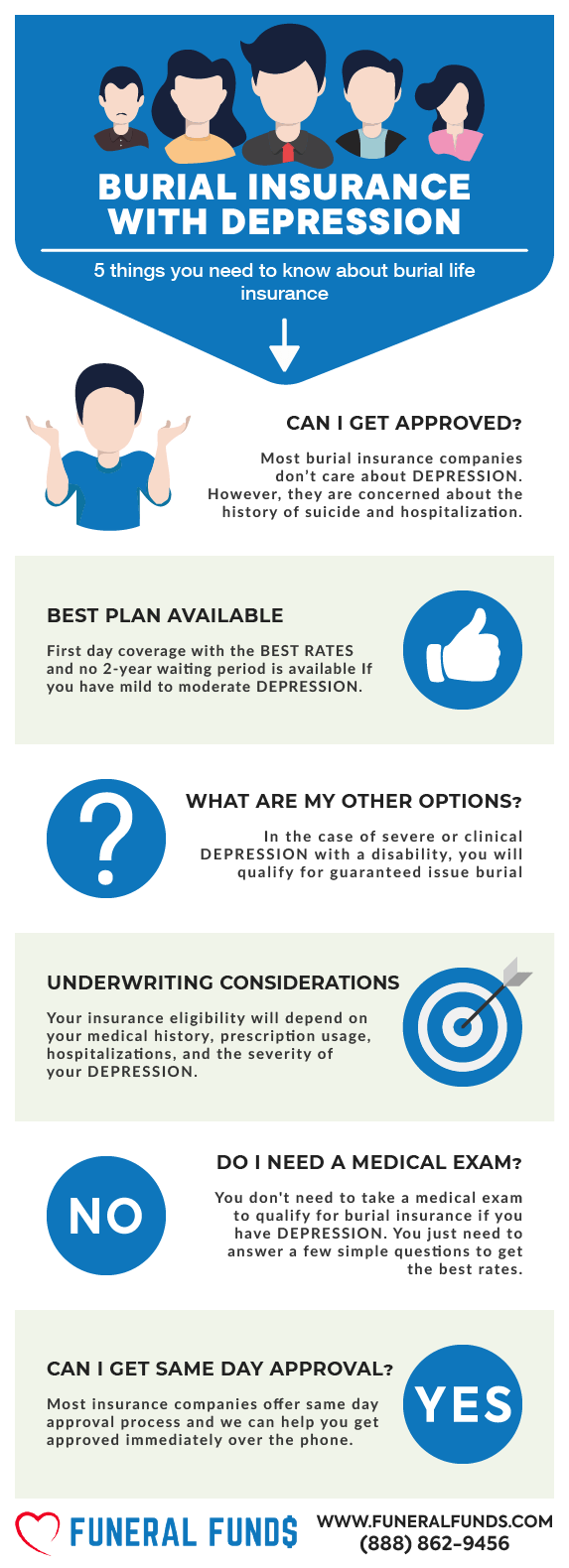

2024 Burial Insurance With Depression

Getting burial insurance with depression has never been easier. Most burial insurance companies will easily accept people with depression. Most companies don’t even ask about depression in their health questions.

If you have depression, you will be eligible for instant coverage if you select the correct burial insurance company. You will benefit by paying the lowest premium and you are protected from the first day you purchased the policy.

FOR EASIER NAVIGATION:

- What Is My Best Insurance Option If I Have a History of Depression?

- What Types of Burial Insurance Should I Avoid?

- What Type of Burial Insurance Is Best?

- If I Have Depression, Do I Need A Medical Exam to Qualify for Burial Insurance?

- Burial Insurance Underwriting If You Have Depression

- How Much Insurance Do I Need If I Have Depression?

- How Should I Pay My Premiums?

- Depression and Burial Insurance Riders

- Types of Depression and Burial Insurance

- How Can Funeral Funds Help Me?

- Additional Questions & Answers On Burial Insurance With Depression

What Is My Best Insurance Option If I Have A History Of Depression?

MILD DEPRESSION

You have mild depression if:

- Your depression is well controlled, and you are taking only one medication

- You follow the treatment plan prescribed by your doctor

- You are not receiving psychiatric treatment

- You have no history of hospitalization due to depression

If your depression is mild, you can qualify for a level death benefit that covers you from the first day with no waiting period.

If you die one day after the policy is in force, your beneficiaries will receive 100% of the death benefit.

Best Option: Level Death Benefit (First-day Coverage)

MODERATE DEPRESSION

You have moderate depression if any of these conditions apply to you:

- You are taking more than one medication

- You are receiving psychiatric treatment

If you have moderate depression, you can still qualify for a level death benefit.

Best Option: Level Death Benefit (First-day Coverage)

MAJOR DEPRESSION

You have severe depression if:

- You have hospitalization because of depression

- Your depression caused a disability

- You have a previous suicide attempt on your record

- You are prescribed multiple heavy medications for depression and schizophrenia

A person with depression can experience temporary hospitalization. It will not affect your burial insurance eligibility if you have been temporarily hospitalized due to major depression.

The reality is, that only a few insurance carriers have a health question that asks if you have been hospitalized within the last 6 or 12 months. Since so many other companies do not have this sort of question, hospitalization is not an issue in most cases.

Best Option: Level Death Benefit (First-day Coverage)

SEVERE CLINICAL DEPRESSION WITH DISABILITY

Suppose your depression is so severe that you are on disability because of it. In that case, you can qualify for a level death benefit if you can perform normal activities of daily living.

Best Option: Level Death Benefit (First-day Coverage)

What Types Of Policies Should I Avoid?

| PLANS TO AVOID | WHY? |

|---|---|

| Term life | Premiums increase after 5 years. Coverage ends after 80. |

| Pre-paid funeral plans | Expensive |

| Universal life | Tied with stocks |

| No health questions policies | With 2-year waiting period |

| Plans offering "teaser rates" | $9.95 per unit plans or $1 buys $100,000 coverage |

| Over priced plans | Insurance from TV and junk mail |

| Plans that accept mail-in payments | Risky |

| Plans that accept Direct Express | High lapse rate |

| Plans that accept Credit Cards | High lapse rate |

What Type Of Burial Insurance Is Best?

| FUNERAL FUNDS PLAN BENEFITS | INCLUDED |

|---|---|

| 1st Day Coverage | YES |

| Rates NEVER Increase | YES |

| Coverage NEVER Decreases | YES |

| Easy to get approved | YES |

| No Medical Exam | YES |

| Same Day Approval | YES |

| Death Claims Pay Fast | YES |

| Builds cash value | YES |

| Coverage Up To Age 121 | YES |

If I Have Depression, Do I Need A Medical Exam To Qualify For Burial Insurance?

Burial insurance policies don’t require a medical exam, and some don’t even have health questions to answer. That’s right, no health questions!

You will qualify even if you have severe depression. The company will issue you a policy if you meet the age requirement and the policy is available in your state.

Burial Insurance Underwriting If You Have Depression

The underwriting process for burial insurance with depression is simple. The underwriter will assess your health through the health questionnaire and check your prescription history. Your answer to the health questions and the medications you take will determine if your application will be approved or denied.

The Health Questionnaire For Burial Insurance With Depression

Insurance companies rarely ask about depression and antidepressant medications in their health questionnaires.

Most insurance companies don’t ask about depression at all. If they do, they only ask about major depression, bipolar, or hospitalizations for depression or thoughts of suicide.

Depression is a non-issue with most burial insurance companies.

Prescription History Check For Depression

Every burial insurance company with underwriting (health questions) will check your prescription history to verify your health status. If you are taking various medications to manage your condition, it is perfectly fine with most burial insurance companies.

Here is a list of depression prescription medications that most burial insurance carriers will accept for first-day coverage:

- bupropion (Wellbutrin, Forfivo, Aplenzin)

- citalopram (Celexa)

- clomipramine (Anafranil)

- desipramine (Norpramin)

- desvenlafaxine (Pristiq, Khedezla)

- duloxetine (Cymbalta)

- escitalopram (Lexapro)

- fluoxetine (Prozac, Sarafem)

- fluvoxamine (Luvox)

- imipramine (Tofranil)

- isocarboxazid (Marplan)

- levomilnacipran (Fetzima)

- maprotiline (Ludiomil)

- mirtazapine (Remeron)

- nortriptyline (Pamelor)

- paroxetine (Paxil, Pexeva, Brisdelle)

- phenelzine (Nardil)

- rimipramine (Surmontil)

- selegiline (Emsam)

- sertraline (Zoloft)

- tranylcypromine (Parnate)

- trazodone (Oleptro)

- venlafaxine (Effexor XR)

- vilazodone (Viibryd)

- vortioxetine (Brintellix)

The only way these medicines would be an issue is with the most severe forms of depression and hospitalizations for depression or thoughts of suicide.

How Much Insurance Do I Need If I Have Depression?

The amount of burial insurance you need varies depending on your personal and financial circumstances, but it should cover the cost of your end-of-life expenses.

The first step to figuring out how much burial insurance you need is to know your end-of-life expenses. Your funeral cost is often the biggest single expense you need t pay. Other end-of-life expenses to consider are your outstanding medical bills, living expenses, credit card bills, and other debts.

Here’s an example of a funeral cost breakdown from the National Funeral Directors Association.

| AVERAGE FUNERAL COST WITH VIEWING AND BURIAL | |

|---|---|

| Non-declinable basic services | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Hearse | $325 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Metal casket | $2,500 |

| Vault | $1,572 |

| Median Cost of a Funeral With Viewing and Burial | $9,420 |

| AVERAGE FUNERAL COST WITH VIEWING AND CREMATION | |

|---|---|

| Non-declinable basic services fee | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Cremation fee (if firm uses a third-party crematory) | $368 |

| Cremation Casket | $1,310 |

| Urn | $295 |

| Median Cost of a Funeral with Viewing and Cremation | $6,970 |

| Rental Casket | $995 |

| Alternate Cremation Container | $150 |

How Should I Pay My Premiums?

The best way to pay your premium is through a savings or checking account. We recommend you set a bank draft from your savings or checking account. That way, the bank will automatically pay your premium each month, and you don’t need to worry about your policy lapsing due to non-payment.

Depression And Burial Insurance Riders

Insurance policy riders add benefits to your basic life insurance policy. You can customize your policy by adding insurance riders to enhance it and ensure it fits your specific needs.

There is an additional cost if you add riders to your policy. Riders are affordable, and they involve little to no underwriting.

| FUNERAL FUNDS ADD-ONS | AVAILABILITY |

|---|---|

| Terminal Illness Add-On Benefit | Included with most plans |

| Nursing Home Care Add-On Benefit | Included with most plans |

Types Of Depression And Burial Insurance

MAJOR DEPRESSIVE DISORDER OR CLINICAL DEPRESSION

Is a severe mood disorder that causes severe symptoms. It affects how you feel and think, and the way you handle daily activities such as eating, working, and sleeping. The symptoms of depression must be present for at least two weeks to be diagnosed with major depression.

Eligibility: Major depressive disorder or Clinical depression may or may not be concerned about this condition depending on your medical background, prescription usage, and if you have had hospitalizations or thoughts of suicide.

DYSTHYMIA OR PERSISTENT DEPRESSIVE DISORDER

Is also called function depression. Dysthymia is a depression that lasts for at least two years. A person diagnosed with this condition may feel sadness and have a problem sleeping, but it doesn’t stop them from doing their daily activities. A person may have major depression and periods of less severe symptoms lasting for at least two years.

Eligibility: Dysthymia or persistent depressive disorder does not impact your ability to qualify for the best burial plans available.

POSTPARTUM DEPRESSION

It’s a significant depression experienced by women during pregnancy or after the baby’s delivery. Postpartum depression can make new mothers feel sad, anxious, or tired and make it difficult to complete everyday care activities for themselves and their babies.

Eligibility: Postpartum depression does not impact your ability to qualify for the best burial plans available.

SEASONAL AFFECTIVE DISORDER

Is characterized by depression during the winter months. Lack of sunlight is primarily to blame for SAD. It makes people more irritable, anxious, and tired during winter. Symptoms of winter depression include social withdrawal, weight gain, or weight gain. This type of depression generally lifts during summer and spring.

Eligibility: Seasonal affective disorder has no impact on your ability to qualify for the best burial plans available.

PSYCHOTIC DEPRESSION

Occurs when a person has clinical depression coupled with some form of psychosis, such as having delusions and hallucinations or hearing sounds or seeing sights that others cannot hear or see. Psychotic depression requires more attention because it can create severe problems if not treated correctly.

Eligibility: Psychotic Depression may or may not impact your ability to get burial insurance. Your eligibility will depend on your unique medical background, prescription usage, and if you have had hospitalizations or thoughts of suicide.

BIPOLAR DISORDER OR MANIC-DEPRESSIVE DISORDER

It occurs when a patient suffers from extreme highs and lows. Moods fluctuate between mania and depression. People with bipolar disorder experience episodes of major depression or extreme high moods.

Eligibility: Bipolar disorder or manic-depressive disorder generally has no negative impact on your ability to get burial insurance. Your eligibility will depend on your unique medical background and if you have had hospitalizations or thoughts of suicide.

SITUATIONAL DEPRESSION

This adjustment disorder is caused by a significant life-changing event or a period of high stress. It doesn’t need medication, but it can be treated with a short-term prescription if a doctor sees that you need it.

Situational depression does not impact your ability to qualify for the best burial plans available.

Eligibility: Most burial insurance companies don’t care about the signs of depression. However, they will be concerned about any thoughts of suicide or death (that makes sense because they are life insurance companies!). We can help you understand your options if you have struggled with these thoughts.

How Can Funeral Funds Help Me?

It should be clear by now that depression is not an issue for most burial insurance companies.

Trying to find a policy for depression needn’t be a frustrating process, but working with an independent agency like Funeral Funds will make the process easier and quicker.

If you have a health history of depression, let us help you; we will work with you side by side to find a plan that fits your needs.

We will work with you every step to find the plan that fits your financial requirements and budget. You need not waste your precious time searching for multiple insurance companies because we will do the dirty work for you.

We will shop your case to different insurance carriers and get you the best price.

We work with many A+ rated insurance carriers that specialize in covering high-risk clients like you. We will search all those companies to get the best rate. We will match you up with the best burial insurance company that gives the best rate.

We will assist you in securing the coverage you need at a rate you can afford. So, if you are looking for a funeral, final expense, or burial insurance with depression in your medical history, we can help.

Fill out our quote form on this page or call us at (888) 862-9456, and we can give you an accurate quote.

Additional Questions & Answers On Burial Insurance With Depression

Can you get life insurance if you have depression?

Yes, you can get life insurance if you have depression. Most life insurance companies offer first-day coverage plans to people with depression.

Do I need to take a medical exam if I have depression?

No, you do not need to take a medical exam if you have depression. Most life insurance companies we work with will give you first-day coverage without a medical exam.

Is depression a pre-existing condition for life insurance?

Yes, depression is a pre-existing condition for life insurance. However, most life insurance companies we work with will give you first-day coverage without a medical exam.

What are the rates for life insurance if you have depression?

The rates for life insurance if you have depression vary depending on the company you choose. Most life insurance companies offer first-day coverage plans to people with depression.

Do I need to tell insurance about depression?

Yes, you need to tell insurance about depression if they ask about it.

Is there an age limit for burial insurance with depression?

Most life insurance companies accept applicants who are 18-85 years old.

Can a person with depression get burial insurance?

Yes, a person with depression can get burial insurance. Most life insurance companies offer first-day coverage plans to people with depression.

What is the waiting period for burial insurance with depression?

Generally, depression does not have a waiting period. People with depression often get first-day coverage plans even with depression.

Can you get first-day coverage insurance if you have depression?

Yes, you can get first-day coverage insurance if you have depression. Most life insurance companies offer first-day coverage plans to people with depression.

Is depression considered a critical illness?

No, depression is not considered a critical illness.

What are the things that may affect my eligibility if I have depression?

There are some things that may affect your eligibility if you have depression, such as your age, gender, and health.

Is depression disease a disability?

No, depression is not a disease or disability.

What are the benefits of having burial insurance with depression?

The benefits of having burial insurance with depression are that you can get first-day coverage without a medical exam and that most life insurance companies offer this type of coverage.

What is the life expectancy after depression?

The life expectancy after depression is the same as the general population.

Can you get cremation insurance if you suffer from anxiety?

Yes, you can get cremation insurance if you have anxiety. Most life insurance companies offer first-day coverage plans to people with anxiety.

What is my best insurance option if I have depression?

The best insurance option for you if you have depression is to get a first-day coverage plan from a life insurance company.

Is depression fatal in life insurance?

No, depression is not fatal in life insurance.

Can you be denied insurance for depression?

No, you cannot be denied insurance for depression unless you have a recent hospitalization due to depression.

How do you get life insurance after a depression diagnosis?

You can get life insurance after a depression diagnosis by getting a first-day coverage plan from a life insurance company.

Is depression considered a life-threatening illness in insurance?

No, depression is not considered a life-threatening illness in insurance.

Can depression affect your life insurance rates?

No, depression does not affect your life insurance rates.

Can depression medication affect my premium?

No, depression medication will not affect your premium.

What are the premiums for burial insurance with depression?

The premiums for burial insurance with depression vary depending on your chosen company.

Can depression patients get final expense insurance?

Yes, depression patients can get final expense insurance. Most life insurance companies offer first-day coverage plans to people with depression.

What is the average cost of life insurance for someone with depression?

The average cost of life insurance for someone with depression is the same as the general population.

Can you be rejected for life insurance because of depression?

No, often, you cannot be rejected for life insurance because of depression unless you have other significant medical conditions.

Can depression affect life insurance?

No, depression on its own will not affect your life insurance eligibility and rates.

What are the chances of getting approved for life insurance with depression?

Your chances of getting approved for life insurance with depression are the same as the general population.

How can you get the best life insurance rates with depression?

The best way to get the best rate in life insurance rates is to work with a qualified insurance agent who can help you compare rates from different companies.

What is the best life insurance for people with depression?

The best life insurance for people with depression is a policy that gives you first-day coverage without a medical exam.

What are the best life insurance companies for depression?

The best life insurance companies for depression offer first-day coverage plans without a medical exam.

What are some tips for getting life insurance with depression?

Some tips for getting life insurance with depression are to work with a qualified insurance agent and get a policy that gives you first-day coverage without a medical exam.