Top 10 Final Expense Life Insurance Companies in 2024

Our top 10 final expense life insurance companies will help you find the lowest price, get the most coverage, and help you determine which insurance company is best for you and your cremation, burial, or final expense insurance needs.

We give you the actual company names, underwriting tips, and tricks, and we even provide their actual application questions for you to review to what you qualify for.

Why do we do this?

First of all, we like well-educated shoppers. Well-educated shoppers don’t say silly things like “what’s the price” in the first five seconds of a conversation before we know their age or how much coverage they want.

More importantly, we want you to understand exactly what you are buying, why we would recommend a particular insurance company, and why we recommend you should avoid certain insurance companies.

All the final expense life insurance companies we help people with at Funeral Funds include the following benefits:

- 1st-day coverage or benefits

- Permanent whole life protection

- Rates never increase (locked in for life)

- Coverage never decreases (locked in for life)

- Approvals are issued before you have to put any money down

- You get to choose your billing date

- Builds cash value that you can borrow against in an emergency

FOR EASIER NAVIGATION:

- Our Top 10 Final Expense Life Insurance Companies

- Trinity Life

- Family Benefit Life

- Royal Neighbors

- Mutual of Omaha

- American Amicable

- Aetna

- Liberty Bankers

- Prosperity

- Guarantee Trust Life

- AIG

- Our “FEARFUL 4” Final Expense Policies

- Additional Questions & Answers On Top 10 Final Expense Insurance Companies

Our Top 10 Final Expense Life Insurance Companies

#1 – TRINITY LIFE

1ST-DAY COVERAGE: Yes, with Funeral Funds

Financial Rating: A+ BBB Rating

Age Availability: 50-85

Face Amount Range: $2,500 – $25,000

Lowest Rate: $7.38 per month*

Final Expense Product: Golden Eagle Final Expense

Trinity Life Insurance Company offers their Golden Eagle final expense plan with first-day coverage for people 50-85 years old.

They have has flexible underwriting, and most health conditions qualify for first-day coverage. They also have an easy same-day application and phone approval process (Trinity Life & Family Benefit Life use the same application questions).

PROS:

- Extremely low prices compared to other companies.

- Underwriting that makes it easier to qualify

- They have one of the easiest phone approval processes.

- The beneficiary can be a funeral home

- Terminal illness accelerated death benefit rider

- Nursing home provision rider

CONS:

- Products not available in all states

- They do not accept check or money order payments by mail (must have checking or savings account)

NOT APPROPRIATE FOR:

- ADL Restrictions (Activities of Daily Living)

- AIDS, ARC, HIV

- Cancer (current diagnosis or treatment)

- Congestive Heart Failure

- COPD

- Dementia

- Diabetic Neuropathy or complications.

- Dialysis

- Hospitalization in the last 6 months

- Inhalers (if used more than 1 time a month)

- Kidney or Liver Disease

- Nursing home confinement

- Obese applicants

- Oxygen use

PRICING:

- Some of the best rates in the entire insurance industry

- Rates are determined by age, health, gender, state, and the coverage amount

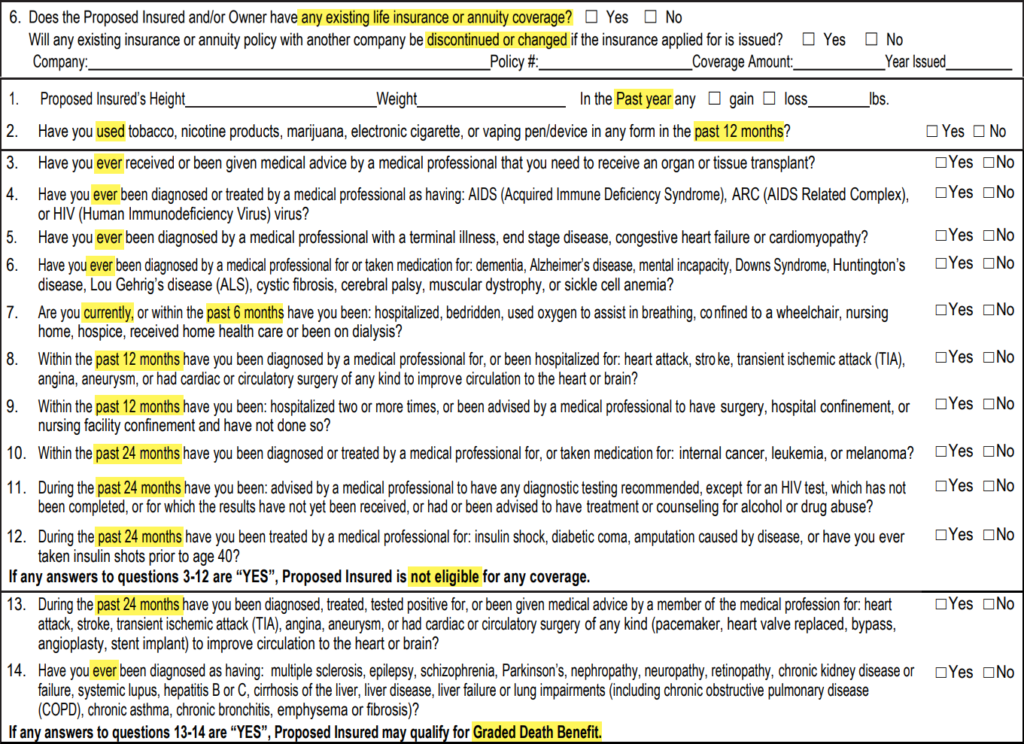

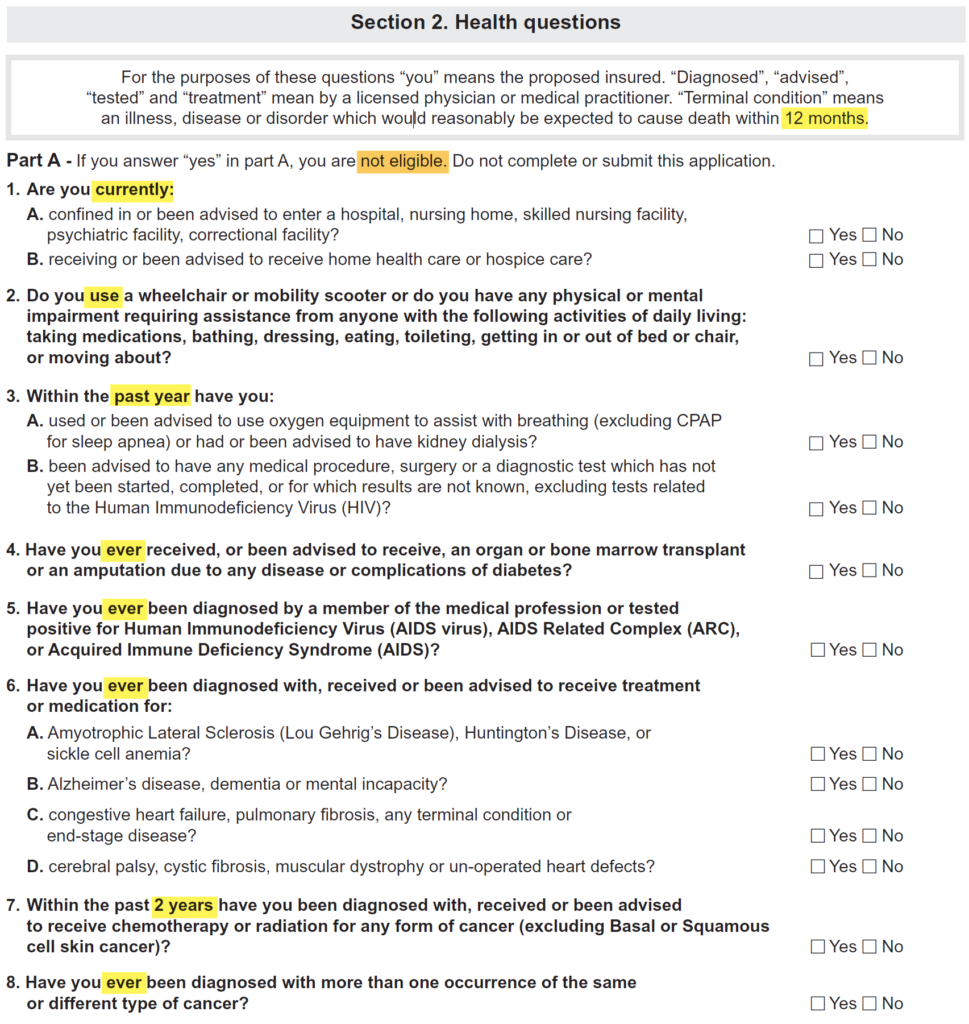

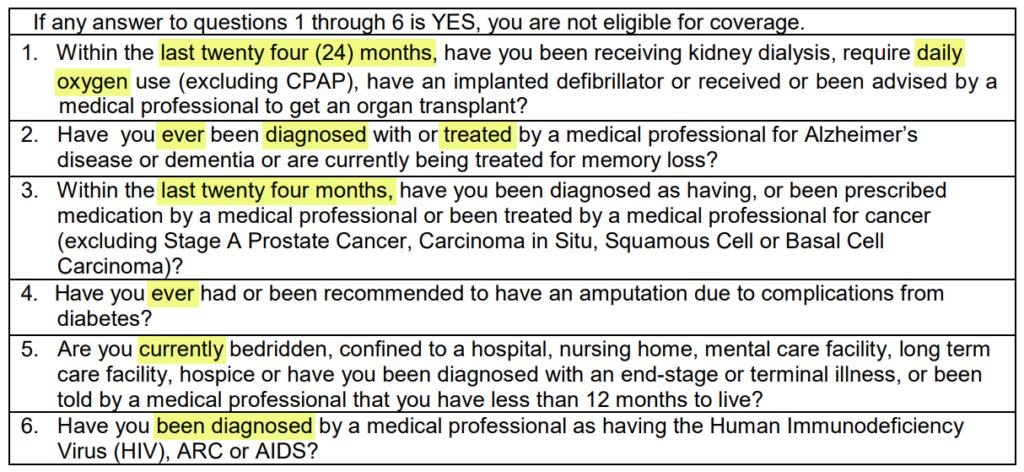

Application & Eligibility Questions:

#2 – Family Benefit Life

1ST-DAY COVERAGE: Yes, with Funeral Funds

Financial Rating: A+ BBB Rating

Age Availability: 50-85

Face Amount Range: $2,500 – $25,000

Lowest Rate: $7.38 per month*

Final Expense Product: Golden Eagle Final Expense

Family Benefit Life offers their Golden Eagle final expense plan with first-day coverage for people 50-85 years old.

They have has flexible underwriting, and most health conditions qualify for first-day coverage. They also have an easy same-day application and phone approval process (Trinity Life & Family Benefit Life use the same application questions).

PROS:

- Extremely low prices compared to other companies.

- They have one of the easiest phone approval processes.

- They have one of the easiest phone approval processes.

- A beneficiary can be a funeral home

- Terminal illness accelerated death benefit rider

- Nursing home provision rider

CONS:

- Products not available in all states

- They do not accept check or money order payments by mail (must have a checking or savings account)

NOT APPROPRIATE FOR:

- ADL Restrictions (Activities of Daily Living)

- AIDS, ARC, HIV

- Cancer (current diagnosis or treatment)

- Congestive Heart Failure

- COPD

- Dementia

- Diabetic Neuropathy or complications.

- Dialysis

- Hospitalization in the last six months

- Inhalers (if used more than one time a month)

- Kidney or Liver Disease

- Nursing home confinement

- Obese applicants

- Oxygen use

PRICING:

- Some of the best rates in the entire insurance industry

- Rates are determined by age, health, gender, state, and the coverage amount

Application & Eligibility Questions:

#3 – Royal Neighbors Of America

1ST-DAY COVERAGE: Yes, with Funeral Funds

Business Rating: A.M. Best – A-

Age Availability: 50-85

Face Amount Range: $7,000-$30,000

Lowest Rate: $26.1w per month*

Final Expense Product: Simplified Issue Whole Life

Royal Neighbors of America has a simplified issue whole life and graded death benefit products for its final expense life insurance.

- Recent hospitalization

- No build chart for height and weight

- Diabetic neuropathy

Royal Neighbors has a plan for you if you’re looking for burial insurance for seniors over 70. You will just need to answer a few simple health questions, and yes, answers will still allow applicants between 50 and 85 years old for a graded death benefit. There are no preferred or sub-standard rates issues; they only have ratings for tobacco and non-tobacco users.

Royal Neighbors of America’s final expense life insurance has the most lenient underwriting out of all top final expense insurance companies. They are the most diabetic-friendly final expense insurance carrier in the nation. They are also known to insure applicants with other health issues.

PROS:

- Low prices compared to other companies.

- They have one of the easiest phone approval processes.

- Great for overweight people (no height & weight chart)

- They accept diabetic neuropathy (this will likely change in the future)

- They will accept COPD if no diagnosis or treatment in the last 24 months

- Recent hospitalizations are accepted

- They accept almost all frequent inhaler use

- The beneficiary can be a funeral home

- Terminal illness accelerated death benefit rider

CONS:

- Products not available in all states

- The lowest amount of coverage available is $7,000 (but they do go up to $30,000)

- They do not accept check or money order payments by mail (must have a checking or savings account)

NOT APPROPRIATE FOR:

- ADL Restrictions (Activities of Daily Living)

- AIDS, ARC, HIV

- Cancer (current diagnosis or treatment)

- Congestive Heart Failure

- COPD (diagnosed or treated in last 24 months)

- Dementia

- Dialysis

- Kidney or Liver Disease

- Nursing home confinement

- Oxygen use

PRICING:

- Great rates…especially for people with specific medical problems

- Rates are determined by age, health, gender, state, and the coverage amount

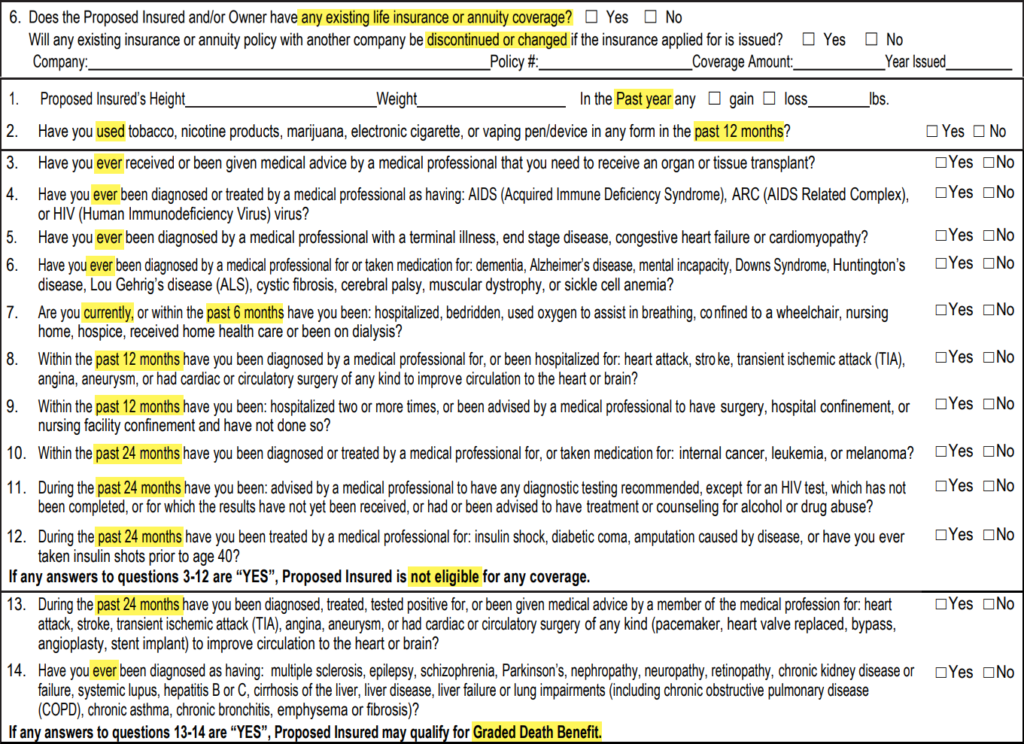

Application & Eligibility Questions:

#4 – Mutual Of Omaha

1ST-DAY COVERAGE: Yes, with Funeral Funds

Business Rating: A.M. Best A+

Age Availability: 45-85

Face Amount Range: $2,000-$40,000

Lowest Rate: $7.42 per month*

Final Expense Product: Living Promise

Mutual of Omaha has a whole life final expense insurance policy called Living Promise. Mutual of Omaha burial insurance is a whole life final expense policy that builds cash value.

Living Promise is available for ages 45 to 85, with no separate classifications for a smoker. You can buy $2,000 to $40,000 coverage. The Living Promise offers a great level of benefits policy.

To qualify for this policy, you must undergo a health background check, including a prescription history check and MIB record verification. Build charts are also a requirement, and phone interviews are done randomly.

Living Promise comes with an accelerated death benefit rider which pays out if the policyholder is determined by a medical professional with a terminal illness and given less than 12 months to live. It also pays out early if the insured is confined to a nursing home for more than 90 days and expected to remain in confinement for life.

Mutual of Omaha final expense insurance is one of our favorite choices for funeral funding due to its financial strength and low prices.

PROS:

- Good prices compared to other companies.

- They are friendly for people with a history of seizures

- Riders?

CONS:

- Mutual of Omaha does offer a 2-year wait-only policy…don’t get fooled into buying this type of policy.

- They do not offer same-day approvals, and you may have to wait up to a week to get your approval (which is unnecessary since other companies offer same-day coverage at lower prices in most cases)

- 4-year lookback on some health issues results in more declined applications

- Terminal illness accelerated death benefit rider

- Nursing home provision rider

NOT APPROPRIATE FOR:

- ADL Restrictions (Activities of Daily Living)

- AIDS, ARC, HIV

- Cancer (current diagnosis or treatment)

- Congestive Heart Failure

- COPD

- Dementia

- Diabetic Neuropathy or complications.

- Dialysis

- Hospitalization in the last six months

- Inhalers (if used more than one time a month)

- Kidney or Liver Disease

- Nursing home confinement

- Obese applicants

- Oxygen use

PRICING:

- Competitive rates in the insurance industry

- Rates are determined by age, health, gender, state, and the coverage amount

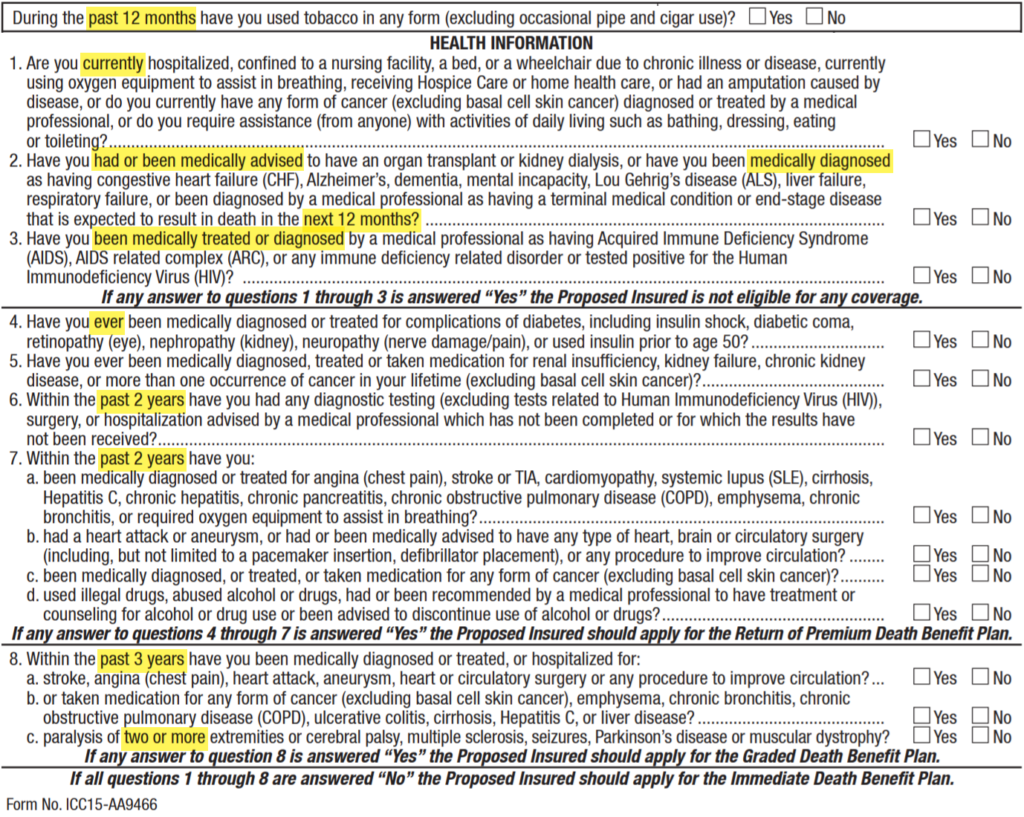

#5 – American Amicable

1ST-DAY COVERAGE: Yes, with Funeral Funds

Financial Rating: A (excellent)

Age Availability: 50-85

Face Amount Range: $2,500 to $35,000

Lowest Rate: $8.65 per month*

Final Expense Product: Senior Choice

If you qualify, their Senior Choice Immediate Death Benefit Plan comes with first-day coverage. You will be 100% covered from the first day, and your beneficiary will receive your full death benefit when you pass away.

They often have the best pricing for tobacco users. If you smoke cigarettes or chew tobacco, they are a good company to price check, especially if you qualify for the immediate benefit plan.

American Amicable also has many riders. If you’re after the additional benefits the riders provide, their burial insurance plans make the most sense.

PROS:

- Average pricing compared to other companies.

- They have easy phone approval processes.

- They will accept Nitroglycerin prescriptions if prescribed but never used

- A good option for insulin use started after the age 50

- A beneficiary can be a funeral home

- Terminal illness accelerated death benefit rider

- Nursing home provision rider

CONS:

- Products not available in all states

- 3-year lookback on some health conditions (whereas other companies only have 2-year lookback periods)

- Not good for large/obese people because they use height and weight charts to qualify people for coverage

- They do not accept check or money order payments by mail (must have a checking or savings account)

NOT APPROPRIATE FOR:

- ADL Restrictions (Activities of Daily Living)

- AIDS, ARC, HIV

- Cancer (current diagnosis or treatment)

- Congestive Heart Failure

- COPD

- Dementia

- Diabetic Neuropathy or complications.

- Dialysis

- Kidney or Liver Disease

- Nursing home confinement

- Obese applicants

- Oxygen use

PRICING:

- Good rates in the insurance industry

- Rates are determined by age, health, gender, state, and the coverage amount

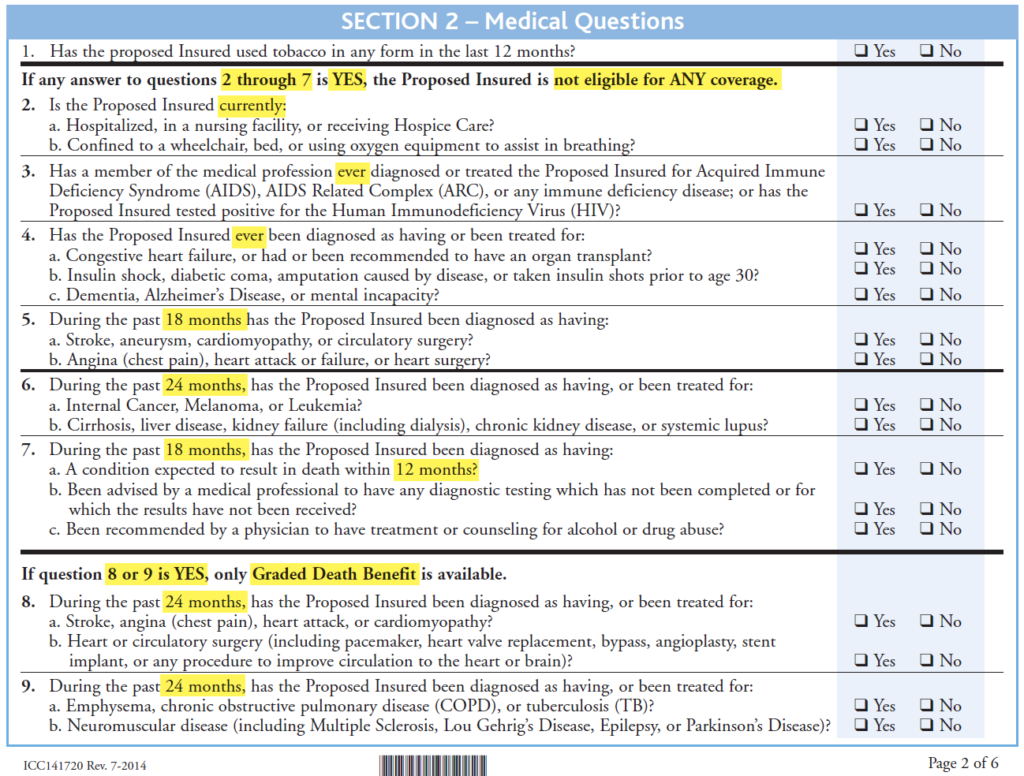

#6 – Aetna

1ST-DAY COVERAGE: Yes, with Funeral Funds

Business Rating: A.M. Best – A

Age Availability: 60-89

Face Amount Range: $3,000-$35,000

Lowest Rate: $10.64 per month*

Final Expense Product: Final Expense Life Insurance

American Continental Insurance Company provides Aetna’s final expense insurance.

Aetna is among the few companies offering coverage to people up to 89 years old; this feature allows them to offer great value to many seniors looking for final expense coverage.

The Aetna burial life insurance is a whole life insurance policy guaranteed up to age 121. The premiums and the death benefit are level and will never change as long as premiums are paid. The policy builds cash value that can be used to cover premiums if there is enough money in the account. You can withdraw funds or take a loan against the cash value.

They have a relaxed underwriting process, no height and weight chart, and do not check the Medical Information Bureau as part of their application. There are three levels of coverage available: Immediate death benefit, Graded death benefit, and Modified death benefit.

PROS:

- Extremely low prices compared to other companies.

- They have one of the easiest phone approval processes.

- Great for overweight people (no height & weight chart)

- COPD without oxygen approved for 1st-day coverage

- Recent hospitalizations are accepted

- They accept almost all frequent inhaler use

CONS:

- Products not available in all states

- They do not accept check or money order payments by mail (must have a checking or savings account)

NOT APPROPRIATE FOR:

- ADL Restrictions (Activities of Daily Living)

- AIDS, ARC, HIV

- Cancer (current diagnosis or treatment)

- Congestive Heart Failure

- COPD with oxygen use

- Dementia

- Diabetic Neuropathy or complications.

- Dialysis

- Kidney or Liver Disease

- Nursing home confinement

- Oxygen use

PRICING:

- Some of the best rates in the entire insurance industry

- Rates are determined by age, health, gender, state, and the coverage amount

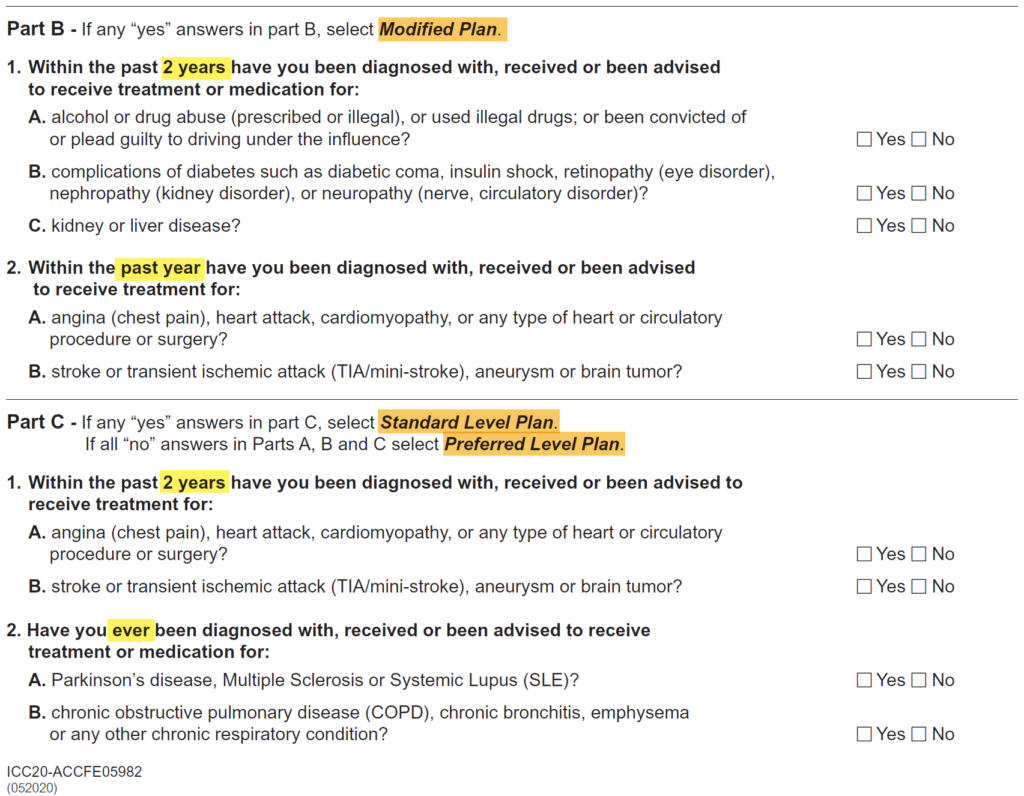

#7 – Liberty Bankers

1ST-DAY COVERAGE: Yes, with Funeral Funds

Financial Rating: A- (Excellent)

Age Availability: 18-80

Face Amount Range: $3,000-$30,000

Lowest Rate: $10.91 per month*

Final Expense Product: SIMPL Preferred & Standard Plan

Liberty Bankers offers their SIMPL Preferred and SIMPL Standard insurance plans offer first-day coverage. You may qualify for first-day coverage even if you have any of these medical conditions:

- COPD (without any oxygen use)

- Emphysema

- Hepatitis

- Kidney disease (not requiring dialysis)

- Liver cirrhosis

- Liver disease

- Systemic Lupus

- Parkinson’s disease (with no ADL issues)

PROS:

- Extremely low prices compared to other companies.

- They have one of the easiest phone approval processes.

- The beneficiary can be a funeral home

- Terminal illness accelerated death benefit rider

- Nursing home provision rider

CONS:

- Products not available in all states

- They do not accept check or money order payments by mail (must have a checking or savings account)

NOT APPROPRIATE FOR:

- ADL Restrictions (Activities of Daily Living)

- AIDS, ARC, HIV

- Cancer (current diagnosis or treatment)

- Congestive Heart Failure

- COPD

- Dementia

- Diabetic Neuropathy or complications.

- Dialysis

- Hospitalization in the last six months

- Inhalers (if used more than one time a month)

- Kidney or Liver Disease

- Nursing home confinement

- Obese applicants

- Oxygen use

PRICING:

- Some of the best rates in the entire insurance industry

- Rates are determined by age, health, gender, state, and the coverage amount

This is an excellent plus since these medical conditions will result in a waiting period with other companies.

You can also opt to add a children’s and grandchildren rider, accelerated death benefit rider, and accidental death and dismemberment rider.

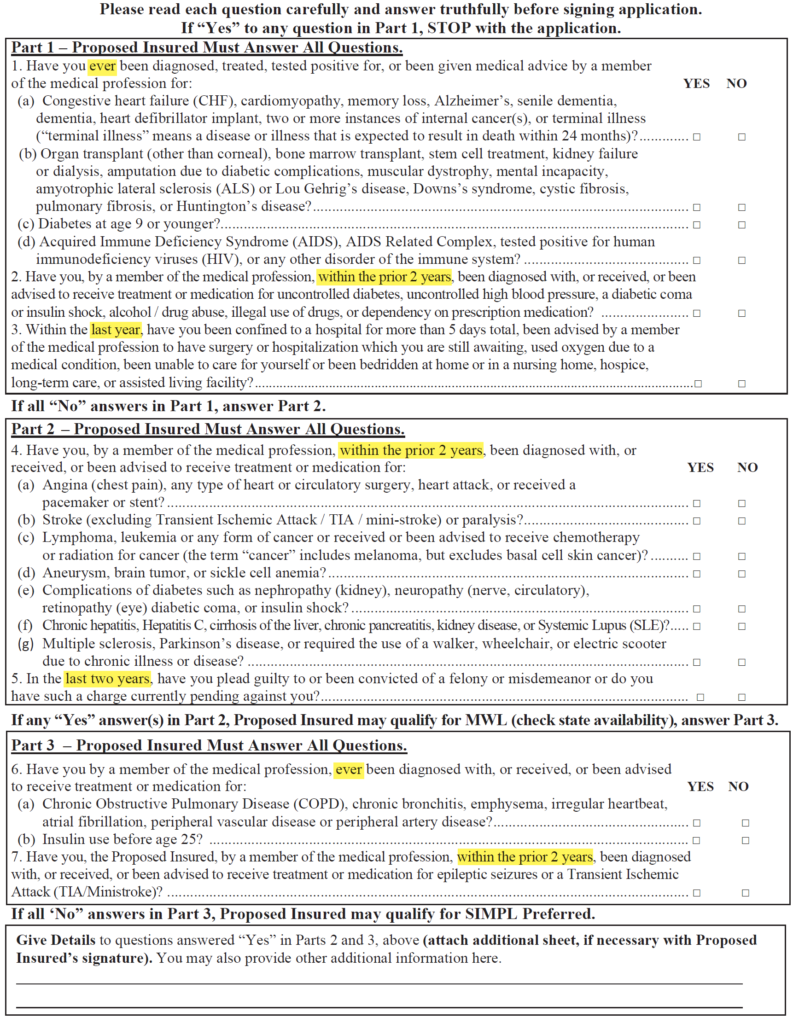

#8 – Prosperity Life

1ST-DAY COVERAGE: Yes, with Funeral Funds

Financial Rating: A- (Excellent) rating from A.M. Best

Age Availability: 50-80 years old

Face Amount Range: $1,500 to $35,000

Lowest Rate: $7.43 per month*

Final Expense Product: New Vista

Prosperity Life’s New Vista Level benefit plan has average pricing in the same range as other big insurance companies offering first-day coverage plans.

This is best for non-cigarette smokers. Their smoker rate only applies to cigarette smoking. Tobacco and nicotine users can get non-tobacco rates equal to 30-40% savings on their premiums.

Semi-lenient underwriting – most medical conditions will qualify for first-day coverage.

PROS:

- They accept Direct Express Government debit cards for payments (one of the few companies that do this)

- Non-cigarette tobacco product users get non-tobacco rates

- They have one of the easiest phone approval processes.

- They accept seizure disorders like epilepsy

- Wheelchair-bound because of accident approved

- Terminal illness accelerated death benefit rider

CONS:

- Products not available in all states

- Their customer service is sometimes difficult to get in touch with for policy updates and changes

NOT APPROPRIATE FOR:

- ADL Restrictions (Activities of Daily Living)

- AIDS, ARC, HIV

- Cancer (current diagnosis or treatment)

- Congestive Heart Failure

- COPD

- Dementia

- Diabetic Neuropathy or complications.

- Dialysis

- Kidney or Liver Disease

- Nursing home confinement

- Obese applicants

- Oxygen use

PRICING:

- Good rates in the insurance industry

- Their non-smoker tobacco rates are terrific compared to other insurance companies

- Rates are determined by age, health, gender, state, and the coverage amount

#9 – Guarantee Trust Life

1ST-DAY BENEFITS: Yes, with Funeral Funds

Financial Rating: B++ (Very Good) by A.M. Best Company

Age Availability: 18-80

Face Amount Range: $2,500 to $20,000

Lowest Rate: $12.54 per month*

Final Expense Product: Personal Security Life

GTL has two whole life insurance available to 50-85 years old. The level death benefit plan is a first-day coverage plan that only asks health questions. While their graded death benefit plan has first-day benefits.

PROS:

- Benefits that start from the first day with coverage phased in over time

- They accept 90% of all major health conditions

- They offer low prices for more high-risk applicants compared to other companies

- They have an easy phone approval processes (about 3-4 minutes to apply by phone)

- Flexible billing options

- Permanent lifetime protection

- Rates and coverage are locked for life

- Builds cash value that you can borrow against in an emergency

- The beneficiary can be anyone you want

CONS:

- Products not available in all states

- They do not accept check or money order payments by mail (must have a checking or savings account)

NOT APPROPRIATE FOR:

- ADL Restrictions (Activities of Daily Living)

- AIDS, ARC, HIV

- Cancer (diagnosis or treatment in the last 24 months)

- COPD

- Dementia

- Diabetic Amputation

- Dialysis

- Nursing home confinement

- Daily Oxygen use

PRICING:

- Some of the best rates in the insurance industry

- Rates are determined by age, health, gender, state, and the coverage amount

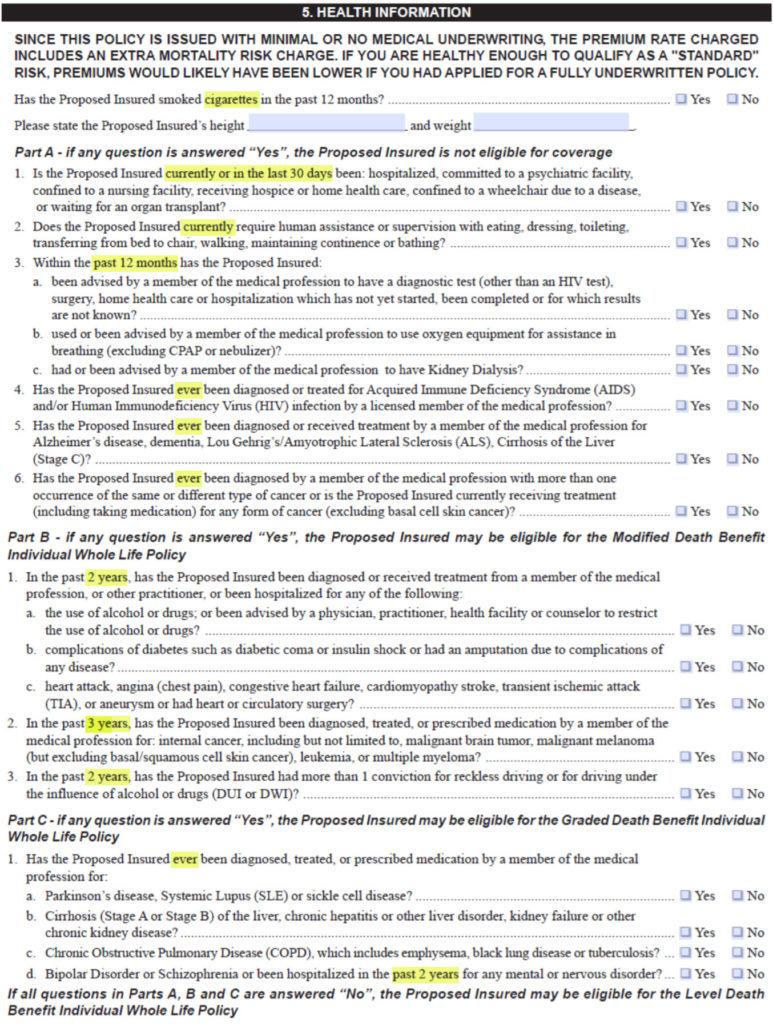

#10 – AIG

1st-Day Coverage: 2-year waiting period only

Business Rating: A.M. Best – A

Age Availability: 50-80

Face Amount Range: $5,000-$25,000

Lowest Rate: $20.29 per month*

Final Expense Product: Guaranteed Issue Whole Life

AIG offers no medical exam or health questions policy. This plan is offered for ages 50 to 80 with $25,000 maximum coverage. You can get this policy for your parents or grandparents who cannot afford the premiums.

The guaranteed issue policy from AIG comes with a two-year waiting period. If you die during the waiting period, your beneficiary will only get 110% of the premiums paid into the policy. The 100% death benefit will be given if you die in the third year of the policy.

If you are in good to moderate health, we can help you qualify for a better 1st-day coverage plan with immediate death benefits rather than an AIG plan with a 2-year waiting period.

PROS:

- One of the best and most reputable companies in the United States

- Every Medical Condition Is Accepted…No Health Questions Asked

- Easy approval over the phone with an email signature process

- Accidental death coverage is provided for the full face amount from the first day.

- 100% Return of premium if death occurs in the first 24 months

- Terminal Illness & Chronic Illness rides included for free

- Available in almost all states

CONS:

- More expensive than other companies because they accept high health-risk applicants.

- Mandatory 2-year waiting period for any health or medical-related death

- They do not accept check or money order payments by mail (must have a checking or savings account)

APPROPRIATE FOR:

- ADL Restrictions (Activities of Daily Living)

- AIDS, ARC, HIV

- Cancer (diagnosis or treatment in the last 24 months)

- COPD

- Dementia

- Diabetic Amputation

- Dialysis

- Nursing home confinement

- Daily Oxygen use

NOT APPROPRIATE FOR:

- People who are expected to live less than two years (hospice, terminal illness, etc.)

PRICING:

- Rates are determined by age, health, gender, state, and the coverage amount

Our “Fearful 4” Final Expense Policies

If you are fearful that you will be sold a policy by some companies that won’t pay out when you need it the most, you are right to be worried!

There are some companies we DON’T recommend because they are term life policies, have 2-year waiting periods or their marketing practices are often described by many consumers as deceptive.

$9.95 POLICIES FROM COLONIAL PENN – NOT RECOMMENDED

- Your insurance through Colonial Penn WILL NOT cost $9.95 unless you only want a meaningless amount of coverage.

- Colonial Penn’s $9.95 per unit pricing often only pays out less than $500 per unit (depending on your age).

- Colonial Penn also has a 2-year waiting period where they won’t pay out any health or medical-related death claims.

- So you get terrible pricing and a terrible 2-year waiting period.

TERM LIFE INSURANCE FROM GLOBE LIFE, AARP, NEW YORK LIFE, & TRUESTAGE – NOT RECOMMENDED

- This company’s most advertised and sold consumer product is their TERM LIFE insurance.

- It is less expensive at first than whole life, but then it rapidly increases in price every five years

- It cancels after age 80 (exactly when you need this coverage the most).

- These policies rarely pay out because people have to cancel them as they grow increasingly expensive or because they outlive their policy.

- After your policy cancels, these companies keep your money, and you now have no coverage.

- Globe Life & AARP & New York Life & TruStage’s term life insurance policies are almost identical… disappointing term life insurance products that go up in price every five years and cancel when you need them the most.

2-YEAR WAITING PERIOD PLAN MUTUAL OF OMAHA (UNITED OF OHAMA) – NOT RECOMMENDED

- Because Mutual of Omaha sells 1st-day coverage, some people mistakenly believe this plan offers that protection; it does not!

- Mandatory 2-year waiting period with this program.

- Will not pay any death benefit in the first two years for health or medical reasons.

FUNERAL ADVANTAGE PLANS FROM LINCOLN HERITAGE

- Lincoln Heritage offers some of the most expensive final expense policies in the marketplace.

- Some cases are astoundingly expensive, especially if you have more significant health problems.

- Up to a 3-year waiting period for more significant pre-existing health conditions.

Additional Questions & Answers On Top 10 Final Expense Insurance Companies

Is final expense insurance a good deal?

Final expense life insurance is a good deal because it can provide peace of mind knowing that your loved ones will be taken care of financially after you die.

Is final expense whole life?

Yes, final expense life insurance is a form of whole life insurance that lasts for the entirety of the policyholder’s life.

Why should I buy final expense insurance?

There are a few reasons why you might want to purchase final expense insurance. First, it can provide peace of mind knowing that your loved ones will be taken care of financially after you die. Second, it can be a cheaper alternative to other life insurance policies. And finally, it can be a good way to cover funeral expenses and other end-of-life costs.

What is the senior final expense program?

The senior final expense program is a specific type of final expense life insurance designed for people aged 50 to 85.

Who is final expense insurance for?

Final expense insurance is for anyone who wants to ensure their loved ones are taken care of financially after dying. It’s a particularly good option for people looking for a cheaper alternative to other life insurance policies.

What is the difference between final expense and term life insurance?

The main difference between final expense and term life insurance is that final expense insurance is a form of whole life insurance, whereas term life insurance is only for a specific period.

How much does final expense insurance cost?

Final expense insurance costs vary depending on age, gender, coverage amount, and location.

How big is the final expense insurance industry?

The final expense insurance industry is estimated to be worth more than $80 billion.

What are our top 10 final expense life insurance companies?

Our top 10 final expense life insurance companies are:

1. Trinity Life

2. Family Benefit Life

3. Royal Neighbors

4. Mutual of Omaha

5. American Amicable

6. Aetna

7. Liberty Bankers

8. Prosperity

9. Guarantee Trust Life

10. AIG

How does life insurance work for seniors?

Seniors can purchase life insurance in a few different ways. They can buy a policy directly from an insurance company, or they can buy it through an agent.

Does Final expense insurance have a waiting period?

There are two types of final expense life insurance. One has a first-day coverage plan (this is what we help people with). The second is guaranteed issue life insurance with a two-year waiting period (which we rarely recommend).

What is the best life insurance for seniors over 80 years old?

The best life insurance for seniors over 80 is a policy with no waiting period. This means you will be covered from the day you buy the policy.

Do I have to take a medical exam for final expense insurance?

No, you do not have to take a medical exam for final expense insurance. You only need to answer a few health questions.

What is the average cost of final expense insurance?

The average cost of final expense insurance varies depending on age, gender, coverage amount, and location. However, it typically costs between $30 to $100.

Does AARP offer final expense insurance?

AARP primarily offers term life insurance that goes up in price every 5 years and cancels after you turn age 80. AARP insurance plans are underwritten by New York Life Insurance.

What Funeral Advantage Program assists seniors with?

The Funeral Advantage Program assists seniors with pre-planning their funeral and burial arrangements. The downside of this program is that it’s attached to an extremely overpriced whole life insurance policy.

What type of insurance is Lincoln Heritage?

Lincoln Heritage is a final expense life insurance company that offers guaranteed issue life insurance policies. You do not have to take a medical exam to qualify for coverage.

How does Lincoln Heritage funeral Advantage work?

The Lincoln Heritage Funeral Advantage program allows you to pre-plan your funeral and burial arrangements. However, you must be aware that their final expense plan can be 30-40% more expensive than other plans, making it a poor choice for most people.

How much coverage does Colonial Penn give you for 995 a month?

The coverage you can buy for $9.95 depends on your age. The older you are, the less coverage you can get, with $9.95. It can sometimes be as low as a few hundred dollars, making it a terrible option for most people.

How much is a unit worth at Colonial Penn?

A unit at Colonial Penn is worth $9.95.

Can I cancel my policy with Colonial Penn?

Yes, you can cancel your policy with Colonial Penn at any time. However, you will only receive a partial refund if you cancel your policy after the first 30 days.

Does AARP have whole life insurance?

AARP does offer whole life insurance from New York Life.

Does Globe Life insurance go up every year?

Yes, Globe Life term insurance goes up every year.

Does Globe Life insurance expire?

Yes, Globe Life insurance expires at the end of the term you choose.

What is the minimum age for Globe Life insurance?

The minimum age for Globe Life insurance is 18 years old.

Does Mutual of Omaha have a refund policy?

Yes, Mutual of Omaha has a refund policy. If you cancel your policy within the first 30 days.

Does Mutual of Omaha offer final expense insurance?

Yes, Mutual of Omaha offers final expense insurance. They have two policies: a guaranteed issue life insurance policy with a two-year waiting period and a first-day coverage policy.

Is Aetna Life insurance Good?

Aetna is a good life insurance company. They offer both term and whole life insurance policies.

How long has Royal neighbors been in business?

Royal Neighbors has been in business for over 100 years.

What is the phone number for Royal Neighbors?

The phone number for Royal Neighbors is 1-800-776-4837.

Does Royal Neighbors have final expense insurance?

Yes, Royal Neighbors offers both term and whole life insurance policies. They also have a final expense insurance plan.

What is the phone number for Globe Life?

The phone number for Globe Life is 1-800-365-5433.

Does Globe Life offer final expense insurance?

Yes, Globe Life offers both term and whole life insurance policies. They also have a final expense insurance plan.

How long does it take Mutual of Omaha to pay life insurance claims??

It typically takes Mutual of Omaha between four and six weeks to process a life insurance claim.

What is the phone number for Aetna?

The phone number for Aetna is 1-800-227-8451.

Where is Royal Neighbors of America located?

Royal Neighbors is located in Rock Island, Illinois.

What is the phone number for Colonial Penn?

The phone number for Colonial Penn is 1-800-776-7337.

Does Colonial Penn have final expense insurance?

Yes, Colonial Penn offers both term and whole life insurance policies. They also have a final expense insurance plan.

What is the phone number for AARP?

The phone number for AARP is 1-888-687-2277.

What is the rating for AIG insurance?

AIG Insurance is rated A+ by the Better Business Bureau.

What is the phone number for Lincoln Heritage?

The phone number for Lincoln Heritage is 1-800-454-3990.

*Pricing based on female age 50 years old

2 Comments

CAROLYN A JOHNSON

Looking for myself

Funeral Funds

Carolyn – You can get a free quote by visiting this page>>> <a href="https://funeralfunds.com/free-quote/" rel="noopener" target="_blank">https://funeralfunds.com/free-quote/</a>