Burial Insurance with Atrial Fibrillation or AFib (2024 Update)

Got AFib or had it in the past and thinking burial insurance is out of reach? Think again! We’re pros at snagging you first-day coverage even with a history of AFib.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with AFib or atrial fibrillation, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is Atrial Fibrillation?

Atrial fibrillation, or AFib if you’re feeling fancy, is where your heart’s upper chambers go rogue, beating like a drum solo gone wild instead of a steady rhythm. This chaotic heartbeat can lead to all sorts of trouble – blood clots, stroke, heart failure, and general fatigue that’s not exactly a party.

People with AFib are statistically more likely to face heart-related issues, which makes having burial insurance a no-brainer!

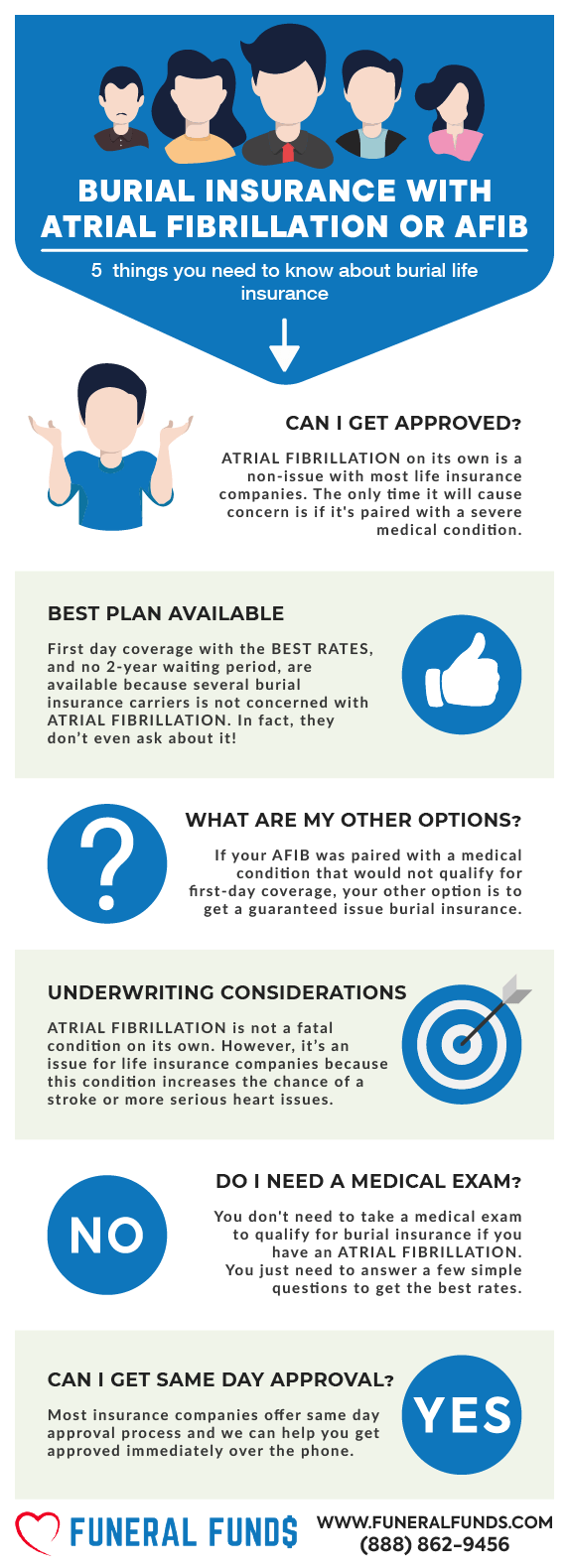

Can I Get Burial Insurance If I Have Atrial Fibrillation?

YES: You can totally grab first-day coverage with some insurers who don’t even ask about AFib on their health questionnaires.

NO: If you’re in the hospital now, or have been hospitalized more than twice in the last two years, or have some other major health woes, you might miss out on first-day coverage.

But don’t sweat it! If first-day coverage isn’t in the cards, you can still get guaranteed-issue burial insurance without those pesky health questions.

What Are The Types Of Burial Insurance Available To People With Atrial Fibrillation?

FIRST-DAY COVERAGE – This is the VIP treatment of burial insurance – no waiting period, and your death benefits kick in right away. Plus, it’s cheaper than guaranteed issue life insurance. Win-win!

GUARANTEED ISSUE LIFE INSURANCE – No medical exam, no health questions, no problem! You’re covered no matter what. But there’s a catch: a two-year waiting period. If you pass away within those two years, the payout is just your premiums plus a bit of interest (7-10% depending on the company).

What Is My Best Insurance Option If I Have Atrial Fibrillation?

If you’ve ever been diagnosed with AFib, treated for it, or even just told you should be treated, your top pick should always be a first-day coverage plan. Some insurance companies don’t even care about AFib or an irregular heartbeat and won’t ask about it on their health questionnaire. So, why settle for less?

Do I Need A Medical Exam To Qualify For Burial Insurance?

Nope! Forget about those medical exams, blood tests, and urine samples. They’re not required for burial insurance approval.

The best plans with first-day coverage just ask a few basic health questions and give you the green light within minutes!

What Is The Cost Of Burial Insurance If I Have Atrial Fibrillation?

The cost of burial insurance will depend on your:

- Age

- Coverage amount

- Gender

- General health

- State of residence

- Smoking status

- Type of policy

Check out these sample rates for a generous 60-year-old female with AFib:

| FEMALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Check out these sample rates for an adventurous 60-year-old male:

| MALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Burial Insurance Underwriting If You Have Atrial Fibrillation

Here’s how some insurance companies check out AFib on their application:

- In the last 12 months, have you received a diagnosis or treatment for atrial fibrillation?

- Have you ever been diagnosed or treated for atrial fibrillation or irregular heartbeat?

- During the past 36 months, have you been hospitalized for heart attack, heart failure, or heart or circulatory surgery, including pacemaker, heart valve replacement, stent implant, or any procedure to improve circulation to the heart?

These are some common meds prescribed for AFib:

- Amiodarone (Cordarone, Pacerone)

- Digoxin (Lanoxin)

- Dofetilide (Tikosyn)

- Flecainide (Tambocor)

- Propafenone (Rythmol)

- Sotalol (Betapace, Sorine)

Information We Need If You Had A History Of Atrial Fibrillation

To get you the best plan and the lowest price, we might ask you a few of these questions:

- Are you diagnosed with atrial fibrillation, when were you diagnosed?

- Are you receiving treatment for atrial fibrillation?

- Are you taking prescription medications?

- Did you have any heart complications from atrial fibrillation?

- Have you been having irregular heartbeats? For how long?

- Have you ever visited an emergency room or been hospitalized due to atrial fibrillation?

- Have you had a stroke or heart attack?

- Have you undergone any treatment or surgery for an irregular heartbeat?

- How long do your irregular heartbeats last?

What If My Application Was Rejected Because Of Atrial Fibrillation?

Been turned down for burial insurance because of AFib? Don’t sweat it! Team up with an independent insurance agency like Funeral Funds. Our savvy agents know the ins and outs of various insurers’ underwriting guidelines, so we can get you approved with another company that offers the lowest rates.

With access to over 20 insurance companies, we’ll help you find a heart-friendly life insurance company that’s just right for you.

How to Get First-Day Coverage With A History Of Atrial Fibrillation

Not all insurance companies treat AFib the same way. The secret to getting a first-day coverage burial insurance plan is working with an independent agency like Funeral Funds.

Our expert agents will compare different insurers that offer first-day coverage and hook you up with the best plan at the best price.

How To Apply For Burial Insurance With Atrial Fibrillation

- Consult with an Independent Insurance Agent – Work with an agent from Funeral Funds who knows their stuff when it comes to AFib underwriting. They’ll help you navigate your options, compare quotes, and pick the burial insurance plan that suits you best.

- Complete the Application Honestly – Choose the plan that fits your needs and budget, and don’t hold back on the details. Be upfront and accurate about your health, treatments, and any lifestyle changes you’ve made.

- Review and Confirm Policy Details – Take a good look at the policy terms before giving your thumbs up. Follow the insurance company’s instructions for submitting your application to avoid any hiccups.

How Can Funeral Funds Help Me?

At Funeral Funds, we’re experts in finding life insurance for folks with a history of atrial fibrillation.

We partner with top-rated insurance companies that offer plans designed for pre-existing conditions. We’ll hunt down the best rate and match you with the perfect life insurance option.

Fill out our quote form on this page or call us at (888) 862-9456 to get accurate burial insurance quotes.

Frequently Asked Questions

Which insurance is best for patients with AFib?

A first-day coverage plan is your golden ticket! These plans kick in right from day one and don’t mess around with waiting periods. Perfect for those with AFib.

Can I get burial insurance after atrial fibrillation treatment?

Absolutely! Some insurers won’t even bat an eye at your AFib treatment on their health questionnaire, making it a breeze to qualify for a first-day coverage plan.

Do I need to tell insurance about atrial fibrillation?

Yes, if the health questionnaire asks about it. Honesty is the best policy!

Can I get insurance if I have atrial fibrillation and am on blood thinners?

For sure! Some insurance companies are totally cool with people on blood thinners.

Is there an age limit for burial insurance with atrial fibrillation?

You can get burial insurance up until age 89, and your policy will keep going strong until you hit 121.