Burial Insurance with Heart Bypass Surgery (2024 Update)

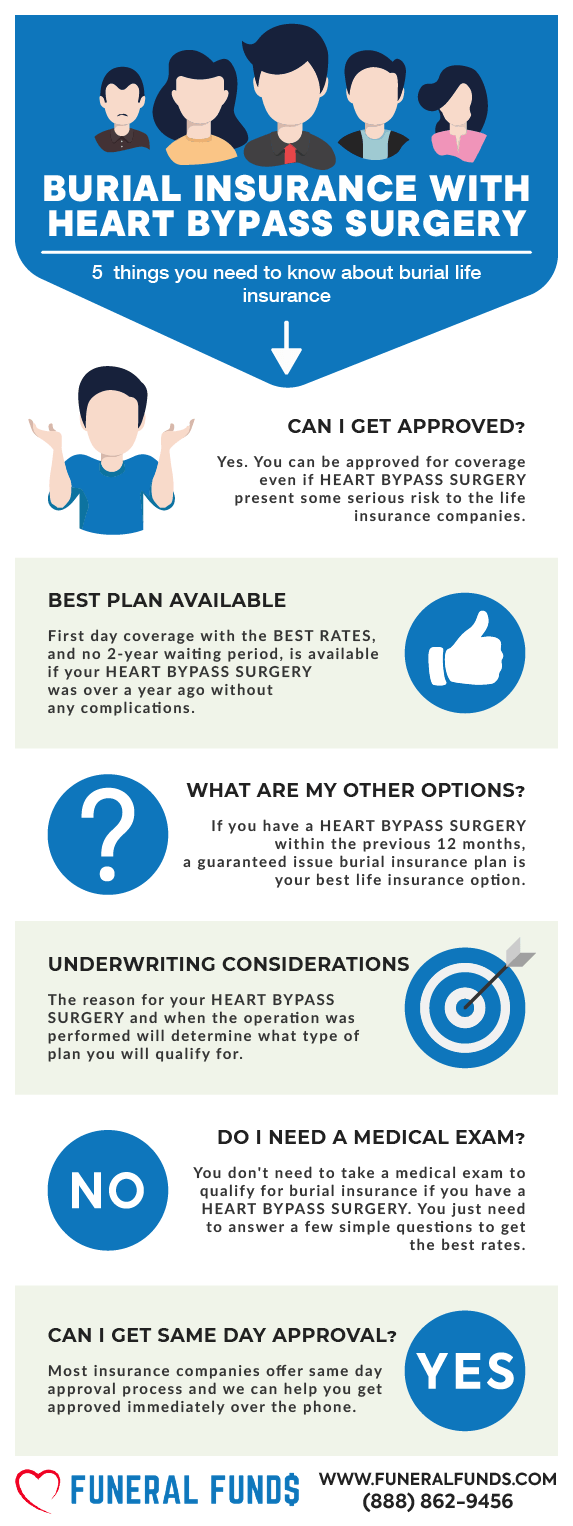

Worried about snagging burial insurance after a heart bypass? Relax, with the right company, you can often get first-day coverage, no problem. Just a heads up, though…not all insurers play nice depending on what state you live in.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

Fill out our quote request form for instant assistance or info. If you prefer to keep reading, we’ve got more details on burial insurance for those with heart bypass surgery.

| TABLE OF CONTENTS | |

|---|---|

What Is A Heart Bypass Surgery?

Your heart needs oxygen delivered through these handy dandy blood highways called arteries. But sometimes, there’s a traffic jam caused by “plaque” buildup. That’s coronary artery disease, and it can lead to chest pain, shortness of breath, and even a heart attack.

That’s where heart bypass surgery, also known as (CABG), comes in. Coronary Artery Bypass Grafting is a procedure to improve blood flow to the heart muscle. The doctor swoops in and takes a healthy blood vessel from your leg (like a detour road) and grafts it around the blockage. This lets fresh oxygen-rich blood flow freely to your heart, keeping your heart muscle pumpin’ strong.

Different types of bypasses exist, but if you’re looking for burial insurance, that’s our area to geek out on. Just remember, bypass surgery is your heart’s chance to ditch traffic and get pumpin’ again like a rock star!

There are different types of heart bypass surgery you’re going to want the lowdown on:

- Single bypass

- Double bypass

- Triple bypass

- Quadruple bypass

- Quintuple bypass

Can I Get Burial Insurance If I Have Had Heart Bypass Surgery?

YES: Depending on your health, you might score first-day coverage with some life insurance companies, as long as you haven’t been hospitalized two or more times in the past two years and you live in the right zip code!

NO: If you’ve got a heart bypass or circulatory surgery coming up, forget about first-day coverage until you’re done with all that medical drama.

If first-day coverage isn’t in the cards, don’t worry! You can still snag guaranteed-issue burial insurance, which welcomes everyone with open arms, no matter your health issues.

Burial Insurance Available To People Who Had Heart Bypass Surgery?

FIRST-DAY COVERAGE – This burial insurance is as straightforward as it gets – no waiting around. You make the first payment, and bam, your loved ones get the full 100% death benefit when the time comes.

GUARANTEED ISSUE LIFE INSURANCE – No medical exams, no health questions – it’s the easy road to coverage regardless of your health history. But, fair warning, this convenience comes at a price – about 50% more expensive – and there’s a mandatory two-year wait.

If you kick the bucket during those first two years, your beneficiaries won’t get the jackpot payment. They’ll get back what you paid in premiums plus a smidge of interest, usually 7 to 10%.

| INSURANCE COMPANY | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice | $53.09 |

| Colonial Penn – Guaranteed Issue | $59.70 6 units |

| Gerber Life – Guaranteed Issue | $63.89 |

| Lincoln Heritage – Modified | $114.14 |

| Mutual Of Omaha – Guaranteed Issue | $56.90 |

What Is My Best Insurance Option If I Have Had Heart Bypass Surgery?

Look, if you’ve had bypass surgery and you’re eyeing burial insurance, aim for that first-day coverage plan. It’s the gold standard.

Our top pick, the one that’s cool with recent circulatory fixes, might ask you “Have you been hospitalized twice in the last two years?” If you can say “Nope” to that, you’re on track for first-day coverage perks assuming you live in a state where the correct plans are offered.

Now, if you’re still in the hospital or you’ve clocked in two or more stays in the last few years, your next move is snagging guaranteed-issue whole life insurance. Sure, there’s a two-year waiting period, but hey, it’s better than a kick in the shins because you waited to long to get this insurance.

What Is The Cost Of Burial Insurance If I Had Heart Bypass Surgery?

The cost of burial insurance will depend on your:

- Age

- Coverage amount

- Gender

- General health

- State of residence

- Smoking status

- Type of policy

Pricing example for a tenacious 60-year-old female who have had a heart bypass surgery:

| INSURANCE COMPANY | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Pricing example for a resilient 60-year-old male who have had a heart bypass surgery:

| INSURANCE COMPANY | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Burial Insurance Underwriting If You Had Heart Bypass Surgery

Let’s dive into the heart bypass questions asked on your burial insurance questionnaire:

- Have you had any type of heart surgery within the last 12 months?

- Have you had any type of heart surgery within the last 2 years?

Insurance companies are gonna check your prescriptions during their low-key underwriting process. Got meds for health stuff going on? Hang on, because that could totally shake up which plans and rates you’re eligible for in some cases.

Information We Need if You Had A History Of Heart Bypass Surgery

Here’s what we gotta know to hook you up with the best plan and price:

- Did you experience any complications like internal bleeding, cardiac tamponade, or a stroke after the surgery?

- Do you have other risk factors for heart disease, such as smoking, high blood pressure, or high cholesterol?

- How many blocked arteries did you have treated?

- How old were you when your heart bypass surgery was completed?

- What medications are you taking after the bypass surgery?

- When did you have your bypass surgery?

- Why did you need to have bypass surgery?

How to Get First-Day Coverage With A History Of Heart Bypass Surgery

Looking to snag first-day coverage even after a heart bypass? Companies don’t all play by the same rules with that. Your move? Team up with a professional outfit like Funeral Funds.

Our insurance pros will hunt down the best first-day coverage deals out there and hook you up with a killer plan at the right price.

Don’t settle – get with the pros who’ve got your back!

How To Apply For Burial Insurance With Heart Bypass Surgery

- Consult with an Independent Insurance Agent – Find yourself a savvy, independent agent like Funeral Funds who knows the ins and outs of heart bypass survivors like you. They’ll break down all the burial insurance options, dish out price comparisons, and straight-up handle your queries.

- Complete the Application Honestly – Pick a plan that fits your vibe and wallet. No fibs! Lay it all out – your health scoop, treatments, and any lifestyle tweaks you’ve made.

- Review and Confirm Policy Details – Carefully review the policy terms before you sign anything. Follow Funeral Funds instructions for submitting your application.

How Can Funeral Funds Help Me?

Here at Funeral Funds, we specialize in getting life insurance coverage for people with a history of heart bypass surgery.

We work with A+-rated insurance all-stars, the kind of companies that understand that sometimes our reliable hearts take some health detours. We’ll search high and low (mostly online, thank goodness) to find the best rate for you.

So, if you’re looking for some peace-of-mind insurance after that bypass surgery, we can definitely help. Fill out our quick quote form, it’s easier than remembering your grandkids’ names! Or, you can call us at

![]() (888) 862-9456. Let’s get you covered before you start planning your shuffleboard team in the afterlife!

(888) 862-9456. Let’s get you covered before you start planning your shuffleboard team in the afterlife!

Frequently Asked Questions

What is a pre-existing heart condition in life insurance?

Basically, anything that might make the underwriter think your ticker is more of a tambourine than a metronome. This includes past diagnoses, surgeries like bypasses, or any attempts to prop your heart open with tiny balloons (we’re talking angioplasty and stents here).

Do I need to tell the insurance company about heart bypass surgery?

Big yes. It’s like trying to sneak a giraffe into a movie theater – they’ll find out, and it won’t be pretty. Not telling them could mean your policy evaporates faster than your New Year’s resolutions.

How long does bypass surgery affect life insurance?

Every company plays by its own rules, but generally, if you’re two years past your bypass adventure, you can be eligible for coverage that starts right away (called first-day coverage).

Is there an age limit for burial insurance with heart bypass surgery?

Not usually! Some companies will welcome you with open arms (metaphorically, not literally…too many awkward goodbyes that way) even if you’re pushing 85. The policy itself might even last longer than your grumpy uncle at Thanksgiving dinner (until a ripe old age of 121, to be exact).

Can you get first-day coverage insurance if you have heart bypass surgery?

Maybe! If you’ve been bypass-free for two years and are in good health otherwise, you might qualify for that sweet first-day coverage if you go with the right company.

Can I qualify for cremation insurance with a history of heart bypass surgery?

It depends! Depending on your overall health and what insurance is available in your area, you might even snag first-day coverage for, well, your last day.

Can you be denied insurance for heart bypass surgery?

Unfortunately, yes. If your surgery is super recent and you’ve had a few hospital visits lately, they might pump the brakes on your coverage.

What is the average cost of life insurance for someone with heart bypass surgery?

The price tag depends on a bunch of factors, kind of like a choose-your-own-adventure for your wallet. Age, gender, how much coverage you want, where you live, and your overall health all play a part.

How long does it take for life insurance to kick in after heart bypass surgery?

Generally, most policies start working their magic immediately after your first payment. So, pay up, your loved ones will thank you later (hopefully much, much later).