2024 Royal Neighbors Burial Insurance Review

In this Royal Neighbors of America burial insurance review, we will help you understand their burial insurance products, benefits, and other information.

Two Royal Neighbor life insurance products are great (if you qualify), but we don’t recommend buying the other two.

This article will provide complete information on Royal Neighbors to help you decide if they fit you best.

Table of Contents

Click any topic below to navigate to specific sections:

WHAT TO ASK BEFORE BUYING ROYAL NEIGHBORS LIFE INSURANCE

What Are My Policy Options With Royal Neighbors?

With its Ensured Legacy Series, Royal Neighbor offers three burial insurance products:

- Preferred Whole Life – First-day coverage

- Standard Whole Life – First-day coverage

- Graded Death Benefit Plan – Phased in coverage with first-day benefits

- Guaranteed Issue Whole Life (GIWL) – 2-year waiting period for people with more significant health conditions

If you qualify, their simplified issue whole life insurance plan will give you full coverage from the first day, and your family or loved ones will receive 100% of your death benefit when you pass away.

Royal Neighbors Ensured Legacy Policy Details:

| ENSURED LEGACY | PREFERRED | STANDARD | GRADED BENEFIT | GUARANTEED ISSUE |

|---|---|---|---|---|

| Medical Exam | No | No | No | No |

| Coverage | First Day | First Day | First-day Benefit | Two-year Waiting Period |

| Issue Ages | 50-75 | 50-85 | 50-85 | 50-80 |

| Face Amount | $25,000 – $40,000 | $5,000 – $40,000 | $5,000 – $20,000 | $3,000 – $10,000 |

| Premium | Fixed | Fixed | Fixed | Fixed |

| Death Benefit | 100% | 100% | 30% first year 70% second year | 110% premiums paid |

| Builds Cash Value | Yes | Yes | Yes | Yes |

| Accelerated Death Benefit Rider | Yes | Yes | Yes | Yes |

| Accidental Death Benefit Rider | $5,000 – $40,000 | $5,000 – $40,000 | $5,000 – $20,000 | $3,000 – $10,000 |

Is Royal Neighbors Burial Insurance Good For Seniors?

Royal Neighbors’ whole life insurance is a good option if you have these health conditions:

- Alcohol drug treatment within the last 3 years

- Aneurysm

- Arthritis

- Asthma

- Basal cell skin cancer

- Cancer treatment 5 years ago

- Cardiomyopathy diagnosed 2 years

- Cholesterol

- Chronic bronchitis

- COPD

- Coronary artery disease diagnosed 2 years

- Depression

- Diabetes with no insulin and no complications

- Diabetes with insulin no complications

- Emphysema

- Heart attack in last 2 years

- Heart surgery diagnosed 2 years

- Hepatitis B & C

- Hypertension

- Multiple sclerosis

- Pacemaker placed more than 1 year

- Parkinson’s

- Schizophrenia was diagnosed 1 year ago

- Stroke or TIA 1 year ago

- Wheelchair use is temporary due to injury

Are There Any Health Conditions NOT Accepted By Royal Neighbors?

These health conditions will only qualify for a guaranteed issue life insurance:

- Activities of daily living

- AIDS

- ALS – Lou Gehrig’s disease

- Alzheimer’s

- Amputation due to disease

- Cancer more than one occurrence

- Cancer treatment completed in last 2 years

- Chronic kidney disease diagnosed 1 year

- Chronic kidney disease on dialysis

- Cirrhosis

- Congestive heart failure

- Currently hospitalized

- Defibrillator

- In hospice, nursing home, long-term or memory care

- Kidney failure diagnosed less than 1 year

- Organ transplant

- Oxygen – any use of oxygen

- Regular use of wheelchair or electric scooter

- Sickle cell anemia

- Systemic lupus

- Terminal illness

Does Royal Neighbors Have Any Hidden “Fine Print” In Their Policy?

Their first-day coverage plans (Preferred and Standard) are straightforward and do not have any hidden fine print. Your coverage begins on the date of your first premium payment.

The Graded Death Benefit plan starts from the first day but the death benefit is phased in for the first two years:

- If you die in the first year – Beneficiary receives 30% of death benefit.

- If you die in the second year – Beneficiary receives 70% of death benefit

- If you die after 24 months – Beneficiary receives 100% of death benefit

Their Guaranteed Issue policy has a mandatory two-year waiting period.

PROS & CONS OF ROYAL NEIGHBORS INSURANCE

#1 – Standard & Preferred Plan

PROS

- 1st-Day coverage

- Easy application and approval over the phone

- Pricing is comparable with other companies

- Accepts diabetic complication for first-day coverage

- Fraternal benefits are also available to policyholders

- Most health issues qualify for a first-day coverage plan

CONS

- Plans are not available in all states

- You cannot buy coverage below $5,000

#2 – Graded Benefit Plan

PROS

- Enjoy fraternal benefits

- Accepts significant health issues

- Easy phone application and approval within minutes

- Protection begins on the first day, but benefit payout is phased in over time.

CONS

- 2-year waiting period before 100% benefit payout

- Not available in all 50 states

- You can only buy up to $10,000 in coverage

#3 – Guaranteed Issue

PROS

- Enjoy fraternal benefits

- Accepts all health issues

- Easy phone application and approval within minutes

CONS

- Not competitive pricing compared to competitors’ GI products

- Two-year waiting period

- Not available in all 50 states

- You can only buy up to $10,000 in coverage

RIDERS & OTHER BENEFITS

Royal Neighbors Riders

- Accelerated Living Benefit For Terminal Condition & Permanent Confinement: “When the Insured has been continuously confined to a nursing home for 90 days and the physician-certified confinement is expected to be permanent; when the insured is diagnosed by a physician as having a terminal condition and has a life expectancy of 12 months or less”

- Accidental Death Benefit Rider: (at an additional premium) provides an additional amount if you die from an accident. It has a flexible face amount you can choose.

- Preferred: $5,000-$40,000

- Standard: $5,000-$40,000

- GDB: $5,000 – $20,000

- GI: $3,000 – $10,000

- Charitable Giving Rider: (no additional cost) 1% of the face amount or $1,000, whichever is lesser.

- Grandchild Rider: ($60 annually) provides $5,000 life insurance to grandchild

Royal Neighbors’ Other Benefits

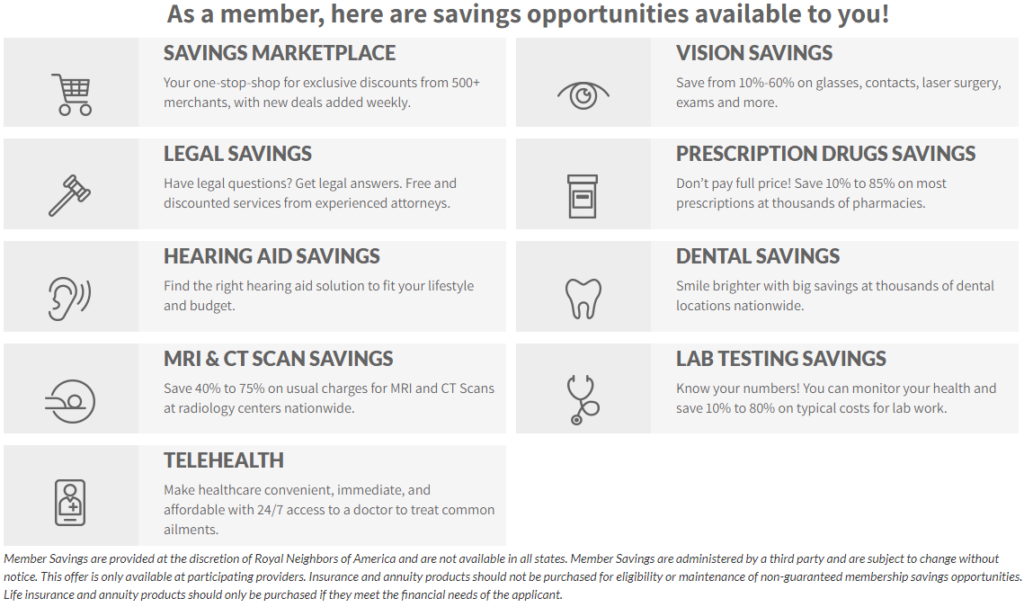

Membership Benefits:

- Dental discounts

- Vision Discounts

- Lab Testing Discount

- Legal Services Discount

- MRI & CT Scans Discount

- Prescription Discounts

- Hearing Aids & Services

Member Programs:

- Community Chapters

- Difference Maker Fund

- Nation of Neighbors

- Scholarship Program

- Member Relief Fund

- Member Savings

- Royal Connect

HOW TO GET APPROVED BY ROYAL NEIGHBORS?

Royal Neighbors’ first-day coverage life insurance application asks about any health issues that have occurred in the last 12, months, 24 months, and 10 years.

Royal Neighbors’ Application Questions You’re Required To Answer

Your answer to the health questions is the most important part of the Royal Neighbors’ final expense insurance application process.

MEDICAL QUESTIONS

A “Yes” answer does not disqualify the applicant from all offers.

1. Are you CURRENTLY prescribed oxygen, hospitalized, receiving dialysis, require a wheelchair or electric (motorized) scooter for mobility; or have you been hospitalized within the past year for more than 2 weeks?

2. Are you CURRENTLY in the care of any of the following facilities: hospice, nursing home, long term care or memory care?

3. Has a medical professional ADVISED or DIAGNOSED you as having a terminal illness with a life expectancy of 12 months or less?

4. In the last 12 MONTHS, have you been treated for or advised by a member of the medical profession to have surgery or any diagnostic test (excluding HIV/AIDS) that has not been completed, or been referred by a member of the medical profession to a specialist for further evaluation?

5. In the last 12 MONTHS, have you used any form of tobacco or nicotine products including cigarettes, chewing tobacco, e-cigarettes, cigars, or vape?

6. In the last 10 YEARS, have you been diagnosed, treated, or been given medical advice by a member of the medical profession or prescribed medication for: (“Diagnosed” means the initial date of when illness is identified and said illness continues to be an active diagnosis for which you are monitored.)

- a. Congestive heart failure, heart attack, coronary artery disease, cardiomyopathy, heart surgery, pacemaker, defibrillator, stroke, TIA, or aneurysm?

- b. Bipolar disorder or schizophrenia, dementia, Alzheimer’s, or memory loss?

- c. Cancer (other than basal cell skin cancer), melanoma, or brain tumor?

- d. Diabetes with insulin use?

- e. Chronic Obstructive Pulmonary Disease (COPD), emphysema, chronic bronchitis, lung damage, lung disease or disorder?

- f. Chronic kidney disease, kidney failure or disease, hepatitis B or hepatitis C, or cirrhosis?

- g. Multiple sclerosis, Parkinson’s disease, or epilepsy?

- h. Sickle cell anemia, systemic lupus, ALS (Lou Gehrig’s disease), or been a recipient of an organ transplant?

- i. Abuse of drugs(s), prescription medication(s), or alcohol; or chronic pain lasting 6 months or longer in duration with the use of narcotic pain medications?

7. In the last 10 YEARS has a member of the medical profession recommended you to have, or performed an amputation of any body part due to disease (including complications of diabetes)?

8. Has the Proposed Insured EVER been diagnosed by a member of the medical profession or tested positive for Human Immunodeficiency Virus (AIDS virus) or Acquired Immune Deficiency Syndrome (AIDS)?

9. HEIGHT & WEIGHT

ROYAL NEIGHBORS BURIAL INSURANCE PRICING

Royal Neighbors rates are based on your age, gender, health, coverage amount, and the state you live in at the time of application.

| ROYAL NEIGHBORS STANDARD RATES AGE 50-80 | ||||

|---|---|---|---|---|

| AGE | $10,000 | $15,000 | $20,000 | $25,000 |

| 50 | F: $35.45 M: $41.35 | F: $51.00 M: $59.85 | F: $66.55 M: 78.35 | F: $82.10 M: $96.85 |

| 52 | F: $36.95 M: $44.05 | F: $53.25 M: $63.90 | F: $69.55 M: $83.75 | F: $85.85 M: $103.60 |

| 54 | F: $38.55 M: $46.75 | F: $55.65 M: $67.95 | F: $72.75 M: $89.15 | F: $89.85 M: $110.35 |

| 56 | F: $39.45 M: $48.85 | F: 57.00 M: $71.10 | F: $74.55 M: $93.35 | F: $92.10 M: $115.60 |

| 58 | F: $39.75 M: $50.35 | F: $57.45 M: $73.35 | F: $75.15 M: $96.35 | F: $92.85 M: $119.35 |

| 60 | F: $39.95 M: $51.85 | F: $57.75 M: $75.60 | F: $75.55 M: $99.35 | F: $93.35 M: $123.10 |

| 62 | F: $42.55 M: $55.35 | F: $61.65 M: $80.85 | F: $80.75 M: $106.35 | F: $99.85 M: $131.85 |

| 64 | F: $45.05 M: $58.75 | F: $65.04 M: $85.95 | F: $85.75 M; $113.15 | F: $106.10 M: $140.35 |

| 66 | F: $48.75 M: $63.95 | F: $70.95 M: $93.75 | F: $93.15 M: $123.55 | F: $115.35 M: $153.35 |

| 68 | F: $53.55 M: $70.85 | F: $78.15 M: $104.10 | F: $102.75 M: $137.35 | F: $127.35 M: $170.60 |

| 70 | F: $58.25 M: $77.75 | F: $85.20 M: $114.45 | F: $112.15 M: $151.15 | F: $139.10 M: $187.85 |

| 72 | F: $67.65 M: $92.65 | F: $99.30 M: $136.80 | F: $130.95 M: $180.95 | F: $162.60 M: $225.10 |

| 74 | F: $77.05 M: $107.45 | F: $113.40 M: $159.00 | F: $149.75 M: $210.55 | F: $186.10 M: $262.10 |

| 76 | F: $89.05 M: $123.85 | F: $131.40 M: $183.60 | F: $173.75 M: $243.35 | F: $216.10 M: $303.10 |

| 78 | F: $103.65 M: $141.95 | F: $153.30 M: $210.75 | F: $202.95 M: $279.55 | F: $252.60 M: $348.35 |

| 80 | F: $118.35 M: $160.05 | F: $175.35 M: $237.90 | F: $232.35 M: $315.75 | F: $289.35 M: $393.60 |

*Pricing is for illustration purposes only and is subject to change without notice.

Royal Neighbors Approval Process

Royal Neighbors has an easy same-day application process that allows for approvals within 15 minutes over the phone.

How Does Royal Neighbors Pricing Compare To Other Insurance Companies?

If you are open to looking at better insurance companies with better rates, we can help you!

COMMON ROYAL NEIGHBORS COMPANY QUESTIONS

What is a Fraternal Benefits Society?

Royal Neighbors is a fraternal benefits society. A fraternal benefit society is a not-for-profit organization that sells life insurance but differs from a regular insurance company.

A fraternal benefit society exists to provide benefits and support to its members. It has no shareholders, and its profits go back to its members.

The government backs traditional life insurance companies with U.S. state-guaranteed funds. If the company becomes insolvent, the guaranteed fund ensures that policyholders will still receive coverage.

This fund does not cover fraternal benefits society. They must manage their business to prevent insolvency because no fund can back it up.

What Is Royal Neighbors’ Operational History

Royal Neighbors of America was established in Council Bluff, Iowa, in 1895. The founding eight women were one of the first insurers in America to provide life insurance to women and children.

Royal Neighbors currently have over 250,000 members, with more than $2.7 billion in life insurance in force. They also have nearly $1 billion in assets.

They are a stable company you can trust to pay your claim on time.

Company Address

230 16th Street

Rock Island, Illinois, IL 61201

Contact Info

Website: Royal Neighbors of America

Support: (800) 627-4762

Royal Neighbors’ Financial Rating

Royal Neighbors has an “A” Excellent rating with A.M Best due to its financial strength and its timely payment of claims.

Also, Royal Neighbors has been an accredited member of the Better Business Bureau since July 31, 1986. The BBB has given them an A+ rating.

Royal Neighbors Consumer Complaints

Royal Neighbors had ten complaints with the BBB Better Business Bureau. The consumer complaints concern claim handling, policyholder service, marketing, and sales.

WHAT SHOULD YOU KNOW BEFORE BUYING ROYAL NEIGHBORS LIFE INSURANCE?

Royal Neighbors’ Sales Process

Royal Neighbors is not a “Captive Carrier.” Independent agencies like Funeral Funds of America can sell Royal Neighbors’ burial insurance products.

The Royal Neighbors Graded Benefit Plan has a limited death benefit payout during the first two years of the policy. The beneficiary will receive 30% of the benefit if the policyholder dies on the first year. If death occurs in the second year, the beneficiary will receive 70%. In the third year, they will receive the full death benefit amount.

The Guaranteed Issue life insurance plan has a two-year waiting period before the full benefit is payable to the beneficiary. If the policyholder dies within the waiting period, Royal Neighbors will only pay 110% of the premiums paid on the policy.

How Can I Get Pricing Help Today?

Use our quoting software below to see how Royal Neighbors’ burial insurance pricing compares to other companies.

- $10,000 to 15,000 is often appropriate for burial needs

- $3,000 to $7,000 is often appropriate for cremation needs

TOP 10 QUESTIONS ABOUT ROYAL NEIGHBORS

Is Royal neighbors a good life insurance company?

Royal Neighbors has an “A” rating with A.M. Best, meaning it has the financial capacity to pay claims on time.How old is Royal Neighbors of America?

Royal Neighbors was founded on December 5, 1888. They have been in business for more than 134 years.When is Royal Neighbors of America founded?

Royal Neighbors was founded on December 5, 1888. They have been in business for 134 years.Where is Royal Neighbors of America located?

The company is located in Rock Island, Illinois.Who founded Royal Neighbors of America?

Marie Kirkland and other women founded Royal Neighbors of America in Council Bluffs, IA.What is a fraternal benefit society?

A fraternal benefit society is a not-for-profit organization that sells life insurance and does charitable programs and benefits to its members and the general public.Is Royal Neighbors a mutual company?

Royal Neighbors is a mutual company.How can I make Royal Neighbors insurance online payment?

You can pay your Royal Neighbors insurance policy online on their website. You can also call them at (800) 627-4762 to make a payment.How do I cancel my Royal Neighbors insurance policy?

To cancel your Royal Neighbors’ life insurance policy, contact their customer service department at (800) 627-4762.What are the common terms used when searching for Royal Neighbors Insurance?

-

Here are some common terms people use when searching for, or describing Royal Neighbors life insurance Products:

- Royal Neighbors Burial Insurance

- Royal Neighbors Cremation Insurance

- Royal Neighbors Final Expense Insurance

- Royal Neighbors Funeral Insurance

- Royal Neighbors Term Life Insurance

- Royal Neighbors Universal Life Insurance

- Royal Neighbors Whole Life Insurance

Sources Cited In This Article:

- Royal Neighbors Final Expense Agent Guide

- Better Business Bureau Accessed March 28, 2024. https://www.bbb.org/us/il/rock-island/profile/life-insurance/royal-neighbors-of-america-0664-102650/complaints