2024 Burial Insurance with Angina

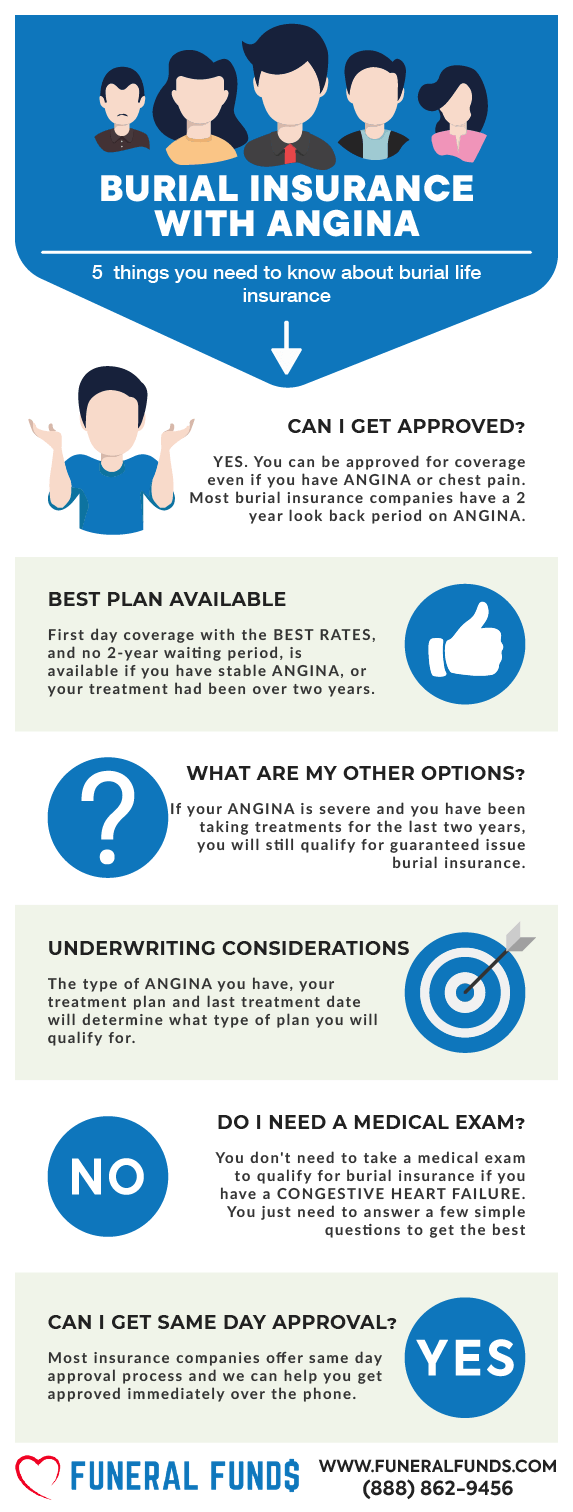

Having a history of angina will not prevent you from being approved for burial insurance with first-day coverage.

The key to getting the best burial insurance with angina is knowing which burial insurance company looks at your heart condition favorably.

If you or someone you love have angina and are considering applying for a burial insurance policy, keep reading. We will give you an overview of angina burial insurance underwriting and how to get the best rate possible.

FOR EASIER NAVIGATION:

- What Is Angina?

- Can I Get Burial Insurance If I Have Had Angina?

- What Are The Types Of Burial Insurance Available To People Who Have Angina?

- What Is My Best Insurance Option If I Have Angina?

- Do I Need A Medical Exam To Qualify For Burial Insurance?

- What Is The Cost Of Burial Insurance If I Have Angina?

- Burial Insurance Underwriting If You Have Angina

- Information We Need if You Had A History Of Angina

- What If My Application Was Rejected Because Of Angina?

- How to Get First-Day Coverage With A History Of Angina

- How To Apply For Burial Insurance With Angina

- How Can Funeral Funds Help Me?

What Is Angina?

Angina is a chest pain symptom that occurs when the heart muscle isn’t getting enough blood flow. This can be caused by narrowed arteries due to plaque buildup.

People with angina experience discomfort in the chest, sometimes radiating to the arms, jaw, or back. The pain is often described as tightness, pressure, or squeezing, and can be triggered by physical exertion or stress.

Angina raises a red flag for life insurers because it indicates potential heart issues. The insurance company will consider factors like the severity and frequency of angina attacks, medications or treatments needed, and overall health when approving your life insurance application and premiums.

Can I Get Burial Insurance If I Have Had Angina?

YES: Depending on your overall health and the plans available in your state, you can qualify for first-day coverage insurance with no waiting period.

NO: If you have been hospitalized twice or more in the last two years, you will not qualify for our preferred first-day coverage plan. If you don’t qualify for 1st-day coverage, you will easily qualify for guaranteed-issue burial insurance with a 2-year waiting period.

What Are The Types Of Burial Insurance Available To People Who Have Angina?

FIRST-DAY COVERAGE – This burial insurance covers you from the first day (no waiting period). Your beneficiaries will receive the full death benefit when you pass away. Burial insurance with no waiting period is always cheaper than guaranteed issue life insurance.

GUARANTEED ISSUE LIFE INSURANCE—This policy does not require a medical exam or health questions. You will be approved regardless of any health issues. The downside is the mandatory two-year waiting period. If you pass away during the waiting period, the policy will only pay out the premiums you have paid plus 7-10% interest (depending on the company).

What Is My Best Insurance Option If I Have Angina?

If you’ve ever been diagnosed, received treatment, or advised to receive treatment and medication for angina, your preferred option should always be a first-day coverage plan.

One company that offers this 1st-day coverage will ask if you’ve been hospitalized two or more times in the past two years. If you have only had one hospitalization in the last two years, you’ll qualify for 1st-day coverage if that plan is available in your state.

If you’ve been hospitalized twice or more in the past two years, you will still qualify for guaranteed-issue whole-life insurance with a waiting period.

Do I Need A Medical Exam To Qualify For Burial Insurance?

Medical exams, blood tests, and urine samples are not required for burial insurance approval.

The best plans with first-day coverage ask some health questions; with these companies, you’ll often get official approval from the insurance company within minutes!

What Is The Cost Of Burial Insurance If I Have Angina?

The cost of burial insurance will depend on your:

- Age

- Coverage amount

- Gender

- General health

- State of residence

- Smoking status

- Type of policy

Burial Insurance Underwriting If You Have Angina

Here’s how some insurance companies ask about angina on the insurance application:

- During the past 36 months, have you’ve been diagnosed as having, or been hospitalized for: stroke, angina (chest pain) heart attack or heart failure?

- Have you had or been treated for angina (chest pains), aneurysm, heart attack, or failure within the last 12 months?

- Have you been diagnosed or treated for angina within the last two years?

- In the past 10 years, have you opted to not seek treatment, have not taken medication, and have not followed the prescribed treatment plan following a medical diagnosis for congestive heart failure, angina, cardiomyopathy or heart disease?

Here is a list of various chest pain medications that may be prescribed for angina management:

- Amlodipine

- Atenolol

- Caduet

- Carvedilol

- Coreg

- Diltiazem

- Ecotrin

- Enoxaparin

- Felodipine

- Isordil

- Isosorbide Mononitrate

- Ivabradine

- Lopressor

- Metoprolol

- Nitroglycerin

- Nitrostat

- Norvasc

- Ranexa

- Ranolazine

- Toprol-XL

- Verapamil

Many angina medications are also dual-purpose medications used to treat High Blood Pressure. If any of these drugs appear on your prescription history check, the insurance company may ask you to verify what you are taking specific medications for.

Information We Need if You Had A History Of Angina

Here are some of the questions we may ask to get you the best plan and pricing:

- Are you taking treatments for angina?

- Do you have high blood pressure?

- Do you have a high cholesterol level?

- Have you experienced chest pains or heart attacks in the past two years?

- What medicines are you taking for angina?

- When was the last time you had chest pains?

What If My Application Was Rejected Because Of Angina?

If you’ve been declined in the past because of angina, it is best to work with an independent insurance agency like Funeral Funds. We know the underwriting guidelines of multiple companies, and we can get you a better plan with the lowest rates.

We have access to more than 20 insurance companies and can help you qualify with a heart-friendly life insurance company.

How to Get First-Day Coverage With A History Of Angina

If you have had angina, the best way to get a first-day coverage burial insurance plan is to work with an independent agency like Funeral Funds. Our independent life insurance agents can compare companies offering first-day coverage insurance and recommend the best plan with the best pricing.

How To Apply For Burial Insurance With Angina

- Consult with an Independent Insurance Agent – Ask independent insurance agents specializing in underwriting for angina for guidance. They can help you understand your options, compare quotes, and choose the most suitable burial insurance plan.

- Complete the Application Honestly – Be truthful when filling out the life insurance application with your agent. Provide accurate details about your health, treatments, and any lifestyle changes you’ve made.

- Review and Confirm Policy Details – Carefully review the policy terms before confirming your acceptance. Make sure the insurance coverage meets your needs and your budget.

How Can Funeral Funds Help Me?

Here at Funeral Funds, we specialize in getting life insurance coverage for people with a history of angina.

We work with many A+ rated insurance companies that specialize in high-risk clients. We will search those companies to give you the best rate. We’ll match you up with your best life insurance option.

We will assist you in securing the coverage you need at a rate you can afford. So, if you’re looking for burial insurance for angina, we can help. Fill out our quote form on this page or call us at (888)862-9456 to get accurate quote burial insurance quotes.

Additional Questions & Answers On Burial Insurance With Angina

Can a person with angina get life insurance?

Yes, you may even qualify for a first-day coverage plan if this plan is available in your state.

Is angina a pre-existing condition for life insurance?

Angina and other health issues you have before applying for life insurance is a pre-existing condition for life insurance,.

Which insurance is best for patients with angina?

A first-day coverage plan is the best insurance for patients with angina.

Can you get first-day coverage insurance if you have angina?

Yes, you can often get first-day coverage insurance if you apply with the right company.

Do I need to tell insurance about angina?

Yes, you must tell your life insurance company if they ask for it in the health questionnaire.

What are the things that may affect my eligibility if I have angina?

Length of time since your angina diagnosis, treatment, and medication usage.

Can you be denied insurance for angina?

Yes, with the preferred company if you’ve been hospitalized twice or more in the past two years.

Is there a waiting period for life insurance with angina?

No, if you qualify for a first-day coverage plan.

Is there an age limit for burial insurance with angina?

Yes, you can apply for life insurance up to 89 years old and your plan would last until age 121.