130-139 or diastolic pressure of 80-89 mmHg

- Stage 2 hypertension: Systolic pressure of 140 or higher or diastolic pressure of 90 or higher

Uncontrolled high blood pressure is when it consistently reaches stage 2 levels or higher, even with treatment.

There are a number of factors that can contribute to uncontrolled high blood pressure, including:

- Not taking medication as prescribed

- An unhealthy lifestyle, such as a poor diet, lack of exercise, and smoking

- Underlying medical conditions, such as diabetes or kidney disease

Left untreated, uncontrolled high blood pressure can lead to serious health problems, such as heart attack, stroke, kidney failure, and dementia.

Uncontrolled high blood pressure raises a red flag for life insurance companies because it increases your risk of health problems down the line.

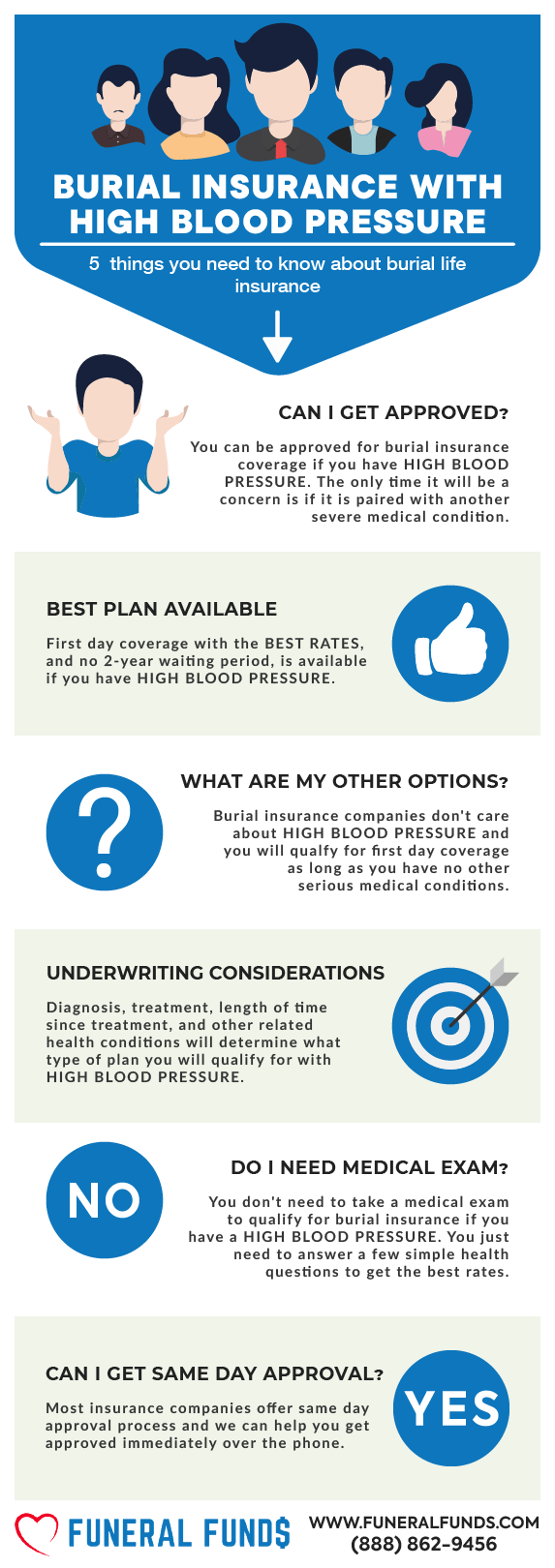

Can I get Burial Insurance If I Have Uncontrolled High Blood Pressure?

Yes, people will often qualify for first-day coverage insurance with no waiting period if they have high blood pressure or uncontrolled high blood pressure, provided they have been taking medications for high blood pressure and following their doctors’ recommendations. These plans for uncontrolled high blood pressure are not available in all states, so feel free to contact us if you have any questions.

Types of Burial Insurance For People With Uncontrolled High Blood Pressure?

First-Day Coverage – This is a no-medical exam life insurance policy. You only need to answer a few health questions. The first-day coverage plan has immediate coverage and no waiting period.

Guaranteed Issue – This is a no medical exam and no health questions insurance policy. Guaranteed issue life insurance policies are designed for people with significant health issues who may not qualify for traditional term life insurance or whole life insurance.

Guaranteed issue whole life insurance comes with a two-year waiting period, and the premiums are higher than first-day coverage insurance. During this waiting period, if you were to pass away, you would not get the full death benefit. The policy would only pay out the premiums you have paid plus 7-10% interest (depending on the insurance carrier.

What Is My Best Insurance Option With Uncontrolled High Blood Pressure?

CONTROLLED AND UNCONTROLLED HIGH BLOOD PRESSURE (with no hospitalization) – First-day coverage is your best option if you have high blood pressure problems. First-day coverage (level benefit plan) and no waiting period are available for people taking medication to control their blood pressure.

UNCONTROLLED HIGH BLOOD PRESSURE WITH 2 OR MORE HOSPITALIZATION IN THE LAST 2 YEARS – If you have had two or more hospitalizations in the last two years, your best option is often guaranteed acceptance life insurance.

Do I Need A Medical Exam?

NO. You don’t need a physical or medical exam to qualify for burial insurance. You will only need to complete a simple health questionnaire to qualify.

The application process is straightforward, and you don’t need to get your medical records from your doctor or send in blood and urine samples.

With first-day coverage insurance, you’ll often get approved by the insurance company within minutes!

How Much Does Burial Insurance Cost If I Have Uncontrolled High Blood Pressure?

The cost of burial life insurance with high blood pressure will depend on your:

- Age

- Coverage Amount

- Gender

- General Health

- State of Residence

- Smoking Status

- Type of Insurance Plan

Burial Insurance Underwriting For High Blood Pressure Patients

Most burial insurance companies offering first-day coverage plans ask some health questions and perform a prescription history check to verify your health.

You will often see health questions for uncontrolled high blood pressure asked this way:

- Have you been diagnosed or treated for uncontrolled high blood pressure within the last 24 months?

- Have you even been medically diagnosed or treated by a member of the medical profession for uncontrolled high blood pressure?

- In the past 10 years, have you opted not to seek treatment, have not taken medication, and or have not followed the prescribed treatment plan following a medical diagnosis for uncontrolled high blood pressure?

Most life insurance companies want you to take medication to control your blood pressure.

Here are some medications the insurance companies will look for to determine if you have uncontrolled high blood pressure:

- Altace

- Amyl Nitrate

- Atacand

- Atenolol

- Avapro

- Avalide

- Amlodipine

- Benicar

- Bystolic

- Carvedilol

- Clonidine

- Chlorthalidone

- Coreg

- Cozaar

- Diovan

- Enalapril

- Exforge

- Hydrochlorothiazide

- Hyzaar

- Furosemide

- Lasix

- Lisinopril

- Lopressor

- Losartan

- Lotrel

- Metoprolol

- Minoxidil

- Monoket

- Propranolol

- Micardis

- Norvasc

- Ramipril

- Spironolactone

- Tekturna

- Triamterene

- Valsartan

- Verapamil

How To Get The Best Rates For Burial Insurance

The best way to get the lowest rates and save money on insurance is to let an independent life insurance agency like Funeral Funds of America compare insurance companies for you. Our independent life insurance experts will help you identify the most affordable final expense life insurance rates.

How To Apply For Burial Insurance With High Blood Pressure

- Work with an Independent Insurance Agent – Ask for assistance from independent insurance agents specializing in underwriting for high blood pressure. An independent insurance agent can help you understand your options and choose the best burial insurance plan that best suits your needs and budget.

- Complete the Application Honestly – When filling out the life insurance health questionnaire, be truthful about your stroke and other health issues. You need to provide accurate details about your health, treatments, and any lifestyle changes you’ve made.

- Review and Confirm Policy Details – Carefully review the policy terms before confirming your acceptance. Make sure the insurance coverage meets your needs and your budget.

How Can Funeral Funds Help Me?

Here at Funeral Funds, we specialize in getting life insurance coverage for applicants with high blood pressure.

We work with many A+ rated insurance companies that specialize in high-risk clients. We will search those companies to find the best rate. We’ll match you up with your best life insurance option.

We will assist you in securing the coverage you need at a rate you can afford. So, if you want to get life insurance with high blood pressure, we can help. Fill out our quote form on this page or call us at (888)862-9456 to get accurate burial insurance quotes.

Frequently Asked Questions

Does high blood pressure disqualify you from life insurance?

No, you can still qualify for first-day coverage insurance with high blood pressure.

Is high blood pressure classed as a critical illness in life insurance?

No, it’s a disease that can lead to other health problems that may be classified as critical illnesses.

Can you get funeral insurance if you have high blood pressure?

Yes, you can even get first-day coverage funeral insurance, or final expense insurance.

Does having uncontrolled high blood pressure affect your insurance rates?

Yes, if you’ve been hospitalized two or more times in the last two years because of uncontrolled high blood pressure, your best option may be guaranteed issue insurance, which is more expensive.

Is high blood pressure a pre-existing condition for insurance?

Yes, any health condition you have before applying for a final expense insurance policy is considered a pre-existing medical condition in life insurance.

Can you get cremation insurance if you have high blood pressure?

Yes, you will qualify for first-day coverage cremation insurance if high blood pressure is your only health impairment.

Does having high blood pressure affect your insurance?

No, as long as you take medications and follow your doctor’s recommendation.