Jonathan Lawson Actor At Colonial Penn

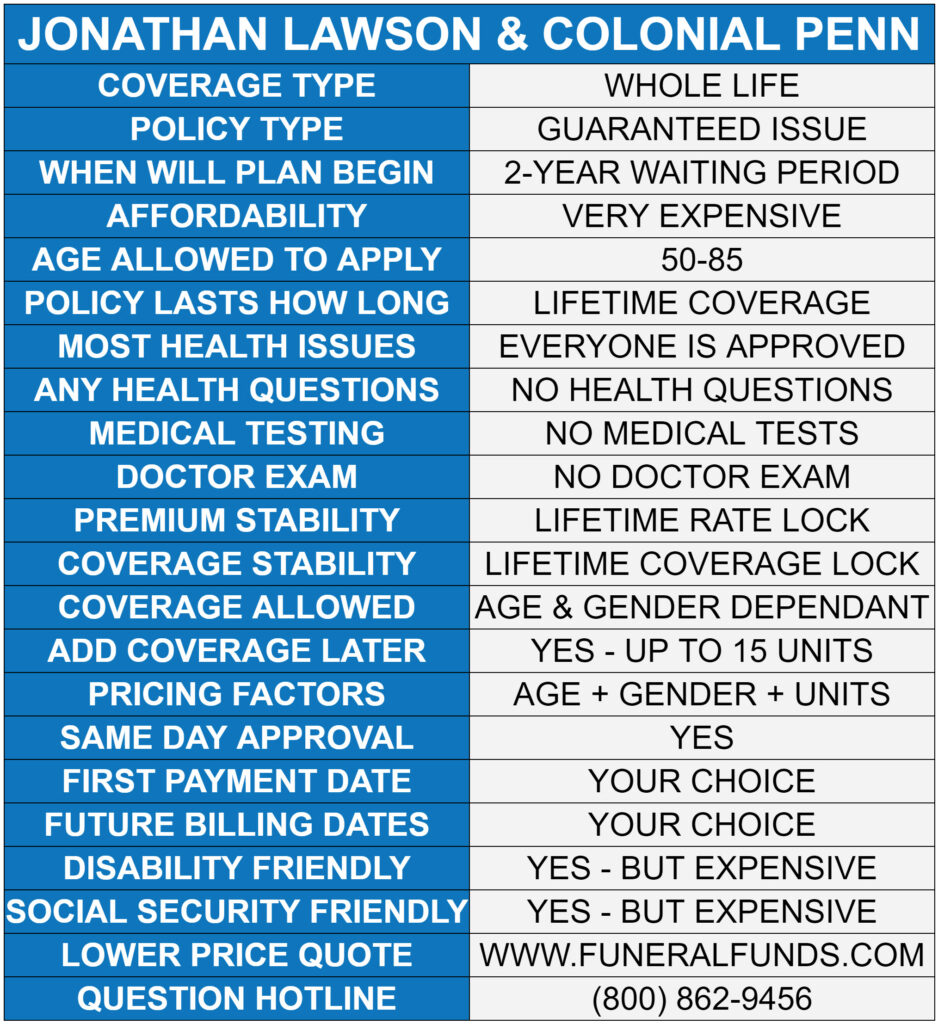

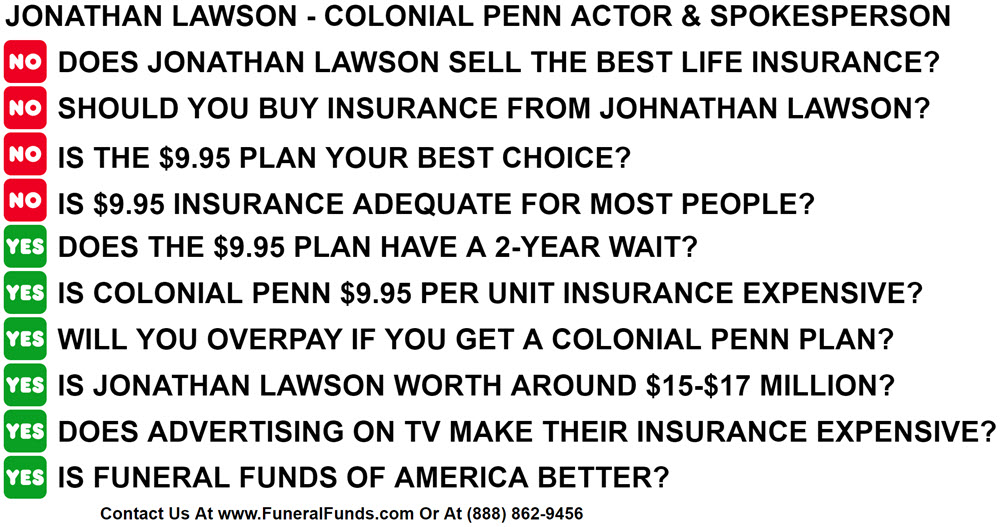

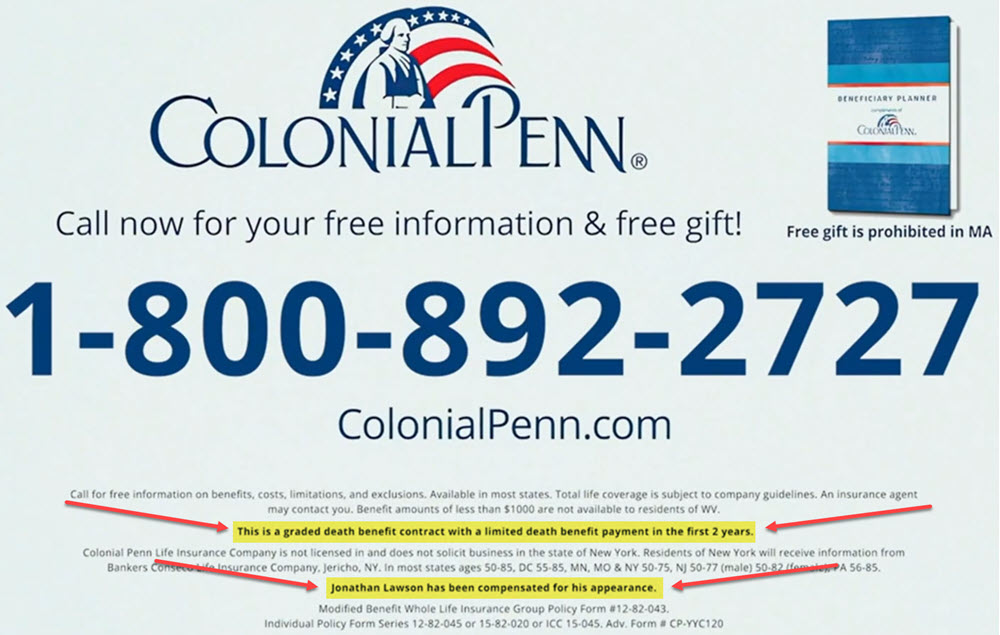

Jonathan Lawson is the Colonial Penn actor and spokesperson who works for CNO Financial Group. He’s paid to appear in the Colonial Penn TV commercials pushing their $9.95 per unit Guaranteed Issue whole life insurance plan.

No one would ever buy a Colonial Penn 995 plan if they knew how it worked.

This is because their $9.95 per unit plan is controversial and has resulted in truckloads of complaints from senior citizens, thinking they would get adequate life insurance coverage for only $9.95 a month. Let’s dive deeper into the life and career of Jonathan Lawson, the face of Colonial Penn, and discover the man and company behind the $9.95 TV life insurance commercials.

Key Leaning Point

- Jonathan Lawson is a paid actor, employee, and life insurance expert that specializes in the Colonial Penn $9.95 per unit 2-year wait plan

- The 995 plan is marketed as burial or final expense insurance and is much more expensive than other life insurance options

- Colonial Penn $9.95 life insurance is one of the most inferior and expensive life insurance product you can buy

- Consumers should never purchase Colonial Penn’s 995 plan due to its high cost and two-year waiting period

- Funeral Funds of America offers 1st-day coverage and much lower pricing than Colonial Penn

Jonathan Lawson’s Role at Colonial Penn

Jonathan Lawson’s role at Colonial Penn includes promoting the 995 plan guaranteed acceptance life insurance and serving as the Director of Quality Assurance and Escalations with CNO Financial Group.

Jonathan Lawson, a dedicated Colonial Penn employee, assumes a multifaceted role within the company. As an actual employee of Colonial Penn, Jonathan Lawson works as an actor in the Colonial Penn commercials and as the Director of Quality Assurance and Escalations within the esteemed CNO Financial Group.

As an actor for Colonial Penn, Jonathan Lawson is paid to bring credibility and trust to the company’s commercials and advertisements. Working with Colonial Penn over the last 15+ years, has made him a familiar face for seniors seeking life insurance. With his background in the Marine Corps and time served selling the 995 plan. Some would say Jonathan Lawson has become a trusted representative for Colonial Penn.

In his capacity as an actor in the Colonial Penn commercials, hehe brings a level of credibility and trust to the company’s advertisements, making him an integral part of Colonial Penn’s marketing strategy.

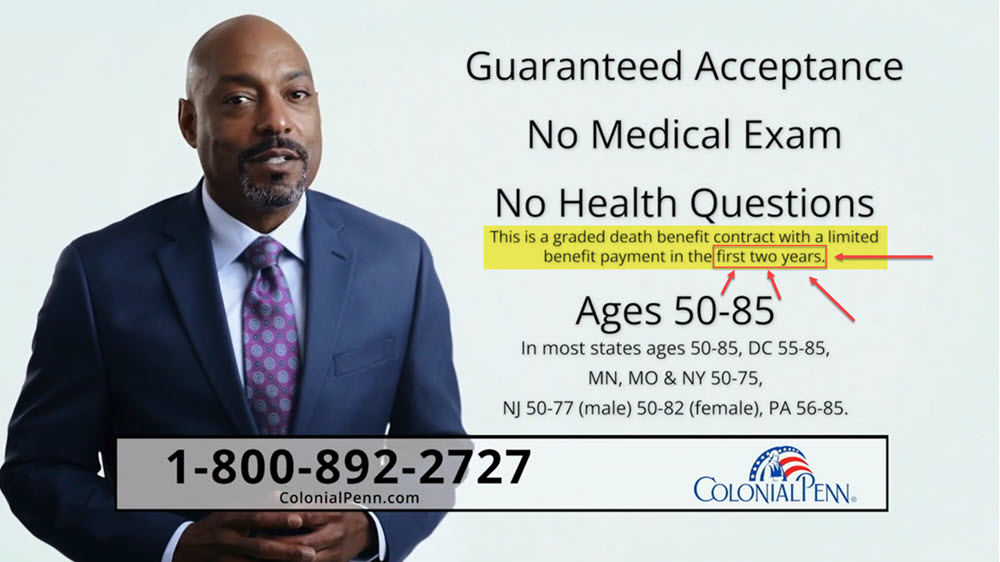

The expensive 995 plan, marketed as burial insurance, which Colonial Penn offers final expense coverage and guarantees acceptance without any health questions or medical exams. Although the monthly PER UNIT cost is advertised to be $9.95, it’s widely understood that the actual coverage provided is LIMITED with this plan.

Jonathan Lawson’s From Colonial Penn Personal Details

Jonathan Lawson is a well-known figure who has been featured in numerous Colonial Penn commercials and advertisements. As the Director of Quality Assurance and Escalations at Colonial Penn, Jonathan Lawson participates in developing marketing strategies to promote the company’s products and services. He also serves on several boards within the financial sector.

Colonial Penn Life Insurance offers a range of products, including their popular guaranteed acceptance plan and whole life insurance policies. These plans provide coverage for final expenses and offer a guaranteed acceptance policy, meaning there are no health questions or medical exams required to qualify.

While the 995 plan promoted by Jonathan Lawson in Colonial Penn commercials is more expensive compared to other life insurance options, some people still end up buying this uncompetitive life insurance product.

Criticism of Colonial Penn’s Life Insurance Policy

The $9.95 per unit price of Colonial Penn’s life insurance policy will always be be more expensive than 1st-day coverage available from Funeral Funds of America.

Here are three reasons why this criticism for Colonial Penn exists:

- Expensive Compared to Other Plans: Colonial Penn’s $9.95 per unit cost may seem affordable, but compared to other life insurance plans, the coverage provided is limited, and the pricing is considerably higher. Other companies offer similar coverage at a lower cost, making Colonial Penn’s policy massively more expensive.

- Lack of Customization: Colonial Penn’s guaranteed acceptance plan, which Jonathan Lawson promotes, doesn’t consider individual factors such as age, gender, and health concerns. This lack of customization means that individuals end up paying more for the coverage they purchase.

- Better Options Available: Life insurance is an important investment, and better options are available for seniors than Colonial Penn. By shopping around and comparing rates from multiple providers, individuals can find more affordable coverage that meets their specific needs.

As a life insurance expert, I recommend thoroughly researching and exploring different options before committing to a Colonial Penn policy. By doing so, you can ensure you’re getting the best coverage at the most affordable price.

Comparison of Colonial Penn’s Insurance to Other Options

It’s is smart to weigh the pros and cons of Colonial Penn’s insurance compared to other available options.

While Colonial Penn’s insurance offers guaranteed acceptance and no health questions or medical exams, it is more expensive compared to other companies that have more affordable rates.

When considering life insurance options, you should review your needs, budget, and the coverage provided by different companies. By comparing rates and features, you can find better life insurance options that offer the right balance of cost and coverage for you and your loved ones.

Jonathan Lawson and Colonial Penn Commercials

As the spokesperson for the Colonial Penn plan, Colonial Penn TV commercials feature the familiar face of Jonathan Lawson promoting life insurance for the Colonial Penn product line. Lawson specializes in their 2-year waiting period plans final expense, 995 plan, and guaranteed acceptance plan.

Jonathan Lawson has appeared in numerous commercials and advertisements, showcasing the company’s commitment to providing life insurance options for seniors. His role extends beyond just being an actor; he also works as the Director of Quality Assurance and Escalations with CNO Financial Group, the parent company of Colonial Penn.

Jonathan Lawsons extensive experience with Colonial Penn spans over many years, making him a valuable asset to the company. His dedication to helping seniors obtain the life insurance coverage they need is evident in his work. By appearing in commercials and TV advertisements, Jonathan Lawson has been instrumental in raising awareness about Colonial Penn’s products and services.

If you’re considering life insurance options, it’s worth exploring what Colonial Penn has to offer, and the negatives associated with the plans they sell.

Here are some key points to consider about Jonathan Lawson and Colonial Penn commercials:

- Importance of Life Insurance: Jonathan Lawson’s commercials emphasize the importance of life insurance and the peace of mind it can provide for individuals and their families. Life insurance can help cover funeral expenses and outstanding debts and provide financial support for loved ones after one’s passing.

- $9.95 Plan: The $9.95 plan offered by Colonial Penn is a guaranteed acceptance plan. This means you don’t have to answer health questions or undergo a medical exam to qualify for coverage. However, the monthly cost of $9.95 per unit is more expensive compared to other life insurance options, and to find the best policy, you’ll want to look elsewhere with different insurance companies.

- Unit Of Coverage: In the context of the $9.95 plan, a unit represents a specific amount of insurance coverage. The cost of each unit is based on factors such as the insured’s age and gender. While the monthly cost may be $9.95 per unit, the coverage provided per unit is limited. Your coverage needs and compare the cost of units across different insurance providers.

- Colonial Penn 995 Plan Per Unit Cost: The Colonial Penn 995 plan charges $9.95 per unit of insurance coverage. This means that for every unit you purchase, you’ll pay this monthly premium. Don’t forget to calculate how many units you need based on your desired coverage amount.

- Guaranteed Acceptance Plan: Colonial Penn’s commercials highlight their guaranteed acceptance plan, which means no health questions or medical exams are required to qualify for coverage. This can be appealing for individuals who may have pre-existing health conditions (most of which would qualify for 1st-day coverage with companies that Funeral Funds of America represents.

- Final Expense Life Insurance: The Colonial Penn 995 plan is designed to cover funeral and burial expenses, providing peace of mind to policyholders and their families.

- Uncertainty: There’s a level of uncertainty surrounding Colonial Penn’s $9.95 plan. While it may seem like a great deal at first…it’s only $9.95…the reality is that the coverage provided is limited and will often not meet your needs. It’s important to carefully consider the terms and conditions of the plan before making a decision.

Colonial Penn Life Insurance Products

It’s a smart idea to explore the various products offered by Jonathan Lawson of Colonial Penn. This in because the premiums for this plan can be more expensive compared to other life insurance options.

It’s important to weigh the pros and cons of Colonial Penn’s life insurance products. While their policies provide coverage for seniors and offer a guaranteed acceptance option, the premiums will be higher compared to other companies. You’ll save money by comparing rates from multiple providers to make sure you get the most affordable coverage.

Issues With Colonial Penn’s Plan

The issues with the plan offered by Colonial Penn have been a topic of discussion and concern. Here are three key issues with any review of Colonial Penn offerings:

- Limited Coverage: The Colonial Penn insurance plan, known as the guaranteed acceptance plan, provides coverage for individuals without health questions or medical exams. While this may seem convenient, the coverage is often limited compared to other life insurance options. Carefully evaluate the coverage amount and ensure it meets your needs.

- Higher Cost: The Colonial Penn TV plan, promoted by actor Jonathan Lawson, charges $9.95 per insurance unit. While this may initially seem affordable, the cost per unit is often more expensive than other life insurance plans. Compare rates from multiple providers to ensure you’re getting the best deal for your coverage.

- Better Options Available: Despite Colonial Penn and Jonathan Lawson’s marketing efforts, better life insurance options are available. It’s important to explore different types of life insurance, such as simplified issue whole life insurance with 1st-day coverage, to find the coverage that best suits your needs and budget.

Carefully evaluate the plan, consider the coverage amount, and compare rates from multiple providers. Doing so can ensure you’re making an informed decision and getting the most affordable and comprehensive coverage for you and your loved ones.

What Does $9.95 a Month Get You With Colonial Penn

The Colonial Penn Whole Life Insurance $9.95 final expense insurance plan is marketed as burial insurance and is promoted by their spokesperson, Jonathan Lawson, in their TV commercials. This plan is a guaranteed issue policy, meaning no health questions or medical exams are required to qualify. This can be a great option for those concerned about their health, but it is also an overpriced product for roughly 9 out of 10 people.

With the $9.95 plan, you’ll receive a fixed premium that will never increase, and the death benefit will never decrease. There’s a two-year waiting period before the full death benefit is available. During this waiting period, if the insured passes away, the beneficiary will receive the premiums paid plus a small amount of interest (7%). Most shoppers say the cons of Colonial Penn outweigh the pros, and there is much better life insurance available through other carriers.

| AGE | MONTHLY PAYMENT | MALE BENEFIT | FEMALE BENEFIT | MALE & FEMALE |

|---|---|---|---|---|

| 50 | $9.95 | $1,786 | $2,083 | 2-Year Wait |

| 51 | $9.95 | $1,732 | $2,068 | 2-Year Wait |

| 52 | $9.95 | $1,676 | $2,022 | 2-Year Wait |

| 53 | $9.95 | $1,621 | $1,973 | 2-Year Wait |

| 54 | $9.95 | $1,562 | $1,929 | 2-Year Wait |

| 55 | $9.95 | $1,506 | $1,884 | 2-Year Wait |

| 56 | $9.95 | $1,452 | $1,838 | 2-Year Wait |

| 57 | $9.95 | $1,392 | $1,786 | 2-Year Wait |

| 58 | $9.95 | $1,333 | $1,732 | 2-Year Wait |

| 59 | $9.95 | $1,273 | $1,676 | 2-Year Wait |

| 60 | $9.95 | $1,214 | $1,621 | 2-Year Wait |

| 61 | $9.95 | $1,157 | $1,562 | 2-Year Wait |

| 62 | $9.95 | $1,099 | $1,506 | 2-Year Wait |

| 63 | $9.95 | $1,043 | $1,452 | 2-Year Wait |

| 64 | $9.95 | $987 | $1,392 | 2-Year Wait |

| 65 | $9.95 | $932 | $1,333 | 2-Year Wait |

| 66 | $9.95 | $880 | $1,273 | 2-Year Wait |

| 67 | $9.95 | $834 | $1,214 | 2-Year Wait |

| 68 | $9.95 | $792 | $1,157 | 2-Year Wait |

| 69 | $9.95 | $753 | $1.099 | 2-Year Wait |

| 70 | $9.95 | $717 | $1,043 | 2-Year Wait |

| 71 | $9.95 | $683 | $987 | 2-Year Wait |

| 72 | $9.95 | $652 | $932 | 2-Year Wait |

| 73 | $9.95 | $620 | $880 | 2-Year Wait |

| 74 | $9.95 | $589 | $834 | 2-Year Wait |

| 75 | $9.95 | $560 | $792 | 2-Year Wait |

Other guaranteed issue life insurance plans offer past premiums plus 10% interest if a death occurs in the first two years.

While the $9.95 monthly premium may seem affordable, the coverage provided by this plan is limited. You should compare rates from multiple insurance providers to ensure you’re getting the best deal and the coverage that suits your needs

995 Plan Is A Guaranteed Issue With A 2-year Waiting Period

The Colonial Penn 995 plan offers guaranteed issue coverage but comes with a two-year waiting period. This means that you can get coverage without having to answer any health questions or undergo a medical exam. Knowing that you’ll be accepted for coverage regardless of your health status provides peace of mind. However, it’s important to be aware of the terrible two-year waiting period.

If you were to pass away during this time, the plan wouldn’t pay out the full death benefit. Instead, it would typically only refund the premiums that you’ve paid plus a small amount of interest. After the two years, the plan would provide the full death benefit.

Keep in mind that Colonial Penn can offer their customers a 995 plan, but it’s important to be mindful of your individual needs when you buy this life insurance. There are better plans available outside of Colonial Penn that offer more comprehensive coverage or better rates. Compare quotes from multiple insurance providers with a licensed insurance agent at Funeral Funds of America who is an expert that specializes in final expense insurance to guarantee you get the best pricing. This way you can get personalized guidance based on how much coverage you need.

Alternatives To Colonial Penn To The 995 Plan

If you need to buy life insurance, buying a final expense life insurance policy shouldn’t leave you hurting financially. Guaranteed acceptance plans and what Colonial Penn offers should be your last choice when it comes to buying this kind of coverage.

There are many plans better than Colonial Penn and it’s not difficult to explore alternative life insurance options worth buying that offer more comprehensive coverage and better rates than the 995 plan. When considering your life insurance needs, evaluating all available options is important to ensure you’re getting the best coverage for your situation.

Here are three areas that Funeral Funds of America can help you, and prevent you from buying an overly expensive 995 plan from Colonial Penn Life Insurance Company:

- More comprehensive coverage: While the 995 plan may offer guaranteed acceptance, it has a 2-year waiting period before the full death benefit is available. Other life insurance companies we work with povide immediate coverage without any waiting period, giving you peace of mind knowing your loved ones are protected from day one.

- Better rates: The 995 plan may seem affordable at first glance, but when compared to other life insurance options, it’s horribly expensive. By shopping around and comparing rates from multiple providers, you can find a policy that offers better rates and potentially more value for your money.

- Additional benefits: Some life insurance policies offer additional benefits, such as riders or the ability to build cash value over time. These added benefits can provide flexibility and financial security that the 995 plan may not offer.

- Term life insurance: We don’t recommend temporary life insurance for a permanent need. Most term life insurance products targeted at seniors go up in price every 5 years and cancel after age 80, so term life is not the answer for most seniors long-term needs.

When it comes to life insurance, it’s important to research and explore all available options. By considering alternatives to the 995 plan, you can find a policy that meets your specific needs and offers better coverage and rates.

Conclusion

Spokesman Jonathan Lawson, the pitchman for the Colonial Penn commercials, seems like a nice guy selling an inferior life insurance product. He even served in the Marine Corps, but still faces criticism for a perceived lack of honesty and affordability with the 995 plan versus other life insurance options.

Carefully consider the details of a Jonathan Lawson Colonial Penn life insurance policy and compare it to alternatives before deciding what plan is best for your needs. While the 995 Colonial Penn coverage plan may have its limitations, other life insurance options may better suit your needs.