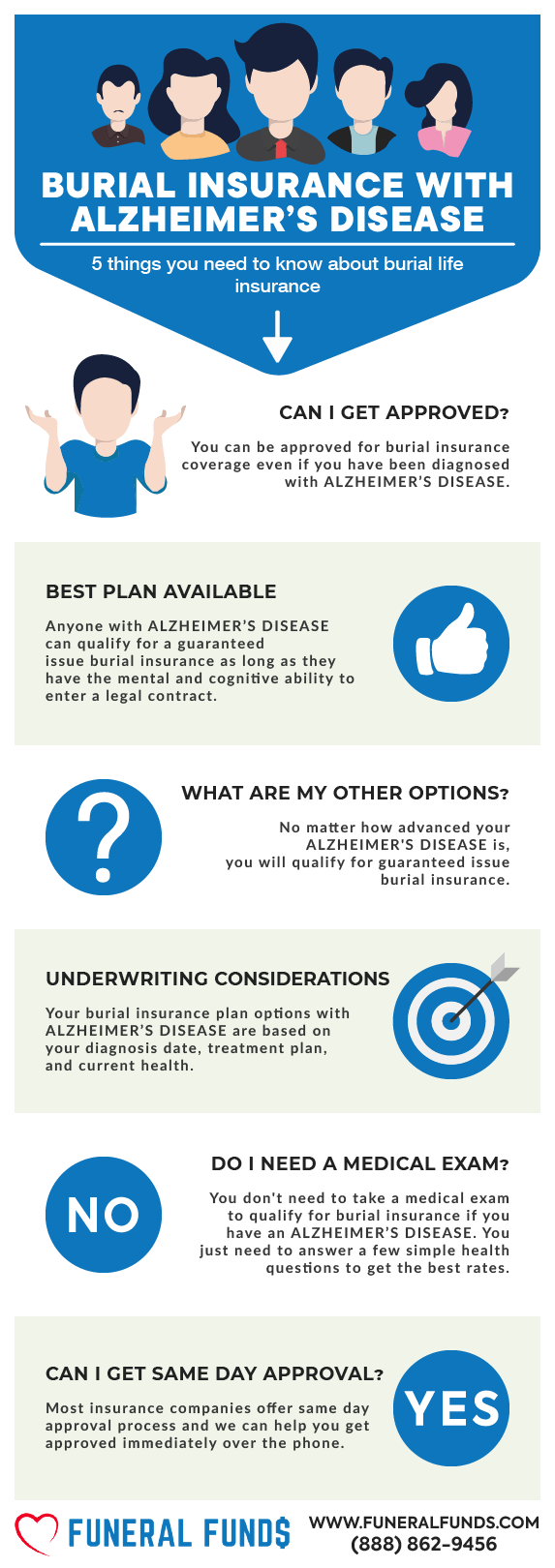

2025 Burial Insurance with Alzheimer’s Disease

If you’re looking for burial insurance with Alzheimer’s disease, you need to be aware that your burial, cremation, final expense, and life insurance options are limited.

!!! READ THIS FIRST !!!

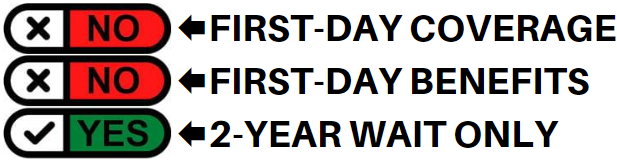

Alzheimer’s disease is a life-threatening health condition, and there are no insurance companies that offer 1st-day coverage to Alzheimer’s disease patients.

We recommend Alzheimer’s disease patients purchase a guaranteed issue life insurance that asks no health questions but does come with a 2-year waiting.

If you or a family member has been diagnosed with Alzheimer’s disease and would like more information about burial insurance, keep reading to know how to qualify for the most affordable burial insurance policy possible.

| TABLE OF CONTENTS | |

|---|---|

What Is My Best Insurance Option If I Have A History Of Alzheimer’s Disease?

To purchase a life insurance policy with Alzheimer’s disease, you will only qualify for a guaranteed issue burial insurance policy with a 2-year waiting period.

Best Option: Guaranteed issue burial insurance

OTHER FACTORS THAT MAY AFFECT YOUR ELIGIBILITY IF YOU HAVE ALZHEIMER’S DISEASE

ACTIVITIES OF DAILY LIVING

The insurance companies will want to know if you can perform activities of daily living on your own.

Insurance companies define Activities of Daily Living (ADL) as needing help with:

- Eating

- Bathing

- Continence

- Dressing

- Toileting

- Transferring

Every life insurance company will ask you if you need help with ADL’s.

If you are in the last stage of Alzheimer’s, you will need help as your condition worsens. Every burial insurance company will decline anyone who needs help with ADLs for a first-day coverage plan.

Best Option: Guaranteed issue burial insurance

HOME HEALTH CARE

Every life insurance company will ask about home health care, just like with ADLs.

Most Alzheimer’s patients require permanent home health care during the last stage of the disease. If this is your situation or your loved ones, it would be best to take out a guaranteed issue life insurance.

Best Option: Guaranteed issue burial insurance

WHAT IS A GUARANTEED ISSUE BURIAL INSURANCE?

Guaranteed life insurance plans are policies that do not require an applicant to take a medical examination or answer any health questions. This means that individuals with a severe medical condition like Alzheimer’s disease will qualify for coverage.

Guaranteed final expense insurance is whole life insurance, and it usually has a graded or limited death benefit during the first two to three years of the policy.

If you are a U.S. citizen and live in the state where these policies are available and fall within the required age of 50 to 85, you should be able to qualify for a guaranteed life insurance policy.

The application process for guaranteed issue policy is quick it only takes a matter of minutes over your phone or computer.

After the insurance company approves your application, your policy will be mailed to you. The two-year waiting period would begin after you paid your first monthly premium.

What is a Graded Death Benefit?

Guaranteed issue life insurance will immediately pay for accidental causes of death, but will not cover natural causes of death during the first 24 months.

If you die during the waiting period due to Alzheimer’s, the company will refund all your premiums plus interest, typically 10%. If you live beyond the 24 months, 100% of your death benefit will be paid out regardless of the cause of death.

BENEFITS OF GUARANTEED ISSUE BURIAL INSURANCE

- Easy to qualify – It is effortless to apply for and get insurance coverage. There is no medical exam, and you don’t have to answer any health-related questions. You will qualify regardless of Alzheimer’s disease or any medical condition. Your approval is guaranteed if you meet the minimum age requirement.

- Level death benefit – The death benefit amount is fixed and guaranteed to never decrease for any reason. Your beneficiaries will receive the full amount if you pass away after waiting. The death benefit is 100% for accidental death at any time. The death benefit is 110% of all premiums paid during the first two years for the natural cause of death.

- Fixed monthly premiums. Your monthly premium is fixed and will never increase. Your rate is determined by your current age, and the premium will never go up because of your age or medical condition.

- The policy will never expire – Guaranteed issue burial insurance is whole life insurance that never expires as long as payments are made on time.

- Tax-free. Your death benefit payout will be given directly to your beneficiary tax-free.

- Builds cash value – Guaranteed issue policy accumulates cash value. It is a good savings option that builds up over time which you can borrow if you need money,

WHAT TO AVOID WITH MANY COMMONLY ADVERTISED LIFE INSURANCE PROGRAMS:

Increasing premium – Don’t purchase a plan that increases in price over time.

Policy termination at age 80 – Don’t purchase a plan that cancels after you turn 80 years old.

3-year waiting period – Never buy a 3-year waiting period plan. A 2-year waiting period plan will have lower pricing and quicker full coverage than a 3-year waiting period plan.

For this reason, working with an independent life insurance agency that has access to multiple life insurance companies offering a guaranteed issue policy is important.

THE BEST GUARANTEED ISSUE BURIAL INSURANCE

If you have Alzheimer’s disease, then GI policy is an excellent choice because they have no medical exam and ask no health questions.

If you pass away during the waiting period, the company will return your premiums plus 10% interest to your beneficiary.

What Types Of Burial Insurance Should I Avoid?

| PLANS TO AVOID | WHY? |

|---|---|

| Term life | Premiums increase after 5 years. Coverage ends after 80. |

| Pre-paid funeral plans | Expensive |

| Universal life | Tied with stocks |

| No health questions policies | With 2-year waiting period |

| Plans offering "teaser rates" | $9.95 per unit plans or $1 buys $100,000 coverage |

| Over priced plans | Insurance from TV and junk mail |

| Plans that accept mail-in payments | Risky |

| Plans that accept Direct Express | High lapse rate |

| Plans that accept Credit Cards | High lapse rate |

What Type Of Burial Insurance Is Best?

| FUNERAL FUNDS PLAN BENEFITS | INCLUDED |

|---|---|

| 1st Day Coverage | YES |

| Rates NEVER Increase | YES |

| Coverage NEVER Decreases | YES |

| Easy to get approved | YES |

| No Medical Exam | YES |

| Same Day Approval | YES |

| Death Claims Pay Fast | YES |

| Builds cash value | YES |

| Coverage Up To Age 121 | YES |

If I Have Alzheimer’s Disease, Do I Need A Medical Exam To Qualify For Burial Insurance?

You are NOT required to take a medical exam to qualify for burial insurance with Alzheimer’s Disease.

When you apply for burial insurance, you only have to answer basic questions about your health. The application process is simple; you don’t need to provide medical records or blood and urine samples.

You’ll get the official approval from the insurance company often within minutes!

Burial Insurance Underwriting If You Have Alzheimer’s Disease

Every burial insurance company underwriting will ask you a series of health questions. In addition, they will electronically check your prescription history as a way to verify your health.

HEALTH QUESTIONS

You will always find burial insurance companies asking about Alzheimer’s disease on the application. Your answer to the health questions will determine what plans you will qualify for and how much is your monthly premium.

Here are some health questions that most burial insurance companies will ask regarding Alzheimer’s disease:

- Have you ever been diagnosed, treated, or taken medication for Alzheimer’s disease?

- During the past 24 months, have you been diagnosed or been treated for Alzheimer’s disease?

- Have you ever been diagnosed with, or received, or been advised to receive treatment or medication for Alzheimer’s disease or dementia, or been prescribed: Aricept, Cognex, Donepezil, Exelon, Razadyne, or Namenda?

One of the first questions you will see on the life insurance application is whether or not you have Alzheimer’s disease. They will ask these questions in the “knockout” section. If you answer yes to any of the questions in the knockout section, you will only qualify for guaranteed issue burial insurance with a waiting period.

PRESCRIPTION HISTORY CHECK

All burial insurance companies will run a prescription history check to validate your health status. Let’s say you answer “No” to the Alzheimer’s disease question on the application. Some think doing this is a clever way to get past the insurance company. But they will know you are lying if they see Alzheimer’s medication in your prescription history.

Certain Alzheimer’s medications will indicate you have this medical condition. They will be on the lookout for these Alzheimer’s medications they have flagged.

Alzheimer Medications Life Insurance Companies Care About

- Aricept

- Cognex

- Donepezil

- Ergoloid Mesylates

- Exelon

- Galantamine

- Hydergine

- Namenda

- Namzaric

- Razadyne

- Reminyl

- Rivastigmine

If you ever filled a prescription for any of these drugs, you will be viewed as a person with Alzheimer’s disease.

How Much Insurance Do I Need If I Have Alzheimer’s Disease?

The amount of burial insurance you should buy varies depending on your personal and financial circumstances. However, burial insurance should cover the cost of your funeral, burial, and final expenses.

The first step to figuring out how much burial insurance you need is to know your end-of-life expenses. Your funeral cost is often the biggest single expense you need to pay. Other end-of-life expenses to consider are your outstanding medical bills, living expenses, credit card bills, and other debts.

Here’s an example of a funeral cost breakdown from the National Funeral Directors Association.

| AVERAGE FUNERAL COST WITH VIEWING AND BURIAL | |

|---|---|

| Non-declinable basic services | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Hearse | $325 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Metal casket | $2,500 |

| Vault | $1,572 |

| Median Cost of a Funeral With Viewing and Burial | $9,420 |

| AVERAGE FUNERAL COST WITH VIEWING AND CREMATION | |

|---|---|

| Non-declinable basic services fee | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Cremation fee (if firm uses a third-party crematory) | $368 |

| Cremation Casket | $1,310 |

| Urn | $295 |

| Median Cost of a Funeral with Viewing and Cremation | $6,970 |

| Rental Casket | $995 |

| Alternate Cremation Container | $150 |

How Should I Pay My Premiums?

The best way to pay your premium is through a savings or checking account. We recommend you set a bank draft from your savings or checking account. That way, the bank will automatically pay your premium each month, and you don’t need to worry about your policy lapsing due to non-payment.

Alzheimer’s Disease And Burial Insurance Riders

Insurance policy riders add benefits to your policy. Adding insurance riders will enhance your policy to fit your needs. Some riders are built into your policy, while other riders can be added at an additional cost. Most riders are affordable, and it involves little to no underwriting.

Here’s a list of common burial insurance riders:

| FUNERAL FUNDS ADD-ONS | AVAILABILITY |

|---|---|

| Terminal Illness Add-On Benefit | Included with most plans |

| Nursing Home Care Add-On Benefit | Included with most plans |

Information We Need If You Have Alzheimer’s Disease

We will need to ask you some questions to know which insurance company will be your best match. Doing this allows us to give you an accurate quote upfront and guarantee that the insurance company we will recommend is the best fit for you.

Here are some questions we may ask:

- When were you diagnosed with Alzheimer’s disease?

- Do you have other health issues?

- Do you need help performing daily living activities (eating, bathing, dressing, toileting, and transferring)?

The more information you give us, the better your chances of finding affordable coverage.

What If I Been Declined Life Insurance Because Of Alzheimer’s?

One of the biggest mistakes you can make is to avoid getting covered because of your Alzheimer’s disease.

The best way to get approved for life insurance is to work with an independent life insurance agency like Funeral Funds that are knowledgeable about insurance underwriting.

If you notice any signs of Alzheimer’s in a family member, you should make sure that they have a life insurance policy before they are treated with medication.

- Confusion and disorientation even when in a familiar environment

- Difficulty concentrating and thinking

- Difficulty comprehension even with simple questions

- Easily forgetting things after seeing them

- Routinely misplace things

- Difficulty talking and writing correct words

- Behavior and personality changes

- Inability to recognize and deal with numbers

- Finding it challenging to manage finances

- Social withdrawal

Other Common Uses For Final Expense Life Insurance With Alzheimer’s Disease

All of these examples are appropriate uses for Final Expense Life Insurance:

- Burial insurance plan with Alzheimer’s Disease

- Cremation insurance plan with Alzheimer’s Disease

- Funeral home insurance plan with Alzheimer’s Disease

- Final Expense insurance plan with Alzheimer’s Disease

- Prepaid funeral plan insurance with Alzheimer’s Disease

- Mortgage payment protection plan with Alzheimer’s Disease

- Mortgage payoff life insurance plan with Alzheimer’s Disease

- Deceased spouse’s income replacement plan with Alzheimer’s Disease

- Legacy insurance gift plan to family or loved ones with Alzheimer’s Disease

- Medical or doctor bill life insurance plan with Alzheimer’s Disease

We can help you with any of the plans above. Your pricing will depend on your age, health, and coverage amount for each program option.

How Can Funeral Funds Help Me?

Finding Alzheimer’s life insurance coverage or burial insurance needn’t be frustrating; working with an independent agency like Funeral Funds will make the process easier and quicker.

We will work with you every step to find the plan that fits your financial requirements and budget. You don’t have to waste your precious time searching for multiple insurance companies because we will do the dirty work for you.

We work with many A+ rated insurance carriers that specialize in covering high-risk clients like you. We will search all those companies and match you up with the best burial insurance company that gives the best rate.

We will assist you in securing the coverage you need at a rate you can afford. So, if you are looking for Alzheimer’s disease funeral insurance, Alzheimer’s disease burial insurance, or Alzheimer’s disease life insurance, we can help. Fill out our quote form on this page or call us at (888) 862-9456, and we can give you an accurate quote.