Burial Insurance with Kidney Failure (2024 Update)

You can totally get a burial insurance policy with kidney failure. There are good companies out there that offer first-day coverage just for folks like you who are dealing with kidney issues or dialysis.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with kidney failure, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is Kidney Failure?

Your kidneys, those two bean-shaped buddies in your back, are like the workhorses of your body. They filter waste products out of your blood, like a trusty colander. They also keep your fluids balanced, like making sure your favorite drink isn’t too watery.

But sometimes, these champs get tired and can’t keep up. That’s kidney failure, or end-stage renal disease (ESRD) as the doctors call it.

Kidney functions:

- Filtering waste products and toxins from your blood

- Maintaining a healthy balance of fluids and electrolytes in your body

- Producing hormones that regulate blood pressure and red blood cell production

There are two main ways your kidneys can slow down:

- Acute kidney failure: This hits you suddenly, like when you forget your grocery list. It can happen from illness or injury, but with treatment, your kidneys might perk back up.

- Chronic kidney disease (CKD): This one’s more gradual, like a slow drip in the faucet. It builds up over time, often from conditions like diabetes or high blood pressure. Here, the damage is usually more permanent.

There are ways to help your kidneys keep going:

- Dialysis: This is basically an artificial kidney machine that cleans your blood. There are two options: hemodialysis (think getting your blood filtered at a clinic) and peritoneal dialysis (done at home, like self-care for your kidneys).

- Kidney transplant: This is where a kind stranger or family member gives you one of their healthy kidneys.

If you’re worried about your kidneys, see a doctor. Catching problems early is important! And with a little care, your kidneys might keep on filtering for many years to come.

Can I Get Burial Insurance With Kidney Failure?

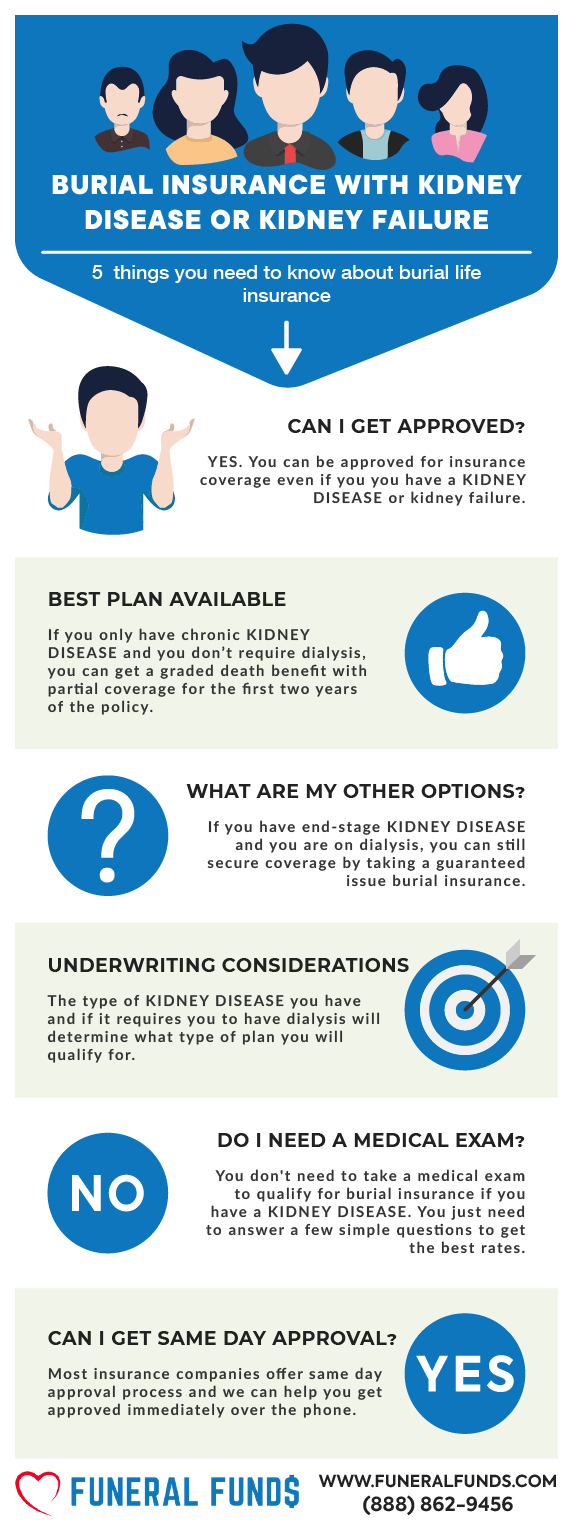

You absolutely can get burial insurance with kidney failure. There are even plans with coverage from day one, no waiting period, if you’re already getting treatment for your kidneys. That way, you can focus on your health without worrying about your burial or cremation expenses.

Prices can vary depending on your age, health, and the amount of coverage you want.

What Is My Best Insurance Option If I Have Kidney Failure?

Chronic Kidney Disease (Renal Failure)

Some companies offer “day one” coverage, meaning you’re insured right away, depending on your zip code. No medical exam, but answer some health questions to get the best rates. Coverage starts when you pay your first premium and lasts your whole life.

Kidney Failure with Dialysis

If you follow your doctor’s treatment plan, you can often still get “day one” coverage. But if you refuse dialysis, your only option is a guaranteed policy with a 2-year wait.

Kidney Transplant

You may qualify for 1st-day coverage if your transplant occured 5 or more years ago (if you go with the right company).

The only other option here is a no-exam, no-questions policy with a 2-year wait. Basically, these policies won’t pay out if you die within 2 years of getting them, but they’ll give you your money back with a little interest.

How Much Does Kidney Failure Insurance Cost?

The cost of burial insurance if you have kidney failure will depend on your:

- Age

- Gender

- State of residence

- Smoking status

- Type of policy

- Coverage amount

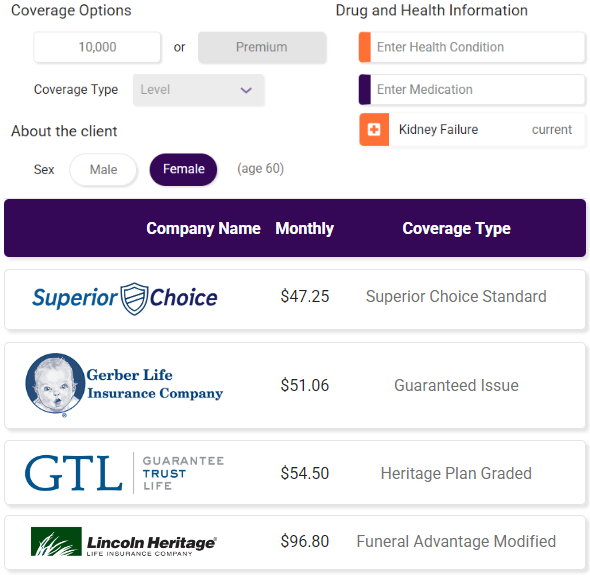

Sample pricing for a 60-year-old female with kidney failure.

Do I Need a Medical Exam for Burial Insurance With Kidney Failure?

Even with kidney failure, getting burial insurance is possible! Forget needles and white coats – you won’t need a medical exam. The application is simple, just answer some basic health questions. No need to dig up old records or provide samples.

The best part? Approval can be super quick, sometimes just minutes!

Burial Insurance Underwriting with Kidney Failure

Life insurance companies with health checks will ask about your health history and meds to figure out if you qualify.

Some common kidney problems or procedures the insurance company may ask about:

- chronic kidney disease

- dialysis

- end-stage kidney failure

- kidney disease

- kidney failure

- kidney transplant

- renal disease

Be honest! If they ask about kidney problems, answer “yes” if you have them.

You will often see kidney disease questions asked this way:

- During the past 24 months, have you been treated for kidney failure or chronic kidney disease?

- Have you ever had, or been diagnosed with, or received or been advised to receive treatment or medication for kidney disease?

- Within the past 12 months, have you been advised to have kidney dialysis?

PRESCRIPTION HISTORY CHECK

The insurance companies will look into your medications to see if you are taking any common medicines for kidney disease.

Here are some common kidney problem medications:

- Alucaps

- Amlodipine

- Atorvastatin

- Azathioprine

- Calcitriol

- Cinacalcet

- Cyclosporine

- Fosrenol

- Levocarnitine

- Mycophenolate

- Perindopril or Ramipril

- Phosex

- Prednisolone

- Renagel

- Sirolimus

- Tacrolimus

If you take certain medications, the insurance companies will assume you have kidney function problems.

What If My Application Was Rejected Because of Kidney Failure?

Getting rejected for life insurance because of kidney problems can be frustrating. But don’t worry – there are still options! We specialize in helping clients with kidney issues find more understanding life insurance companies.

We work with a variety of insurers, so even if you’ve been denied before, there’s a good chance we can find a plan that fits your needs. Don’t let a past rejection discourage you – we can help you qualify for the life insurance coverage you deserve.

Information We Need To Help You With This Insurance

To find the best life insurance rates for your kidney situation, we’ll need some details:

- Are you taking medications for your kidney disease? What are they?

- Are you undergoing dialysis?

- Do you have other health conditions aside from kidney disease?

- Have you been hospitalized because of kidney disease?

- Have you been recommended to receive a kidney transplant?

- When were you diagnosed with kidney disease?

- What type of kidney disease do you have?

Honesty is key here! The more info you give, the better chance we have of finding affordable coverage.

Basically, the more transparent you are, the cheaper your premium might be.

Best Burial Insurance Companies For People With Kidney Failure

Your pricing will vary based on your age, gender, zip code, and other factors. There are some companies you should avoid as they charge high rates and require waiting periods if you are approved.

For example, here is pricing for a 60-year-old female with kidney failure undergoing dialysis.

- Superior Choice (Recommended) – 60-year-old female

- FIRST-DAY COVERAGE

- Coverage: $10,000

- Premium: $47.25

- Gerber Life (Avoid) – 60-year-old female

- 2-year Waiting period

- Coverage: $10,000

- Premium: $51.06

- Lincoln Heritage (Avoid) – 60-year-old female

- 2-year Waiting period

- Coverage: $10,000

- Premium: $96.80

How To Find The Best Burial Insurance For Kidney Failure?

Even with kidney failure, finding the right burial insurance is possible! Look for companies offering “day one” coverage specifically for people with kidney failure. These plans get you insured immediately, without a waiting period.

Remember, the best plan for you will depend on your age, health, and desired coverage amount. So work with an independent agent from Funeral Funds to help you compare prices from different companies to find the most affordable option that fits your needs.

How Can Funeral Funds Help Me?

Finding burial insurance can be overwhelming, especially for people with health concerns. But Funeral Funds can simplify the process.

We work with highly rated insurance companies that specialize in offering coverage to people with health conditions. Forget spending hours comparing plans – our licensed agents will search for the best rates and get you a quote quickly and easily. No pressure, just straight answers.

Fill out our online quote form or call us at (888) 862-9456 to get started.

Frequently Asked Questions

Can I increase the coverage amount for burial insurance if my kidney failure worsens over time?

Yes, some plans let you increase coverage if your kidney condition worsens. But there might be rules, so check with your insurer first.

Are there waiting periods associated with burial insurance for kidney failure, and how do they work?

Yes, some plans, especially for folks needing a transplant, have waiting periods. During this time, you might not get the full payout, but your beneficiary would get your premiums back.

Can I purchase burial insurance for a family member with kidney failure?

Yes, absolutely! But your family member needs to be on board with it.

Do burial insurance policies cover expenses beyond funeral costs for individuals with kidney failure?

Yep! While burial insurance is meant for final expenses, your beneficiary can use the money however they see fit.

If I’ve had a kidney transplant, does that impact my eligibility for burial insurance?

You’ll likely qualify for a plan, but there’s often a two-year waiting period unless 5 years have passed and you must live in an acceptable correct zip code.

1 Comment

David Roberson

I have End Stage Renal Diease and on dialysis