2024 Bipolar Disorder Burial Insurance

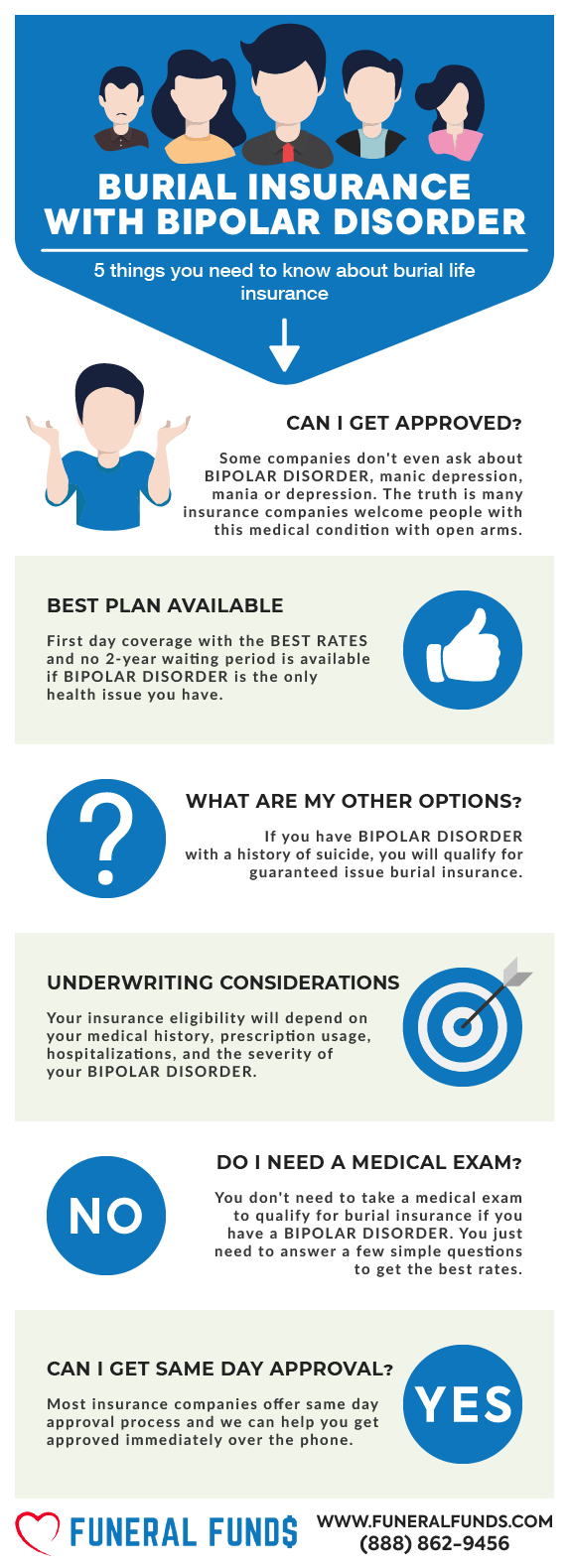

Securing affordable Bipolar disorder burial insurance has come a long way in the last decade. Life insurance companies now better understand people with Bipolar disorder than they believed not so long ago.

Today, it is possible to purchase burial insurance from many companies if you have Bipolar disorder. Even if you have life insurance declined due to hospitalization in the past.

We work with clients who have Bipolar disorder, and we can confidently say that they receive first-day coverage…especially those who don’t have other medical issues.

FOR EASIER NAVIGATION:

- What Is My Best Insurance Option If I Have a History of Bipolar Disorder?

- What Types of Burial Insurance Should I Avoid?

- What Type of Burial Insurance Is Best?

- If I Have Bipolar Disorder, Do I Need A Medical Exam to Qualify for Burial Insurance?

- Burial Insurance Underwriting If You Have Bipolar Disorder

- How Much Insurance Do I Need If I Have Bipolar Disorder?

- How Should I Pay My Premiums?

- Bipolar Disorder and Burial Insurance Riders

- Benefits of Bipolar Disorder Burial Insurance

- How to Get the Best Burial Insurance Rates for Bipolar Disorder Patients?

- How Can Funeral Funds Help Me?

- Additional Questions & Answers On Bipolar Disorder Burial Insurance

What Is My Best Insurance Option If I Have A History Of Bipolar Disorder?

If you have Bipolar disorder, we can quickly get you approved for a level death benefit plan with no waiting period and 1st-day coverage.

Most burial insurance companies do not care whether you have:

Bipolar 1 Disorder – characterized by one or more manic episodes that last at least seven days. Bipolar 1 disorder is marked by extreme manic episodes in that the person needs immediate hospital care. Typically patients will experience periods of depression at the same time.

Best Option: Level death benefit with first-day coverage

Bipolar 2 Disorder is a milder form of mood elevation where one or more major depressive episodes alternate with episodes of hypomania. Hypomanic episodes are not as high as those with Bipolar 1 disorder.

Best Option: Level death benefit with first-day coverage

Cyclothymic Disorder – this is a milder form of Bipolar disorder characterized by hypomanic symptoms alternating with brief periods of depression that last for at least two years.

Best Option: Level death benefit with first-day coverage

Rapid cycling – four or more mood episodes happening within 12 months. Some people experience high to low or vice-versa within a week or even within a single day.

Best Option: Level death benefit with first-day coverage

Whatever type of Bipolar disorder you have, you can get affordable burial insurance coverage that you and your loved ones deserve.

What Types Of Burial Insurance Should I Avoid?

| PLANS TO AVOID | WHY? |

|---|---|

| Term life | Premiums increase after 5 years. Coverage ends after 80. |

| Pre-paid funeral plans | Expensive |

| Universal life | Tied with stocks |

| No health questions policies | With 2-year waiting period |

| Plans offering "teaser rates" | $9.95 per unit plans or $1 buys $100,000 coverage |

| Over priced plans | Insurance from TV and junk mail |

| Plans that accept mail-in payments | Risky |

| Plans that accept Direct Express | High lapse rate |

| Plans that accept Credit Cards | High lapse rate |

What Type Of Burial Insurance Is Best?

| FUNERAL FUNDS PLAN BENEFITS | INCLUDED |

|---|---|

| 1st Day Coverage | YES |

| Rates NEVER Increase | YES |

| Coverage NEVER Decreases | YES |

| Easy to get approved | YES |

| No Medical Exam | YES |

| Same Day Approval | YES |

| Death Claims Pay Fast | YES |

| Builds cash value | YES |

| Coverage Up To Age 121 | YES |

If I Have Bipolar Disorder, Do I Need A Medical Exam To Qualify For Burial Insurance?

Your burial insurance policy will not require a medical exam, blood draw, or urine sample. Because life insurance with depression or bipolar disorder is a simplified issue, all you need to do is answer some health questions.

The medical exam is bypassed as well as the lengthy underwriting process. You’ll get the official approval from the insurance company often within minutes!

Burial Insurance Underwriting If You Have Bipolar Disorder?

The bipolar disorder life insurance underwriting process consists of health questions and a prescription history check. This information will enable the insurance company to verify your burial insurance eligibility for immediate protection.

HEALTH QUESTIONNAIRE:

Many burial insurance health questionnaires don’t even ask about Bipolar, manic depression, mania, or depression.

Since most insurance carriers don’t ask about Bipolar disorder, it means they are accepting of this condition.

PRESCRIPTION HISTORY CHECK

Most people take medication to better cope and function with Bipolar disorder.

Here’s a list of Bipolar disorder medications insurance companies are looking for. These prescription medications indicate to the insurance company that you may have bipolar disorder:

- Alprazolam (Xanax)

- Aripiprazole (Abilify)

- Asenapine (Saphris)

- Carbamazepine (Tegretol)

- Cariprazine (Vraylar)

- Clonazepam (Klonopin)

- Clozapine (Clozaril)

- Diazepam (Valium)

- Divalproex sodium (Depakote)

- Haloperidol (Haldol)

- Lamotrigine (Lamictal)

- Lithium (Lithobid)

- Lorazepam (Ativan)

- Loxapine (Loxitane)

- Olanzapine (Zyprexa)

- Quetiapine (Seroquel)

- Risperidone (Risperdal)

- Topiramate (Topamax)

- Valproic Acid (Depakene)

- Ziprasidone (Geodon)

There are many other effective bipolar medications on the market right now. It won’t make any difference if you take one or more of these medications to keep your bipolar under control.

Your application will be approved as long as you have no other serious medical condition.

How Much Insurance Do I Need If I Have Bipolar Disorder?

The amount of burial insurance you should buy varies depending on your personal and financial circumstances. However, burial insurance should cover the cost of your funeral, burial, and final expenses.

The first step to figuring out how much burial insurance you need is to know your end-of-life expenses. Your funeral cost is often the biggest single expense you need to pay. Other end-of-life expenses to consider are your outstanding medical bills, living expenses, credit card bills, and other debts.

Here’s an example of a funeral cost breakdown from the National Funeral Directors Association.

| AVERAGE FUNERAL COST WITH VIEWING AND BURIAL | |

|---|---|

| Non-declinable basic services | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Hearse | $325 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Metal casket | $2,500 |

| Vault | $1,572 |

| Median Cost of a Funeral With Viewing and Burial | $9,420 |

| AVERAGE FUNERAL COST WITH VIEWING AND CREMATION | |

|---|---|

| Non-declinable basic services fee | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Cremation fee (if firm uses a third-party crematory) | $368 |

| Cremation Casket | $1,310 |

| Urn | $295 |

| Median Cost of a Funeral with Viewing and Cremation | $6,970 |

| Rental Casket | $995 |

| Alternate Cremation Container | $150 |

How Should I Pay My Premiums?

The best way to pay your premium is through a savings or checking account. We recommend you set a bank draft from your savings or checking account. That way, the bank will automatically pay your premium each month, and you don’t need to worry about your policy lapsing due to non-payment.

Bipolar Disorder And Burial Insurance Riders

You may have the option to add a policy rider(s) to your basic policy. Insurance riders add benefits to your policy. Adding insurance riders can enhance your policy to fit your specific needs.

Some riders can be added to your policy without additional cost. However, some riders come with some extra costs. Don’t worry; riders are affordable and involve little to no underwriting.

| FUNERAL FUNDS ADD-ONS | AVAILABILITY |

|---|---|

| Terminal Illness Add-On Benefit | Included with most plans |

| Nursing Home Care Add-On Benefit | Included with most plans |

Benefits Of Bipolar Disorder Burial Insurance

There are many benefits of owning a bipolar disorder burial life insurance policy:

- Ease of issue – Easy to qualify and get insurance coverage. No medical exam is needed; you are only required to answer a few health questions.

- Level premium – Your premium will never increase. It is locked into a rate at your current age, and the price will never go up regardless of advancing age or medical conditions.

- Fixed death benefit – Your death benefit is fixed and guaranteed to never decrease for any reason.

- Tax-free – The death benefit payout is paid to your beneficiary tax-free

- Not cancelable – Your policy can never be canceled by the life insurance company as long as premium payments are made on time.

- You can get a much smaller amount of coverage – Burial insurance can range from $1,000 to $50,000

- Cash value builds up – Burial insurance is whole life policies that build cash value over time.

- Peace of mind – knowing that your burial expenses won’t be a financial burden to your loved ones when you die is comforting.

How To Get The Best Burial Insurance Rates For Bipolar Disorder Patients?

If you’re looking to get the best rates possible with Bipolar disorder, it is essential to manage your condition by taking your medication as prescribed. Following your doctor’s orders is not only good for your health, but it’s good for your wallet as well!

Bipolar disorder can cause you emotional strain and stress, leading you to smoke to find relief. You must be aware that smoking is not only terrible for your lungs but can also rob your wallet regarding life insurance premiums for smokers.

A smoker’s life insurance rate will double or even triple your monthly premiums.

One of the great things you can do to save money and lower your rates is to kick your bad smoking habit before applying for burial insurance. Quit smoking, and you will enjoy a lower monthly premium and savings.

The best way to get the lowest burial insurance rate is to let us shop around for you with the many different companies we work with.

How Can Funeral Funds Help Me?

Instead of wasting hours talking to different agents and answering the same questions repeatedly, let us do the work for you to find affordable bipolar final expense insurance. Fill out the instant QUOTE form on this page, and we will give you the best rates available for Bipolar disorder.

Funeral Funds is an independent insurance agency that can shop your application to many companies available. This way, you can be sure that you will get the best carrier that favors Bipolar disorder.

We work with the top-rated life insurance companies in the United States, many of which offer immediate coverage at the lowest rates. We work with clients with Bipolar regularly; we have experience helping people with Bipolar disorder find the best burial insurance policy at affordable rates.

If you need help finding Bipolar disorder burial insurance or bipolar disorder final expense insurance, please don’t hesitate to contact us at (888)862-9456.

Additional Questions & Answers On Bipolar Disorder Burial Insurance

Can you get life insurance if you have bipolar disorder?

Yes, you can get life insurance if you have bipolar disorder. You may even qualify for a first-day coverage plan with no waiting period even if you have bipolar disorder.

Is bipolar disorder a pre-existing condition for life insurance?

Yes, bipolar disorder is a pre-existing condition for life insurance. However, you may still be able to get life insurance coverage with a pre-existing condition if you meet the requirements of the insurer.

Do I need to tell insurance about bipolar disorder?

Yes, you need to tell insurance about bipolar disorder. This is important because if you do not disclose your condition and then make a claim, the insurer may deny the claim.

Can a person with bipolar disorder get burial insurance?

Yes, a person with bipolar disorder can get burial insurance. You can qualify for a first-day coverage plan for whatever type of bipolar disorder you have.

Do I need to take a medical exam if I have bipolar disorder?

No, you do not need to take a medical exam if you have bipolar disorder. However, the insurer may still require you to answer health questions to qualify for coverage.

Is there an age limit for burial insurance with bipolar disorder?

Most life insurance companies offer burial insurance for bipolar disorder up to 85 years old.

Can bipolar disorder be considered a critical illness in life insurance?

Bipolar disorder can be considered a critical illness in life insurance. If you have bipolar disorder and die from the condition, your beneficiary would receive a payout from the life insurance policy.

Is bipolar disorder considered a terminal illness?

Bipolar disorder is not considered a terminal illness.

Can you get first-day coverage insurance if you have bipolar disorder?

Yes, you can get first-day coverage insurance if you have bipolar disorder. This means that you do not have to wait before the policy covers you.

What are the things that may affect my eligibility if I have bipolar disorder?

The things that may affect your eligibility if you have bipolar disorder include your type of bipolar disorder, how well it is controlled, and your overall health.

What is the life expectancy after bipolar disorder?

The life expectancy after bipolar disorder varies depending on the individual. However, people with bipolar disorder generally have a normal life expectancy if they receive treatment.

Which insurance is best for patients with bipolar disorder?

The best insurance for patients with bipolar disorder is a life insurance policy that offers a first-day coverage plan. This type of policy will provide coverage for people with bipolar disorder regardless of age.

Is bipolar disorder disease a disability?

Bipolar disorder is not a disability. However, some symptoms of bipolar disorder may qualify you for disability benefits.

Can I qualify for cremation insurance with a history of bipolar disorder?

Yes, you can qualify for cremation insurance with a history of bipolar disorder. The insurer will likely require you to answer health questions to qualify for coverage, but you should be able to get coverage if you have the condition.

How do you get life insurance after a bipolar disorder diagnosis?

The best way to get life insurance after a bipolar disorder diagnosis is to speak with an insurance broker. The broker will work with you to find a policy that meets your needs and covers your condition.

What is my best insurance option if I have bipolar disorder?

Your best insurance option if you have bipolar disorder is a life insurance policy that offers first-day coverage. This policy will provide coverage for you, no matter your age.

Is bipolar disorder fatal in life insurance?

Bipolar disorder is not fatal in life insurance. However, if you die from the condition, your beneficiary would receive a payout from the life insurance policy.

Can you be denied insurance for bipolar disorder?

You can be denied insurance for bipolar disorder if you have a recent hospitalization because of this condition. However, the insurer may still offer you coverage if you answer health questions to qualify.

Is there a waiting period for life insurance with bipolar disorder?

There is no waiting period for life insurance with bipolar disorder. You can be covered by the policy on the first day you purchase it.

Can bipolar disorder affect your life insurance rates?

Bipolar disorder can affect your life insurance rates. This is because the condition can increase your risk of death. However, you may be able to get a policy that covers you even if you have bipolar disorder.

Can bipolar disorder medication affect my premium?

Bipolar disorder medication can affect your premium. This is because the medications may increase your risk of death. However, you may be able to get a policy that covers you even if you are taking bipolar disorder medication.

What are the premiums for burial insurance with bipolar disorder?

The premium for burial insurance with bipolar disorder depends on your age, gender, location, coverage amount, and general health.

What is the average cost of life insurance for someone with bipolar disorder?

The average cost of life insurance for someone with bipolar disorder may vary depending on your age, health, and other factors.

What is the best time to buy life insurance?

The best time to buy life insurance is when you are young and healthy. This will ensure that you receive the best rates and coverage.

Do I need life insurance if I have bipolar disorder?

You may need life insurance if you have bipolar disorder. This is because the condition can increase your risk of death. You should speak with an insurance broker to find a policy that meets your needs.

Can bipolar disorder patients get final expense insurance?

Yes, bipolar disorder patients can get final expense insurance. The insurer will likely require you to answer health questions to qualify for coverage, but you should be able to get coverage if you have the condition.

Is bipolar disorder covered by a critical illness rider?

A critical illness rider does not typically cover bipolar disorder. However, you should consult an insurance broker to find a policy that meets your needs.

Can bipolar disorder affect life insurance?

Yes, bipolar disorder can affect life insurance. This is because the condition can increase your risk of death. However, you may be able to get a policy that covers you even if you have bipolar disorder.

Can you be rejected for life insurance because of bipolar disorder?

You can be rejected for life insurance if you have a recent hospitalization because of bipolar disorder. However, the insurer may still offer you coverage if you answer health questions to qualify.

How can you get the best life insurance rates with bipolar disorder?

You can get the best life insurance rates with bipolar disorder by buying a policy when you are young and healthy. You should also answer all of the health questions on the application accurately.

What is the best insurance option for people with bipolar disorder?

The best insurance option for people with bipolar disorder may vary depending on your individual needs. You should speak with an insurance agent from Funeral Funds to find a policy that meets your specific needs.

What are the best life insurance companies for bipolar disorder?

The best life insurance companies for bipolar disorder may vary depending on your needs. You should speak with an insurance agent from Funeral Funds to find a policy that meets your specific needs.

What are some tips for getting life insurance with bipolar disorder?

Some tips for getting life insurance with bipolar disorder include buying a policy when young and healthy, answering all health questions accurately, and choosing a reputable life insurance company.

1 Comment

Liana

thanks for info