Affordable Burial Insurance with a Pacemaker (2024 Update)

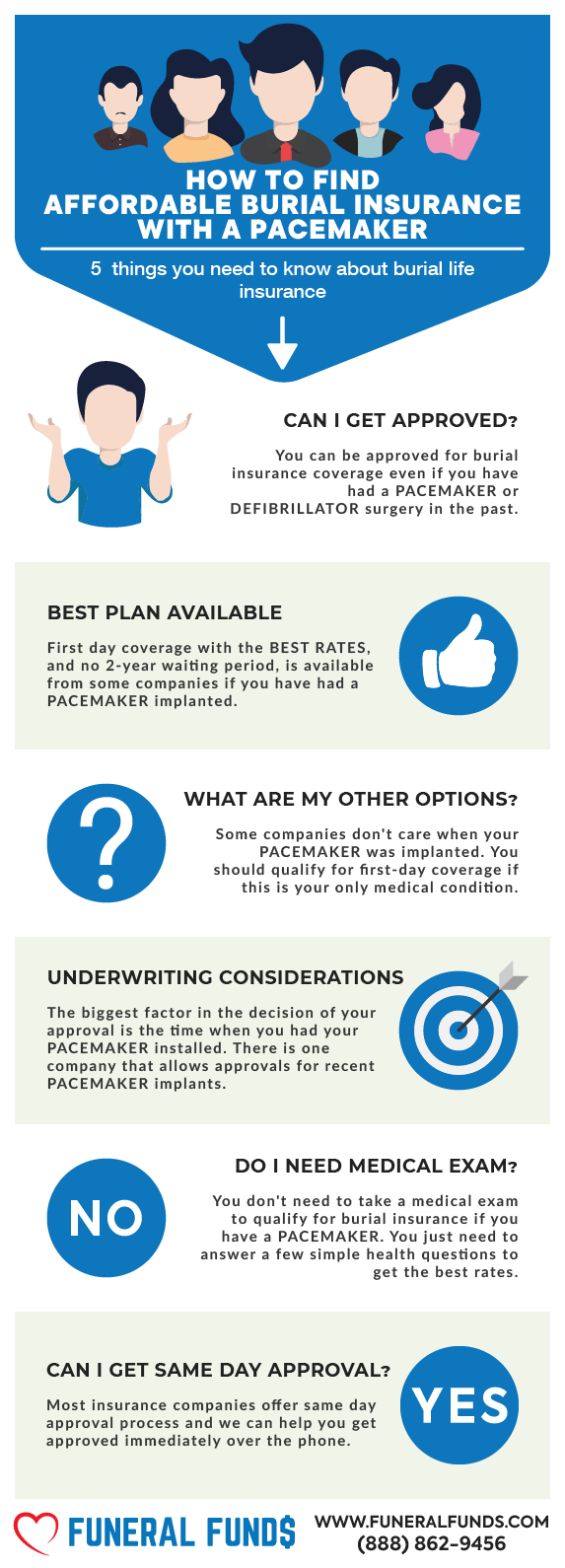

Got a pacemaker and worried about getting burial insurance? Relax! Even with that little chest gadget keeping your heart in check, you can still get a funeral or burial life insurance policy with first-day coverage.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with pacemaker, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is A Pacemaker?

A pacemaker is a tiny, battery-powered hero planted in your chest to make sure your heart doesn’t slack off and get too slow.

How it works:

Electricity to the Rescue: This bad boy sends electrical pulses to your heart, keeping it beating on a steady rhythm, like the DJ of your life.

Leads: Think of these thin wires as the backstage crew, delivering those life-saving pulses directly into your heart.

Pulse Generator: The star of the show – the main unit with the battery and computer – hangs out under your skin, making sure everything runs smoothly.

Heart Issues That Might Need a Pacemaker:

- Bradycardia – When your heart’s taking it too easy, either because of blocked arteries or some pesky meds.

- Tachycardia – Your heart’s got a need for speed, beating faster than it should.

- Atrial fibrillation – When your heart decides to play its own beat – irregularly, of course.

- Chronic arrhythmia – More serious irregular beats, often thanks to heart disease.

- Cardiomyopathy – When your heart muscle’s acting out, but no one’s sure why.

- Syncope – Fancy word for passing out, like your heart hit the snooze button.

- Congestive heart failure – When your heart’s just plain tired of doing its job.

What Is My Best Insurance Option If I Have A Pacemaker?

First things first – your pacemaker counts as circulatory surgery.

How long you’ve had it is going to make a big difference in what kind of insurance deal you can get.

IF YOUR PACEMAKER WAS IMPLANTED OVER TWO YEARS AGO

Lucky you! Most burial insurance companies will roll out the red carpet with level rates. You’ll also get first-day coverage, meaning you’re covered from day one, and your premium? It’ll be as low as it can go.

If it’s been over two years since your implant, you’re sitting pretty with the best options.

IF YOUR PACEMAKER WAS IMPLANTED WITHIN THE LAST 24 MONTHS

Now, if your pacemaker’s a bit newer, here’s the deal: The top insurance companies will ask, “Have you been in the hospital twice in the last two years?” If you can confidently say, “Nope!” then you’re golden for first-day coverage – assuming the right plan is available in your zip code.

But if you’ve had two or more hospital stays recently, or you’re still camped out in the hospital, your best bet is guaranteed-issue whole life insurance. Sure, there’s a two-year waiting period, but trust me, it’s way better than leaving yourself high and dry without coverage. Don’t wait until it’s too late!

Do I Need A Medical Exam To Qualify For Burial Insurance?

Good news! No medical exam needed to get burial insurance with a pacemaker. That’s right – no poking, no prodding, no blood, and no pee tests. All you’ve got to do is answer a few basic health questions.

The process is so simple that you’ll probably get the green light from the insurance company within minutes.

Burial Insurance Underwriting If You Have A Pacemaker

Now, here’s the scoop on how burial insurance companies size you up if you’ve got a pacemaker. When they do underwriting, they’ll toss a few health questions your way and peek at your prescription history to double-check everything’s in order.

You will typically see it asked this way:

- Within the past 2 years, have you had or been diagnosed with heart or circulatory surgery?

- During the past 24 months, have you been diagnosed with heart or circulatory surgery, including pacemaker, heart valve replacement, bypass angioplasty, stent implant, or any procedure to improve circulation to the heart?

- Have you been medically diagnosed as having or been treated for heart or circulatory surgery (including pacemaker, bypass, heart valve replacement, angioplasty, or stent implant) or any procedure to improve circulation to the heart or brain?

Since your pacemaker counts as heart or circulatory surgery, every life insurance company will want to know about it. They’ll ask if you’ve had any heart or circulatory surgery, usually within a certain timeframe. If your pacemaker fits that timeframe, you’ll be marking “yes” on the form.

How Much Insurance Do I Need If I Have A Pacemaker?

Figuring out how much burial insurance to buy depends on your situation. You want enough to cover your funeral, burial, and any final expenses.

Start by estimating your end-of-life costs. The funeral’s usually the big-ticket item, but don’t forget about lingering medical bills, living expenses, credit card debt, and anything else you might leave behind.

How Should I Pay My Premiums?

The smartest way to handle your premiums? Let your bank do the heavy lifting! Set up a bank draft from your savings or checking account, and let the money magic happen. The bank will automatically take care of your premium each month, so you can kick back and relax – no more stressing about your policy lapsing because you forgot to pay. Easy breezy!

Information We Need If You Have A Pacemaker?

When you’re applying for burial insurance with a pacemaker, spill the tea on your health. The more info you give us, the better we can understand your situation and hook you up with an accurate quote.

We’ll need to ask a few health questions, so don’t be shy – help us help you get the best deal.

- When did you have your pacemaker implanted?

- Why did you have a pacemaker?

- Do you have symptoms of heart disease?

- Have you had a stroke or heart attack?

- Have you been hospitalized in the last two years?

- Are you currently taking any prescription drugs?

How To Find Affordable Burial Insurance With A Pacemaker

Getting affordable burial insurance with a pacemaker is all about finding the right company that’s cool with your situation. And guess what? We’ve got you covered! We know exactly which A-rated life insurance carriers will offer you low-cost burial insurance without making you jump through hoops like medical exams.

At Funeral Funds, we’re pros at finding you the best coverage at a price that won’t break the bank. Our agents know all the insider tips to score you the most affordable burial insurance, so you can rest easy knowing you’re covered – without blowing your budget.

Benefits Of Burial & Funeral Insurance

Here are some of the benefits of purchasing a burial or funeral policy:

- No medical exam or doctor’s visit is required – Getting approved is a breeze – no need to deal with doctors or exams.

- Ease of issue – Qualifying for coverage is as simple as it gets.

- No Money Down to get approved – That’s right, you can get approved and start your policy whenever you want without paying a dime upfront.

- Level premium – Your premium stays locked in – no surprise hikes, ever.

- Fixed death benefit – Your payout amount won’t shrink, no matter what.

- Permanent protection – As long as you keep up with your premiums, your policy’s yours for life – no takebacks from the insurance company.

- Tax-free – When the time comes, your beneficiary gets the death benefit tax-free.

- Cash value builds up – This isn’t just any policy – it’s whole life insurance that builds cash value over time, giving you a little something extra in your pocket.

How Can Funeral Funds Help Me?

Got a pacemaker and feeling frustrated with insurance shopping? Don’t sweat it! Let Funeral Funds make your life easier.

We know the struggle of finding the right policy when you’ve got a pacemaker. That’s why we’re here to work with you, side by side, to find a plan that checks all your boxes. Forget wasting your time bouncing between insurance companies – we’ll handle the heavy lifting.

At Funeral Funds, we specialize in locking down life insurance for folks with pacemakers. We’ve got connections with tons of A-rated insurance companies that know how to deal with high-risk clients like a boss. Our goal? To secure the coverage you need at a price that won’t make your wallet cry.

Fill out our quote form on this page or call us at (888) 862-9456, and we can give you an accurate quote.

Frequently Asked Questions

Is a pacemaker implant considered surgery in life insurance?

Absolutely, a pacemaker implant is considered surgery in life insurance.

Do I need to tell insurance about my pacemaker?

You bet! You must inform your insurer about your pacemaker. If you skip this detail, you risk having your policy voided.

Is there an age limit for burial insurance with a pacemaker?

Yes, you can get burial insurance up until you’re 89, and it’ll stay active until you hit 121.

Can I get insurance if I have a pacemaker and blood thinners?

Yes, having a pacemaker and being on blood thinners doesn’t disqualify you from getting insurance.

What are the things that may affect my eligibility if I have a pacemaker?

Your eligibility could be influenced by several factors, including:

- Why you got the pacemaker

- How long you’ve had it

- The condition of the pacemaker

- Your age

- Your health history

- The type of life insurance you’re going for

- The insurer’s underwriting rules

Which insurance is best for patients with pacemakers?

First-day coverage is your best bet if you have a pacemaker.

Can I qualify for cremation insurance with a pacemaker?

Yes, you can qualify for cremation insurance even with a pacemaker. You might even snag a first-day coverage plan.