2024 Burial Insurance with Arrhythmia

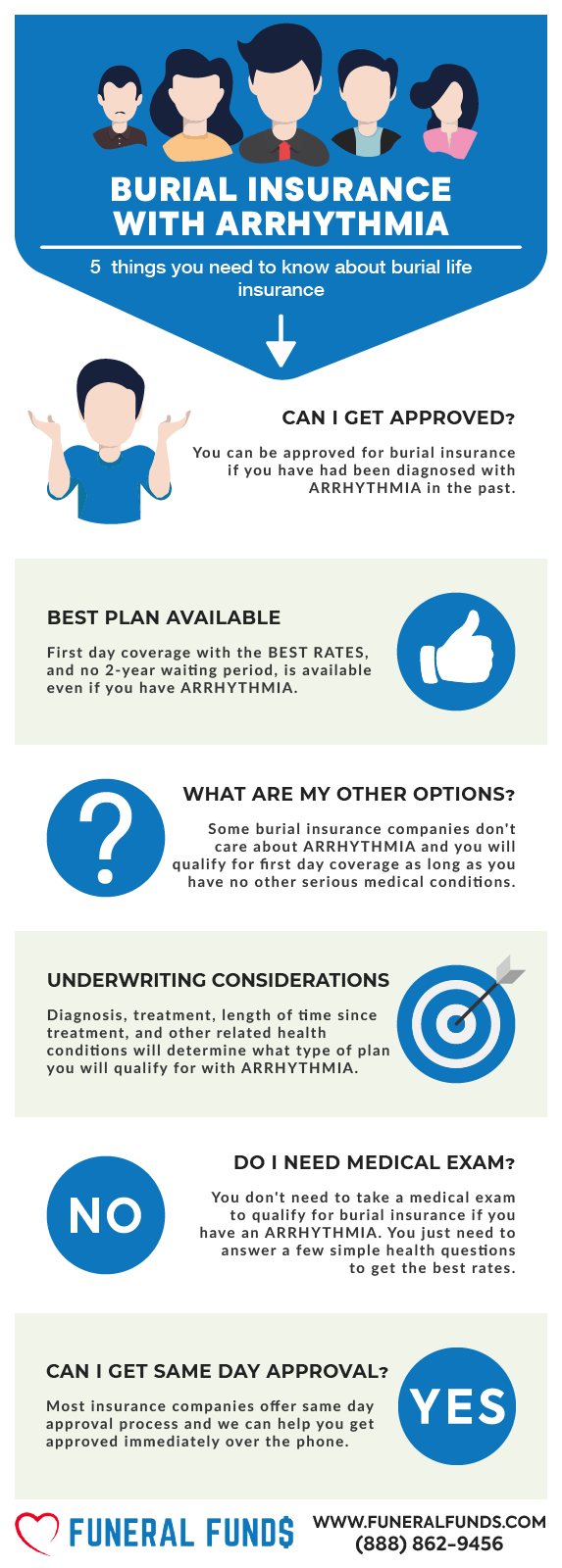

Affordable burial insurance with an arrhythmia or irregular heartbeat is available with certain insurance companies.

If you have any type of arrhythmia, applying with these companies will give you the best chance of approval.

This article will show you how to get the best plan with the best rates if you have arrhythmia.

FOR EASIER NAVIGATION:

- What Is Arrhythmia?

- Can I Get Burial Insurance If I Have Arrhythmia?

- What Are The Types Of Burial Insurance Available To People Who Have Arrhythmia?

- What Is My Best Insurance Option If I Have Arrhythmia?

- Do I Need A Medical Exam To Qualify For Burial Insurance?

- What Is The Cost Of Burial Insurance If I Have Arrhythmia?

- Burial Insurance Underwriting If You Have Arrhythmia

- Information We Need if You Had A History Of Arrhythmia

- What If My Application Was Rejected Because Of Arrhythmia?

- How to Get First-Day Coverage With A History Of Arrhythmia

- How To Apply For Burial Insurance With Arrhythmia

- How Can Funeral Funds Help Me?

- Frequently Asked Questions

What Is Arrhythmia?

Arrhythmia is a general term for any irregularity in your heartbeat. A normal heart rhythm falls within a certain range of beats per minute (bpm). Arrhythmias can be:

- Tachycardia: Heart beats faster than normal (above 100 bpm)

- Bradycardia: Heart beats slower than normal (below 60 bpm)

- Fibrillations or flutterings: Irregular heartbeats that can be fast or slow.

There are many types of arrhythmias, some harmless and others potentially serious.

Life insurance companies view arrhythmia as a potential health risk, since it can increase the chances of complications like stroke or heart failure.

Can I Get Burial Insurance If I Have Arrhythmia?

YES: You can qualify forfirst-day coverage depending on your overall health and the plans available in your state.

NO: If you have significant health issues other than arrhythmia, you may not qualify for a first-day coverage plan.

If you don’t qualify for first-day coverage, you can still qualify for guaranteed-issue burial insurance that doesn’t ask health questions.

What Are The Types Of Burial Insurance Available To People Who Have Arrhythmia?

FIRST-DAY COVERAGE—This burial insurance has no waiting period. Your beneficiaries will receive a 100% death benefit when you pass away. Burial insurance with no waiting period is always cheaper than guaranteed issue life insurance.

GUARANTEED ISSUE LIFE INSURANCE—This policy does not require a medical exam or health questions. You will be approved regardless of any medical condition you have. The downside is the mandatory two-year waiting period. If you pass away during the first two years, the insurance provider will only pay out the premiums you have paid plus 7-10% interest (depending on the company).

What Is My Best Insurance Option If I Have Arrhythmia?

Some burial insurance companies are not concerned with arrhythmia or irregular heartbeat and don’t ask about it on their health questionnaire.

If you’ve ever been diagnosed, received treatment, or advised to receive treatment and medication for arrhythmia, your preferred option should always be a first-day coverage plan.

Do I Need A Medical Exam To Qualify For Burial Insurance?

Medical exams, blood tests, and urine samples are not required for burial insurance approval.

The best burial insurance plans with first-day coverage ask some basic health questions. If you go with the best company, you can often get official approval from the insurance carrier within minutes!

What Is The Cost Of Burial Insurance If I Have Arrhythmia?

The cost of burial insurance will depend on your:

- Age

- Coverage amount

- Gender

- General health

- State of residence

- Smoking status

- Type of policy

Burial Insurance Underwriting If You Have Arrhythmia

Here’s how some insurance companies ask about arrhythmia on the insurance application:

- In the last 12 months, have you received a diagnosis or treatment for arrhythmia?

- Have you ever been diagnosed or treated for arrhythmia?

- During the past 36 months, have you been hospitalized for heart attack, heart failure, or heart or circulatory surgery, including pacemaker, heart valve replacement, stent implant, or any procedure to improve circulation to the heart?

Some companies will use the word “irregular heartbeat” instead of arrhythmia. Here is an example:

- Have you ever been treated for an irregular heartbeat or irregular heart rhythm?

If you have an arrhythmia, you must answer yes to these questions (no matter how they phrase them).

Here’s a list of common medications for arrhythmia:

- Amiodarone (Cordarone, Pacerone)

- Flecainide (Tambocor)

- Procainamide (Procanbid)

- Sotalol (Betapace, Sorine)

- Beta-blockers (Metoprolol, Toprol XL)

- Calcium channel blockers (Verapamil, Calan)

Taking medications to control your condition will be seen as positive by the insurers, so if you take drugs to regulate your heartbeat, it will not be counted against you as long as you don’t have significant changes in your medication recently.

Information We Need if You Had A History Of Arrhythmia

Here are some of the questions we may ask to get you the best plan and pricing:

- Are you diagnosed with any type of arrhythmia?

- Are you receiving treatment for arrhythmia?

- Are you taking prescriptions? What medications are you taking?

- Did you have any heart complications from arrhythmia?

- Have you been having irregular heartbeats? For how long?

- Have you ever visited an emergency room or been hospitalized due to arrhythmia?

- Have you had a stroke or heart attack?

- Have you undergone any treatment for an irregular heartbeat?

- How long do your irregular heartbeats last?

- When were you diagnosed with arrhythmia?

What If My Application Was Rejected Because Of Arrhythmia?

If you’ve been declined in the past because of arrhythmia, it is best to work with an independent insurance agency like Funeral Funds. We know the underwriting guidelines of multiple companies, and we can get you a better plan with the lowest rates.

We have access to more than 20 insurance companies and can help you qualify with a heart-friendly life insurance company.

How to Get First-Day Coverage With A History Of Arrhythmia

If you have had arrhythmia, the best way to get a first-day coverage burial insurance plan is to work with an independent agency like Funeral Funds. Our independent life insurance agents can compare insurance companies offering first-day coverage insurance and recommend the best plan with the best pricing.

How To Apply For Burial Insurance With Arrhythmia

- Consult with an Independent Insurance Agent – Ask independent insurance agents specializing in underwriting for arrhythmia for guidance. They can help you understand your options, compare quotes, and choose the most suitable burial insurance plan.

- Complete the Application Honestly – Be truthful when filling out the life insurance application with your agent. Provide accurate details about your health, treatments, and any lifestyle changes you’ve made.

- Review and Confirm Policy Details – Carefully review the policy terms before confirming your acceptance. Make sure the insurance coverage meets your needs and your budget.

How Can Funeral Funds Help Me?

Here at Funeral Funds, we specialize in getting life insurance coverage for people with a history of arrhythmia.

We work with many A+ rated insurance companies that specialize in high-risk clients. We will search those companies to give you the best rate. We’ll match you up with your best life insurance option.

We will assist you in securing the coverage you need at a rate you can afford. So, if you’re looking for burial insurance for arrhythmia, we can help. Fill out our quote form on this page or call us at (888)862-9456 to get accurate burial insurance quotes.

Frequently Asked Questions

Is arrhythmia a pre-existing condition for life insurance?

Arrhythmia and other diagnosed medical conditions are considered pre-existing conditions for life insurance.

Is there an age limit for burial insurance with arrhythmia?

Yes, you can apply for burial insurance up to age 89, and your plan will last until you are 121.

Can you get first-day coverage insurance if you have arrhythmia?

Yes, some life insurance companies do not ask about arrhythmia in their health questionnaire.

Do I need to tell insurance about arrhythmia?

Yes, if they ask about arrhythmia in their health questionnaire.

If I have an arrhythmia, will my insurance rates go up?

After your acceptance, your rates will never go up.

What are the chances of getting life insurance with arrhythmia?

Most people with arrhythmia qualify for a first-day coverage plan.

What is my best insurance option if I have arrhythmia?

A first-day coverage whole-life plan is your best option if you have an arrhythmia.

Can you be denied insurance for arrhythmia?

You can be denied if you are currently hospitalized for circulatory surgery or a pacemaker implant.