2025 Burial Insurance with ALS – Lou Gehrig’s Disease

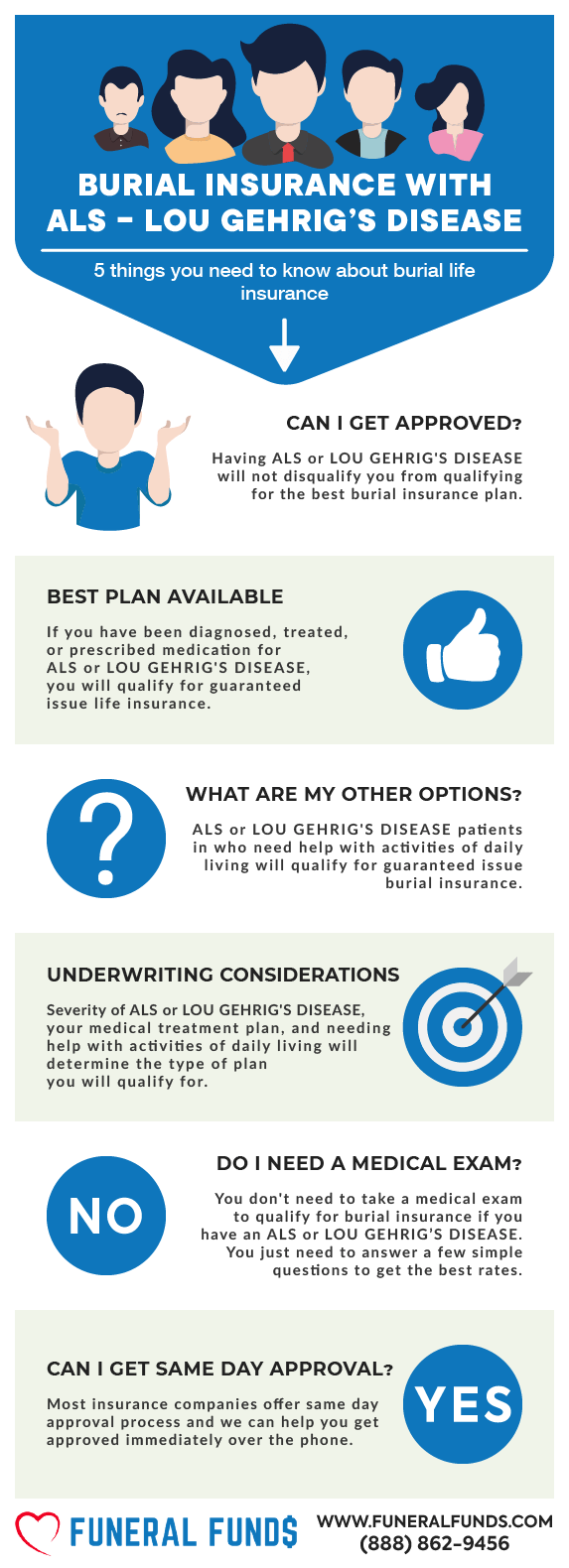

If you’re looking for burial insurance with ALS (Amyotrophic Lateral Sclerosis) or Lou Gehrig’s disease, you need to be aware that your burial, cremation, final expense, and life insurance options are limited.

!!! READ THIS FIRST !!!

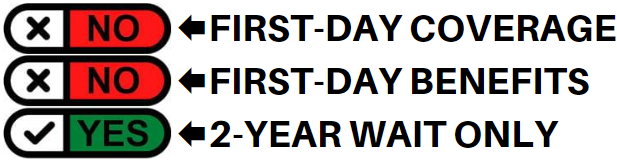

ALS (Lou Gehrig’s Disease) is a life-threatening health condition, and there are no insurance companies that offer 1st-day coverage to ALS patients.

We recommend Lou Gehrig’s Disease patients purchase a guaranteed issue life insurance that asks no health questions but does come with a 2-year waiting.

If you or a family member has been diagnosed with ALS or Lou Gehrig’s disease and would like more information about burial insurance, keep reading this article.

| TABLE OF CONTENTS | |

|---|---|

What Is My Best Insurance Option If I Have A History Of ALS?

There are two types of ALS the insurance companies care about:

- Sporadic

- Familial

If you have ALS or Lou Gehrig’s disease, then a guaranteed issue life insurance policy that asks no health questions is your best option.

Guaranteed issue policies don’t ask you about your medical history or current health. The insurance company will automatically approve your application, and the policy will take effect within a day.

You can qualify for a guaranteed final expense insurance policy if you are between the age of 40 and 85. You are a U.S citizen, and you live in a state where guaranteed issue policies are sold.

Guaranteed issue burial insurance has a 24-month graded period, but if you pass away in the first two years as a consequence of your ALS, your beneficiary will receive your premiums plus 10% interest.

Your beneficiaries will also receive a full death benefit if you die from an accident or other catastrophic events in the first 24 months.

Best Option: Guaranteed issue burial insurance

BENEFITS OF GUARANTEED ISSUE POLICIES

- Easy to obtain. It is very easy to qualify and get coverage. You don’t need to take a medical exam or answer questions regarding your health. You will be automatically approved if you meet the age requirements and the policy is available in your state.

- The death benefit is fixed. The amount of your death benefit is guaranteed never to decrease. Your beneficiaries will receive the exact amount of your policy when you pass away.

- Fixed monthly premiums. Your monthly insurance bill is fixed and will never go up. The rate is computed at your current age and will never increase regardless of your age or medical condition.

- The benefit is tax-free. Your death benefit will be paid directly to your beneficiaries tax-free when you pass away.

- Your policy will never expire. A guaranteed issue is a whole-life policy that will last your whole life. It will never expire as long as monthly premiums are paid on time.

- Your policy is not cancelable. Your policy cannot be canceled by the life insurance company as long as you pay your premium.

- Cash value accumulation. Guaranteed issue life insurance has a cash value component. The cash value can accumulate over time.

- You can choose a minimal amount of coverage. The death benefit for a guaranteed acceptance policy ranges from $1,000 to $25,000.

DISADVANTAGES OF GUARANTEED ISSUE LIFE INSURANCE

There are three major disadvantages of guaranteed issue life insurance that you should be aware of:

- Guaranteed issue policies have a minimal amount of coverage. These policies only offer a maximum of $25,000 in coverage. If you want to cover lost wages or your mortgage balance in the event of premature death, guaranteed issue policies will not be a great option.

- Guaranteed issue policies are more expensive than traditional term or whole life policies. The burial insurance companies will charge you more because they take more risks to insure you without knowing your medical condition. If you’re planning to buy several guaranteed issue policies from different companies to get higher coverage than $25,000, you can do it, but you need to be aware that it will be really expensive.

- Guaranteed issue life insurance has a mandatory two-year waiting period. There is no full coverage for the first two years. If you die by the onset of ALS, this plan will not pay. Your beneficiary will only receive the return of the premium plus some interest. Once the two years have passed, even if it’s a day after, your beneficiary will be fully paid out the amount of your full coverage.

WHY DO YOU NEED TO GET GUARANTEED ISSUE LIFE INSURANCE IF YOU HAVE ALS?

There is no known cure for ALS or Lou Gehrig’s disease, and no effective treatment was discovered to stop or reverse the progression of this condition. The life expectancy of people with ALS is two to five years.

Buying burial insurance is a must for a patient with ALS who is confronted with the reality of death. The sooner you get covered, the better because of the two-year waiting period. The sooner you work on the waiting period, the sooner you will have full coverage.

If you just received a recent diagnosis, there is a good chance that you will outlive the two-year limitation if you start now. Additionally, your monthly premium is computed based on your current age. You will save on premium if you apply NOW!

What Types Of Burial Insurance Should I Avoid?

| PLANS TO AVOID | WHY? |

|---|---|

| Term life | Premiums increase after 5 years. Coverage ends after 80. |

| Pre-paid funeral plans | Expensive |

| Universal life | Tied with stocks |

| No health questions policies | With 2-year waiting period |

| Plans offering "teaser rates" | $9.95 per unit plans or $1 buys $100,000 coverage |

| Over priced plans | Insurance from TV and junk mail |

| Plans that accept mail-in payments | Risky |

| Plans that accept Direct Express | High lapse rate |

| Plans that accept Credit Cards | High lapse rate |

What Type Of Burial Insurance Is Best?

| FUNERAL FUNDS PLAN BENEFITS | INCLUDED |

|---|---|

| 1st Day Coverage | YES |

| Rates NEVER Increase | YES |

| Coverage NEVER Decreases | YES |

| Easy to get approved | YES |

| No Medical Exam | YES |

| Same Day Approval | YES |

| Death Claims Pay Fast | YES |

| Builds cash value | YES |

| Coverage Up To Age 121 | YES |

Do I Need A Medical Exam To Qualify For Burial Insurance?

You are NOT required to take a medical exam to qualify for burial insurance with ALS.

When you apply for burial insurance, you only have to answer some basic questions about your health. The application process is simple, and you don’t need to provide medical records or blood and urine samples.

You’ll get the official approval from the insurance company often within minutes!

Burial Insurance Underwriting If You Have ALS

Burial insurance companies have two ways of underwriting:

FIRST – They may ask you a series of health questions. Your answers to their questions will determine your eligibility.

SECOND – They will electronically review your prescription history to verify your health.

HEALTH QUESTIONS:

- Have you ever been diagnosed, treated, or prescribed Lou Gehrig’s disease (ALS)?

- During the past 24 months, have you been treated for neuromuscular diseases including Lou Gehrig’s disease, multiple sclerosis, epilepsy, and Parkinson’s disease)?

- Have you ever been diagnosed with, received, or been advised to receive treatment or medication for Amyotrophic Lateral Sclerosis (ALS)?

Every life insurance company wants to know if you have ALS. Insurance companies that ask about ALS in their application will flat-out decline your application for first-day coverage.

When you have ALS or Lou Gehrig’s disease you cannot qualify for life insurance with medical underwriting.

PRESCRIPTION HISTORY CHECK:

There are two drugs approved for ALS treatment:

- Riluzole (Rilutek)

- Edaravone (Radicava)

If you are taking any of these drugs, the insurance company will know that you have ALS, and they will decline your application for a first-day coverage plan.

How Much Insurance Do I Need If I Have ALS?

The amount of burial insurance you should buy varies depending on your personal and financial circumstances. However, burial insurance should cover the cost of your funeral, burial, and final expenses.

The first step to figuring out how much burial insurance you need is to know your end-of-life expenses. Your funeral cost is often the biggest single expense you need to pay. Other end-of-life expenses to consider are your outstanding medical bills, living expenses, credit card bills, and other debts.

Here’s an example of a funeral cost breakdown from the National Funeral Directors Association.

| AVERAGE FUNERAL COST WITH VIEWING AND BURIAL | |

|---|---|

| Non-declinable basic services | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Hearse | $325 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Metal casket | $2,500 |

| Vault | $1,572 |

| Median Cost of a Funeral With Viewing and Burial | $9,420 |

| AVERAGE FUNERAL COST WITH VIEWING AND CREMATION | |

|---|---|

| Non-declinable basic services fee | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Cremation fee (if firm uses a third-party crematory) | $368 |

| Cremation Casket | $1,310 |

| Urn | $295 |

| Median Cost of a Funeral with Viewing and Cremation | $6,970 |

| Rental Casket | $995 |

| Alternate Cremation Container | $150 |

How Should I Pay My Premiums?

The best way to pay your premium is through a savings or checking account. We recommend you set a bank draft from your savings or checking account. That way, the bank will automatically pay your premium each month, and you don’t need to worry about your policy lapsing due to non-payment.

ALS And Burial Insurance Riders

Insurance policy riders add benefits to your policy. Adding insurance riders will enhance your policy to fit your needs. Some riders are built into your policy, while other riders can be added at an additional cost. Most riders are affordable, and it involves little to no underwriting.

Here’s a list of common burial insurance riders:

| FUNERAL FUNDS ADD-ONS | AVAILABILITY |

|---|---|

| Terminal Illness Add-On Benefit | Included with most plans |

| Nursing Home Care Add-On Benefit | Included with most plans |

The Best Guaranteed Issue Life Insurance Policy

The best-guaranteed-issue life insurance policy will not make you wait more than two years to take effect. Some plans have THREE or even FOUR-year waiting periods. It’s insane! Avoid these plans at all costs.

The coverage comes into effect in two years with guaranteed issue life insurance. It is the shortest period possible before your coverage is in full effect. You don’t have to wait for more than that.

Your application will be easy because there are no medical exams or health questions. Guaranteed issue life insurance has a two-year waiting period, if you die in the first two years as a consequence of your organ transplant, you will get your premiums back plus 10% interest.

Other Common Uses For Final Expense Life Insurance With ALS

All of these examples are appropriate uses for Final Expense Life Insurance:

- Burial insurance plan with ALS

- Cremation insurance plan with ALS

- Funeral home insurance plan with ALS

- Final Expense insurance plan with ALS

- Prepaid funeral plan insurance with ALS

- Mortgage payment protection plan with ALS

- Mortgage payoff life insurance plan with ALS

- Deceased spouse’s income replacement plan with ALS

- Legacy insurance gift plan to family or loved ones with ALS

- Medical or doctor bill life insurance plan with ALS

We can help you with any of the plans above. Your pricing will depend on your age, health, and coverage amount for each program option.

How Can Funeral Funds Help Me?

Finding a policy with ALS needn’t be frustrating; working with an independent agency like Funeral Funds will make the process easier and quicker.

We will work with you every step to find the plan that fits your financial requirements and budget. You don’t have to waste your precious time searching for multiple insurance companies because we will do the dirty work for you.

We work with many A+ rated insurance carriers that specialize in covering high-risk clients like you. We will search all those companies and match you up with the best burial insurance company that gives the best rate.

We will assist you in securing the coverage you need at a rate you can afford. So, if you are looking for ALS funeral insurance, or ALS burial insurance, or ALS life insurance, we can help.

Fill out our quote form on this page or call us at (888) 862-9456, and we can give you an accurate quote.

12 Comments

Barry Andrews

I've been diagnosed with ALS a year ago.. I'm still able to take care of my needs.. I would like a quote.

Funeral Funds

Barry – Your pricing will depend on your age (which you did not disclose) and what state you live in (not all plans are available in all states). Give us a call and we can get you the quote you requested. (888) 862-9456

Michelle

My first symptoms of ALS occurred in 2009, but was diagnosed in 2011. I had severe symptoms ranging from shortness of breath, balance problems, couldn't walk without a walker or a power chair, I had difficulty swallowing and fatigue. I was given medications which helped but only for a short burst of time, then I decided to try alternative measures and began on ALS Formula treatment from Herbal Health Point, It has made a tremendous difference for me. I had improved walking balance, increased appetite, muscle strength, improved eyesight and others.

Funeral Funds

Michelle – It's great to hear that you are doing so well! We wish you continued health and improvement in the future!

Carlos Benita

My mom ALS (amyotrophic lateral sclerosis) symptoms started out with a "foot drop" on her left foot. From there her left leg lost all muscle tone and all the entire left leg muscles was almost gone. Also her fingers and thumbs "contract" at times. Left arm is losing muscle tone too,she have been suffering from amyotrophic laterals sclerosis (ALS) disease for the last seven years and had constant pain which really get us worried, especially in her knees, the only treatment for this ALS (amyotrophic lateral sclerosis) is natural organic treatments to remedy to all the Motor Neuron Disease including ALS.

Funeral Funds

Carlos – Thank you for sharing that information and we wish your mother comfort and healing.

Howard Barksdale

i was diagnosed 2011. i was diagnosed with the bulbar form of ALS and was given one year to live. My symptoms progressed quickly. Soon i was having difficulty breathing, swallowing and even walking short distances. With the help of Rich Herbal Garden natural herbs I have been able to reverse my symptoms using diet, herbs, which i feel has made the most difference. The ALS natural formula immensely helped my condition, it reversed my ALS. my slurred speech. And then the inability to eat without getting choked, breathing, and coughing. gradually disappeared. I’m now playing golf again. and i turned 69 today. i am glad to get my life back DON’T GIVE UP HOPE!!!

Funeral Funds

Howard – That is a terrific recovery! We are so happy for your encouraging thoughts and health recommendations you shared with us all!

marian cooker

My first symptoms of ALS occurred in 2009, but was diagnosed in 2011. I had severe symptoms ranging from shortness of breath, balance problems, couldn't walk without a walker or a power chair, i had difficulty swallowing and fatigue. I was given medications which helped but only for a short burst of time, then i decided to try alternative measures and began on ALS Formula treatment. I have improved walking balance, increased appetite, muscle strength, improved eyesight and others.

Funeral Funds

Marian – It's terrific that you have seen improvement with your new treatment! We wish you continued health and happiness in the future!

Katherine Bhana

ALS is a cruel disease. My mum is 83 and had great difficulty speaking and swallowing much of anything. Food was getting trapped in her throat and blocking her air way was happening more often. she battled for each breath. The riluzole did very little to help her. The medical team did even less. Her decline was rapid and devastating.

Meyer Odette

Last year, my 68-year-old partner was diagnosed with Lou Gehrig's disease also known as ALS. Speaking and swallowing were two of his challenges. His collapse was swift and catastrophic, and neither the riluzole nor the medical staff did much to aid him. He would not have survived if our primary care physician hadn't given him attentive care and attention, as the hospital center didn't provide any psychological support. His fall was abrupt and catastrophic. His hands and legs gave way to weakness in his arms. This year our family physician suggested using natural herbs centre for ALS/MND treatment, which my husband has been receiving for a few months now. I'm delighted to say that the treatment greatly reduced and reversed his symptoms of ALS, he no longer requires a feeding tube, sleeps soundly, works out frequently, and is now very active. In the hopes that it could be useful, I thought I would relate my husband's tale; in the end, you have to do what suits you the best.