Burial Insurance with a Defibrillator (2024 Update)

Got a defibrillator and need burial insurance? Buckle up, because you’re in for some good news. If your heart’s got a little extra zing, you can still get that burial policy without breaking the bank.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with a defibrillator, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

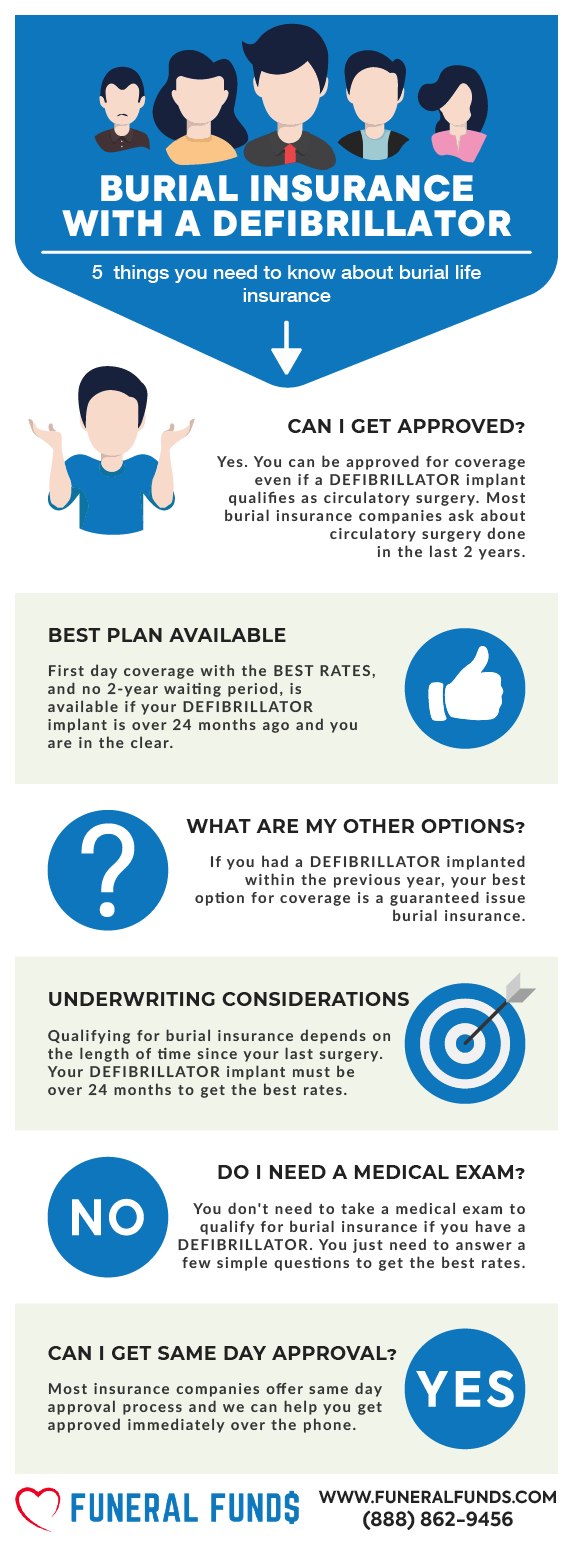

What Is My Best Insurance Option If I Have A Defibrillator?

How long your defibrillator has been hanging out in your chest is a big deal when it comes to your insurance options.

DEFIBRILLATOR IMPLANTED OVER 2 YEARS AGO

An implantable cardioverter defibrillator (ICD) isn’t just a mouthful – it’s your lifeline. These gadgets are implanted in your chest or abdomen to save you from sudden cardiac arrest. Yep, it’s a big deal and counts as circulatory surgery.

If your ICD has been in place for over 24 months, congrats! You can get a level death benefit plan with first-day coverage from a bunch of burial insurance companies.

You’ll get rates similar to those of folks in perfect health and be fully protected from day one. Plus, you qualify for the lowest premiums.

DEFIBRILLATOR IMPLANTED WITHIN 24 MONTHS

Got your ICD within the last two years? No worries! Our preferred company will simply ask, “Been hospitalized twice in the last two years?” If you can say “Nope,” you’re on the fast track to a first-day coverage plan, as long as you’re in the right zip code.

But if you’re still in the hospital or you’ve had two or more visits in the past couple of years, then it’s time to go for guaranteed-issue whole life insurance. Sure, there’s a two-year waiting period, but that’s way better than kicking yourself later for waiting too long to get covered.

DEFIBRILLATOR BATTERY CHANGES

Switching out a defibrillator battery? That’s just a quick outpatient tune-up.

Some insurance companies might treat this like major heart surgery, meaning you’d face a waiting period and higher premiums if it’s fresh.

But here’s the kicker: we know burial insurance companies that don’t fuss over battery changes. If you’ve just had one, we can connect you with a company that offers first-day coverage without the wait.

Do I Need A Medical Exam To Qualify For Burial Insurance?

Absolutely not! No medical exams required for getting burial insurance with a defibrillator.

You’ll just need to answer a few straightforward questions about your health. It’s smooth sailing from there – no medical records, no blood, no urine samples.

You’ll get the green light from the insurance company, often in a matter of minutes!

Burial Insurance Underwriting If You Have A Defibrillator

Burial insurance companies have two ways of digging into your health:

FIRST – They’ll hit you with a bunch of health questions. Your answers will make or break your eligibility.

SECOND – They’ll snoop through your prescription history electronically to see what’s really going on with your health.

A defibrillator implant is considered a circulatory surgery. Most burial insurance companies are nosy about recent circulatory surgeries, usually within the last 24 months. It’s rare for them to care about surgeries beyond two years ago.

HEATH QUESTIONS:

- Prior to age 50 or during the past 24 months, have you been hospitalized for heart or circulatory surgery (including pacemaker, heart valve replacement, bypass, angioplasty, stent implant, or any procedure to improve circulation to the heart or brain?

- Within the past 24 months, have you been treated or hospitalized for heart or circulatory surgery (including pacemaker, bypass, heart valve replacement, angioplasty, stent implant, or any procedure to improve circulation to the heart or brain?

- Within the past 2 years, have you had or been diagnosed with angina, heart attack, cardiomyopathy, or any type of heart or circulatory surgery?

In a nutshell, qualifying for burial or final expense insurance hinges on how long it’s been since your last surgery. If your defibrillator implant is fresh, it might jack up your premium and stick you with a waiting period.

PRESCRIPTION HISTORY CHECK

Insurance companies will also peek into your prescription history during their underwriting process.

If you’re popping pills for other heart issues related to your defibrillator, it could mess with the plans and rates you qualify for.

What Is My Burial Insurance Rate If I Have A Defibrillator?

The cost of burial insurance if you have a defibrillator will depend on:

- Age

- Coverage amount

- Gender

- General health

- State of residence

- Smoking status

- Type of policy

Hunting for the best life insurance rates with a defibrillator? Partner up with the top insurance matchmaker in town – Funeral Funds. We’ll scour the market, compare rates from various carriers, and find your perfect insurance match.

Check out these sample rates for a fabulous 60-year-old female with a defibrillator:

| FEMALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Check out these sample rates for a rugged 60-year-old male with a defibrillator:

| MALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

How Should I Pay My Premiums?

The best way to pay your premium is through a savings or checking account. Set up a bank draft from your savings or checking account, and let the bank handle your monthly premium. This way, you won’t have to stress about your policy lapsing due to non-payment.

Information We Need If You Have A Defibrillator

When applying for final expense insurance with a defibrillator, it’s crucial to spill the beans. We’ll ask you a series of health questions to get the full picture of your condition.

These questions include:

- When was your ICD installed?

- Why do you need a defibrillator?

- When was the last time you had a battery change?

- What other health conditions do you have?

- What prescription medications do you take, and for what condition?

We need all the details about your medical condition to give you the best recommendation. The more info we have, the better our chances of finding you affordable insurance coverage.

How To Get The Best Burial Insurance Rates For People With Defibrillators

To score affordable coverage after your defibrillator implant, you need to reach out to an independent insurance agency like Funeral Funds that knows the ropes and works with companies that look favorably at defibrillators.

We’re in the know about the insurance companies underwriting guidelines and requirements for burial insurance with a defibrillator. We’ll shop your case around with multiple companies to match you with the best plan and the most affordable rate. Our mission? To get you the lowest-cost coverage for your condition.

So, if you’re hunting for burial insurance with a defibrillator implant, we’ve got your back.

How Can Funeral Funds Help Me?

Finding a policy with a defibrillator doesn’t have to be a headache. Team up with Funeral Funds, and we’ll make the process smooth and speedy.

We’ll be with you every step of the way to find the plan that fits your financial needs and budget. Save your time – no need to chase down multiple insurance companies because we’ll handle the legwork for you.

Our goal is to secure the coverage you need at a rate you can afford. So, if you’re on the hunt for funeral or burial insurance with a defibrillator, we’ve got you covered.

Fill out our quote form on this page or call us at (888) 862-9456, and we’ll give you an accurate quote.

Frequently Asked Questions

What heart conditions require a defibrillator?

A defibrillator is your heart’s best friend when it stops beating, a condition known as cardiac arrest. But it’s not just for that – it also zaps other pesky heart issues like ventricular tachycardia or fibrillation back into line.

Is a defibrillator implant considered surgery in life insurance?

You bet it is! A defibrillator implant counts as surgery in the eyes of life insurance companies.

Do I need to tell insurance about my defibrillator use?

Absolutely! Spill the beans about your defibrillator use to your insurance company. Keeping it a secret could lead to denied claims or jacked-up premiums down the road.

Can I get insurance if I have a defibrillator and use blood thinners?

Yes, you can still get life insurance even if you’ve got a defibrillator and are on blood thinners. Many insurers see a defibrillator as a minor bump in the road and won’t charge you extra for it.

Can you get first-day coverage insurance if you have a defibrillator?

Yes, you can land first-day coverage insurance with a defibrillator. Just be ready for your insurer to ask why you need that handy device.

What are the things that may affect my eligibility if I have a defibrillator?

Several factors might mess with your life insurance eligibility if you have a defibrillator. These include a recent heart attack or stroke, using blood thinners, and how long it’s been since your defibrillator was implanted.