Burial Insurance with a Heart Transplant (2024 Update)

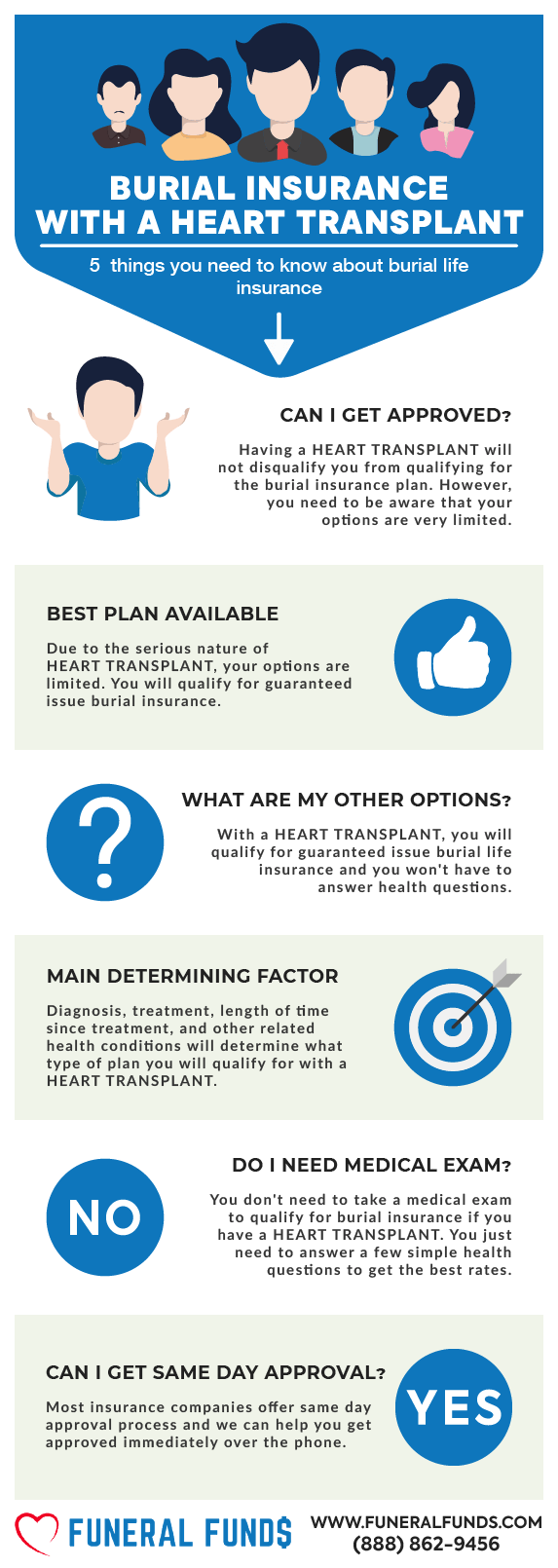

You can get approved for burial insurance with a heart transplant, but here’s the deal: you can get first-day coverage if it’s been 5 years since your heart transplant. Under 5 years? No worries – you’ll still qualify for guaranteed issue life insurance, but there’s a two-year waiting period.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with heart transplant, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is My Best Insurance Option If I Have A History Of Heart Transplant?

Life insurance companies are super nosy about heart transplants. Why? Because, let’s face it, a heart transplant isn’t exactly a minor procedure. It’s a serious deal, and that means your life expectancy stats take a hit.

Having a heart transplant means you will need to live for five years before you qualify for a first-day coverage plan. There is no need for a medical exam; just answer a few health questions.

Under 5 years since your heart transplant? You’ll still qualify for guaranteed issue life insurance. Having a heart transplant means you’ve got to stick around for two years before your beneficiaries see that full 100% death benefit (for any medical reason). Kick the bucket within that period, and the insurance company will only refund your premiums plus 10% interest (unless it’s an accidental death – then they’ll pay out your full coverage amount).

You will qualify for guaranteed issue burial insurance even if you say yes to the following questions:

- Do you have a heart transplant?

- Did you have any complications after the heart transplant?

- Have your doctor told you that you might not live more than a few months after your surgery?

Under these circumstances, you will still be eligible for a guaranteed acceptance or issue policy.

You will need to meet the following requirements to get approved:

- You are a U.S. citizen

- You meet the age requirements of 50-85 years old

- You live in a state where guaranteed issue life insurance policies are available.

WHAT IS A GUARANTEED ISSUE BURIAL INSURANCE?

Welcome to the world of no-exam, no-questions-asked life insurance, also known as guaranteed acceptance life insurance for transplant patients. This whole life insurance is your ticket to coverage that lasts a lifetime.

The application process? Easy-peasy. Just fill out your personal, beneficiary, and payment info. You can even sign the application over the phone or on your computer. In minutes, you’ll be approved.

This policy is a godsend for heart transplant recipients – no medical exams, no health questions. Just pure, simple coverage.

BENEFITS OF GUARANTEED ISSUE BURIAL INSURANCE

- No health questions – This is the most significant advantage for heart transplant recipients because you’re guaranteed to be approved, and no questions are asked and no medical exam either.

- Easy to qualify – It’s a straightforward yes or no. No medical exams, no digging into your medical records, no peeking at your prescription history. Most companies will approve you on the spot.

- Fixed monthly premium – Your premium is locked in at your current age and will never increase. Pay your monthly premiums, and you’re golden for life.

- Not Cancelable – Unlike some policies that bail on you when your health takes a turn, guaranteed issue burial insurance will never cancel due to declining health or age.

- The death benefit will never decrease – Your death benefit is fixed and guaranteed. Your beneficiaries will get the full amount after the two-year waiting period.

- Cash value accumulation – This whole life insurance policy builds cash value over time. Use it to pay your premiums or borrow against it for whatever you need.

These are the fabulous benefits of a guaranteed life insurance policy. Once you’re past the two-year waiting period, you’re covered for natural causes of death. Take out the policy and make that first payment, and you’re fully covered for accidental death from day one.

Should I Buy A Guaranteed Issue Policy If I Had A Heart Transplant?

If you’ve had a heart transplant, guaranteed issue life insurance with a waiting period is your only option. if it has been less than 5 years. You might be thinking, “Why bother if it doesn’t cover me right away?” Here’s the scoop:

All heart transplant recipients are on a cocktail of immunosuppressants, anti-rejection meds, and other “knock-out” drugs that are red flags for every insurance company.

Here’s why we recommend guaranteed acceptance life insurance if your heart transplant is less than 5 years:

- There could be a complication from your operation.

- You could have a heart attack.

- You could develop other health conditions like high blood pressure or diabetes.

- Your doctor may prescribe other medications that are flagged by the life insurance company.

Other health conditions can also block you from qualifying for immediate coverage. Guaranteed issue burial insurance is your only shot. Act now, get that guaranteed issue plan, and start the waiting period.

Bottom line: The sooner you start the waiting period, the sooner you’ll get full coverage. Don’t wait – get that plan and get covered!

The Best Guaranteed Issue Life Insurance Policy

The best insurance for transplant patients won’t make you wait more than two years to get fully covered.

Some companies try to push plans with three or even four-year waiting periods. Three and four-year wait policies are absolute garbage! If anyone proposes these to you, reject them immediately. Avoid these plans like the plague.

Two years is the shortest waiting period possible before you’re fully covered. You should never have to wait longer than that.

No health questions, no medical exams. If you pass away during the first two years because of your heart transplant, your beneficiaries will get the return of your premiums plus 10%.

Do I Need A Medical Exam To Qualify For Burial Insurance?

Nope! You do NOT need a medical exam to qualify for burial insurance with a heart transplant.

When you apply for burial insurance, you’ll only answer basic questions about your health. The application process is super simple – no medical records, no blood, no urine samples.

You’ll get official approval from the insurance company often within minutes!

Burial Insurance Underwriting If You Have A Heart Transplant

Underwriting is the insurance carrier’s way of figuring out how risky you are and whether you qualify for burial insurance.

Burial insurance companies offering first-day coverage have two underwriting methods:

FIRST – They’ll ask you a bunch of health questions. Your answers determine if you’re eligible.

SECOND – They’ll do an electronic check of your prescription history to verify your health.

HEALTH QUESTIONS

Every burial insurance company will ask about heart transplants.

Here are some common questions you might face:

- Have you been treated for or diagnosed or been advised by a physician to have an organ transplant?

- Have you had, or been advised to have by a member of the medical profession, an organ transplant, or have you been diagnosed as having a terminal illness?

- Have you ever received, or been advised to receive, an organ or bone marrow transplant?

Most life insurance companies with underwriting (health questions) will ask these questions in the “knockout” section. If you answer any of the questions with a “YES” in a knockout section, you will not qualify for an immediate coverage plan.

PRESCRIPTION HISTORY CHECK

After a heart transplant, your body sees the new heart as a foreign invader. It’ll try to attack and destroy it. To prevent this, you’ll be prescribed immunosuppressant drugs to keep your body from rejecting the new organ. These anti-rejection drugs help minimize side effects and keep your new heart safe.

But here’s the catch: some of these immunosuppressant drugs are red flags for life insurance companies. If you’re taking any of these medications, you’ll be flagged as a heart transplant recipient and considered a high-risk applicant.

Taking any of these drugs signals to the insurance company that you’ve had an organ transplant. Here are a few common ones:

- Azathioprine

- Basiliximab (Simulect)

- Belatacept

- Calcineurin

- Cyclosporine

- Daclizumab

- Muromonab-CD3

- Mycophenolate Mofetil (CellCept)

- Mycophenolic acid (Myfortic)

- Prednisone

- Sirolimus (Rapamune)

- Tacrolimus

- Thymoglobin

How Much Insurance Do I Need If I Have A Heart Transplant?

The amount of burial insurance you need depends on your personal and financial situation. But here’s the scoop: your policy should cover funeral, burial, and final expenses.

Step one is figuring out your end-of-life expenses. Your funeral is usually the biggest cost. Other expenses to consider are outstanding medical bills, living expenses, credit card bills, and other debts.

How Should I Pay My Premiums?

The best way to pay your premium is through a savings or checking account. Set up a bank draft from your account so the bank automatically pays your premium each month. This way, you’ll never have to worry about your policy lapsing due to non-payment. Easy peasy!

Other Common Uses For Final Expense Life Insurance

All of these examples are appropriate uses for Final Expense Life Insurance:

- Burial insurance plan with a heart transplant

- Cremation insurance plan with a heart transplant

- Funeral home insurance plan with a heart transplant

- Final Expense insurance plan with a heart transplant

- Prepaid funeral plan insurance with a heart transplant

- Mortgage payment protection plan with a heart transplant

- Mortgage payoff life insurance plan with a heart transplant

- Deceased spouse’s income replacement plan with a heart transplant

- Legacy insurance gift plan to family or loved ones with a heart transplant

- Medical or doctor bill life insurance plan with a heart transplant

We can help you with any of the plans above. Pricing depends on your age, health, and the coverage amount you choose.

How Can Funeral Funds Help Me?

Finding a policy with a heart transplant doesn’t have to be a headache. An independent final expense broker like Funeral Funds makes it easier and quicker.

We’re with you every step of the way to find a plan that fits your financial needs and budget. No need to waste time searching for multiple insurance companies – we do the work for you.

We partner with many A+ rated insurance carriers specializing in high-risk clients like you. We’ll search all those companies to find the best burial insurance at the best rate.

We’ll help you secure the coverage you need at a price you can afford. If you’re looking for heart transplant funeral insurance, burial insurance, or life insurance, we’ve got you covered. Fill out our quote form on this page or call us at (888) 862-9456 for an accurate quote.