Burial Insurance with Kidney Disease

Some insurance companies have finally listened to consumers and started offering first-day coverage burial insurance for kidney disease patients in treatment or dialysis. Took them long enough, right?

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with kidney disease, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

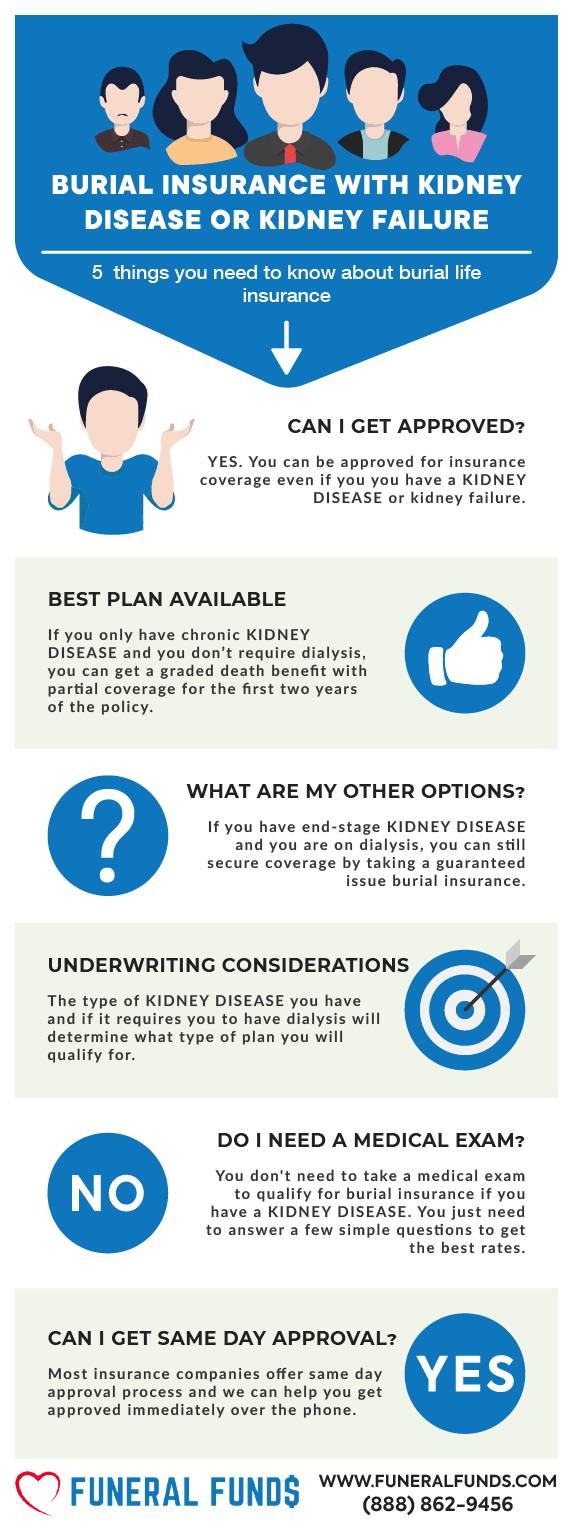

Can I Get Burial Insurance With Kidney Disease?

Absolutely! You might even qualify for first-day coverage with no waiting period if you’re keeping up with your treatments and medications.

Types Of Burial Insurance Available For Kidney Disease Patients

First-Day Coverage – No medical exams required, just answer a few simple health questions. The best part? No waiting period. You’re covered from day one, and your beneficiary gets the full death benefit when you pass. Talk about instant peace of mind!

Guaranteed Issue Whole Life Insurance – There are no medical exams or health questions. However, there’s a two-year waiting period for health-related causes of death. If you pass from an illness during that time, your beneficiaries get all your premiums back plus 7-10% interest. Once those two years are up, it’s 100% death benefit, no matter how you go.

What Is My Best Insurance Option If I Have Kidney Disease?

Chronic Kidney Disease (Renal disease) – If you have kidney disease and aren’t on dialysis, first-day coverage insurance is your best bet. Some companies are fine to offer this, depending on your zip code (not all states allow this coverage).

Kidney disease with Dialysis – Got end-stage kidney disease or on dialysis? First-day coverage insurance is still your top pick, but you have to be following your doctor’s treatment plan. Refusing dialysis? Then, you’re looking at guaranteed acceptance life insurance with a two-year waiting period.

Kidney Transplant – Had a kidney transplant or been told you need one? Your go-to option is guaranteed issue life insurance – no medical exams, no health questions. If your transplant was more than five years ago, you might even qualify for first-day coverage, depending on your zip code.

How Much Does Burial Insurance Cost If I Have Kidney Disease?

The cost of burial insurance if you have kidney disease will depend on your:

- Age

- Gender

- State of residence

- Smoking status

- Type of policy

- Coverage amount

Check out these sample rates for an independent 60-year-old female with kidney disease:

| FEMALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Check out these sample rates for a confident 60-year-old male with kidney disease:

| MALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Do I Need A Medical Exam To Qualify For Burial Insurance?

Nope, you don’t need a medical exam to get burial insurance if you have kidney disease or are on dialysis. Just answer a few basic health questions. The application process is a breeze – no medical records, blood, or urine samples are needed. We can often get you approved within minutes.

Burial Insurance Underwriting With Kidney Disease

Life insurance companies ask health questions and check your prescription history to decide if you’re eligible.

Look out for these terms in the health questionnaire about kidney disease:

- Kidney disease

- Renal disease

- Chronic kidney disease

- Chronic renal disease

- End-stage kidney disease

- End-stage renal disease

- Kidney transplant

- Dialysis

Insurance companies will ask about kidney disease like this:

- Have you ever been diagnosed, treated for, or advised to have treatment for kidney disease?

- During the past 24 months, has the Proposed Insured been diagnosed by a physician as having or been treated for kidney disease (including dialysis) or chronic kidney disease?

- Have you ever been diagnosed with, received, or been advised to receive treatment or medication for kidney disease?

- In the past 10 years, have you opted not to seek treatment, have not taken medication, or have not followed the prescribed treatment plan following a medical diagnosis of kidney disease?

If you have any kidney disease, you’ll need to answer “yes” to that question, no matter how they word it.

PRESCRIPTION HISTORY CHECK

Here’s list of common kidney disease medications:

- Amlodipine

- Atorvastatin

- Azathioprine

- Calcitriol

- Cinacalcet

- Cyclosporine

- Fosrenol

- Flomax

- Levocarnitine

- Mycophenolate

- Nifedipine

- Perindopril or Ramipril

- Phosex

- Prednisolone

- Renagel

- Sirolimus

- Tacrolimus

If you’re taking any of these medications, the insurance company will know you’re receiving kidney disease treatments.

Information We Need If You Have Kidney Disease

To capture the best rates, here are some questions we might ask about your kidney disease:

- Are you taking medications for your kidney disease? What are they?

- Are you undergoing dialysis?

- Do you have any surgery to treat your kidney disease?

- Do you have other health conditions aside from kidney disease?

- Have you been hospitalized in the past 12 months because of kidney disease?

- Have you been recommended to receive a kidney transplant?

- What type of kidney disease do you have?

- When were you diagnosed with kidney disease?

Answer every question honestly. The more details you provide, the better your chances of landing affordable first-day coverage insurance.

What If My Insurance Application Was Rejected Because of Kidney Disease?

If your insurance application got the boot from another insurance company because of kidney disease, don’t stress! We help clients get approved by shopping around with multiple life insurance companies that actually accept applicants with kidney issues.

If necessary, kidney transplant patients can request a guaranteed acceptance life insurance plan with no medical exam or health questions. Approval is guaranteed, no matter your health.

How To Get First-Day Coverage Insurance

Want first-day coverage burial insurance? Your best bet is to work with an independent life insurance agent from Funeral Funds who knows the top companies offering first-day coverage for people with kidney disease.

The life insurance experts at Funeral Funds of America will guide you through the entire application process, making it as smooth as possible.

How Can Funeral Funds Help Me?

Why waste your time hunting down insurance companies when we can do it all for you? We work with top-rated insurance carriers that specialize in covering high-risk clients.

Our licensed insurance agents will search for the best companies to find you the best rates, and we promise to make the process quick and easy.

Just fill out our quote form on this page or call us at (888) 862-9456, and we’ll get you an accurate quote in no time.

Frequently Asked Questions

Is kidney disease a pre-existing condition for life insurance?

Absolutely. Any health issue you had before applying for insurance is considered a pre-existing condition in life insurance.

What are the benefits of having burial insurance if you have kidney disease?

Some benefits include peace of mind, financial security for your loved ones, and the freedom to choose your burial arrangements.

Do I need to tell insurance about kidney disease?

For first-day coverage, you must tell the insurance carrier about your kidney disease. Keeping secrets could result in your policy being declined or canceled.

Is there an age limit for burial insurance for kidney disease?

You can apply for burial insurance if you are between 18 and 89 years old.

What are the things that may affect my eligibility if I have kidney disease?

Your eligibility depends on the severity of your condition, your current treatment plan, hospitalizations in the last two years, and any recommendations for a kidney transplant.

Can you be denied insurance for kidney disease?

You can be denied first-day coverage life insurance if you’ve been hospitalized two or more times in the last two years, if you are recommended to get an organ transplant, or if you’ve had a transplant in the last five years.

Can I get life insurance if I’m on kidney dialysis?

Yes, you may qualify for a first-day coverage plan if you follow your doctor’s treatment plan and live in the right state.