Burial Insurance after Angioplasty (2024 Update)

After an angioplasty, you can get affordable burial insurance. It won’t break the bank. If you’re feeling okay, some companies might even cover you right away.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with angioplasty, or fill out our quote request form for immediate assistance and pricing information.

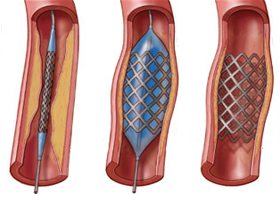

What Is Angioplasty?

Angioplasty is a quick fix for a clogged heart artery. Doctors use a tiny balloon to open up the blockage and let blood flow better. It’s like unclogging a drain, but for your heart.

People who’ve had an angioplasty often need more heart care down the line. This could mean pills, more procedures, or even open-heart surgery.

Life insurance companies don’t like risk. If you’ve had an angioplasty, they might think you’re more likely to have heart trouble again. This makes you a riskier bet for them.

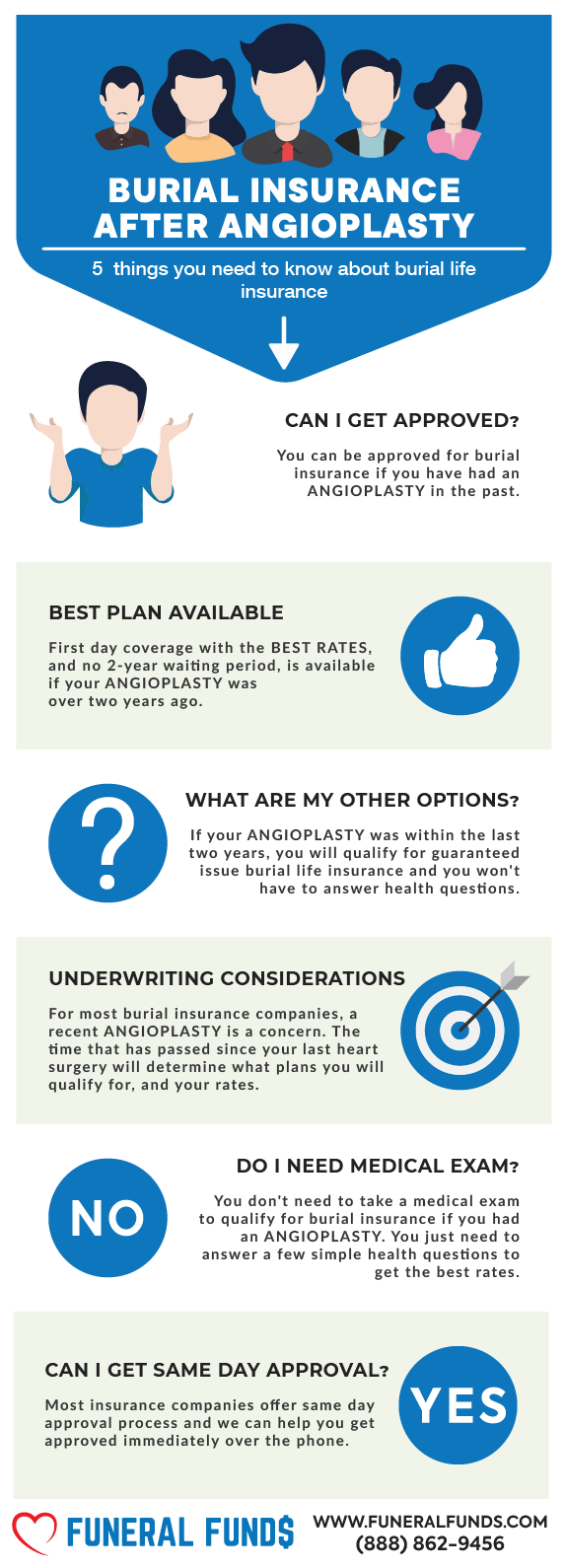

Can I Get Burial Insurance After An Angioplasty?

YES: You could get burial insurance that starts working right away, depending on your health and your zip code.

NO: If you’re in the hospital now or have been twice in the last two years, you can’t get that super-fast coverage with our preferred company. But don’t worry, you can still get a plan with a two-year wait.

What Are The Types Of Burial Insurance Available To People With Angioplasty?

FIRST-DAY COVERAGE – This means your insurance starts working right away. If you pass, your family gets the full amount. It’s usually cheaper than the next option.

GUARANTEED ISSUE LIFE INSURANCE – You don’t need a health checkup for this one. Anyone can get it, even if you’re not in perfect shape. But there’s a catch: you have to wait two years before your family gets the full payout. If you pass away during those two years, they only get back what you paid plus a little extra.

What Is My Best Insurance Option After Angioplasty?

If you just had an angioplasty, you want insurance that starts working right away. That’s the best option. Our preferred company offers this, but they ask about recent hospital stays. If you haven’t been in the hospital much, you’re in luck!

If you’ve been in the hospital a lot, don’t worry. There’s another kind of insurance that anyone can get, but you have to wait two years for the full payout.

Do I Need A Medical Exam To Qualify For Burial Insurance?

Nope, no needles or anything like that for burial insurance. Some plans might ask you a few health questions, but you’ll usually know if you’re approved really fast.

The best plans with first-day coverage ask some health questions, and you’ll often get official approval from the insurance company within minutes!

If you don’t want to answer any health questions, you can get guaranteed issue life insurance with a 2-year waiting period.

What Is My Burial Insurance Rates After Angioplasty?

The burial insurance rates will depend on your:

- Age

- Coverage amount

- Gender

- State of residence

- Smoking status

- Type of life insurance policy

Pricing example for a witty 60-year-old female with angioplasty:

| FEMALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Pricing example for a humorous 60-year-old male with angioplasty:

| MALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Burial Insurance Underwriting After Angioplasty

Here’s a sneak peek of the kind of questions that might pop up:

- During the past 36 months, have you been hospitalized for stroke, angina, heart attack, or heart or circulatory surgery, including angioplasty, pacemaker, stent, or any procedure to improve circulation to the heart or brain?

- Have you ever been advised by a doctor to seek coronary disease treatment?

- In the last two years, other than to prevent or lower risks, have you received treatment for heart or circulatory disorders?

- In the previous 12 months, have you been advised to have heart surgery for coronary disease?

- In the previous two years, did you have any surgery for circulation or blood clots in the heart or brain or been prescribed medication?

Common Post-Angioplasty Meds:

- ACE inhibitors (Captopril, Enalapril, Lisinopril)

- Antiplatelet (Aspirin, Clopidogrel, Prasugrel, Ticagrelor)

- Beta-blockers (Atenolol, Metoprolol, Nadolol)

You know those meds you’re popping after your procedure? Yeah, the insurance folks do too. If they spot these in your prescription history, they’ll know your heart’s been through the wringer.

Information We Need if You Have Had Angioplasty

We might throw a few questions your way to score you the best plan and pricing:

- Have you been diagnosed with other health conditions?

- How many stents did you have?

- Was your angioplasty a result of a heart attack?

- What type of heart disease do you have?

- What medications are you currently taking?

- When was your first angioplasty?

- When did you have your last angioplasty?

What If My Application Was Rejected Because of Angioplasty?

So, you got turned down before because of your angioplasty? No sweat. Team up with an independent insurance agency like Funeral Funds. We’ve got the inside scoop on how different companies work, so we can hook you up with a better plan at a price that won’t make you cringe.

We’ve got connections with over 20 insurance companies, and we know just how to find a heart-friendly plan that suits you.

How to Get the Best Burial Insurance Rates With Angioplasty

Had an angioplasty? No worries! The smartest move is to work with an independent agency like Funeral Funds. Our agents will dig through first-day coverage options and find you the perfect plan with the best pricing. We do the comparing, so you get the coverage – simple as that!

How Can Funeral Funds Help Me?

At Funeral Funds, we’re pros at landing life insurance coverage for folks with an angioplasty history.

We’ve got connections with A+ rated insurance companies that love high-risk clients. We’ll dive into that pool and fish out the best rate for you. Consider us your matchmakers for life insurance.

We’ll help you lock down the coverage you need without breaking the bank. So, if you’re on the hunt for burial insurance after angioplasty, we’ve got your back. Just fill out the quote form on this page or give us a ring at (888) 862-9456 for some spot-on burial insurance quotes.

Frequently Asked Questions

Can angioplasty be considered a critical illness in life insurance?

Nope, angioplasty doesn’t typically put you in the grave, so it’s not considered a critical illness.

Is angioplasty a major surgery in insurance?

Nah, in the insurance world, angioplasty is more of a minor tune-up than major surgery.

Do I need to tell insurance about angioplasty?

Yep, if they ask about it in the health questionnaire, spill the beans.

Can you be denied insurance for angioplasty?

Yep, if you’re still hanging out in the hospital, you might get the boot for first-day coverage insurance.

Is there a waiting period for insurance after angioplasty?

Nope, if you qualify for first-day coverage insurance.

Is there an age limit for burial insurance with angioplasty?

You’re good to apply until you’re 89, and that plan will stick with you until you’re 121.