2024 AARP Burial Insurance Review – Pros & Cons

Important: Read this AARP burial insurance review before purchasing their term life insurance or guaranteed issue coverage through AARP.

American Association of Retired Persons (AARP) offers various life insurance products to seniors nationwide. These burial insurance plans are called the AARP Life Insurance Program from New York Life.

This article will give complete information on what AARP burial insurance policies are all about. We have some relevant facts that you need to know to help you decide if AARP final expense insurance is the best fit for you.

| AARP FUNERAL FUNDS 5-STAR RATING | |

|---|---|

| First-day Coverage | ★★★ |

| Ease of Approval | ★★★★ |

| Coverage Amount | ★★★★★ |

| Pricing | ★★ |

| Riders | ★ |

FOR EASIER NAVIGATION:

- Does AARP Offer First-day Coverage?

- Pros of AARP Burial Insurance

- Cons of AARP Burial Insurance

- AARP Burial Insurance Products

- AARP Burial Insurance Riders

- When Does AARP Burial Insurance Makes the Most Sense?

- AARP Underwriting Guidelines

- AARP Pricing Examples

- Getting Approved for AARP Burial Insurance

- The Best Payment Option

- AARP Company Overview

- How Can Funeral Funds Help Me?

- 5 Reasons You Should Be Worried About AARP Life Insurance

- Additional AARP Questions & Answers

Does AARP Offer First-day Coverage?

YES, AARP has a burial insurance plan that offers first-day coverage in two of their three insurance products, but they tend to be more expensive than other companies.

Their term life insurance and whole life insurance offer 1st-day coverage. However, their guaranteed issue life insurance has a 2-year waiting period.

Some of their policy provisions are a bit tricky, so read the pros and cons for each product further in this article.

AARP Burial Insurance Products

The different types of burial insurance plans marketed by AARP through New York Life include:

- Term Life – $10,000 up to $100,000

- Permanent – up to $50,000

- Guaranteed Issue (2-year waiting period) – up to $25,000

Pros Of AARP Burial Insurance

Three different products to choose from – you need to be CAREFUL about what plan they are selling you.

Brand recognition – most people have heard of AARP before

Multiple price range options – pricing to fit most people’s budget, but don’t buy from AARP on price alone, or you may buy the wrong policy!

Cons Of AARP Life Burial Insurance

Term life insurance can be misleading – the price goes up every 5 years, and the coverage ends at age 80. In most cases, only people in great health qualify.

Whole life insurance expensive & waiting period – other companies offer better rates, and their guaranteed issue life insurance plan has a 2-year waiting period.

AARP is not an insurance company – AARP burial insurance plans are underwritten and maintained by New York Life, so after the sale, AARP is out of the picture for policy updates, and AARP claims.

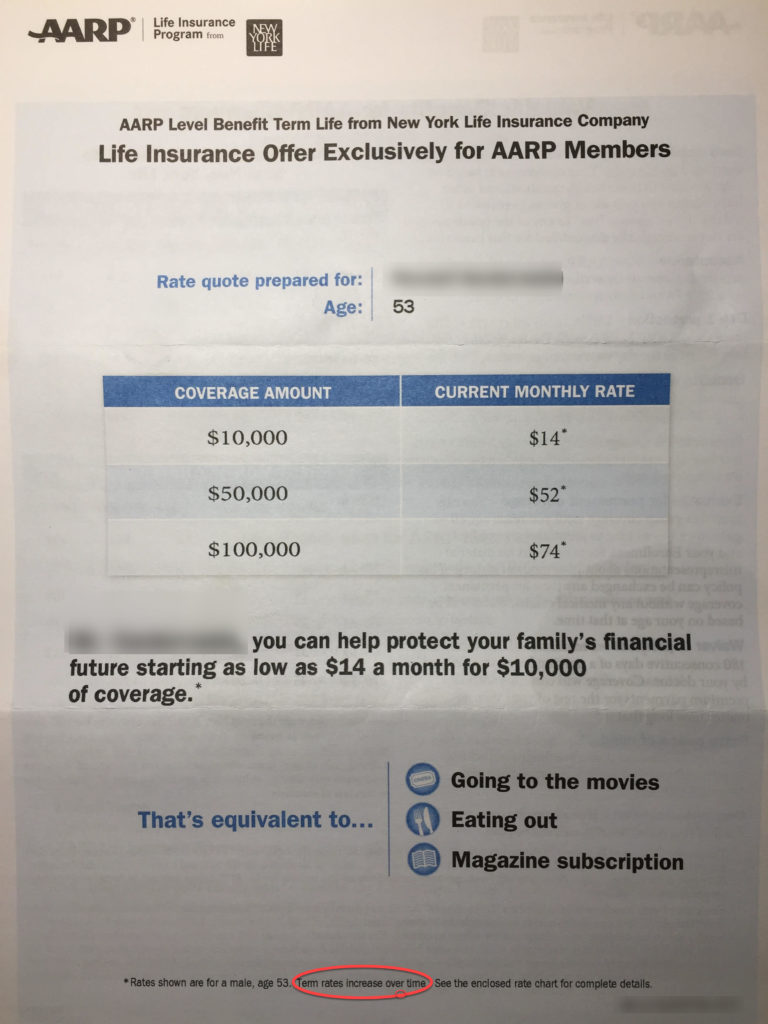

AARP Level Benefit Term Life Insurance

This term life policy is AARP’s flagship life insurance product and the one that is marketed and sold most aggressively.

This term life policy does not include burial plans or final expense insurance but is marketed as such. If you’re looking for funeral insurance for parents or those over 80, this is not for you.

PROS OF AARP LEVEL BENEFIT TERM LIFE INSURANCE

- Provides $10,000 up to $100,000 in protection

- Coverage for people aged 50-74

- No medical exam (acceptance is based on answers to a few health questions)

- No criminal record review

- You won’t be penalized for smoking or chewing tobacco

CONS OF AARP LEVEL BENEFIT TERM LIFE INSURANCE

- Higher monthly premium

- Competitors will charge less for a fixed premium

- Premiums increase every five years

- The policy expires after the age of 80th

It is incredibly risky to purchase this policy if you plan to use it for final expenses.

Unfortunately, many consumers don’t ask enough questions (which may be why this plan is their bestseller).

Don’t be confused when you hear level benefit term life insurance….the presentation is a little bit tricky.

To most insurance companies, “level” means a term life policy with a fixed premium for the whole term.

The term level does not refer to rates to AARP, but AARP LifeLock refers to the death benefit. The only thing “level” to AARP is the death benefit that does not decrease.

Coverage begins at age 45, and the premium will increase at age 50, then at age 55, until you reach age 80, when the coverage ends.

They sell this plan as a burial insurance policy, but you will want a burial insurance policy that will not expire when you turn 80. Thousands of seniors bought this plan, only to lose coverage after age 80.

What happens when you outlive your policy?

When you live older than 80, your family will be left with your funeral expenses because your life insurance is gone. You won’t get any money back, and you don’t have the option to renew a new term.

If this happens, you would need to apply to NYLAARP for further coverage with a different type of plan, which may be expensive.

AARP’s level benefit life insurance may sound good at first, but you need to understand the fine print, so you don’t end up in a financial pickle later in life.

AARP Permanent Life Insurance (1St-day Coverage)

Unlike the AARP Term Life plan that expires at the age of 80, you have covered your entire life with this plan as long as you continue paying the monthly premium.

AARP permanent life insurance has a premium with guaranteed rates that never increase for the policy’s life. It also has a level of death benefit that does not decrease. This plan is simple to qualify; you must be 45 to 80 years old to apply for coverage.

PROS OF AARP PERMANENT LIFE INSURANCE

- Up to $50,000 in protection

- New York Life Insurance rates for seniors never increase

- Immediate coverage – no waiting period

CONS OF AARP PERMANENT LIFE INSURANCE

- AARP monthly membership fees required

- Premium is expensive compared with other insurance companies

This plan is along the lines of a traditional burial insurance policy.

One of the features of AARP senior insurance or senior funeral plan is immediate coverage. You are protected from day one, unlike other plans, which have a two-year waiting period.

Your beneficiary will receive the full death benefit if you pass away after your application is approved.

This product is real burial insurance for seniors, final expense insurance, or senior citizens’ funeral insurance that provides up to $50,000 in protection. Although, AARP life insurance for seniors over 80 is not possible.

AARP Easy Acceptance Life Insurance (2-Year Wait)

Guaranteed acceptance of life insurance by AARP is a 2-year waiting period for burial insurance, cremation insurance, or funeral insurance plan. This is designed to be the life insurance for the uninsurable.

The policy provides lifetime protection and won’t expire as long as you pay the premium on time. A level premium means the monthly price will not change, unlike the Level benefit term life. The death benefit will not decrease as well.

PROS OF EASY ACCEPTANCE LIFE INSURANCE

- Provides up to $25,000 in protection

- Lifetime protection

- Guaranteed acceptance (you can’t be turned down)

- No health questions

CONS OF EASY ACCEPTANCE LIFE INSURANCE

- Limited benefit for the first two years (waiting period)

- Includes extra mortality risk charge

This AARP guaranteed acceptance plan has no medical exam and no medical questions.

Because approval is guaranteed, there is a two-year waiting period before the policy will pay out 100% death benefit.

New York Life will pay out the full death benefit if you have an accidental death during the waiting period. However, if you die from a natural cause during the waiting period, your beneficiary will receive a refund of 125% of the amount you paid.

The drawbacks of this plan are the price and the 2-year waiting period.

An extra mortality risk charge is included in the pricing, which makes AARP more expensive than many other insurance companies. Many other burial insurance companies offer the exact guaranteed acceptance coverage as AARP but cost much less.

For example, AARP guaranteed acceptance rates for 60-year-old male wanting $15,000 coverage is $90 a month. Compare burial insurance quotes with other top-rated companies with the same policy, which runs $61 a month. That is $29 a month in saving or $348 a year, or $6,960 in 20 years.

AARP Burial Insurance Riders

Accelerated death benefit rider – you can accelerate 50% of your death benefit if you’re diagnosed with a terminal illness with a life expectancy of 24 months or less.

OTHER BENEFITS:

POLICY LOANS – you can borrow up to 100% of your New York Life insurance cash value. This is tax-free. Loans reduce your cash value amount and are subtracted from your death benefit. The interest on policy loans varies by state.

When Does AARP Burial Insurance Makes The Most Sense?

You can get numerous benefits from choosing AARP burial insurance plans, mainly if you don’t have other life insurance coverage.

However, despite all the advantages, AARP may not be the best place to get your burial insurance. You need to weigh the AARP pros and cons before making your final decision…especially the higher pricing!

You can often find better rates from other top-rated insurance companies rather than going with AARP.

AARP Underwriting Guidelines

To qualify for AARP life insurance, you must answer these New York Life insurance exam questions honestly and pass the medication history check and Medical Information Bureau (MIB) check.

1. In the last 24 months, have you been diagnosed with or taking medication or treatment for stroke, heart disease, cancer, diabetes, lung disease, kidney or liver disease, immune system disorder, AIDS, AIDS-related complex? (Yes – No)

2. Have you been admitted to a hospital, extended care, nursing home, or specialized treatment facility during the past two years? (Yes – No)

3. In the previous three months, have you consulted a physician or had medication, treatment, or any type of diagnostic test? (Yes – No)

Your application will be denied if your MIB file and prescription history show any treatments for any of the above-mentioned medical conditions.

You will only be accepted if you answer no to all these questions and clear your medication history.

The AARP qualifications process for permanent life insurance is based on three health questions you need to answer and pass a prescription history check.

Your application will be denied if you take certain prescription medications or have MIB records indicating you have any health conditions mentioned in the AARP health questionnaire.

You will not qualify for AARP permanent life insurance if you have the following health conditions:

- Type 1 diabetes

- Diabetes complications like diabetic coma, neuropathy, retinopathy, or amputation

- Heart disease

- Liver diseases

- Lung diseases such as asthma, COPD, chronic bronchitis, or emphysema

- Lupus

- Kidney diseases

- Parkinson’s disease

- Rheumatoid arthritis

Only a person in good health can medically qualify for AARP burial insurance senior.

AARP’s permanent life insurance policy has unattractive pricing, and If you’re not in good health, AARP will decline your application.

AARP permanent life insurance is also available. But, you need to request it by telling their agents that you want this type of policy. You will most likely be offered their term life policy if you don’t.

The consumer AARP price for this policy is significantly higher than most competitors’ prices.

For example, AARP permanent life insurance rates for a 50-year-old male applying for a $25,000 coverage comes in at $82 a month.

Compare insurance quotes to one of the top-rated life insurance companies that offer $25,000 coverage for only $66.35. That is a savings of $187.80 a year or $5,634 in savings over 30 years.

AARP Pricing Examples

| FEMALE AGE | $5,000 | $10,000 | $25,000 |

|---|---|---|---|

| 50 | $13.00 | $25.00 | $60.00 |

| 55 | $16.00 | $30.00 | $73.00 |

| 60 | $19.00 | $37.00 | $89.00 |

| 65 | $23.00 | $45.00 | $109.00 |

| 70 | $32.00 | $63.00 | $155.00 |

| 75 | $41.00 | $81.00 | $201.00 |

| 80 | $51.00 | $100.00 | $248.00 |

| MALE AGE | $5,000 | $10,000 | $25,000 |

|---|---|---|---|

| 50 | $17.00 | $33.00 | $79.00 |

| 55 | $21.00 | $41.00 | $100.00 |

| 60 | $25.00 | $48.00 | $118.00 |

| 65 | $31.00 | $61.00 | $150.00 |

| 70 | $40.00 | $79.00 | $195.00 |

| 75 | $50.00 | $98.00 | $242.00 |

| 80 | $62.00 | $123.00 | $306.00 |

Getting Approved For Aarp Burial Insurance

| BURIAL INSURANCE APPLICATION PROCESS | |

|---|---|

| Rates & coverage | Agent can help provide help with this |

| Underwriting | Agent will help you qualify for the best plan |

| Beneficiary | You determine who will get your death benefit |

| Application | Agent submits application to insurance company |

| Approval | Congratulations on your new policy! |

| Policy start date | Policy active after 1st payment date |

| Policy delivery | 7-10 business days after first draft date |

The Best Payment Option

| PAYMENT METHOD | RECOMMENDED? |

|---|---|

| Savings Account | Best way to pay |

| Checking Account | Best way to pay |

| Cash | Not recommended |

| Money Order | Not recommended |

| Cashier's Check | Not recommended |

| Debit Card | Not recommended |

| Credit Card | Not recommended |

| Direct Express | Not recommended |

| PAYMENT FREQUENCY | RECOMMENDED | ACCEPTED BY |

|---|---|---|

| Monthly | Recommended | All Companies |

| Quarterly | Not Recommended | Some Companies |

| Semi-annually | Not Recommended | Some Companies |

| Annually | Not Recommended | Some Companies |

AARP Company Overview

New York Life is one of the largest life insurance companies in the United States.

It has been selling various policies and life insurance coverage options since 1845. They presently operate in every U.S. State and many other countries.

New York Life Financial Strength Ratings

- AM Best – A++, Stable outlook

- Fitch Ratings AAA, Stable outlook

- Moody’s – Aaa, Stable outlook

- Standard & Poor – AA+, Stable outlook

How Can Funeral Funds Help Me?

In reality, inexperienced and less knowledgeable insurance companies and agents will cost you loads of money by selling you overpriced burial and final expense policies.

Affordable burial policies for seniors don’t have to cost an arm and a leg.

Our job at Funeral Funds is to be the most knowledgeable burial insurance expert available. By doing so, we can knock it out of the park and get you the most accurate quote and affordable rates.

Once we know more about your age and health history, we can accurately give you burial insurance quotes from the final expense companies that best fit you.

We have the best carriers that cater to seniors seeking affordable burial insurance coverage.

We can help you shop and compare your AARP insurance quote to get the best deal. You shouldn’t have to pay high premiums every month to get burial insurance coverage. We will help you find the perfect policy to fit your needs!

BUT WAIT…THERE’S MORE!

5 Reasons You Should Be Worried About AARP Life Insurance

Do you have AARP life insurance? Are you considering purchasing an AARP life insurance?

AARP is branded as an advocacy group for seniors lobbying for their rights; however, this senior rights protector’s claim may make you think they have the best life insurance plans. Most seniors can find better insurance options with other life insurance companies, so it is best to compare products and quotes before buying a policy.

This article will answer your questions if you want more information on AARP life insurance products for yourself or your parents.

In this article, we will go over the different reasons why you should be worried about AARP life insurance.

FOR EASIER NAVIGATION:

- REASON #1 – AARP Is Not an Insurance Company

- REASON #2 – Level Term Life Insurance Increase in Price Every 5 Years

- REASON #3 – Coverage Ends at Age 80

- REASON #4 – You Need to Be In Great Health to Qualify

- REASON #5 – It Has a Two-year Waiting Period

REASON #1 – AARP IS NOT AN INSURANCE COMPANY

The first reason you should be worried about AARP life insurance is that AARP is not even an insurance company to begin with.

AARP is a popular organization selling life insurance for seniors. Don’t be misled; AARP is not an insurance company. The organization does not provide AARP insurance products. The term and whole life insurance policies sold to senior members over 50 with no medical exam are underwritten by New York Life.

AARP has been endorsing New York Life since 2011. It’s an open secret that AARP endorses life insurance companies that give them the most benefits. AARP only serves as the marketing arm of New York Life. New York Life provides all life insurance through AARP.

You need to be an AARP member to buy life insurance. This is the one important requirement you cannot escape.

AARP members, ages 50 through 79, can buy life insurance. There are two types of AARP life insurance available: term life insurance and permanent life insurance.

Term life insurance is available to members who are 50 to 74 years old. You can buy up to $100,000 coverage. You can qualify for coverage without undergoing New York life insurance medical exam.

Permanent life insurance is available to AARP members 50 to 80 years old. You can buy up to $50,000 coverage without a medical exam.

REASON #2 – LEVEL TERM LIFE INSURANCE INCREASE IN PRICE EVERY 5 YEARS

The second reason you need to be worried about AARP life insurance is that their level of term life insurance increases in price every five years. If you bought a level term life insurance from AARP, I suggest you read the “fine print.”

Reviewing the fine print, you will see that it says “affordable rates that increase over time.”

AARP market their term life insurance as a level term benefit. What’s misleading about this marketing tactic is that they lead you to believe that the premium is level or won’t change for the policy’s life.

Many seniors are led to believe that their monthly premiums will remain level when, in truth, what they mean when they say the level is that the DEATH BENEFIT will not change. The death benefit will never decrease.

Don’t get fooled by this marketing tactic. Almost every life insurance company offering term life insurance has a death benefit that never decreases.

When they say level, they mean your premium will remain the same for five years. Your term life insurance premium will only increase every five years as you enter each new five-year age band. Once you reach the next age band, you must pay the new monthly rate that applies to your current age.

Suppose you truly want a real level term life insurance. In that case, we can get you a level term life insurance policy with another company with a fixed premium that is guaranteed to never change for the term of the policy. If you’re interested in buying term life insurance, call us. We work with reputable life insurance companies that specialize in term life insurance.

REASON #3 – COVERAGE ENDS AT AGE 80

AARP term life insurance is only available to members ages 50 to 74. It means if you are 75 and older, you can’t buy a term life insurance policy with them.

If you read the fine print, you will discover that term life insurance with AARP ends once you reach age 80. The coverage ends exactly when you need it the most.

If you want a policy that will last, do not get term life insurance. Apply for permanent life insurance instead. AARP also offers permanent life insurance. However, they will not sell you this policy unless you specifically ask for it.

REASON #4 – YOU NEED TO BE IN GREAT HEALTH TO QUALIFY

To qualify, you must answer the AARP insurance application’s health questions. Both term life insurance and permanent life insurance ask three health questions.

Let’s take a look at the three health questions on the application:

- In the past two years, have you been treated for or been diagnosed by doctors with heart trouble, stroke, cancer, lung disease or disorder, diabetes, liver, kidney disease, AIDS, AIDS Related Complex, or immune system disorder?

- In the past two years, have you been admitted to or confined in a hospital sanitarium, nursing home, extended care, or special treatment facility in numbers?

- In the past three months, have you consulted a doctor or had treatment or diagnostic tests of any type?

If you answer “yes” to any of the questions, your application for coverage will be denied.

Aside from the three health questions, New York Life will also conduct a prescription history check. If you are taking prescription medications that are a red flag for specific health issues, your application will also be declined.

If you look at the health questions, you will realize that you need to be perfectly healthy to qualify for term life insurance and permanent life insurance with AARP.

The following health issues will cause your application to be declined:

1. Heart trouble (heart attacks, coronary artery disease, stents, bypass, pacemaker, AFib, arrhythmia, a blood thinner, blood clots, aneurysm, heart or circulatory surgery in the last two years)

2. Lung disease (asthma, emphysema, COPD, chronic bronchitis, sarcoidosis)

3. Kidney disease (renal problems, dialysis, chronic kidney disease)

4. Stroke and mini-stroke

5. Any type of cancer

7. Diabetes and diabetic complications such as retinopathy, neuropathy, nephropathy, diabetic coma, or insulin shock – if you have diabetes and take medications to manage your condition – you will not qualify for coverage with them.

The biggest problem with AARP underwriting is that only people in great health will qualify for coverage.

If you have health issues and you cannot qualify for AARP term life or permanent life insurance, they will offer you their pricey guaranteed issue life insurance policy. Better make an AARP life insurance policy search before making a decision.

If you have health issues, we can help. We work with many insurance companies that are exceptionally forgiving with these health issues, and they will approve you for first-day coverage.

REASON #5 – IT HAS A TWO-YEAR WAITING PERIOD

If you answered “yes” to the health questions in the AARP insurance application, expect to be offered a guaranteed issue life insurance.

If you have any health issues, you will only qualify for guaranteed issue life insurance with AARP. This life insurance product does not ask health questions; anybody can qualify for this plan.

The number five reason you should be worried about AARP’s guaranteed issue life insurance is that it has a two-year waiting period.

Because your acceptance is guaranteed, New York Life takes a significant risk in insuring you for coverage. They put a two-year waiting period on your policy as a safety net. This means that if you die from natural causes during the first two years of the policy, your beneficiary will not receive your full death benefit. They will only receive all the premiums you paid into the policy plus 25% interest.

New York Life will only pay full death benefit for accidental death during the first two years.

AARP will always offer this product to people who are not in perfect health. They keep offering this plan because many people couldn’t qualify for term life insurance or permanent life insurance with them. This plan is the most expensive plan offered by the company.

You see, most of the health issues not accepted by AARP qualify for first-day coverage with other life insurance companies. For example, if you have diabetes, you will only qualify for a guaranteed issue with AARP. If you have diabetes, even if you’re taking insulin, we can get you first-day coverage with diabetic-friendly life insurance companies.

Why would you settle for a plan with a two-year waiting period if you can qualify for first-day coverage?

Have you received life insurance offers from AARP? If you already have life insurance with AARP, review these five reasons why you should be worried about AARP life insurance. If you see something that keeps you worried, call me, and I will discuss your other options.

To purchase life insurance, it is essential to understand that every life insurance company looks at your health issues differently. Some life insurance will decline your coverage, while other companies will offer you first-day coverage even with some health issues.

My first goal is to find you a company that will accept your health issues at affordable rates.

I work with over 50 life insurance companies, most of which offer better rates than AARP – New York Life. Fill in our quote form to compare prices from different life insurance companies.

ADDITIONAL AARP QUESTIONS & ANSWERS

Is AARP still in business?

Yes, AARP is still in business today. They continue to provide different benefits to their members.

Is AARP legitimate?

Yes, AARP is a legitimate advocacy company in the USA.

Is New York Life Insurance legit?

Yes, New York Life Insurance company is a legitimate insurance company.

What does AARP stand for now?

AARP definition – American Association of Retired Persons, an interest-based group that helps people over 50 by selling paid AARP lifetime membership, marketing insurance, and other services to its members. Also, AARP recommends medical alert systems to keep your loved ones safe.

Is AARP membership good or bad?

AARP membership life insurance can be beneficial for seniors. If you avail life insurance from New York Life you can get an AARP beneficiary planner.

Is AARP an insurance company?

No, AARP is not an insurance company. Their policies are underwritten by New York Life Insurance company.

Who owns AARP life insurance?

New York Life Insurance Company owns the AARP insurance program. AARP is not an insurance company. It only endorsed and market New York Life insurance products.

Who underwrites AARP life insurance?

New York Life Insurance Company underwrites AARP life insurance.

What insurance company does AARP recommend?

AARP recommends New York Life Insurance plans.

What is AARP’s life insurance rating?

AARP life insurance by New York Life is awarded A++ by the rating bureau A.M. Best.

What is the AARP website?

The AARP website is https://www.nylaarp.com

What is AARP’s life insurance phone number?

(800) 288-9858

AARP insurance phone number

AARP life insurance number

AARP New York Life phone number

New York Life AARP insurance phone number

AARP life insurance program phone number

What is the AARP customer service number?

AARP life insurance customer service number: AARP life Customer Experience Team can be reached at (800) 850-2658. This is also the phone number for AARP New York life insurance.

What is the AARP life insurance login? You can manage your account online by clicking the AARP New York Life Insurance login link.

- Make AARP insurance payment

- Update personal information

- Access important forms

- Manage beneficiaries

Where is AARP life insurance located?

AARP New York Life Insurance is located in Tampa, Florida

What is AARP life insurance address?

New York Life Insurance Company

P.O. Box 30712

Tampa, FL 33630-3712

Where can I find AARP life insurance reviews?

Read AARP life insurance reviews, New York Life reviews, New York Life reviews, and New York Life Insurance reviews here and sees the truth about AARP.

Where can I find AARP life insurance reviews BBB?

Check New York Life insurance company reviews, AARP reviews, and AARP Insurance reviews on BBB reviews here.

How to get an AARP life insurance quote?

You can get an AARP insurance quote, New York Life Insurance quote, or New York Life quotes by going to their website or clicking the AARP Insurance quotes form link here.

How to process AARP life insurance online payment?

AARP NYLife manage payments and allows you to make NYLife AARP payment online. Log in to pay. You can also send payment to the AARP life insurance payment mailing address.

Does AARP have a weight chart?

AARP weight chart determines if your body mass index is within the range, they asked for.

How can I access the AARP life insurance claim form?

The fastest way to report a life insurance claim is to complete the online claims form and submit it by mail or fax. You can also call the AARP claims number or AARP insurance claims phone number (800) 695-5165. You can also send an AARP mailing address for claims.

Where can I check the AARP life insurance commercial?

Check NYLife AARP commercials here. We do not have much information on AARP commercial actresses and actors.

Where can I check AARP life insurance complaints?

Check AARP life insurance complaints or AARP complaints here.

What is the AARP age requirement?

AARP eligibility age – you need to be 45 to 80 years old to apply for AARP life insurance.

Can you get AARP under 50?

According to the AARP policy book, people 45 years and older can qualify for AARP life insurance.

What is AARP insurance?

AARP offers various life insurance products to seniors across the nation. New York Life insurance plans from AARP insurance company are called the AARP Life Insurance Program from New York Life.

What type of life insurance does AARP offer?

AARP offers three types of life insurance products:

- Level term life insurance

- Permanent life insurance

- Guaranteed acceptance of life insurance or easy acceptance

What is AARP life insurance for seniors?

AARP life insurance for seniors is an insurance policy underwritten by New York Life for AARP members. New York Life AARP life insurance for seniors is marketed as final expense insurance covering funeral, burial, and final expenses.

How old do you have to be for AARP life insurance?

You must be 45 to 80 years old to qualify for AARP life insurance.

What is AARP level benefit term life insurance?

AARP level benefit term life insurance is AARP’s flagship product, also marketed as burial insurance. The only thing level for this plan is the death benefit that never decreases. However, the premium increases every five years until the AARP coverage ends at age 80.

What is AARP permanent life insurance?

AARP permanent life insurance is whole life insurance that covers you for your entire life. AARP cover death benefit will never decrease, and premiums will never increase. It has first-day coverage and no waiting period.

What is AARP guaranteed acceptance life insurance?

AARP’s easy acceptance life insurance will never turn you down because of health issues. Acceptance is guaranteed. One downside to this AARP insurance plan is the two-year waiting period. If you die from a natural cause during the waiting period, your beneficiary will only receive 125% of the amount you paid.

What age does AARP term life insurance end?

AARP level term insurance ends at age 80.

What are the pros and cons of AARP insurance?

AARP Level Term Insurance

Pros:

- Provides $10,000 up to $100,000 in protection

- Coverage for people age 50-74

- New York Life insurance No medical exam (acceptance is based on answers to a few health questions)

- No criminal record review

- You won’t be penalized for smoking or chewing tobacco

Cons:

- Higher monthly premium

- Competitors will charge less for a fixed premium

- Premiums increase every five years

- The policy expires after age 80th

AARP Permanent Life Insurance

Pros:

- Up to $50,000 in protection

- New York Life insurance rates that never increase

- Immediate coverage – no waiting period

Cons:

- AARP monthly membership fees are required. Check out AARP membership reviews.

- Premium is expensive compared with other insurance companies.

Guaranteed Acceptance Life Insurance

Pros:

- Provides up to $25,000 in protection

- Lifetime protection

- Guaranteed acceptance (you can’t be turned down)

- No health questions

Cons:

- Limited benefit for the first two years (waiting period)

- Includes extra mortality risk charge

How much life insurance can you get with AARP?

Level term life insurance – up to a maximum of $100,000

Permanent life insurance – up to $50,000

Guaranteed acceptance life insurance – up to $25,000

What is a better AARP term or whole life?

AARP permanent whole life insurance is better than burial insurance because this plan never expires and will still be active when you need it the most.

Can AARP save you money on life insurance?

AARP insurance by New York Life is overpriced. You can save more money with other insurance companies offering the same products.

What does AARP life insurance cost?

AARP cost varies by the type of policies, amount of coverage, age, gender, and tobacco use. You can see their pricing in AARP life insurance rates chart.

How much does whole life insurance cost for seniors?

Here’s a copy of AARP permanent life insurance pricing:

| FEMALE AGE | $5,000 | $10,000 | $25,000 |

|---|---|---|---|

| 50 | $13.00 | $25.00 | $60.00 |

| 55 | $16.00 | $30.00 | $73.00 |

| 60 | $19.00 | $37.00 | $89.00 |

| 65 | $23.00 | $45.00 | $109.00 |

| 70 | $32.00 | $63.00 | $155.00 |

| 75 | $41.00 | $81.00 | $201.00 |

| 80 | $51.00 | $100.00 | $248.00 |

| MALE AGE | $5,000 | $10,000 | $25,000 |

|---|---|---|---|

| 50 | $17.00 | $33.00 | $79.00 |

| 55 | $21.00 | $41.00 | $100.00 |

| 60 | $25.00 | $48.00 | $118.00 |

| 65 | $31.00 | $61.00 | $150.00 |

| 70 | $40.00 | $79.00 | $195.00 |

| 75 | $50.00 | $98.00 | $242.00 |

| 80 | $62.00 | $123.00 | $306.00 |

Do you need a medical exam to qualify for AARP life insurance?

No, you don’t need to take a New York Life medical exam to qualify for AARP.

Does AARP ask health questions?

AARP-level term life insurance and permanent life insurance ask health questions as part of their application process.

Does AARP guaranteed acceptance policy have a waiting period?

AARP’s easy acceptance or guaranteed acceptance plan has a two-year waiting period. You must live the first two years before your policy will be active and cover you for the natural cause of death.

What happens if you die during the AARP waiting period?

AARP will pay your full death benefit if you die from an accident, even during the two-year waiting period. However, if you die from natural causes during the waiting period, your beneficiary will only receive 125% of all the premiums you paid.

What kind of AARP life insurance has cash value?

AARP permanent life insurance and guaranteed acceptance are whole life insurance policies that accumulate cash value over the years.

Does AARP permanent life insurance have cash value?

Yes, AARP permanent life insurance accumulates cash value.

Does AARP guaranteed acceptance policy accumulate cash value?

Yes, AARP guaranteed acceptance plan accumulates cash value.

How to claim AARP life insurance?

The fastest way to make a claim is to complete the online AARP claim forms or submit the form by mail or fax. You can also call (800) 695-5165 for any questions or to file a claim by phone.

When does AARP term life insurance end?

AARP level term insurance ends after age 80.

Does AARP guaranteed acceptance policy expire?

No, AARP’s easy acceptance plan never expires. It will be active your whole life.

How can I find a replacement for my AARP policy?

You can find a replacement for your AARP policy by working with an independent life insurance agent who can price shop for you and recommend the best insurance policy at the best price. Ensure your AARP policy is still active while looking for a replacement policy. When your replacement policy is active, you can cancel your AARP insurance by calling the AARP life insurance customer service hotline.

How do I cancel my AARP life insurance policy?

You can cancel your AARP life insurance by calling customer service or the NY AARP com service hotline (888) 687-2277.

3 Comments

Gracie Howard for Vivian Howard

Vivian is my Mother-In-Law. She’s 90 years old. No life insurance. We are interested in burial insurance only. Please contact me via email with rates etc as my son (POA) will be the principle. We look forward to receiving info today as we need to get this in place. Thank you.

Funeral Funds

Gracie – There are no insurance companies that offer insurance for someone who is 90 years old.

Dave

Need burial insurance