Burial Insurance with Coronary Artery Disease (2024 Update)

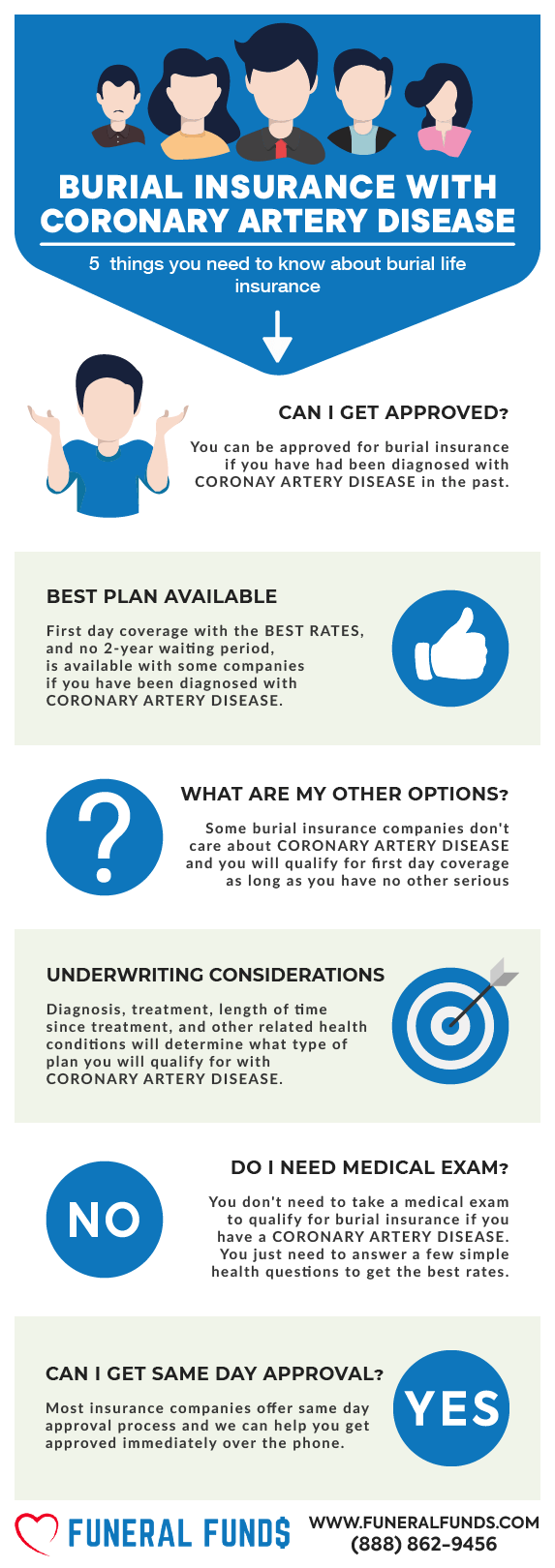

Wondering if you can snag some burial insurance even with coronary artery disease? Yes, you can snag a first-day coverage plan if you’ve been treated by a doctor. Think of it as peace of mind, without giving yourself a heart attack over the cost!

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with COPD, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is Coronary Artery Disease?

Feel like your heart’s been working overtime lately? That tightness in your chest could be something called coronary artery disease, (CAD…basically like rush hour traffic in your heart’s plumbing).

Don’t worry, it’s not a one-way trip to Davy Jones’ Locker just yet. It’s just a build-up of gunk that’s making it tough for your heart to get the blood it needs.

Now, if this blockage gets too bad, it can lead to some not-so-fun stuff like chest pain, shortness of breath, and even a heart attack (which sounds way scarier than it actually is…but it’s still serious).

Coronary artery disease (CAD) is dangerous because it reduces blood flow to your heart, which can lead to several serious complications, some of them even life-threatening.

The most common surgeries performed to treat advanced cases of coronary artery disease are:

- Angioplasty – basically a tiny balloon they use to unclog the pipes.

- Bypass surgery – a fancy detour with a bypass surgery, creating a new path for that blood to flow freely.

- Stents – doctors put in little stents to keep your veins open, like a mini express lane for your heart!

Can I Get Burial Insurance If I Have Coronary Artery Disease?

YES: Some insurance companies are like forgetful goldfish – they don’t even ask about past coronary artery disease on their applications! So, if your heart trouble’s a thing of the past, you might just snag some first-day coverage.

NO: Now, if you’ve recently had a heart attack due to this coronary culprit or have surgery coming up to fix your ticker, those first-day plans might be a no-go. Think of it like waiting in line for the best rollercoaster – gotta wait your turn after a big medical event.

But don’t fret! There’s still “guaranteed-issue” burial insurance. This plan doesn’t play doctor, so no health questions to answer. It’s like getting a seat at the bingo hall – everyone’s welcome, no matter their health history!

What Is My Best Insurance Option If I Have Coronary Artery Disease?

If you’ve been diagnosed with CAD, maybe even some treatment or doctor-prescribed pills to keep things ticking, then first-day coverage is your golden ticket! Think of it like skipping the line at the grocery store – you’re a VIP because you took care of your health!

Here’s the thing, though: Some insurance companies are a little forgetful, like Dory from Finding Nemo. They might not even ask about your past coronary troubles on the application.

But if you’ve got any upcoming procedures or surgeries planned for your heart, let’s chat about the best time to apply. We don’t want you stuck waiting in line like at the DMV; you deserve a smoother ride!

Do I Need A Medical Exam To Qualify For Burial Insurance?

Nope, no need to worry about those pesky medical exams or flashing your behind in a paper gown! These plans are more interested in your meds than your modesty.

They might ask a few basic health questions, but the best companies can get you approved faster than you can say bingo! It’s all about getting you that peace of mind without any unnecessary stress on your golden years.

What Is The Cost Of Burial Insurance If I Have Coronary Artery Disease?

The cost of burial insurance will depend on your:

- Age

- Coverage amount

- Gender

- General health

- State of residence

- Smoking status

- Type of policy

Here’s a pricing example for a mindful 60-year-old female with coronary artery disease:

| INSURANCE COMPANY | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Here’s a pricing example for a determined 60-year-old male with coronary artery disease:

| INSURANCE COMPANY | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Burial Insurance Underwriting For Coronary Artery Disease

Here’s how these insurance companies play detective when it comes to coronary artery disease:

- Within the past two years, have you had or been diagnosed with a heart attack or any type of heart disease or circulatory surgery?

- During the past 24 months, have you been diagnosed as having a heart disease or failure or heart or circulatory surgery?

- Within the past 24 months, have you been medically diagnosed as having been treated or hospitalized for heart disease, heart or circulatory surgery, including angioplasty, bypass, or stent implant?

It’s like they’re doing some medical CSI, but instead of chalk outlines, they’re looking for heart attack history in the past two years. They might ask if you’ve had a heart attack, heart disease, or needed any fancy medical plumbing work done “downstairs” in the last 24 months.

They’ll check your medicine cabinet virtually, looking for those heart disease meds. It’s like they have a sixth sense for nitroglycerin patches!

This list gives you an idea on the heart meds the insurance company will look for:

- Aspirin or blood thinners (Coumadin, Plavix, or Warfarin)

- Angiotensin-converting enzyme (ACE) inhibitors (Losartan, Candesartan, Valsartan )

- Cholesterol Modifying Medications

- Beta-blockers (Metoprolol, Bisoprolol)

- Calcium channel blockers

- Clopidogrel

- Nitroglycerin

- Ranolazine

- Statins (Atorvastatin, Fluvastatin, Lovastatin, Simvastatin, Pravastatin)

What If Application Was Rejected Because of Coronary Artery Disease?

If you’ve been declined in the past, don’t fret. Sometimes your past coronary health history can throw a wrench in the whole insurance-buying process.

Here’s the good news: we’re like detectives of insurance, we know all the secret stashes of good deals! We work with over 20 different insurance companies, so it’s like having a whole box of chocolates – there’s a perfect one out there for you, even with that heart condition.

We’ll find a company that’s more heart-friendly than a bowl of oatmeal, and get you covered without any more rejections. So ditch the frown and give us a call – we’ll get you insured faster than you can say “bypass surgery!

How To Apply For Burial Insurance With Coronary Artery Disease

- Consult with an Independent Insurance Agent: Forget dealing directly with these insurance companies – they can be trickier than a used car salesman! You need an independent insurance agent from Funeral Funds in your corner, someone who specializes in folks with hearts who like to play their own tune. Think of them like your insurance fairy godmother, ready to grant you coverage wishes!

- Complete the Application Honestly: You gotta pick a plan that fits your budget and what you need covered, like a pick-your-own-adventure for your final farewell. Then comes the honesty part – gotta be truthful about your health, treatments, and any lifestyle changes you’ve made. No fibbing about joining a gym membership if you haven’t gotten past the donut shop yet!

- Review and Confirm Policy Details: Take a good long look at the policy details before you sign on the dotted line. Make sure you understand everything, like reading the fine print on a recipe before you bake that award-winning pie. Then, follow the insurance company’s instructions – think of it like assembling a piece of furniture – follow the steps and you’ll be covered in no time!

How Can Funeral Funds Help Me?

Funeral Funds is like a superhero in a comfy cardigan! We specialize in getting folks with hearts that like to go rogue covered with life insurance.

Think of us like detectives of insurance; we can search through tons of A+ rated companies, the good kind with excellent ratings, not the ones with sketchy reviews.

We’ll find a plan that fits your needs and budget perfectly, like finding the juiciest steak at the butcher shop. We won’t stop until you’re matched with your best life insurance option because, let’s face it, who wants extra stress in their golden years?

So ditch the worry wrinkles and give us a call at (888) 862-9456 or fill out our handy-dandy quote form right here on this page. We’ll get you covered faster than you can say “defibrillator,” and at a price that won’t make you faint!

Frequently Asked Questions

What is a pre-existing heart condition?

Think of it like your heart’s report card. Any past diagnosis, like coronary artery disease, skips a beat, or weak muscle shows up as pre-existing.

Do I need to take a medical exam if I have coronary artery disease?

Nope! Some plans are like “open book tests” for insurance, no need for a doctor visit with a simplified issue policy.

Is there an age limit for burial insurance with coronary artery disease?

Most companies are good sports, letting you apply up to 89 years old, and the policy sticks with you until, well, let’s just say you’ve seen a lot of birthdays (121!).

Do I need to tell insurance about coronary artery disease?

Absolutely! This isn’t a game of “hide-and-seek” with your health. Be honest, or they might void your policy later, like getting caught with a cheat sheet on that test!

When should I tell my insurance company about coronary artery disease?

Spill the beans if the application asks about your heart condition. Honesty is the best policy, especially when it comes to your life insurance application.

What is my best insurance option if I have coronary artery disease?

A first-day coverage plan is your golden ticket! The best bang for your buck, with the most coverage at the lowest price.

Can you get life insurance after heart surgery?

Sure! But some companies might be a little cautious, depending on how recent the surgery was. Think of it like applying for a new job – they might want to see how you’re doing post-op first.

Can you be rejected for life insurance because of coronary artery disease?

A very recent heart surgery to fix your coronary artery disease could cause a rejection. But don’t worry! With the right company, you might still qualify for 1st-day coverage as soon as you’re out of the hospital, assuming there are no other upcoming procedures.