Colonial Penn Life Insurance Review 2024

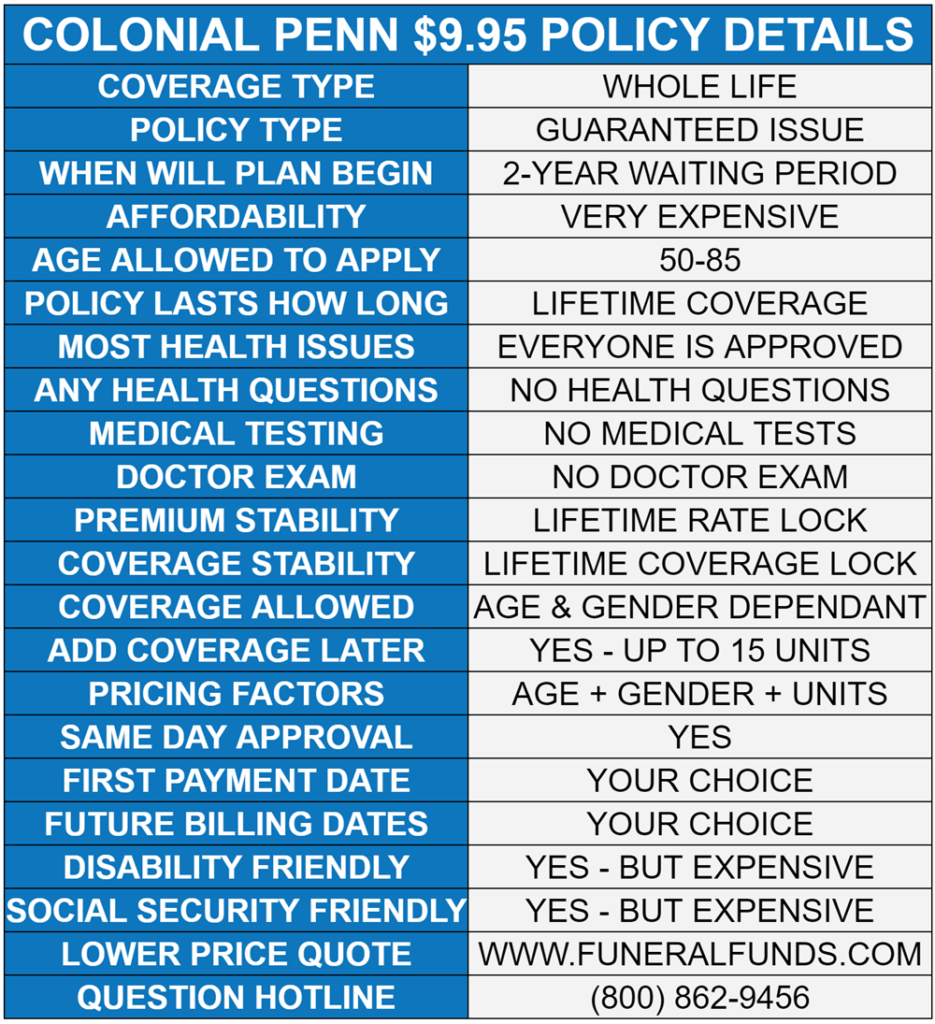

Colonial Penn is a life insurance company that sells its overpriced $9.95 per unit 2-year waiting period life insurance to senior citizens via television commercials and “junk mail”.

No one would ever buy a Colonial Penn 995 plan if they knew how it worked and how horribly expensive it is. In this Colonial Penn final expense insurance review, you’ll find out exact pricing. For example:

- A 75-year-old male would only get $560 for $9.95 a month…and get stuck with a 2-year wait plan!

- A 75-year-old female would only get $792 for $9.95 a month…and get stuck with a 2-year wait plan!

- BOTH will overpay for the rest of their lives.

So, keep reading, as we’ll show you how to get as much as twice the coverage for the premium with other better insurance companies.

Key Learning Points

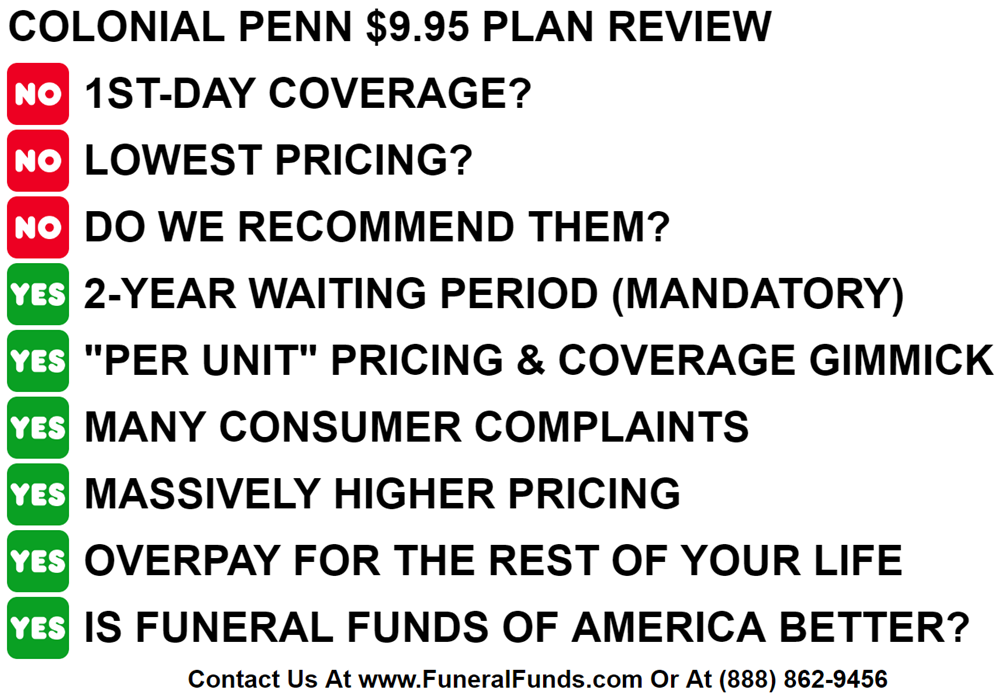

- Colonial Penn only sells their insurance and will not shop around for lower rates for you.

- Colonial Penn is $9.95 PER UNIT…not for your total amount of coverage

- Colonial Penn $9.95 plan has a mandatory 2-year waiting period

- Colonial Penn $9.95 can be up to 200% more expensive than 1st-day coverage

- Colonial Penn has a high customer dissatisfaction rating due to its alleged misleading $9.95 life insurance pricing

- Funeral Funds of America will shop around for 1st-day coverage and get you the lowest rates.

Colonial Penn Life Insurance Options

You can have a guaranteed acceptance $9.95 per unit plan or a plan where you have to qualify medically. Both of which are RARELY your best choice.

The 995 plan has a mandatory 2-year waiting period.

Is Colonial Penn Serious about the 3 P’s?

When it comes to Colonial Penn life insurance, there’s a huge emphasis on the Three P’s: PRICE, PRICE, and PRICE.

Many insurance shoppers say the 3 P’s appear to be a slick marketing technique to get you to call in, so they have young information as a “lead” to call, text, and email you marketing offers.

Colonial Penn has garnered attention for its marketing strategy, where “affordability” takes center stage while often ignoring the coverage component. The plan they seem to try to sell the hardest is their 2-year waiting period 9.95 per unit plan.

Colonial Penn’s guaranteed acceptance life insurance policies cater to those with health issues that would typically hinder them from obtaining coverage elsewhere. Consumers are advised to avoid plans with 2-year waiting periods and pricing that is potentially up to 200% more expensive than other insurance companies, as these factors can significantly impact the value and coverage you receive.

So, while Colonial Penn 995 plan 3 P’s may be a primary selling point, it’s wise to approach Colonial Penn life insurance skeptically and carefully evaluate whether their offerings meet your budget in the long run.

Guaranteed Acceptance $9.95 Plan

One $9.95 unit Colonial Penn life insurance coverage WILL NOT be enough to pay for a burial, and in many cases, it’s not enough to pay for a cremation.

Colonial Penn likely knows its single unit of coverage provides insufficient coverage, so they encourage seniors to buy more exorbitantly priced life insurance with a 2-year waiting period.

How does Colonial Penn life insurance work?

Colonial Penn uses persuasive terms to describe its 995 life insurance plan:

The truth about Colonial Penn life insurance is that their $9.95 plan is aweful for most consumers because Colonial Life insurance rates are often up to 200% higher than other companies…and you have to pay these bloated premiums for the rest of your life.

- “Guaranteed acceptance life insurance.”

- “No medical exam and no health questions required.”

- “Guaranteed acceptance coverage options start at just $9.95 a month.”

- “Your acceptance is guaranteed.”

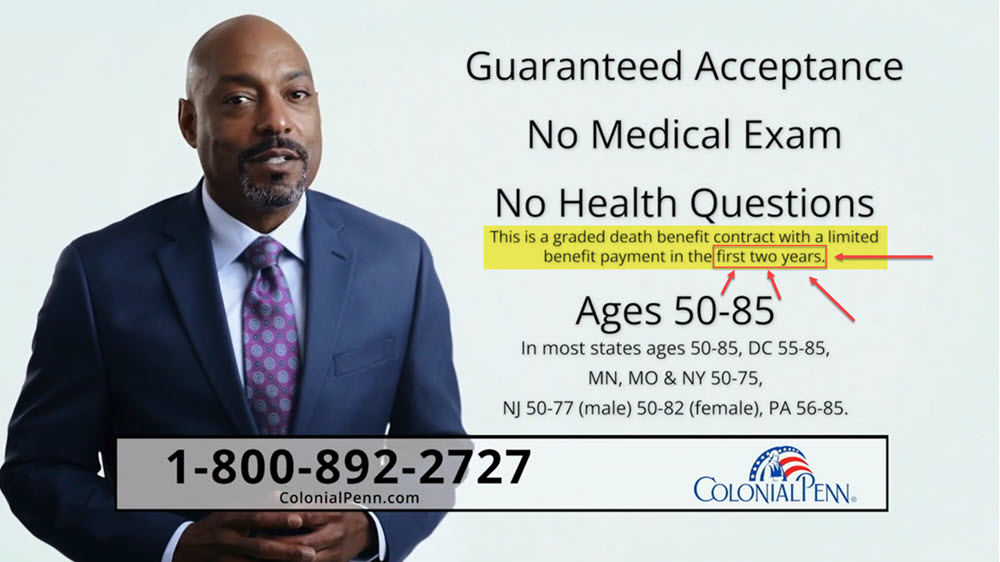

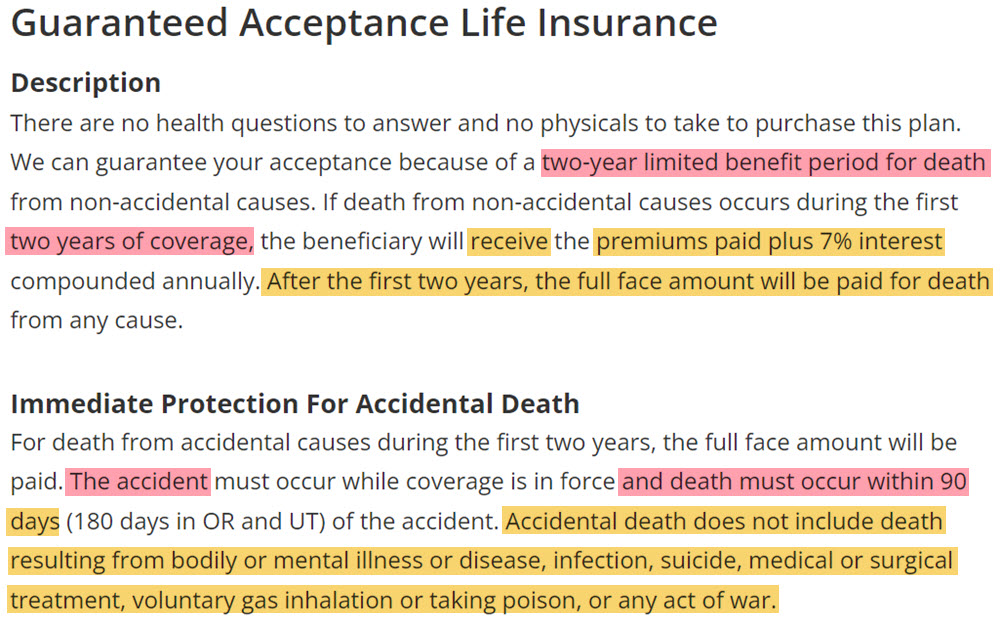

If you die in the first two years for health or medical reasons, the Colonial plan won’t pay your loved ones a single penny of life insurance.

They aren’t like “normal” burial insurance plans that let you choose a particular death benefit to determine your rate ($10,000, for example). Colonial Penn unit prices determine your death benefit by age, and, ultimately the number of units you buy, so you often end up with inconvenient coverage amounts. Your age determines the cost of each unit, and the older you are, the more a unit costs you.

We often get calls asking, “does Colonial Penn have a waiting period?”, so below is an image that shows in clear language that they 995 plans has a 2-year waiting period, making it a high-risk policy for seriors.

If you die in the first two years, their “limited benefit period,” your beneficiary will only receive your premiums paid plus 7% interest in the first two years.

Colonial Penn $9.95 Life Insurance Review

It’s essential to review the pros and cons carefully when buying Colonial Penn life insurance and determine whether the offered coverage corresponds to the life you want for yourself and your loved ones.

“Affordable life insurance” with a 2-year waiting period should be a major concern telling you to read the policy fine print BEFORE you buy and consider all available options to make an informed and wise decision for your financial future.

PROS of Colonial Penn $9.95 Plan

- Cash Value

- Lifetime Coverage

- Guaranteed Acceptance

CONS of Colonial Penn $9.95 Plan

- Per-Unit Price

- Expensive Rate

- Low Death Benefit

- 2-Year Waiting Period

- $9.95 Pricing Gimmick

- Many Consumer Complaint

- The Won’t Price Shop For YoU

- Only sell Their Insurance Products

Are There Any Riders Or Other Benefits With Colonial Penn Life Insurance?

Guaranteed Acceptance $9.95 Plan

No riders are available with this plan.

Other Benefits

POLICY LOANS – You can borrow up to 100% of your cash value, but you will have to pay 8% interest on your outstanding loan balance (which will lower your face or coverage amount if not paid each month.

This is a tax-free Colonial Penn benefit but not an interest-free benefit.

Loans reduce your cash value amount and are subtracted from your death benefit, and the interest rate on policy loans varies by state.

How Do I Get Approved By Colonial Penn Life Insurance?

Guaranteed Issue Life Insurance $9.95 Plan

This plan accepts everyone with no health questions asked. The only reason to consider the Colonial Penn 2-year limited benefit period is if your health is so bad that you don’t qualify for first-day coverage.

Even if your health is so bad that you don’t qualify for a better first-day coverage plan, this 995 plan insurance is not one you should purchase.

Additional Health Niches

You can view our A-Z Health issue chart to see what health conditions qualify for first-day coverage with other companies at Funeral Funds of America.

Colonial Penn Life Insurance Pricing

When considering life insurance options, examine how each company’s coverage corresponds to other insurance companies in the market.

The $9.95 per unit plan that Colonial Penn sells promotes the concept of cheap life insurance for those who may have faced challenges obtaining life insurance because of health concerns in the past.

However, it’s worth noting that such convenience comes at a cost, especially with Colonial Penn, which can be up to 200% more expensive than other life insurance products from other companies.

Guaranteed Acceptance $9.95 Plan

Colonial Penn doesn’t have the best pricing…in fact, it consistently has some of the WORST pricing.

Check out the Colonial Penn life insurance 995 rate charts below to see how inadequate their coverage amounts are for $9.95.

| AGE | MONTHLY PAYMENT | MALE BENEFIT | FEMALE BENEFIT | MALE & FEMALE |

|---|---|---|---|---|

| 50 | $9.95 | $1,786 | $2,083 | 2-Year Wait |

| 51 | $9.95 | $1,732 | $2,068 | 2-Year Wait |

| 52 | $9.95 | $1,676 | $2,022 | 2-Year Wait |

| 53 | $9.95 | $1,621 | $1,973 | 2-Year Wait |

| 54 | $9.95 | $1,562 | $1,929 | 2-Year Wait |

| 55 | $9.95 | $1,506 | $1,884 | 2-Year Wait |

| 56 | $9.95 | $1,452 | $1,838 | 2-Year Wait |

| 57 | $9.95 | $1,392 | $1,786 | 2-Year Wait |

| 58 | $9.95 | $1,333 | $1,732 | 2-Year Wait |

| 59 | $9.95 | $1,273 | $1,676 | 2-Year Wait |

| 60 | $9.95 | $1,214 | $1,621 | 2-Year Wait |

| 61 | $9.95 | $1,157 | $1,562 | 2-Year Wait |

| 62 | $9.95 | $1,099 | $1,506 | 2-Year Wait |

| 63 | $9.95 | $1,043 | $1,452 | 2-Year Wait |

| 64 | $9.95 | $987 | $1,392 | 2-Year Wait |

| 65 | $9.95 | $932 | $1,333 | 2-Year Wait |

| 66 | $9.95 | $880 | $1,273 | 2-Year Wait |

| 67 | $9.95 | $834 | $1,214 | 2-Year Wait |

| 68 | $9.95 | $792 | $1,157 | 2-Year Wait |

| 69 | $9.95 | $753 | $1.099 | 2-Year Wait |

| 70 | $9.95 | $717 | $1,043 | 2-Year Wait |

| 71 | $9.95 | $683 | $987 | 2-Year Wait |

| 72 | $9.95 | $652 | $932 | 2-Year Wait |

| 73 | $9.95 | $620 | $880 | 2-Year Wait |

| 74 | $9.95 | $589 | $834 | 2-Year Wait |

| 75 | $9.95 | $560 | $792 | 2-Year Wait |

Common Colonial Penn Life Insurance Company Questions

Does My Agent Still Work For Colonial Penn Life Insurance?

92% of life insurance agents are out of the insurance profession within three years.

If you’re searching for the best life insurance option, remember that consulting a Colonial Penn “life insurance expert” might not always lead to the most unbiased advice. These experts may have affiliations, incentives, or product restrictions that could sway their recommendations.

It’s worth mentioning that Colonial Penn’s limited range of life insurance products should be met with a degree of caution, as it may not necessarily translate to the best or most suitable option for individuals exploring different types of life insurance to safeguard their financial future. It’s essential to conduct thorough research and seek out independent advice when making decisions about your life coverage.

If your Colonial Penn agent has abandoned you, Funeral Funds of America can help you get a new policy or add additional coverage to your Colonial Penn policy.

What Is Colonial Penn’s Operational History

The Colonial Penn Life Insurance Company was founded in 1968 by AARP co-founder Leonard Davis to provide insurance coverage to the American Association of Retired Persons members.

FPL Group acquired the company in 1985. FPL sold the company to Leucadia National in 1991.

After several ownership changes, in 1997, it became a subsidiary of Conseco, now known as CNO Financial Group.

In 1998, Colonial Penn was renamed Conseco Direct Life to show Conseco ownership. But, in 2001, the insurance name reverted its name back to Colonial Penn.

The company is based in Philadelphia, Pennsylvania. Colonial Penn is not serving New York, but it’s covered by Banker’s Conseco Life Insurance Company, another CNO subsidiary.

Colonial Penn Customer Service & Sales

PO Box 1918

Carmel, IN 46082-1918

Life insurance sales -877-877-8052

Customer service – 800-523-9100

Customer service in New York – 800-323-4542

What Is Colonial Penn’s Financial Rating?

Based on its financial stability and record of paying claims, Colonial Penn Insurance Company has received an A- (Excellent) rating from A.M. Best.

Colonial Penn often touts its so-called “strong” financial strength rating, proudly displaying its A- (Excellent) rating from A.M. Best. While they claim this rating underscores their reliability in paying claims, it’s wise to approach such declarations skeptically.

Colonial Penn Consumer Reviews And Complaints

Consumers would be wise to ask themselves, is the 995 plan any good?

The Better Business Bureau gives Colonial Penn 1.18 stars out of 5, citing many consumer complaints.

Investopedia states, “Some 90% of the companies we reviewed received a higher grade than Colonial Penn from AM Best.” They rate Colonial Penn as 2.4 out of 5 stars.

The National Association of Insurance Commissioners (NAIC) states that the national median of complaints is 1.00, while Colonial Penn’s complaint ratio is 3.06.

Colonial Penn has 300+% more complaints than other insurance companies, according to the NAIC.

Some NAIC-reported complaints filed against Colonial Penn:

- Lack of death benefit

- Exclusions and riders that significantly reduce death benefit payouts

- High premiums

- Pressure to buy other products

- Bait and switch tactics

The Colonial Penn $9.95 life insurance advertising creates a lot of interest, phone calls, and possibly thousands of negative consumer reviews and complaints annually.

It would be wise to research Colonial Penn life insurance complaints to see if this is the company you want to buy insurance from.

Colonial Penn Life Insurance…What To Know Before Buying

What Is Colonial Penn’s Whole Life Insurance Sales Process?

Colonial Penn agents can only sell Colonial Penn products. “Captive Carrier” is the term used to describe insurance companies that only sell their products.

If other companies offer lower pricing (and I can assure you there are many), Colonial Penn agents will never tell you about those other low rates.

Almost all other life insurance companies offer better coverage and rates and most come with no waiting period.

Are Any Health Conditions Not Accepted By Colonial Penn?

These health issues are not accepted for first-day coverage.

- Activities Of Daily Living (ADLs)

- Alzheimer’s or Dementia

- AIDs, HIV, ARC

- Current Cancer

- Congestive Heart Failure

- Cardiomyopathy

- Dementia

- Dialysis

- Diabetic Amputation

- End-stage Renal Disease

- Hospice

- Nursing Home Confinement

- Organ or Tissue Transplant

- Oxygen Use

- Terminal Illness

If you have any of the above health conditions, you will often be offered a guaranteed issue policy for $9.95 per unit..

How Can I Get Pricing Help Today?

When considering life insurance options, examining how coverage corresponds to your budget and the life you envision is important.

Colonial Penn Life Insurance, like many others, offers a variety of life insurance products with limited underwriting, promising accessibility even to those who may have faced challenges obtaining life insurance because of health concerns in the past. However, it’s worth noting that such convenience often comes at a cost.

If you need burial, cremation, final expense, or funeral insurance coverage and want to ensure you get the lowest premium possible, Funeral Funds of America can help you shop and compare companies, policies, and prices.

Permanent Whole Life Insurance

Colonial Penn’s permanent whole life insurance policy for seniors is NOT the same as their 9.95 a month plan.

Colonial Penn life insurance for seniors is a permanent life insurance policy with no medical exam, but you must answer many health questions to qualify. The Colonial Penn age limit for whole life insurance is 40-75.

They have strict underwriting, so often, only healthy applicants can qualify, and you will most likely be offered the Colonial Penn 995 guaranteed acceptance plan with a two-year waiting period.

| $9.95 PLAN | PERMANENT WHOLE LIFE | |

|---|---|---|

| Age Availability | 50-85 | 40-75 |

| Medical Exam | No | No |

| Health Questions | No | Yes |

| Coverage Amount | 1-15 units | $10,000-$50,000 |

| Fixed Premium | Yes | Yes |

| Fixed Benefit | Yes | Yes |

| Living Insurance | No | Yes |

| Advertised on TV | Yes | No |

| 2-Year Waiting Period | Yes | No |

Colonial Penn Whole Life Insurance Review – Pros & Cons

PROS – Colonial Penn Whole Life Plan

- No Medical exam

- Lifetime Coverage

- First-day Coverage

CONS – Colonial Penn Whole Life Plan

- Expensive Rate

- Low Death Benefit

- Strict Underwriting

- Consumer Complaints

- Unpaid Claim Concerns

- The Won’t Price Shop For You

- Only Sell Their Insurance Products

- You’ll Generally Be Sold The $9.95 Plan

Colonial Penn Permanent Whole Life Insurance Riders

While some might appreciate the flexibility of an optional living benefit rider, accessing a portion of the life insurance benefit amount available for critical illnesses or chronic conditions, it’s crucial to evaluate whether this additional feature corresponds to your actual needs.

“Living Insurance” is the marketing term for Colonial Penn’s life insurance riders.

These riders allow policyholders to access 50% of their policy face amount while alive and diagnosed with a serious illness. You will have to pay a policy loan fee the entire time the borrowed money is not repaid.

- CANCER – A policy owner can withdraw up to 25% of the face amount for any type of cancer, excluding skin cancer.

- CHRONIC ILLNESS – Other companies call this a “critical illness rider.” A policy owner can withdraw up to 50% of the face amount for any type of cancer, excluding skin cancer.

- HEART ATTACK OR STROKE – Other companies call this a “critical illness rider.” A policy owner can withdraw up to 50% of the face amount for any heart attack or stroke event.

Colonial Penn Permanent Whole Life Insurance

There are two processes to determine if you will medically qualify for a Colonial Penn whole life insurance policy:

- Health questions

- Prescription history check

An underwriter may request to speak with you over the phone to ask some follow-up questions.

These are the health questions you will find on the application:

- Within the past 12 months, have you used a wheelchair or supplemental oxygen? Are you confined to a hospital or nursing facility? Are you currently receiving home health care? Have you been disabled due to an illness?

- Did the doctor advise you to have surgery or some diagnostic test that hasn’t been completed yet?

- Do you have a diagnosis and treatment for HIV or AIDS?

- In the previous three years, do you have a diagnosis or treatment for the following:

- Coronary artery disease (congestive heart failure, heart attack, cardiomyopathy)

- Lung disease (COPD, sarcoidosis, chronic bronchitis, pulmonary fibrosis, or emphysema)

- Kidney disease (needing dialysis for kidney insufficiency or kidney failure)

- Heart surgery (valve repair or replacement, requires a defibrillator or pacemaker)

- Any type of cancer or cancer recurrence (multiple myeloma, leukemia, or malignant melanoma)

- Liver disease (hepatitis or cirrhosis)

- Peripheral vascular disease, peripheral artery disease, transient ischemic attack, or stroke)

- Dementia or Alzheimer’s disease

- Mental disorders (bipolar disorder, psychosis, schizophrenia)

- Diabetes (using insulin, diabetic complications like amputations)

- Neuromuscular diseases (muscular dystrophy, multiple sclerosis, amyotrophic lateral sclerosis)

- Collagen vascular diseases ( cystic fibrosis or systemic lupus erythematosus)

- Alcohol or drug abuse

If you answer any of these questions “Yes,” your application will be DECLINED. In that case, you will be offered the Colonial Penn guaranteed life insurance plan with a terrible two-year waiting period.

Common health issues that result in a declined application for Colonial Penn whole life:

- Bipolar disorder, Schizophrenia, Psychosis

- Blood thinner use

- COPD, emphysema, chronic bronchitis, pulmonary fibrosis

- Cancer of any type

- Cardiomyopathy, congestive heart failure, mini-strokes (TIA attack)

- Diabetic complications such as neuropathy, retinopathy, nephropathy

- Disabled due to an illness

- Hospitalized within the last year

- Insulin use or dependency

- Liver disease, cirrhosis, hepatitis

- Multiple sclerosis, muscular dystrophy

- Oxygen use

- PVD, severe obesity, or amputations

- Receiving home health care

- Renal disease, kidney failure

- Systemic lupus

- Wheelchair use

If you answered “yes” to any of these medical conditions, you would be automatically declined for Colonial Penn’s whole life policy.

With Colonial Penn’s strict underwriting for their permanent whole life insurance, only a small percentage of applicants will qualify for this whole life plan.

If you were declined, you would typically be offered the Colonial Penn guaranteed acceptance life insurance. Rates start at 995 with an undesirable two-year waiting period.

Permanent Whole Life Insurance

Look at the pricing table below to estimate coverage amounts with the Colonial Penn whole life insurance policy.

| FEMALE AGE | $5,000 | $10,000 | $15,000 | $20,000 |

|---|---|---|---|---|

| 50 | $19.29 | $36.33 | $53.37 | $70.42 |

| 55 | $21.42 | $40.60 | $59.77 | $78.95 |

| 60 | $24.26 | $46.27 | $68.28 | $90.29 |

| 65 | $28.16 | $54.07 | $79.98 | $105.89 |

| 70 | $34.15 | $66.04 | $97.94 | $129.83 |

| 75 | $43.08 | $83.92 | $124.75 | $165.58 |

| MALE AGE | $5,000 | $10,000 | $15,000 | $20,000 |

|---|---|---|---|---|

| 50 | $21.46 | $40.66 | $59.87 | $79.07 |

| 55 | $24.21 | $46.16 | $68.12 | $90.07 |

| 60 | $27.90 | $53.56 | $79.21 | $104.87 |

| 65 | $33.01 | $63.77 | $94.52 | $125.28 |

| 70 | $40.62 | $78.98 | $117.35 | $155.72 |

| 75 | $51.62 | $100.99 | $150.36 | $199.73 |

Colonial Penn rates are based on your age, gender, health, coverage amount, and the state you live in at the time of application.

*Pricing for illustration purposes only and are subject to change without notice.

CONCLUSION

Choosing the right insurance can be tricky, and Colonial Penn Life Insurance is often not the best fit for everyone. It’s important to be careful and look at different options.

The presence of Colonial Penn customer complaints and concerns about pricing should give prospective buyers pause.

Make sure the insurance you select matches your long-term plans and keeps your money safe. Keep in mind that Colonial Penn and it’s 2-year waiting periods have significant drawbacks, so it’s a good idea to exercise caution and consider other choices too.

The most significant concern with Colonial Penn’s life insurance policies is that you’re dealing with a company that focuses heavily on its 2-year waiting period guaranteed issue whole life policy, which is often the worst type of life insurance plan for individuals.

For those seeking better rates and more comprehensive coverage options, exploring alternatives like Funeral Funds of America is advisable. We provide various insurance products and work diligently to match clients’ life insurance needs, offering more flexibility and potentially better value.

6 Comments

Manuel P Valdez

HELP

Funeral Funds

Manual – How can we help you?

John R Nelson

I am interested in purchasing cremation insurance for three members of my family:

My wife age 66 as of February 7, 1956

My self age 69 but will be 70 on May 17, 1952

My older brother who lives with us- age 74 and he will be 75 on November 11, 1947.

We prefer to be cremated and we are not looking for a big payout at death.

I would like to discuss with a Funeral Funds expert

Funeral Funds

John – We sent you an email with some information.

Edgar P.

Do you have any estimation for seniors over 80 life insurance rate?

Funeral Funds

Visit this page for quotes – https://funeralfunds.com/free-quote/