Burial Insurance with Liver Cirrhosis (2024 Update)

Finding burial insurance with liver cirrhosis can be a real headache if you’re new to the insurance game, since only a select few companies are willing to offer first-day coverage for this condition.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with liver cirrhosis, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is Liver Cirrhosis?

Liver cirrhosis is when your liver decides to replace its healthy tissue with scar tissue. This scar tissue isn’t exactly up to par with the liver’s usual duties, so your liver starts slacking off.

Your liver’s attempt to fix itself over time leads to more and more scar tissue, and let’s be real, scar tissue isn’t exactly a superstar at liver functions. It just gets worse from there.

There are many causes of liver cirrhosis, including:

- Alcohol abuse

- Hepatitis B or C infection

- Nonalcoholic fatty liver disease (NAFLD)

- Autoimmune hepatitis

- Primary biliary cholangitis

- Sclerosing cholangitis

- Cystic fibrosis

Liver cirrhosis can be caused by a bunch of things, and while there’s no magic cure, treatments can slow things down and keep the symptoms in check.

Treatment may include:

- Medication to reduce inflammation and scarring

- Medications to control complications, such as fluid buildup or bleeding

- Liver transplant, in severe cases

When it comes to life insurance with liver cirrhosis, here’s what you need to know:

- Cause of cirrhosis: If your liver cirrhosis is a result of something you could have controlled, like binge drinking, insurers might see you as a riskier bet.

- Severity of the condition: How bad your cirrhosis is plays a huge role. Early-stage cirrhosis that’s under control is less of a headache for insurers than severe, complicated cases.

- Overall health: Any other health issues you’ve got going on will also factor into their decision.

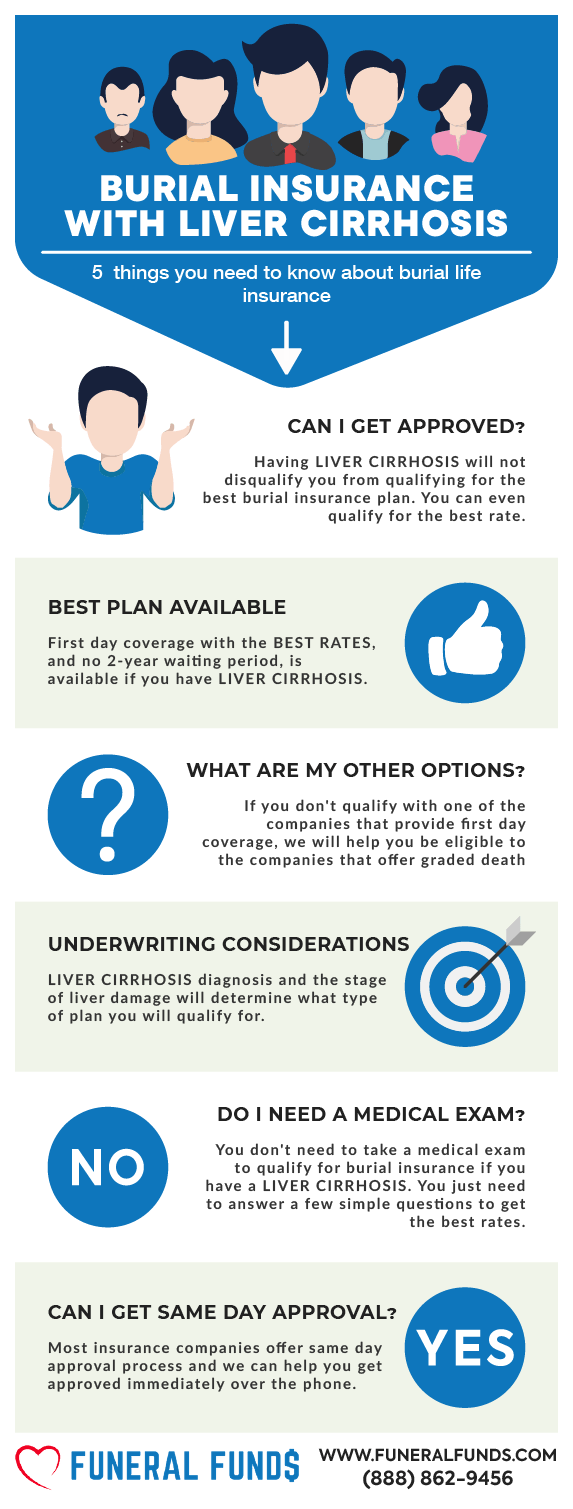

Can I Get Burial Insurance With Liver Cirrhosis?

Absolutely, as long as you find the right insurance company, live in the right zip code, and don’t have too many other health issues in the mix.

What Are Types of Burial Insurance Available For People With Liver Cirrhosis?

First-Day Coverage – This one’s a breeze – no waiting period, no medical exam. Just answer a few simple health questions and your coverage kicks in right after your first premium payment.

Guaranteed Issue – Skip the medical exam and health questionnaire with this option, making it a cinch to get coverage if you have liver cirrhosis. But here’s the catch: it comes with a two-year waiting period. If you pass away within those two years for any health reason, your policy pays out your premium pulse 7-10% interest.

What Is My Best Insurance Option If I Have Liver Cirrhosis?

Liver Cirrhosis Only – If your liver’s in decent shape and you’re on treatment, you might snag first-day coverage. It all depends on your health and where you live.

Past Liver Transplant – If you’ve had a liver transplant, first-day coverage might still be on the table, depending on how many years have passed since the procedure and where you’re located.

Liver Transplant Recommended – If you’re looking at a future liver transplant, your only play might be a guaranteed issue policy with that pesky two-year waiting period.

Do I Need A Medical Exam To Get Burial Insurance?

Nope, you can breathe easy. With liver cirrhosis, you don’t have to take a medical exam. Just answer a few simple health questions, and you’ll usually get approved by the insurance company in no time flat!

And no, you don’t need to fork over medical records or give blood and urine samples either.

What If I’m Declined Coverage Because Of Liver Cirrhosis?

Not every insurer plays by the same rules. Some companies are all about first-day coverage for folks with liver cirrhosis.

Partnering with Funeral Funds of America can help you track down the best options and get the burial insurance you need.

How Much Does Liver Cirrhosis Burial Insurance Cost?

Premiums for burial insurance with liver cirrhosis can be all over the place. They’ll depend on your age, gender, where you live, the type of policy you pick, how much coverage you want, and, of course, the state of your health and how bad your liver cirrhosis is.

Here’s a pricing example for a persistent 60-year-old female with liver cirrhosis:

| FEMALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Here’s a pricing example for a proactive 60-year-old male with liver cirrhosis:

| MALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Burial Insurance Underwriting With Liver Cirrhosis

When you apply for first-day coverage, insurance companies will want to check out your current health with some basic questions on their application form.

Expect questions that might sound something like this:

- Have you ever had, or been diagnosed with, or received, or been advised to receive treatment or medication for liver disease or conditions such as chronic hepatitis or cirrhosis of the liver?

- During the past 24 months, have you been diagnosed with cirrhosis or liver disease?

- In the PAST 10 YEARS, have you opted to NOT seek treatment, have NOT taken medication, and/or have NOT followed the prescribed treatment plan following a medical diagnosis by a member of the medical profession for liver cirrhosis?

And don’t be surprised if they don’t use the exact phrase “liver cirrhosis” – they might phrase it differently, but it’s still asking about your liver health. Make sure to answer honestly because, yes, cirrhosis is a liver disease.

- Have you been diagnosed or treated for any liver condition?

- Have you EVER been medically diagnosed, treated by a member of the medical profession, or prescribed medication for liver disease?

You need to honestly answer “yes” to that health question because cirrhosis is a liver disease.

Liver Transplant

If you’re applying for first-day coverage, you’ll definitely be asked about any liver transplants in the health questionnaire.

Look out for questions like these:

- Do you have an organ or bone marrow transplant? Are you advised to get one?

- Within the LAST 5 YEARS have you been advised to by a member of the medical profession to have an organ transplant?

How To Find Affordable Burial Insurance With Cirrhosis of the Liver

Want the best deal? Go for plans with health questions and first-day coverage. Avoid those two-year waiting period plans – they’ll end up being a pricey mistake you don’t need.

How Can Funeral Funds Help Me?

Forget wasting your time bouncing between insurance companies. We’ve got you covered. We work with top-rated carriers that specialize in high-risk clients.

Our savvy insurance agents will hunt down the best rates for you and make the whole process a breeze.

Just fill out our quote form or give us a call at (888) 862-9456, and we’ll get you a spot-on quote in no time.

Frequently Asked Questions

Can you get life insurance if you have alcoholic-related cirrhosis of the liver?

Absolutely! You might be able to snag burial insurance even with alcoholic cirrhosis. If you’re getting treatment and sticking to your doctor’s orders, you could even score a first-day coverage plan. Just remember, most companies won’t offer first-day coverage if you’re still actively drinking.

Can you be denied insurance if you have liver cirrhosis?

Yup, you can be turned down for first-day coverage with liver cirrhosis. If you’re not following your doctor’s advice, insurance companies might just say “no thanks” to your application.

What are some tips for getting life insurance with liver cirrhosis?

Some tips for getting life insurance with liver cirrhosis are:

- Work with an independent life insurance agent from Funeral Funds who knows their stuff and can help you find a policy that’s right for you.

- Go for a plan that asks health questions rather than one with a lengthy waiting period.

- Be upfront about your health history when applying. Insurance companies will dig into your medical records, so honesty is your best bet.

4 Comments

Renee

Please send information to my email. Thank you.

Funeral Funds

Renee – You can get a free quote by visiting this page – https://funeralfunds.com/free-quote/

Erma brown

I'm trying to get insurance on my boyfriend he had liver cirrhosis

Funeral Funds

Emma – That would be a 2-year waiting period only policy.