Burial Insurance With No Waiting Period

Affordable burial coverage with no waiting period is available for most final-expense life insurance shoppers. If you are in the habit of listening to all the misleading television and magazine advertisements, you would think you would have to settle for a substandard policy with a two-year waiting period – DON’T BE FOOLED by such nonsense!

Most folks shopping for cremation insurance or funeral life insurance for seniors should be able to qualify for first-day immediate coverage insurance and the best pricing.

Get 1St-day Coverage & Save 30-50% With Our Instant Quoter

In this “no waiting period burial insurance article,” we’ll give you the lowdown on qualifying for and getting approved with immediate day-one coverage.

FOR EASIER NAVIGATION:

- Key Learning Points

- How Does Burial Life Insurance With No Waiting Period Work?

- What Are The Different Types of Waiting Periods In Burial Insurance for Seniors?

- Why Do Some Insurance Companies Require Waiting Periods?

- What Is The Difference Between Level And Guaranteed Issue Insurance?

- No Exam vs. No Health Questions Final Expense Insurance Policies

- Is There A Guaranteed Acceptance Life Insurance With No Waiting Period?

- Can I Qualify for No Waiting Period Burial Insurance If I Have Pre-existing Health Conditions?

- What Health Problems Would Result In A Two-year Waiting Period?

- Buying From Funeral Funds Vs. Buying Directly From The Insurance Company

- How Can Funeral Funds Help Me?

- Last Thoughts

- Frequently Asked Questions

Key Learning Points

- Burial insurance with no waiting period provides immediate coverage for funeral expenses.

- Individuals with pre-existing health conditions may have an easier time qualifying for burial insurance than other life insurance types.

- Guaranteed issue life insurance policies typically offer lower death benefits than life insurance with no waiting period.

- Qualifying for a no waiting period life insurance plan will depend on your health.

- Funeral Funds of America is on of the leading 1st-day coverage brokers in the United States.

How Does Burial Life Insurance With No Waiting Period Work?

Burial insurance with no waiting period typically involves answering health questions and being approved by the insurance company. Unlike traditional life insurance policies (term life insurance, for example), no medical exam is required. However, applicants must provide answers to medical questions to determine their eligibility for immediate coverage.

Once approved, the burial life insurance policy provides immediate coverage, meaning that the full death benefit will be paid to the beneficiaries upon the policyholder’s death, regardless of when it occurs. This immediate coverage is especially beneficial for seniors who want to ensure that their loved ones are financially protected in the event of their passing.

To find the best burial insurance without a waiting period, working with an independent life insurance agent who can compare different insurance companies and their offerings is recommended. This way, you can find a policy that provides the coverage you need at a price that fits your budget.

Work with a knowledgeable life insurance agent specializing in finding the best senior life insurance. These agents have access to multiple burial insurance companies and can help you find the best coverage options that suit your needs.

What Are The Different Types of Waiting Periods In Burial Insurance for Seniors?

No Waiting Period

This is the preferred option for all funeral funding and burial plans, as it gives you immediate coverage with a 100% payout of the funds from the day your first premium payment is made.

Burial insurance no waiting period coverage provides immediate coverage with a 100% payout from day one.

Working with an independent life insurance agent at Funeral Funds will increase your chances of finding a burial insurance or simplified whole life insurance policy with no waiting period.

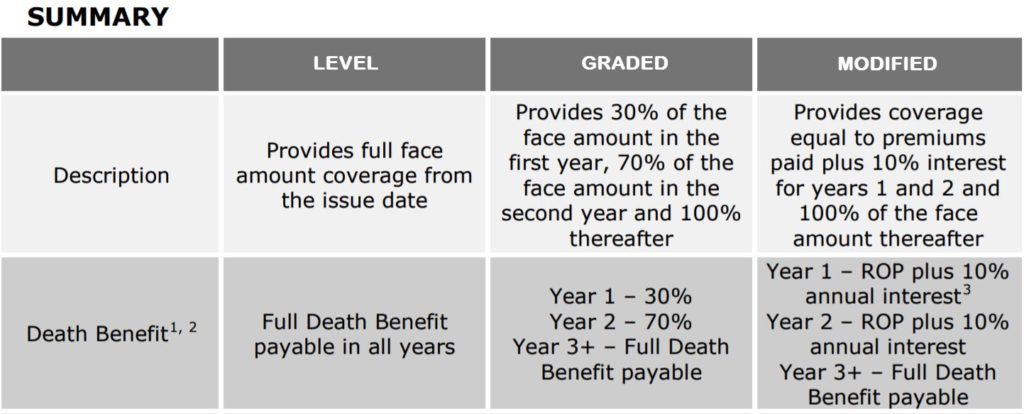

Graded Period

A graded period, also known as a partial waiting period, offers immediate partial coverage with increasing coverage over time.

In the first 12 months of a graded period plan, the payout percentages typically range from 30% to 40%.

From months 13 to 24, the payout percentages usually increase from 50% to 70% of the face amount, and after 24 months, you will have 100% coverage.

The specific payout amounts and percentages vary depending on the insurance company. However, it’s important to note that partial waiting period plans have higher premium payments due to the higher risk category they fall into.

2-Year Waiting Period (Guaranteed Acceptance Policy)

The 2-year waiting period means that the full death benefit will not be paid out if death occurs within the first two years of the policy.

During the first two years, the insurance company may only pay all the premiums plus 7-10% interest. The specific payout amounts and percentages may vary depending on the insurance company.

Two-year waiting period plans have higher premium payments due to the increased risk associated with the longer waiting period.

Understanding the year waiting period and its implications will help you choose the right type of life insurance coverage that meets your needs.

All insurance companies have different eligibility and waiting period criteria. Here is one example of an insurance company‘s waiting period:

Why Do Some Insurance Companies Require Waiting Periods?

Some insurance companies require a waiting period to verify insurability and reduce the risk of insuring individuals with pre-existing terminal health conditions. This waiting period serves as a safeguard for the insurance company, allowing them to assess the applicant’s health status and determine the level of risk they pose.

By implementing a waiting period, insurance companies can ensure they provide coverage to individuals in good health and are less likely to make an insurance claim shortly.

During the waiting period, the insurance company may require medical exams or review the applicant’s health records to gather information about their health history. This information helps the insurance carrier decide whether to provide life insurance coverage and at what premium rate.

This waiting period also restricts individuals with terminal health conditions from getting coverage solely for their funeral or final expense needs AFTER receiving a terminal diagnosis.

Insurance companies that offer burial insurance take on a greater risk by providing immediate coverage without the waiting period, compensating for this risk by charging higher premiums. It is essential to compare different insurance quotes and evaluate the terms and conditions of each policy to find the best type of burial insurance policy that meets your needs and budget.

What Is The Difference Between Level And Guaranteed Issue Insurance?

When considering burial insurance with no waiting period, it is important to understand the difference between level and guaranteed issue insurance.

Here are the key distinctions:

- Underwriting Process: Level insurance requires applicants to undergo an underwriting process, which involves answering health questions and providing medical records. On the other hand, guaranteed insurance does not require health questions or medical exams.

- Coverage Availability: Level insurance policies are available to individuals who meet certain health criteria. However, guaranteed issue burial insurance is available to everyone, regardless of their health status.

- Death Benefit Amount: Level insurance policies typically offer higher death benefit amounts compared to guaranteed issue whole life insurance policies. This is because level insurance policies take into account the applicant’s health and life expectancy.

- Premiums: Level insurance policies generally have lower premiums compared to guaranteed issue insurance. This is because level insurance policies are based on the applicant’s health risk, while guaranteed issue insurance policies have a higher risk pool.

Understanding the difference between level and guaranteed issue insurance is crucial when buying burial insurance with no waiting period. It is recommended to consult with an insurance agent at Funeral Funds to determine the most suitable type of policy for your specific circumstances.

No Exam vs. No Health Questions Final Expense Insurance Policies

Here are the key differences:

- No Exam: Simplified issue burial insurance allows you to get burial insurance without undergoing a medical examination. It can be a quicker and more convenient process, especially for individuals who may have health issues or don’t want to go through a medical exam. However, it still requires answering health questions and may have limitations or exclusions based on your health history.

- No Health Questions: With guaranteed acceptance insurance, there is no requirement to answer any health questions. It provides a guaranteed acceptance policy, meaning anyone who meets the age requirements can get coverage without being denied due to health conditions. This may be the only choice for individuals with significant health issues or pre-existing conditions.

Is There A Guaranteed Acceptance Life Insurance With No Waiting Period?

No, all guaranteed acceptance policies come with a two-year waiting period. Guaranteed acceptance life insurance policies typically do not require a medical exam or health questionnaire for approval, so individuals with significant pre-existing health conditions are restricted to a 2-year waiting period policy. The trade-off for this convenience is a two-year waiting period.

During this waiting period, if the insured individual were to pass away, the full death benefit would not be paid to the beneficiary. Instead, the insurance company would typically refund the premiums paid, sometimes with interest, but not the full coverage amount.

This waiting period is in place to protect insurance companies from individuals who might purchase the life policy to use it for end-of-life expenses or burial expenses immediately after getting coverage. Once the waiting period of two years expires, the full death benefit becomes available to the beneficiaries, regardless of the cause of death.

If you are specifically looking for a guaranteed acceptance funeral insurance plan with no waiting period, that may be challenging to find. Most policies in this category come with a waiting period as a standard feature. However, the waiting period duration can vary among insurance companies, so comparing policies and choosing one that suits your needs is important.

Can I Qualify for No Waiting Period Burial Insurance If I Have Pre-existing Health Conditions?

You may still qualify for no-waiting period insurance with pre-existing health conditions. Most people can qualify for immediate coverage despite past health issues by finding the best life insurance company.

Working with an independent life insurance agent increases your chances of finding a no-waiting period plan that fits your needs. They can help you navigate the insurance market and find a company that covers individuals with pre-existing conditions. You can secure immediate coverage and provide peace of mind for you and your loved ones by answering a few health questions.

Here are the health conditions that may qualify for a No-waiting period policy:

| ✓ Anemia | ✓ Emphysema | ✓ Recent Hospitalization |

| ✓ Angina | ✓ Epilepsy | ✓ Schizophrenia |

| ✓ Anxiety | ✓ Fibromyalgia | ✓ Scoliosis |

| ✓ Arthritis | ✓ Gout | ✓ Seizures |

| ✓ Asthma | ✓ Heart Attack | ✓ Shingles |

| ✓ Atrial Fibrillation | ✓ Heart Bypass Surgery | ✓ Sjogren’s Syndrome |

| ✓ Back Surgery | ✓ Heart Valve Replacement | ✓ Skin Cancer |

| ✓ Bipolar | ✓ Heart Stent(s) | ✓ Sleep Apnea |

| ✓ Blindness | ✓ Hepatitis B | ✓ Sickle Cell Anemia |

| ✓ Bronchitis | ✓ Hepatitis C | ✓ Stent Surgery |

| ✓ Cancer History | ✓ High Blood Pressure | ✓ Stroke In Past |

| ✓ Cardiomyopathy | ✓ Hip Replacement | ✓ Systemic Lupus |

| ✓ Cerebral Palsy | ✓ Huntington’s Disease | ✓ TIA or Mini Strokes |

| ✓ Crohn’s Disease | ✓ Hypertension | ✓ Ulcerative Colitis |

| ✓ Congestive Heart Failure | ✓ High Cholesterol | ✓ Vision Loss |

| ✓ COPD | ✓ Insulin Use | ✓ Water Retention |

| ✓ Coronary Artery Disease | ✓ Irritable Bowell Syndrome | ✓ Most other medical conditions |

| ✓ Cystic Fibrosis | ✓ Knee Replacement | |

| ✓ Defibrillator Implant | ✓ Neuropathy | |

| ✓ Diabetes | ✓ Osteoporosis | |

| ✓ Diabetic Complications | ✓ Overweight or Obese | |

| ✓ Edema | ✓ Pacemaker Implant |

Get 1St-day Coverage & Save 30-50% With Our Instant Quoter

What Health Problems Would Result In A Two-year Waiting Period?

Certain health problems can result in a two-year waiting period for burial insurance. This waiting period means that the full death benefit may not be paid out if death occurs within the first two years of the policy. It is important to be aware of these health problems that could lead to a longer waiting period.

Here are health problems that may result in a two-year waiting period for burial insurance:

- Alzheimer’s Disease

- AIDS, HIV, Aids Related Complex (ARC)

- Current Cancer

- Coma

- Dementia

- Hospice

- Hospital Confinement

- Leukemia

- Kidney Failure or Dialysis

- Memory Loss With Medication Prescribed

- Long-Term Care Confinement

- Nursing Home Confinement

- Terminal Illness

It is important to note that all insurance companies will impose a two-year waiting period for these health problems.

Buying From Funeral Funds Vs. Buying Directly From The Insurance Company

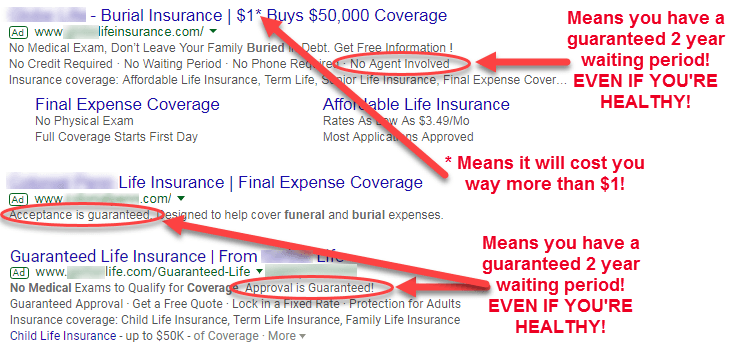

It would be easy to assume that buying directly from an insurance company or getting immediate life insurance online would be the most affordable option.

That’s what some insurance companies want you to think, hoping that you’ll take the bait.

By not employing thousands of people within the insurance company to help sell these policies, insurance companies save money by selling their life insurance products through licensed life insurance agencies like Funeral Funds.

Doing it this way, the insurance companies get to do what they’re best at (issuing policies and managing death claims). In contrast, insurance agencies like Funeral Funds get to do what we are best at (price shopping and underwriting expertise).

So, what’s the catch?

You might think going through an independent insurance agency must cost more.

The burial insurance rates are the same for all independent insurance agencies. What differentiates great agencies from bad agencies is expertise and service.

So, if you’re looking for the best insurance rates for a final expense, burial insurance, or funeral insurance for parents, talk to an independent agency that only sells final expenses and burial policies.

Most captive insurance agents are not well-versed in final expense policies or burial policies. Most only have a few final expense insurance companies they work with. You will unnecessarily overpay or be denied coverage if you have many health problems.

Roughly 95% of all insurance policies are sold through independent agencies like Funeral Funds.

Seen any misleading internet advertisements?

Purchasing the best burial insurance policy can be confusing, so you want a burial insurance specialist to help you get qualified for the best policy.

How Can Funeral Funds Help Me?

Funeral Funds can assist you in finding the best burial insurance companies with no waiting period.

Here’s how Funeral Funds can help you:

- Expertise: Funeral Funds is a knowledgeable life insurance expert who can provide accurate quotes and affordable rates. They deeply understand burial insurance options and can guide you toward the best policy for your needs.

- Access to Multiple Companies: Funeral Funds works with multiple final expense companies, giving you access to various burial insurance options. This ensures you can choose from various plans and find the one that fits your budget and coverage requirements.

- Personalized Guidance: By considering factors such as your age, health history, and financial situation, Funeral Funds can offer personalized guidance. They take the time to understand your needs and help you decide on your burial insurance policy.

- Affordable Coverage: Funeral Funds aims to provide affordable permanent life insurance for burial and final expenses without high costs. They work diligently to find the best-priced plans for immediate coverage, saving you money while ensuring you have the protection you need.

- Excellent Customer Service: Funeral Funds is committed to providing exceptional customer service. They are responsive, attentive, and dedicated to helping you buy this type of insurance. You can rely on their expertise and support to make the right choices for your coverage.

Last Thoughts

Burial insurance with no waiting period provides immediate coverage and allows your loved ones to be financially secure when the time comes.

With this type of life insurance policy, you can have peace of mind, knowing that your beneficiaries will receive the full death benefit, regardless of when death occurs.

By choosing the right burial insurance policy, you can protect your loved ones and ease the burden of final expenses. Trust Funeral Funds to help you find the best burial insurance plan that meets your needs and fits within your budget.

Frequently Asked Questions

What Are the Different Types of Waiting Periods in Burial Insurance?

No waiting period, a partial waiting period, and a two-year waiting period plans. These waiting periods determine when the full death benefit will be paid out.

Why Do Insurance Companies Impose Waiting Periods?

Insurance companies impose waiting periods to verify insurability and reduce risk. They use this time to evaluate pre-existing health conditions and determine coverage eligibility. Waiting periods are put in place to protect the company and ensure fair coverage for all policyholders.

What Is the Difference Between Level and Guaranteed Issue Insurance?

Level insurance and guaranteed issue insurance differ in their underwriting requirements. Level insurance requires health questions and medical underwriting, while guaranteed issue insurance has no health questions and is available to anyone who meets the age requirements.

How Does Burial Insurance With No Waiting Period Work?

They provide immediate coverage without the hassle of pre-existing conditions. It ensures that your beneficiaries will receive the death benefit from the whole life policy even if you pass away on the first day of coverage.

Is There a Guaranteed Acceptance Policy With No Waiting Period?

No, there are no guaranteed acceptance policies with no waiting period. These policies require no health questions but still come with a waiting period.

RELATED POSTS:

10 Comments

Sandra Czyzewski

Email info please

Funeral Funds

Sandra – we don't know what you want to be emailed to you. We have almost everything you would need for information on our website. Feel free to call us directly at (888) 862-9456.

Nicole D Caffee

Hi looking to purchase final life ins for my dad ( 69yrs old) . Would like to view quotes available must include: no waiting period., a fixed rate, no health exam/ and does not expire at certain age. Unfortunately I lost my mother earlier this year & my sister last month in auto accident neither had any life insurance. I want to find out what options are available . Thank you very much.

Funeral Funds

Nicole – We can help you with that. You can get started by going to this page – https://funeralfunds.com/free-quote/

Karen

Would like to find final expense policy I am 62 good health with no waiting period please .

Funeral Funds

Karen – You can get a quote here – https://funeralfunds.com/free-quote/

Victoria

Hi my mom is 70 years of age with kidney issues how do I get first day coverage for her situation? She's uninsured and not receiving dyalisis

Funeral Funds

Victoria – No 1st-day coverage is available for kidney disease…general kidney function issues can often be worked around.

Vincent Poh

Is your Burial insurance cover in overseas? Do you have plans to work in other countries like SEA?

Funeral Funds

Vincent – Yes, it covers you overseas…but you would have to be approved first within the United States. After that, you can travel anywhere, and only a death certificate would be needed to confirm a death.