2025 Life insurance With No Waiting Period

Are you looking for life insurance with no waiting period? For many people looking for life insurance that doesn’t have a waiting period can be challenging. The good news is that getting a life insurance policy with no waiting period is possible!

Affordable coverage is available without having to endure a waiting period for benefits to start. You pay the first premium installment, and you are entitled to get the full benefits of the policy even if you die within a few days.

We will help you find the best coverage burial coverage for your needs and help you qualify for a life insurance policy without a waiting period today.

What Does Waiting Period Mean?

Most people don’t realize that there is a waiting period that comes along with some life insurance plans.

The majority of policies we help people with won’t have a two-year waiting period!

If you bought your policy from a television or magazine advertisement, you probably have a two-year waiting period (even though you qualify for immediate cover life insurance).

If you were to pass away during the waiting period, your beneficiary wouldn’t receive the full payout from the policy. Instead, they will only receive the premiums paid into the policy.

For example, if you bought a $25,000 guaranteed issue life insurance policy with a two-year waiting period and you die during the first two years, your beneficiaries will not receive the full $25,000 payout.

With a 2-year waiting period, your loved ones will only receive the total of the premiums you have paid up to that point.

The waiting period means the insurance companies withhold full coverage for health reasons for two years. The premiums paid during that period will be considered only for partial benefits.

You will get the full benefits after you survive the waiting period. If you die during this period, your beneficiary will get the premiums you paid and interest, typically 5-10%.

Get 1St-day Coverage & Save 30-50% With Our Instant Quoter

Why Does Waiting Period Exist?

Insurance companies have a waiting period to reduce the risk of payout to those terminally ill, with intent to commit suicide and those who will pass away in a short period from purchasing a policy.

The waiting period exists as a safety net to protect the insurance company.

It also gives them the time to investigate the information provided on the application properly. It allows the insurer to contest a claim during the waiting period.

Suicide is a disqualification in terms of death benefit payout. The waiting period for life insurance helps discourage people contemplating suicide from purchasing a last-minute life insurance policy.

If the policyholder dies within the two-year waiting period, the insurance company is only required to pay out the collected premiums plus 5-10% interest.

How To Minimize The Waiting Period On Life Insurance

The best way to minimize waiting is to purchase a life insurance policy early. The younger you are, the healthier you are, and the more you are eligible to take life insurance policies with no waiting period.

Your best option is to buy a life insurance policy with no waiting period.

You can find life insurance immediate cover life insurance companies (you’ll know this as they ask about your health issues on the application).

If the application doesn’t ask any health questions, your policy has a waiting period (and you will pay more than you should for your coverage).

People who are suffering from chronic ailments find such policies beneficial. Seniors in good health often prefer life insurance for seniors no waiting period policies to cover their final expenses.

Why Do Insurance Companies Evaluate Your Health To Offer No Waiting Period Policy?

Insurance companies are faced with a massive amount of risk if there is no waiting period. They must pay the full death benefit even if you just started paying.

The insurance companies are interested if you are going to die right away before taking a risk by offering you a whole life insurance no waiting period policy.

Your health is evaluated to assure that the insurance companies will stay in business in the years ahead.

Some health issues are so high that no insurance company is willing to offer whole life insurance with no waiting period.

The following health issues may result in a waiting period:

- Alzheimer’s disease

- Angina within the last 12 months

- Cancer and cancer treatment

- Confined to a hospital or nursing home

- Diabetic coma within the last 24 months

- Have an organ transplant

- Heart attack within the previous 12 months

- Heart surgery within the last 12 months

- HIV or AIDS

- Hospice care

- Oxygen Use

- Renal failure

- Terminal illness

These health issues may result in a partial waiting period or graded plan:

- Amputation due to diabetics

- Cancer within the last 24 months

- Congestive heart failure

- Treatment for alcohol or drug abuse

Speak to an agent if you are dealing with one or multiple health conditions if you want to get a no-waiting period insurance policy.

Insurance Policies With A Partial Waiting Period

Insurance policies with graded benefits do not pay the full death benefit during the first 24 months. Instead, they will only pay out a portion of your death benefit.

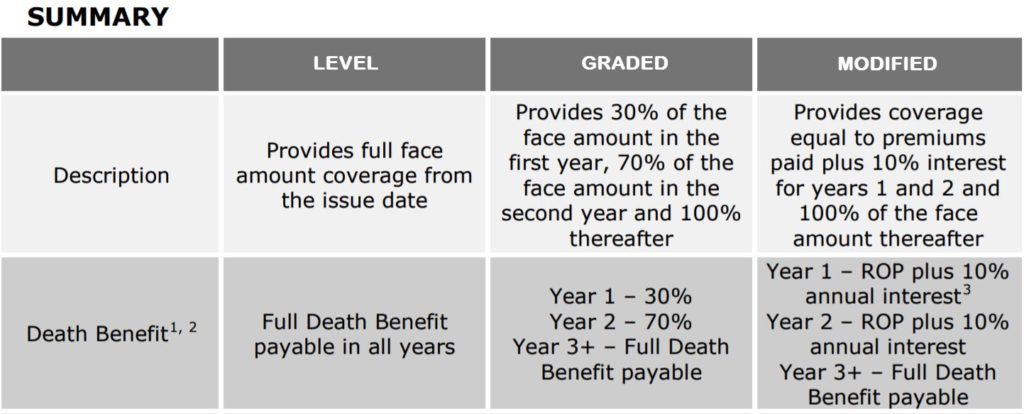

The graded plan looks like this:

- First 12 months – 30%-40% death benefit

- 13-24 months – 70%-80% death benefit

- After 24 months – 100% death benefit

What Features Are Available For Burial Policy Waiting Periods?

- No waiting period – This is the preferred option for all funeral funding and burial plans, as it gives you immediate coverage with a 100% payout of the funds from day one.

- Partial waiting period – These plans give you immediate partial coverage, but it has a 2-year graded death benefit. The first 12 months of coverage will be 30 to 40% of the face amount, the following 13 to 24 months will be 60 to 70% of the face amount, and after 24 months, you will have 100% coverage.

- Two-year waiting period (or Modified waiting period) – Guaranteed issue burial plans for seniors has a two-year waiting period. The best plans offer immediate coverage if accidental death occurs, a return of premiums, 7 to 10% interest on these premiums if a death occurs in the first 24 months, and a guaranteed payout of funds after 24 months.

All insurance companies have different eligibility and waiting period criteria. Here is one example of an insurance company waiting period:

Life Insurance Policies With No Waiting Period

Whole life insurance is a type of permanent coverage. It provides lifetime coverage and includes a cash value component.

Benefits of having no waiting period Whole life insurance

- Full coverage starts on day one when the policy was issued

- The face value of your policy never decrease

- Permanent or lifetime coverage

- Your standard whole life policy has a cash value component that grows over time.

- Your premium payments will never increase

- You can never outlive your policy

- Your policy is active as long as you pay the premiums

- It has a guaranteed death benefit

- Your policy cannot be canceled except for non-payment

Term Life Insurance provides coverage at a fixed amount for a fixed period. Call us if you want to get term life insurance with no waiting period and the lowest rates.

Most term life insurance policies have no waiting period.

Benefits of term life insurance with no waiting period

- Full coverage starts when the policy is approved

- Same-day approval

- Your plan is convertible to a whole life plan

- It has extremely low rates

- Coverage up to age 80

- Premiums will never increase

- Immediate death benefit payout

- Death benefits are tax-free

- It has accidental death riders

- Highest coverage limits

Get 1St-day Coverage & Save 30-50% With Our Instant Quoter

Burial Insurance No Waiting Period

Burial insurance with no medical exam and no waiting period is a whole life insurance policy that will pay out the full death benefit from the first day the policy is purchased.

Your beneficiary will receive the death benefit even if you’ve only made the first payment on your policy.

Benefits of Burial insurance no waiting period:

- Immediate coverage

- Lifetime coverage

- Premiums will never increase

- The policy is active as long as premium payments are paid

- Guaranteed death benefit

The Truth About Guaranteed Acceptance Life Insurance With No Medical Exam

Guaranteed acceptance life insurance is a type of whole life insurance with no medical underwriting. It’s a life insurance no medical exam no health questions policy.

Your application can be approved regardless of your health condition with no medical exam life insurance. You cannot be declined or turned down.

Most companies will not ask qualifying questions about your health. If you have been diagnosed with a terminal illness, chronic illness, or you are in poor health, guaranteed issue life insurance may be your only option.

WHO NEEDS GUARANTEED ACCEPTANCE LIFE INSURANCE?

- People who want no exam life insurance

- People who can’t qualify for coverage with medical underwriting

- People who have been recently diagnosed with a chronic or terminal illness

- People who are permanently disabled need help with activities of daily living

- People who are currently receiving cancer treatment

- A family member who wants to cover burial expenses for a parent

Guaranteed whole life insurance no health questions are available to people between 50 and 80. Even if you’ve been declined for whole life insurance, no medical exam or health questions are required, and most policies are approved within a few days. Contact us if you need guaranteed issue life insurance under 40.

A standard part of guaranteed final expense insurance is a waiting period, meaning that the full death benefits are not available for a specified period. Typically the policyholder may have to wait two years before the whole benefit level is approved.

To sell life insurance without verifying someone’s health, guaranteed acceptance life insurance policies have a waiting period before full coverage begins.

Conditional coverage or graded benefit means that you are fully covered if you pass away from an accident.

However, your beneficiary will not receive the full death benefit if you die from a health issue during the waiting period.

The insurance company will refund the premiums you’ve paid for your policy plus 10% interest. After the waiting period, your beneficiary will receive the full death benefit regardless of how you pass away.

Many people want immediate coverage or life insurance for seniors no waiting period regardless of their health.

Folks need to understand that no life insurance company can afford to sell “no waiting” period to someone who has a severe health condition or terminal illness.

Waiting periods are designed for affordable coverage and allow insurance companies to stay in business.

How To Get Life Insurance Policies With No Waiting Period

To get life insurance policies with no waiting period, you need to apply with an insurance company where you answer a few health questions on the application.

You won’t need to undergo a medical exam, but you will have to answer questions about your health. You can get senior life insurance without a medical exam, but you must answer basic health questions. It is imperative to tell them honestly about your health condition.

Important Note: If they do not ask about a health issue, it means it’s not necessary, and they are okay with it.

The best way to get a no-waiting period policy is to find a company that does not ask about your health issues. If they don’t ask about your particular health issue, it means no waiting period (how cool is that?)

We can help you shop for companies that offer the best coverage.

Where To Find Life Insurance Policies With No Waiting Period

One of the best ways to find life insurance policies with no waiting period is to work with an independent insurance broker.

They will let you know which companies will offer you life insurance with no waiting periods. Independent insurance broker like Funeral Funds works with more than 20 highly rated insurance companies nationwide.

The insurance companies pay us so you can be assured that our services are free.

Our agents will get you the best insurance rates and show you the advantages of each kind of policy, and we will walk you through the whole process of application. We have a large selection of insurance carriers which gives us the best chance of finding you the one that is accepting of your health condition. If there is an insurance company that can get you covered without a waiting period, we’ll find it for you.

We can help you shop for the life insurance immediate coverage you need with no waiting period.

We will get you a quote from different insurance companies based on the type of plan you’re looking for. We will then show you the best insurance rates available to help you decide which policy works best for you and your family.

Tomorrow is uncertain; we don’t know what will happen next. That’s why you should buy the insurance coverage that your family needs today.

What Kind Of Burial Policies Should I Avoid?

TV AND MAGAZINE ADVERTISEMENTS – Most burial insurance policies or final expense policies you see advertised on television or in magazines are sold as the easiest way to shop for this protection.

Everyone is eligible for immediate benefit life insurance coverage and better pricing allowed by these heavily advertised policies that cost an arm and leg.

To make a long story short, it is better to shop for burial policies with a specialist in burial insurance, like FuneralFunds.com, than to sign up with a company that spends millions of dollars each month advertising on television and in magazines.

Those TV and magazine final expense policies may increase in price every five years or have a two-year waiting period before your benefits kick in!

These tricky television magazine ads lure you in with an attractive rate, only to have the cost of your insurance increase every five years until you cannot afford the premiums, then you must cancel your policy.

What happens after you cancel the policy?

You’ll die and have wasted all that money because you bought a policy that increases the price as you get older. These policies just don’t cut the mustard for most folks!

Avoid policies that increase in price yearly or end at a certain age. You don’t want your family worrying when they need this coverage the most.

Why choose Funeral Funds for my burial policy?

Most life insurance agents are fine, respectable people.

However, some life insurance agents will sell you the easiest and most expensive policy possible.

The guaranteed issue folks claim you don’t even need to talk to an agent (but you will need to wait 2 years for your coverage to begin…even if you’re healthy). Answering a few health questions will often get you immediate coverage and MUCH better rates.

The rest of the life insurance agents, who are fine respectable people, are most often generalists.

They deal with all kinds of life insurance policies.

They are nice people, but they are not the logical choice if you want the best pricing and the cheapest burial insurance policy with no waiting period.

We work with 20+ final expense companies, so we can get you qualified for the best price plan to get folks like you immediate coverage when possible.

We have to admit that, for the average burial insurance final expense insurance shopper, all the companies and options will often leave you more confused.

How Can Funeral Funds Help Me?

In reality, inexperienced and less knowledgeable insurance agents will cost you loads of money by selling you overpriced burial and final expense policies.

Getting on affordable burial, final expense, and funeral expense insurance for parents or yourself doesn’t have to cost an arm and a leg.

Our job at Funeral Funds is to be the most knowledgeable burial insurance expert available. By doing so, we can knock it out of the park and get you the most accurate quote and affordable rates.

Once we know more about your age and health history, we can accurately give you burial insurance quotes from the final expense companies that best fit you.

Working with independent final expense insurance brokers like Funeral Funds is always in your best interest.

With access to all the best final expense insurance companies, we will help you understand your best options, given your current age, health, and financial situation.

Get 1St-day Coverage & Save 30-50% With Our Instant Quoter

Frequently Asked Questions

What is a waiting period in life insurance?

The waiting period in life insurance is a fixed amount of time when the insurance company will not pay the full death benefit if the policyholder dies from a non-accidental cause. Most 2-year waiting period life insurance companies have two-year waiting period plans, but some companies have as long as four-year waiting period policies.

If a policyholder dies from natural causes or medical-related death, the life insurance company will only return the premiums paid plus interest which is typically 5-10%.

Is there a waiting period for life insurance?

Not all life insurance policies have a waiting period. Life insurance policies with a waiting period do not pay a full death benefit if you die from natural causes. Life insurance with immediate life insurance coverage starts immediately and do not have a waiting period.

Do life insurance policies have a waiting period?

Only guaranteed issue life insurance or guaranteed acceptance life insurance has a waiting period. This policy does not ask health questions and approves everyone who applies. They accept the risks that’s why they put a waiting period on their policy.

Is there a guaranteed acceptance life insurance with no waiting period?

Sad to say, guaranteed life insurance no waiting period is not possible. There is no guaranteed acceptance life insurance no waiting period. Every guaranteed acceptance burial insurance comes with a minimum of a two-year waiting period. If an agent sells you guaranteed whole life insurance with no waiting period, don’t believe him because he is lying.

What life insurance does not have a waiting period?

Generally, term life insurance, regular whole life insurance, universal life insurance, and index universal life insurance without 2 year waiting period. This life insurance with immediate cover without a 2-year waiting period takes effect on the first day, and the full death benefit is available after making the first payment.

What life insurance starts immediately?

Life insurance is effective immediately ask health questions. Your coverage will be active immediately after you pay your first premium. It is also life insurance that pays out immediately.

What is no waiting period in life insurance?

No waiting period in life insurance means you are fully covered from the first day or the moment you send your first premium. Your beneficiary would receive the full death benefit when you pass away, even if you made just one payment.

What is no wait life insurance?

No-wait life insurance starts immediately. Best life insurance with immediate coverage and no waiting period means you are 100% covered from the first day. If you pass away for any reason, your beneficiaries will get the full death benefit.

Can you get life insurance immediately?

Yes, guaranteed issue life insurance is a no medical exam and no health questions policy you can get immediately. You can apply over the phone and get approved for a policy instantly.

What life insurance policy starts immediately?

Simplified issue policies or cheap life insurance for seniors is whole life insurance, no medical exam, no waiting period policy that only asks health questions and starts immediately. Affordable life insurance without medical exam policies starts on the first day. You get full protection the moment you pay your first premium. You are fully covered no matter what happens to you, and your beneficiary will get the full payout.

Can you get life insurance last minute?

Many life insurance companies now offer immediate approval life insurance. You can apply over the phone or online and get approval within minutes.

What is burial insurance no waiting period?

Senior life insurance with no waiting period is a whole life insurance policy that asks health questions. It starts from the first day and pays out the full death benefit when the policyholder passes away, even if they only way one payment on the policy. Many life insurance companies offer burial insurance with no waiting period.

Which life insurance doesn’t have waiting period?

Life insurance policies that ask health questions don’t have a waiting period. No medical exam policies that ask health questions on the application are senior life insurance no waiting period plans.

Does all life insurance have a waiting period?

No, simplified issue life insurance plans that ask health questions begin from the first day, and it has no waiting period. Guaranteed issue or guaranteed acceptance policies have at least a two-year waiting period before they will pay out the full death benefit to the beneficiaries.

What is a 2 year waiting period for life insurance?

A two-year waiting period for life insurance is a fixed period wherein the life insurance company will not pay a 100% death benefit to the beneficiary if the policyholder dies from non-accidental causes.

The insurance company will only pay the full death benefit if the policyholder dies from an accident. If the policyholder dies from a medical-related or natural cause, the insurance company will only return the premiums paid plus interest.

Is there a 2 year waiting period for term life insurance?

No, 99% of all term life insurance policies do not have a two-year waiting period. Your term life insurance begins on the day your policy gets approved, and you get full insurance coverage immediately. Term life insurance no medical exam no waiting period are possible.

Why is there a waiting period for funeral insurance?

Funeral insurance also called burial insurance or final expense insurance has a waiting period designed by the insurance companies to protect themselves from people who are most likely to die in the next 24 months.

The waiting period was created so insurance companies would not go out of business by ensuring people were on their deathbeds and needing the death benefit to provide for their families.

Does AIG life insurance have a waiting period?

Yes, AIG only offers a guaranteed issue policy for their burial insurance. AIG guaranteed issue policy comes with a two-year waiting period. AIG will only pay the full death benefit if you die from an accident.

They will only pay the full death benefit in the third year of the policy.

If you die from natural causes during the two-year waiting period, AIG will only pay 110% of all the premiums.

What is a waiting period for term life insurance?

The waiting period for term life insurance refers to the period after you apply for a policy and waiting for your coverage to be active. Term life insurance application typically takes about 5-6 weeks. This gap is the waiting period for term life insurance.

Can people buy life insurance online?

Yes, you can buy life insurance online today. Many life insurance companies offer life insurance online. You can apply directly on their site and get a decision immediately. You can get a quote here – https://funeralfunds.com/free-quote/

How fast do you get life insurance?

You can get life insurance protection in as little as 24 hours. Simplified issue policies with no medical exam come with immediate coverage. You can get approval minutes after applying.

Can you get life insurance on your deathbed?

Yes, as long as you have a sound mind to sign the paperwork. You can get life insurance on your deathbed, however; you will only qualify for a guaranteed issue life insurance with a waiting period.

Can life insurance company deny claim after two years?

Every life insurance company has a two-year contestability clause written in the policy. A death claim can be rejected during this time if the policyholder commits suicide or commit misrepresentation on the application.

After the two-year contestability period, life insurance coverage becomes incontestable. The life insurance company cannot deny a claim in the third year if the coverage is active.

Can life insurance be denied after 2 years?

Insurance companies have two-year contestability where life insurance claims can be denied during this time due to suicide or material representation.

Life insurance cannot be denied in the third year, and your beneficiary will receive the full death benefit if the coverage is in force.

Can I have 2 funeral policies?

Yes, you can have more than one funeral insurance policy. However, you need to be aware that you need to pay a policy fee on each policy.

Having more than one funeral or burial insurance policy will give you a larger coverage but has a downside. When you pass away, your beneficiary will need to deal with multiple insurance companies, that can cause delays in the payout.

How long does it take for funeral policy to lapse?

Most funeral insurance policies take 30 days to lapse if you do not pay your premium. Pay your premiums on time to prevent your policy from lapsing.

Setting a draft date from your savings or checking account is the best way to keep your account active.

What usually happens if the insured person dies during a grace period?

Most life insurance companies offer a 30-day grace period. If you pay your premium during the grace period your coverage will remain active.

If the policyholder dies during the grace period without paying the premium owed, the beneficiary will only receive the death benefit amount less the premium owed.

Is life insurance guaranteed?

Only guaranteed issue or guaranteed acceptance life insurance policy guarantees approval regardless of your medical condition. All the other policies will consider your gender, age, and health condition before they approve your application.

Can you get life insurance no questions asked?

Yes, guaranteed issue life insurance has no medical exam and asks no health questions. Final expense life insurance no medical questions policies will approve your application regardless of your medical condition.

One important thing to remember about no health questions-asked policies is that it comes with a two-year waiting period.

What’s the difference between life insurance and burial insurance?

The difference between life insurance and burial insurance is the face amount.

Burial insurance is whole life insurance with a small amount, typically $20,000 to a maximum of $50,000, designed to cover funeral, burial, and final expenses. Regular term and whole life insurance offer larger face amounts over $1,000,000.

What life insurance does not require a physical?

Simplified issue life insurance does not require a physical or medical exam. You only need to answer a few health questions to qualify. You can apply over the phone or on the internet.

How long do you have to wait for a claim to be processed?

It typically takes most life insurance companies 30 to 60 days to process a claim. The claims process could take longer if the insurance company does not receive the complete documentation.

8 Comments

Abzal Mohammed

Looking for Life insurance I just turn 84 years on February 22nd

(1) whole life for $10,000 or $15,000. or

(2) Term Life if available.

Janie reddell

Coverage for final expess

Funeral Funds

Janie – Visit this page to get information and a quote – https://funeralfunds.com/free-quote/

Vester Robinson

Just checking around for the right quote

Scooter Sumpter

Need a quote for whole life $5000 no waiting please.

Funeral Funds

Hi Scooter! You can get pricing and coverage amounts by calling us at (888) 862-9456 or by using our quoting software on this website page – https://funeralfunds.com/free-quote/

Jeffrey Hamner

wouldn't let me finish application process

Funeral Funds

Jeffery – try this – https://funeralfunds.com/free-quote/