Burial Insurance with Congestive Heart Failure (2024 UPDATE)

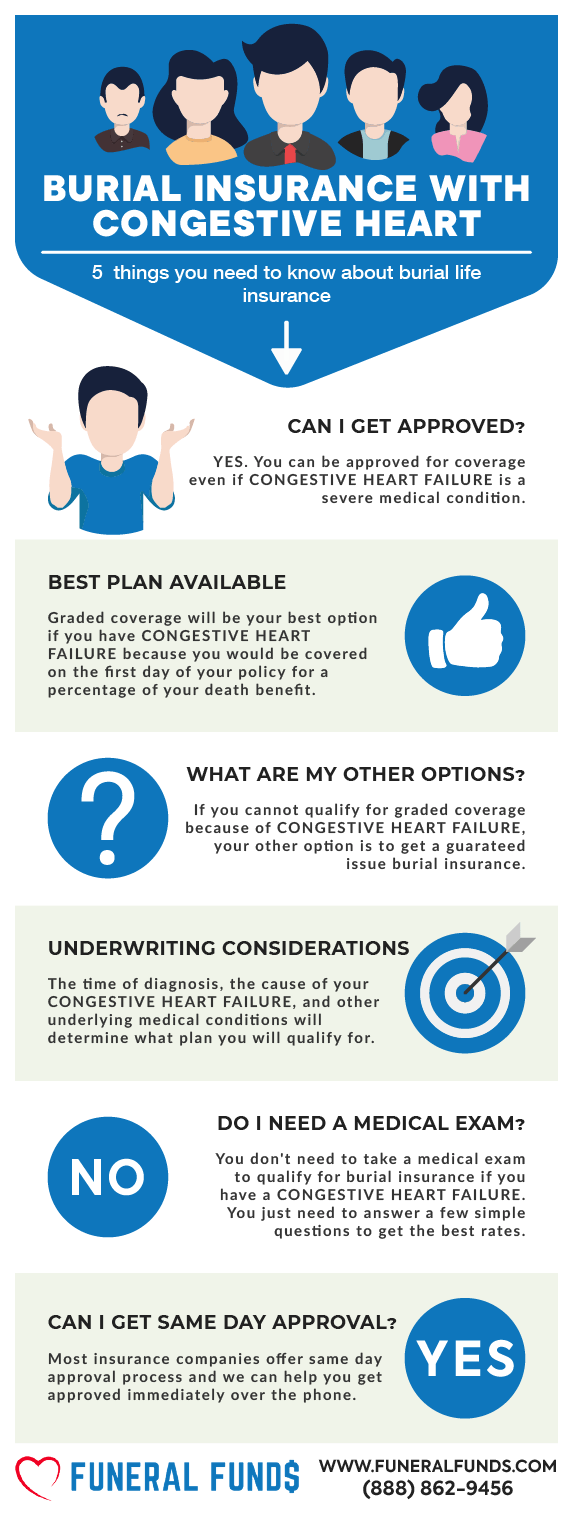

Burial insurance with Congestive Heart Failure may be a big deal, but you can still get first-day coverage, as long as you pick the right company.

Continue reading for an overview of CHF burial insurance underwriting and tips on getting the best and lowest rates possible based on your age, health, and the state you live in.

| TABLE OF CONTENTS | |

|---|---|

What Is Congestive Heart Failure?

Congestive heart failure (CHF), also known as heart failure, is when your heart decides to take a break from being a superstar and can’t pump blood as efficiently as it should. This little slacker move can cause fluid to build up in the lungs and other parts of the body.

Picture your heart as a pump that’s supposed to keep the blood flowing smoothly. When CHF hits, that pump starts slacking off and can’t keep up with the demand. This results in blood backing up in the veins, causing fluid buildup.

But, CHF doesn’t mean your heart has thrown in the towel completely. It just means it’s not working at peak performance. With the right treatment, you can still manage CHF and live an amazing, long life.

Can I Get Burial Insurance If I Have Congestive Heart Failure?

You can totally get burial insurance with congestive heart failure. And here’s the best part: if you’re following your doctor’s advice and treatment, you can qualify for first-day coverage with zero waiting period. How fabulous is that?

What Are The Types Of Burial Insurance Available To People With Congestive Heart Failure?

First-Day Coverage – No need for a medical exam here, darling! Just answer a few health questions, and you’re set. Immediate coverage with zero waiting period. Simple as that!

Modified Coverage – No medical exam is required for this one either. If you can’t swing first-day coverage, this is your next best bet. You’ll get protection from day one, and your benefits will increase over time.

Guaranteed Issue (GI) – Forget the medical exam and health questions! This is for folks who might not qualify for traditional life insurance due to serious health issues.

The catch? A two-year waiting period before the full death benefit kicks in. If you pass away during this time, the policy just pays out the premiums you’ve paid plus a little interest (7-10% depending on the company).

| INSURANCE COMPANY | COVERAGE |

|---|---|

| CICA Life – Superior Choice | 1st-Day Coverage |

| Colonial Penn – Guaranteed Issue | 2-Year Wait |

| Gerber Life – Guaranteed Issue | 2-Year Wait |

| Lincoln Heritage – Modified | 2-Year Wait |

| Mutual Of Omaha – Guaranteed Issue | 2-Year Wait |

What Is My Best Insurance Option If I Have Congestive Heart Failure?

Diagnosed with congestive heart failure? No biggie! Your best move is a first-day coverage plan if you’re following your doctor’s orders to a T.

But if your doctor says you need a heart transplant, then you’ll want to go with a guaranteed issue whole life insurance policy, which comes with a two-year waiting period.

What Is My Burial Insurance Rates If I Have Congestive Heart Failure?

The cost of burial insurance if you have Congestive Heart Failure will depend on your:

- Age

- Coverage amount

- Gender

- General health

- State of residence

- Smoking status

- Type of policy

Looking for the best life insurance rates with a congestive heart failure diagnosis? Partner with the best insurance matchmaker in town, Funeral Funds. We’ll scour the market, compare rates from various carriers, and find your perfect insurance match.

Check out these sample rates for a fabulous 60-year-old female with congestive heart failure:

| INSURANCE COMPANY | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Check out these sample rates for a manly 60-year-old male with congestive heart failure.

| INSURANCE COMPANY | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

By comparing these rates and teaming up with a savvy agency, you can snag the most affordable and perfect burial insurance plan for your needs.

Burial Insurance Underwriting If You Have Congestive Heart Failure

When it comes to getting first-day coverage with congestive heart failure, insurance companies have two tricks up their sleeves:

FIRST – They’ll hit you with a bunch of health questions. Your answers will help them figure out if you’re eligible.

SECOND – They’ll snoop through your prescription history electronically to make sure everything checks out.

HEALTH QUESTIONS:

You will often see CHF asked in the health questionnaire this way:

- Have you ever been diagnosed, treated, or taken medication for Congestive Heart Failure (CHF) or heart failure?

- Have you ever been diagnosed with, or received, or been advised to receive treatment or medication for Congestive Heart Failure?

- Have you been treated for or diagnosed as having Congestive Heart Failure or been advised to have an organ transplant?

- In the past 10 years, have you opted not to seek treatment, have not taken medication, and or have not followed the prescribed treatment plan following a medical diagnosis by a member of the medical profession for Congestive Heart Failure, heart disease, or cardiomyopathy?

PRESCRIPTION HISTORY CHECK:

First-day coverage burial insurance companies want to snoop into your medical records, all based on what pills you’ve been popping.

Prescribed Congestive Heart Failure (CHF) medication can include:

- Apresoline

- Bumetadine

- Captopril

- Carvedilol

- Digoxin

- Eplerenone

- Furosemide

- Imdur

- Isordil

- Lisinopril

- Losartan

- Metolazone

- Metoprolol

- Nitrobid

- Spironolactone

- Torsemide

If you’re popping these pills, brace yourself…the insurance company just might just brand you a Congestive Heart Failure aficionado.

How To Apply For Burial Insurance With Congestive Heart Failure

- Consult with an Independent Insurance Agent – Chat with an independent agent who knows the ropes of heart disease underwriting. They’ll help you explore your options, compare quotes, and find the perfect burial insurance plan.

- Complete the Application Honestly – Complete the application with all the juicy details about your Congestive Heart Failure. Be sure to spill the tea on your health, treatments, and any lifestyle changes.

- Review and Confirm Policy Details – Before you say yes, give those policy terms a thorough once-over. Make sure the coverage fits your needs and budget like a glove.

How Can Funeral Funds Help Me?

Funeral Funds specializes in providing life insurance coverage for individuals with Congestive Heart Failure. We partner with the top-rated insurance carriers experienced in handling high-risk clients.

Think of us as your personal insurance matchmaker. We’ll hook you up with the best coverage at a price that won’t give you heart palpitations. No more insurance red tape – we cut through the BS and get you covered. We’re committed to assisting you qualify for the coverage you need at an affordable rate.

If you’re seeking burial insurance while managing Congestive Heart Failure, we can help. Request a quote by completing our online form or calling (888)862-9456.

Frequently Asked Questions

Can I get life insurance for someone with Congestive Heart Failure?

Sure, but you’ll need their nod to snag that life insurance.

Can someone with Congestive Heart Failure get burial insurance?

Sure thing! Depending on where you reside, you might just qualify for a first-day coverage plan.

Can you get funeral insurance with CHF?

Yes, this type of plan doesn’t even require a medical exam.

Is Congestive Heart Failure an automatic decline?

No, they’ll want to know every little detail about your ticker before they decide if you’re worth covering.

Does life insurance pay out for heart failure?

Yes, how much you will get will depend on the coverage amount you signed up for.

2 Comments

Jacob Cook

I am interested in getting some Burial Insurance

Funeral Funds

Jacob – Use this free quoter form – https://funeralfunds.com/free-quote/