Burial Insurance after a TIA or Transient Ischemic Attack (2024 Update)

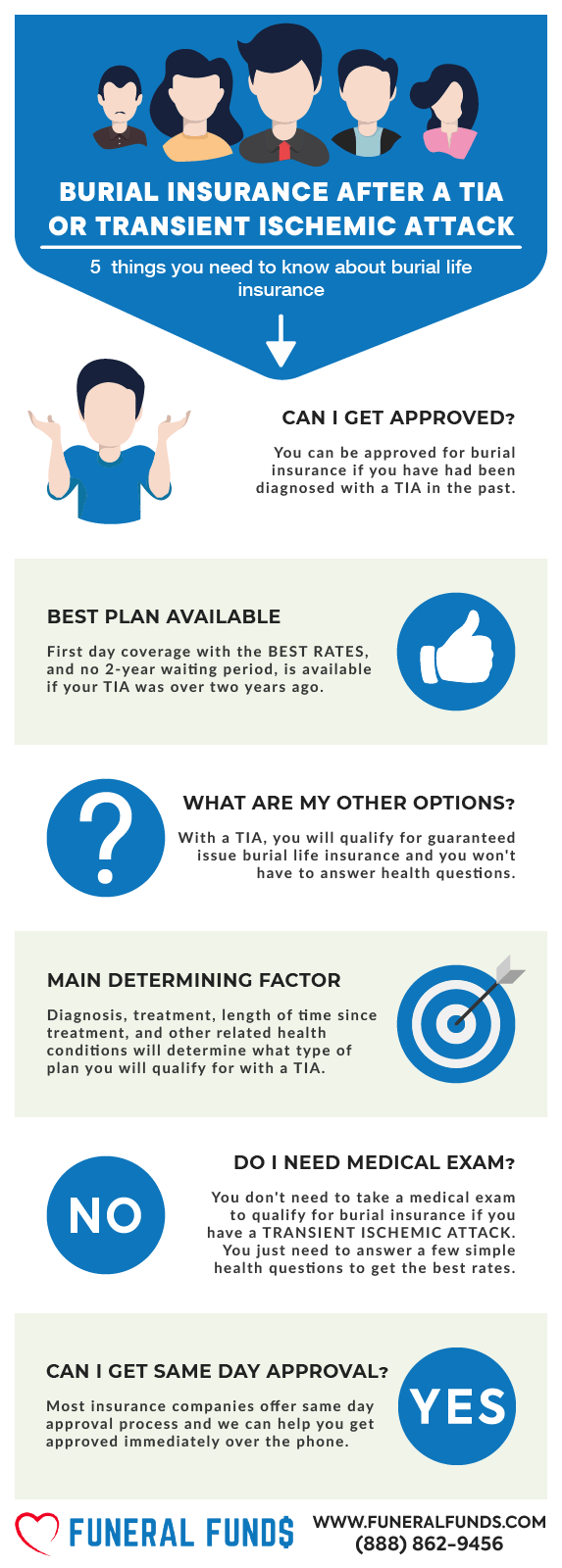

You can qualify for burial insurance after having a TIA (Transient Ischemic Attack) or a mini-stroke. Think of it as a little blip, not a full-blown stroke (silver lining, right?). But it can mean life insurance gets a bit trickier. The good news is, you’re not out of luck!

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with Transient Ischemic Attack (TIA), or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What is a Transient Ischemic Attack or TIA?

Think of your brain as a busy city, always buzzing with activity. A TIA, or Transient Ischemic Attack (fancy medical term for “mini-stroke”), is like a temporary traffic jam up there. Blood flow gets blocked for a short while (usually less than an hour!), but unlike a full-blown stroke, it doesn’t cause lasting damage. However, just like a major traffic jam is a warning of bigger problems on the road, a TIA is a heads-up that you might be at risk for a stroke down the line.

Cause: A temporary roadblock in your brain’s highway system (blood flow).

Symptoms: These are similar to a stroke but they usually clear up within 24 hours (often much faster). Think:

- Feeling weak or numb on one side of your body, like your face has forgotten how to smile or your arm feels like a limp noodle.

- Talking gibberish only your dog understands (confusion and speech problems).

- Suddenly seeing double or your vision getting blurry (vision woes).

- Feeling dizzy or wobbly like you’ve had one too many margaritas (balance issues).

While a TIA isn’t a stroke, it does put you at a higher risk of having one later. Since strokes are a big deal for life insurance companies, your premiums might be a bit higher to reflect that.

Can I Qualify For Burial Insurance After A TIA?

Yes, you can qualify for burial insurance coverage. Just pick the right company and avoid any recent hospital stays (think two or fewer in the past two years) and you can qualify for a first-day coverage plan.

What Is My Best Insurance Option After A TIA?

RECENT OR PAST TIA – First-day coverage is your best bet. Think of it as getting a head start, with full benefits from day one. No waiting period, so it’s like getting insurance before that pesky TIA even showed up!

TWO OR MORE HOSPITALIZATION IN THE PAST TWO YEARS – A guaranteed issue whole life might be the way to go. This option doesn’t require a medical exam, so no need to stress about answering any health questions.

Do I Need A Medical Exam To Qualify For Burial Insurance?

NO. Skip the stethoscope, no doctor’s visit needed for burial insurance! Just answer a few health questions, and you’re good to go. Think of it as a quick quiz, way easier than that crossword puzzle you haven’t figured out yet.

The application process is a breeze, so you can get covered in no time and be on your way to enjoying life (without worrying about leaving the bill to the grandkids)!

Burial Insurance Underwriting For Transient Ischemic Attack

Had a TIA and wondering how burial insurance companies will handle it? Let’s break it down without all the fancy jargon:

FIRST – You’ll answer some basic health questions. Think of it like a quick chat, not a pop quiz. Be honest, but there’s no need to overthink it!

SECOND – The insurance company might peek at your prescription history electronically. It’s like a detective looking for clues about your overall health.

These two things help them decide if you qualify, what plan works best for you, and how much you’ll pay.

HEALTH QUESTIONS:

You will often find TIA health questions asked during the underwriting process:

- Have you been diagnosed or treated for a TIA or mini-stroke within 24 months?

- Have you been diagnosed or treated for a Transient Ischemic Attack (TIA/mini-stroke) within the last 12 months?

- In the past 10 years, have you opted to not seek treatment, have not taken medication, and or have not followed the prescribed treatment plan following a medical diagnosis for stroke or TIA?

PRESCRIPTION HISTORY CHECK

Burial insurance companies, like health detectives, might also do a quick electronic scan of your prescription history. This is just to get a general sense of your health.

Common medications for Transient Ischemic Attacks:

- Apixaban (Eliquis)

- Clopidogrel (Plavix)

- Dabigatran (Pradaxa)

- Dipyridamole (Persantine)

- Edoxaban (Lixiana, Savaysa)

- Rivaroxaban (Xarelto)

- Warfarin (Coumadin, Jantoven)

If you see any meds on the list that you take, don’t worry! It doesn’t necessarily mean any red flags for your insurance.

What Is The Cost Of Burial Insurance After A TIA?

Here’s what goes into the insurance pricing:

- Age

- Coverage amount

- Gender

- General health

- State of residence

- Smoking status

- Type of policy

Here’s a pricing example for an appreciative 60-year-old female who have had a stroke:

| FEMALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Here’s a pricing example for a tenacious 60-year-old male who have had a stroke:

| MALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Information We Need If You Have A Mini-Stroke

When applying for final expense insurance after a TIA, gotta answer a few questions to get a clearer picture of your health. Just answer honestly, and we’ll help you find the perfect plan!

These questions include:

- When was the last time you had a Transient Ischemic Attack?

- How many times did you have a TIA?

- What were your symptoms before and after TIA?

- After your TIA, were you diagnosed with any other medical condition?

- What medications are you currently taking?

- Do you currently have any physical disabilities or neurological disorders?

How To Apply For Burial Insurance After A TIA

- Team Up With an Agent: Think of them as your insurance fairy godmother (with a calculator, not a magic wand). Independent agents from Funeral Funds specialize in TIAs and can find you the best plan, compare prices, and answer all your questions.

- Complete the Application Honestly – When you fill out the application, be truthful about your TIA and any other health stuff. Think of it as a chat with a friend, not a job interview. The more accurate you are, the smoother things go.

- Review and Confirm Policy Details – Before you sign on the dotted line, take a good look at the policy details. Make sure the coverage fits your needs and budget. It’s like picking out a new outfit – gotta make sure it feels right!

How Can Funeral Funds Help Me?

Funeral Funds is here to be your map and compass! We work with tons of top-rated insurance carriers, so you don’t have to. Think of us as your insurance matchmakers, finding the perfect plan at the best price.

Our friendly experts (no suits and ties here!) will search high and low for the best deals. Plus, we’ll make the whole process easier than figuring out those tricky TV remotes.

Just fill out our quick quote form or give us a call at (888) 862-9456. We’ll get you a personalized quote faster than you can say “bingo!” Let’s get you covered and back to enjoying life’s adventures!

Frequently Asked Questions

Can you get life insurance after TIA?

Absolutely! While a TIA might raise a few eyebrows at some insurance companies, with the right one, you could even qualify for first-day coverage. Think of it like finding the perfect pair of shoes – there’s a plan out there that fits just right!

Is a TIA a pre-existing condition in life insurance?

Yep, any health thingy you’ve had before applying for life insurance counts as pre-existing. But don’t worry, it doesn’t mean you’re out of luck!

Do you have to tell the insurance company about TIA?

Yes, If they ask about it on their health questionnaire, then yes, be honest! They’re like insurance detectives, so transparency is key.

Can mini-stroke patients buy life insurance?

Absolutely! Depending on when the TIA happened and which insurance company you work with, you could qualify for first-day coverage. It’s like getting an insurance superpower (without the cape)!

Is there a waiting period for life insurance after TIA?

Typically, there’s no waiting period for TIA survivors! Depending on your state and the insurance company, you might even qualify for coverage that kicks in right away.