2024 Burial Insurance With An Aneurysm

You can qualify for first-day coverage burial insurance with an aneurysm history depending on what state you live in.

This article will show how life insurance underwrites an aneurysm patient and how to get the best plan.

FOR EASIER NAVIGATION:

- What Is Aneurysm?

- Can I Get Burial Insurance With Aneurysm?

- Types Of Burial Insurance For People With Aneurysm

- What Is My Best Insurance Option If I Have Aneurysm?

- Do I Need A Medical Exam To Qualify For Burial Insurance?

- How Much Does Burial Insurance Cost?

- Burial Insurance Underwriting If You Have an Aneurysm

- Information We Need if You Have an Aneurysm

- What If I’m Denied Life Insurance Because of My Aneurysm?

- How To Get First-day Coverage With Aneurysm

- How To Apply For Burial Insurance With Aneurysm

- How Can Funeral Funds Help Me?

- Frequently Asked Questions

What Is Aneurysm?

An aneurysm is a bulge or weakening in the wall of an artery. Arteries are the blood vessels that carry oxygen-rich blood away from your heart to your body. The constant pressure of blood pushing against the weak spot in the artery wall can cause the aneurysm to grow larger over time.

Aneurysms can occur in any artery in your body, but they are most common in the aorta, the largest artery in your body that carries blood from your heart to the rest of your body. Aneurysms can also form in the arteries in your brain, legs, intestines, and kidneys.

There are two main types of aneurysms:

- Saccular aneurysms: These are the most common type of aneurysm. They look like small pouches bulging out from the side of an artery.

- Fusiform aneurysms: These aneurysms cause the entire artery to widen.

Most aneurysms don’t cause any symptoms. However, a large aneurysm may press on nearby tissues and cause pain. A ruptured aneurysm can cause life-threatening bleeding.

If you have an aneurysm, your doctor will recommend treatment based on the size and location of the aneurysm. Treatment options include medication, surgery, and minimally invasive procedures.

Aneurysms, especially untreated ones, are seen as a higher risk by insurance companies.

Can I Get Burial Insurance With Aneurysm?

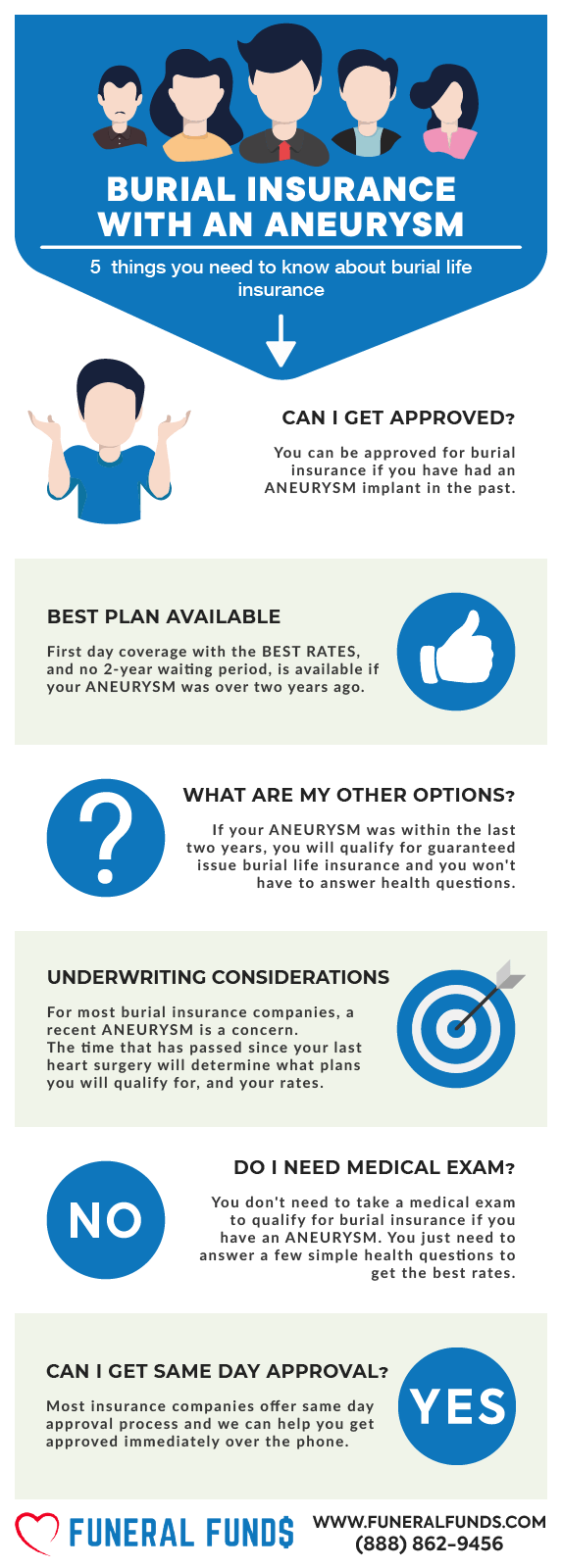

YES: You can qualify for first-day burial insurance coverage with no waiting period, depending on what plans are available in your state.

NO: If you have refused medications or aneurysm treatment in the past ten years or if certain insurance companies are unavailable in your state.

Types Of Burial Insurance For People With Aneurysm

FIRST-DAY COVERAGE – This burial insurance covers you from the first day. Your beneficiaries will receive the full death benefit when you pass away. First-day coverage burial insurance with no waiting period is always cheaper than guaranteed issue life insurance.

GUARANTEED ISSUE LIFE INSURANCE – This policy has no medical exam or health questions. You will be approved regardless of any health issues. The downside of this policy is the mandatory two-year waiting period. If you pass away during the waiting period, the company would only pay out the premiums you have paid plus 7-10% interest (depending on the company).

What Is My Best Insurance Option If I Have Aneurysm?

If you’ve ever been diagnosed, received treatment, or advised to receive treatment and medication for an aneurysm, your best option is a first-day coverage plan.

One company that offers this 1st-day coverage will ask if you’ve been hospitalized two or more times in the past two years. If you haven’t been hospitalized, you’ll qualify for 1st-day coverage if this company is available in your state.

If your physician has advised you to take treatments or surgery, and you refused, your best insurance option is to get a guaranteed issue whole life insurance with a two-year waiting period.

Do I Need A Medical Exam To Qualify For Burial Insurance?

Medical exams, blood tests, and urine samples are not required for burial insurance approval.

The best first-day coverage company for aneurysms asks a few health questions, and you can get approved within minutes!

If you don’t want to answer any health questions, you can get guaranteed issue life insurance with a 2-year waiting period.

How Much Does Burial Insurance Cost?

The cost of burial insurance will depend on your:

- Age

- Coverage amount

- Gender

- General health

- State of residence

- Smoking status

- Type of policy

Burial Insurance Underwriting If You Have an Aneurysm

Here’s how some insurance companies ask about aneurysm on the insurance application:

- During the past 24 months, have you been diagnosed with angina, aneurysm, or heart attack or failure?

- Within the past 2 years, have you had or been diagnosed with a brain tumor or aneurysm?

- Within the past 24 months, have you been medically diagnosed with an aneurysm or brain tumor?

The most common types of aneurysms the insurance companies want to know about:

- Abdominal aortic Aneurysm – occurs near the abdomen or pelvic area

- Cerebral Aneurysm – occurs in the brain

- Mesenteric artery Aneurysm – occurs in the intestine

- Popliteal artery Aneurysm – occurs in the leg behind the knee

- Splenic artery Aneurysm – occurs in the artery in the spleen

- Thoracic Aortic Aneurysm – occurs in the major artery of the heart

Information We Need if You Have an Aneurysm

Here are some of the questions we may ask you to determine your best plan at the best value:

- Did your aneurysm rupture?

- Do you have other health issues related to your aneurysm?

- Have you had surgery or treatment to correct an aneurysm?

- Have you undergone any tests related to your aneurysm recently?

- How long have you been living with an aneurysm?

- Was your aneurysm operable?

- What prescription medications do you take to treat your aneurysm?

- When did you know you had an aneurysm?

- Where is the location of your aneurysm?

What If I’m Denied Life Insurance Because of My Aneurysm?

Your application may be denied if you have other health issues besides an aneurysm that affect your overall health.

If you are healthy and have been denied, chances are you applied with the wrong company.

If you have been rejected for life insurance in the past, we can help you get burial insurance with other companies and will get you the best plan and pricing.

How To Get First-day Coverage With Aneurysm

If you have an aneurysm, the best way to get a first-day coverage burial insurance plan is to work with an independent agency like Funeral Funds. Our independent life insurance agents can compare companies offering first-day coverage insurance and recommend the best plan with the best pricing.

How To Apply For Burial Insurance With Aneurysm

- Consult with an Independent Insurance Agent – Ask for guidance from independent insurance agents specializing in underwriting for aneurysms. They can help you understand your options, compare quotes, and choose the most suitable burial insurance plan.

- Complete the Application Honestly – When filling out the life insurance application with your agent, be truthful about your heart failure. Provide accurate details about your health, treatments, and any lifestyle changes you’ve made.

- Review and Confirm Policy Details – Carefully review the policy terms before confirming your acceptance. Make sure the insurance coverage meets your needs and your budget.

How Can Funeral Funds Help Me?

Here at Funeral Funds, we specialize in getting life insurance coverage for people with a history of aneurysm.

We work with many A+ rated insurance companies that specialize in high-risk clients. We will search those companies to give you the best rate. We’ll match you up with your best life insurance option.

We will assist you in securing the coverage you need at a rate you can afford. So, if you’re looking for burial insurance for heart failure, we can help. Fill out our quote form on this page or call us at (888)862-9456 to get accurate quote burial insurance quotes.

Frequently Asked Questions

What types of aneurysms do the life insurance companies want to know about?

Abdominal aortic, cerebral, mesenteric artery, popliteal artery, splenic artery, thoracic aortic aneurysm.

What are the chances of getting life insurance with an aneurysm?

If you apply with the right company, most people with aneurysms qualify for first-day coverage, burial life insurance, or final expense insurance.

Is an aneurysm a pre-existing condition for life insurance?

Yes, an aneurysm or any health issues you have before applying for life insurance is considered a pre-existing condition.

Is there an age limit for burial insurance with an aneurysm?

The typical age limit to apply for burial insurance with an aneurysm is 89. Once approved, your policy will last until you are 121.

Do I need to tell insurance about an aneurysm?

You must tell the insurance company if they ask about aneurysms in their health questions.

Can you be denied insurance for an aneurysm?

Some life insurance companies might reject your application if you had recent surgery or a medical event related to an aneurysm.

How can you get the best life insurance rates with an aneurysm?

The best way to get the best life insurance rates with an aneurysm is to work with an independent insurance agent. They can help you compare policies and find the best coverage for your needs.